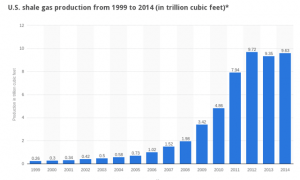

Over the last ten years, the United States gas and oil industry has experienced impressive growth, and has largely outgrown the development of the auxiliary infrastructure that was required to help sustain its profitability in the long term. Production has been unable to grow exponentially, and focus has been redirected from extraction to transportation, storage, and alteration of oil and gas. Phillps 66 (NYSE: PSX) has followed suit, and begun to invest in projects and changes that will yield the company huge benefits as the United States gas and oil industry moves to its next stage of development. Throughout the last decade or so, our development of shale oil has enabled us to generate enough oil to last one hundred years, and has given the United States the boost it needed to get back on its feet to compete with other world economies when we had fallen in a recession. However, due to overestimated revenue as well as 3 year leases where companies drilled for as much oil as they possibly could, the following production created a supply bump that dragged prices all the way from almost $11 million per cubic feet to just under $2 per cubic feet in 2012. This caused companies such as Shell (OTCQB: RYDAF) and BHP Billiton (NYSE: BHP) to sell at a significant loss. On the other hand, smaller oil companies were able to secure better drilling sites, and have been finding oil at a sustainable rate through this slump in gas prices. Production levels at six of the thirty largest drilling sites are disproportionately producing 88% of the total oil production. These sites are starting to lose their capability of keeping up with their previous exponential growth rates. According to experts in the industry, production levels overall will soon begin to level and they will drop by the year 2020. Although interest in investment is high, investors are beginning to realize the highly risky nature of this field.  While some fields at this price level may not be viable in the long term, the industry is not likely to be a bubble that will collapse and production completely stops. It is clear that the business is suffering from an excess of supply, forcing the price of gas down. When combined with extraction rates as low as 7% (versus the traditional natural gas extraction rate of 75%) and high depletion rates in shale gas, oil and gas companies are forced to build and drill more and more wells. This situation has also been worsened by the “drill or kill” leases that give drilling companies three years to drill before voiding their leases. One expert in the industry stated that the average capital expenditure of 35 analyzed companies has increased to a total of $50 per barrel of oil, when their revenue per barrel of oil is $51.50. Due to the inherent nature of shale oil, high depletion rates are to be expected and results in to necessity to always reallocate funds towards exploration drilling so that the company can maintain and increase production levels. Then take into account the inevitable happening of diminishing returns with future drilling, the industry will gradually move towards an equilibrium where the gas price will be raised so that these companies stay economically viable. Phillips 66, a secondary company to ConocoPhillips (NYSE: COP), is a company that is heavily invested in the chemical space, a business that benefits from lower gas prices, and midstream operations. This puts the company in a good position to take control of the oil industry. In fact, Phillips 66 has already begun moving towards the storage, transportation, and conversion of shale gas and oil. This focus on assets that are high in demand and highly profitable makes the company less vulnerable to the highly unstable refining industry. Phillips is positioning itself in the energy industry in the United States to become a dominant leader and take the many opportunities that awaits it.

While some fields at this price level may not be viable in the long term, the industry is not likely to be a bubble that will collapse and production completely stops. It is clear that the business is suffering from an excess of supply, forcing the price of gas down. When combined with extraction rates as low as 7% (versus the traditional natural gas extraction rate of 75%) and high depletion rates in shale gas, oil and gas companies are forced to build and drill more and more wells. This situation has also been worsened by the “drill or kill” leases that give drilling companies three years to drill before voiding their leases. One expert in the industry stated that the average capital expenditure of 35 analyzed companies has increased to a total of $50 per barrel of oil, when their revenue per barrel of oil is $51.50. Due to the inherent nature of shale oil, high depletion rates are to be expected and results in to necessity to always reallocate funds towards exploration drilling so that the company can maintain and increase production levels. Then take into account the inevitable happening of diminishing returns with future drilling, the industry will gradually move towards an equilibrium where the gas price will be raised so that these companies stay economically viable. Phillips 66, a secondary company to ConocoPhillips (NYSE: COP), is a company that is heavily invested in the chemical space, a business that benefits from lower gas prices, and midstream operations. This puts the company in a good position to take control of the oil industry. In fact, Phillips 66 has already begun moving towards the storage, transportation, and conversion of shale gas and oil. This focus on assets that are high in demand and highly profitable makes the company less vulnerable to the highly unstable refining industry. Phillips is positioning itself in the energy industry in the United States to become a dominant leader and take the many opportunities that awaits it.

Phillps 66 (NYSE: PSX) Will Be The Next Leader In US Oil and Gas

29

Share.

Pingback: zweefparasols met voet

Pingback: ufabtb

Pingback: ทางเข้า LSM99

Pingback: cei mai buni medici chirurgie vasculara

Pingback: beste borsten

Pingback: ของพรีเมี่ยม

Pingback: สูทผู้หญิง

Pingback: LSM99 สมัครบาคาร่า

Pingback: coway

Pingback: สำหรับมือใหม่ ผู้เริ่มต้น แทงบอลสเต็ป กติกาบอลสเต็ป ที่ Lsm99 ทำอย่างไร

Pingback: ทางเข้าpg

Pingback: disposable thc vape pens bulk

Pingback: Personal loans

Pingback: สล็อตเว็บตรง ทุนน้อยโบนัสแตกโหด ถอนได้ไม่อั้น

Pingback: aviator website

Pingback: 15 รับ 100

Pingback: openleft.ru

Pingback: เช่ารถเครน

Pingback: Aviator Game India

Pingback: ดาวน์โหลดวิดีโอฟรี

Pingback: tga168 สล็อต

Pingback: หวยนาคราช เว็บแทงหวยออนไลน์ อัตราจ่ายสูงสุด 3 ตัวตรง บาทละ 960

Pingback: agarwood

Pingback: ติดต่อ ALPHABET-ISC

Pingback: kruger

Pingback: reborn dolls website

Pingback: fear of god essentials

Pingback: กราฟีน

Pingback: โรงพยาบาลศัลยกรรมจีน