Carl Icahn wants Apple Inc. (NASDAQ:AAPL) to repurchase $100 billion shares, as soon as possible. Carl Icahn published a letter on his tumblr stating his desire for Apple Inc. (NASDAQ:AAPL) to increase its share buy back program. Apple Inc. (NASDAQ:AAPL) is in no rush to make any changes to their current buyback plan. The billion dollar company has most of its funds tied up in overseas accounts, which makes it difficult to bring the cash back. Doing so can possibly incur a tax by the US government. Some believe Tim Cook should forget about the stock price valuation, and instead should focus on putting funds into Research and Development, to build better and revolutionary products.

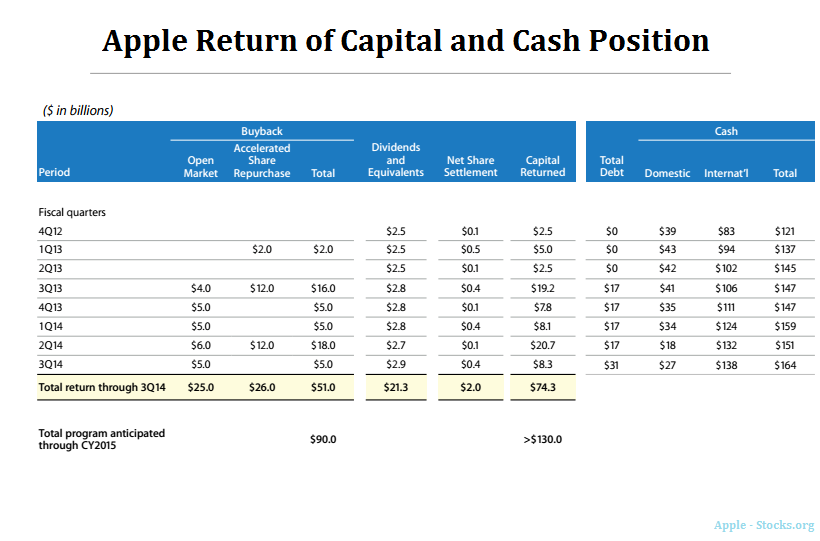

Below is a chart which depicts Apple’s current shares buy back program and plan:

(Source: Shareholder.com)

Icahn wishes Apple Inc. (NASDAQ:AAPL) to speed up its stock repurchase activities. The tech giant has stated:

“We always appreciate hearing from our shareholders. Since 2013, we’ve been aggressively executing the largest capital return program in corporate history. As we’ve said before, we will review the program annually and take into account the input from all our shareholders.”

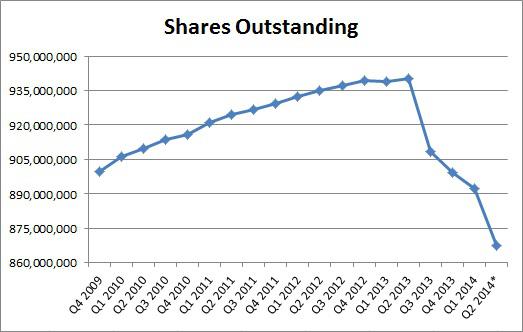

Thanks to Icahn, who was Apple Inc. (NASDAQ:AAPL)’s largest shareholder. He recommended the share buy back program of which Apple took action. Here’s a chart which depicts how aggressive Apple has been in their share buy back program.

Without a proper share buy back program, investors will complain about the low EPS growth. Apple is resorting to smart financial engineering to prop up their stocks, as they search for new innovation. The outcome would be worse if Apple Inc. (NASDAQ:AAPL) announced a year-over-year decline in EPS. Therefore, buying back shares is the best strategy for them as they are able to show positive EPS growth.

What happens when a company doesn’t do a share buy back?

Take a look at Intel (NASDAQ: INTC). The chip company stalled its share buyback program in 2013, reducing its buyback by 50%. As a result, their earnings took a hit and they failed to meet analyst earning expectations three out of the four reported quarters. These misses could be avoided if Intel had just bought back the same amount of shares. Instead they were allocating their capital into Research and Development. Strictly from an investor perspective, immediate buy back would make the company look better, and additional institutional investors would help bolster the shares. Intel (NASDAQ:INCT) can be cited by some, to be doing a responsible thing by investing their funds into Research and Development. The stock suffered at least 10% due to failure of continuing with a shares re-purchasing strategy.

Apple has been successfully investing into research and development, with $4.8 billion allocated for 2013. This amount was 83% greater than their prior spending in 2011. Even management confirmed they are continually spending more into R&D:

“Katy Huberty (Morgan Stanley): And Peter, you’re guiding OpEx flattish sequentially, despite the big revenue downtick. Are there any one-time items in SG&A and R&D in the March quarter? Or is the run rate reflective of investments for future opportunities?

Peter Oppenheimer (Apple CFO): It’s definitely the latter, and let me have Luca take you through some details.

Luca Maestri (Apple VP and Corporate Controller: Yes, at the midpoint of the range of our guidance, we are expecting a minor decrease of $50 million. This is largely due to the lower variable expenses that we’re going to have, in line with the seasonal sequential decline in revenue. But one thing that Peter already mentioned in his remarks is that we continue to invest very heavily in R&D. We make investments in areas that are visible to all of you today, but also in areas that are not visible, which we’re very excited about. And for the things that are not visible to you, obviously were impacting ahead of the revenue that these products and services will generate in the future. So there is nothing that is one-off in nature in our guidance.”

Some feel that Apple already spent enough into R&D, and spending additional funds would not increase the chance of success for their products. More expenditure on R&D would result in lower net income and EPS. There is no guarantee of future products and their potential success.

Pingback: La chica del sem free downloads

Pingback: Blue Coaster33

Pingback: increase leptin

Pingback: watch movies online

Pingback: watch free movies online

Pingback: tv online, online tv

Pingback: alkaline water

Pingback: alkaline water

Pingback: kangen water machine

Pingback: kangen water machine

Pingback: Petunia Conchita Strawberry

Pingback: online casinos

Pingback: payday loans with saving account

Pingback: tvpackages.net

Pingback: her og nu lan

Pingback: fue.mobi

Pingback: stop parking

Pingback: laan penge

Pingback: stop parking

Pingback: water ionizers

Pingback: pay per day loan plans

Pingback: water ionizer pay plan loans

Pingback: alkaline water brands

Pingback: electrician kalamazoo

Pingback: electrician 90808

Pingback: Curing Hay Fever Naturally with Chinese Medicine - Bob Flaws free downloads

Pingback: locksmith for piqua ohio movie

Pingback: get the facts

Pingback: plumbing schools in quebec

Pingback: Payday Loans

Pingback: house blue

Pingback: electrician prices

Pingback: electricians salary

Pingback: HD Coloring Pages

Pingback: ionizer payment plan

Pingback: water ionizer

Pingback: paypal loans

Pingback: water ionizer payment plan

Pingback: view more

Pingback: alkaline water

Pingback: cheap car insurance

Pingback: alkaline water

Pingback: http://makemoney.camkingz.com/

Pingback: http://webkingz.camkingz.com/

Pingback: learn more

Pingback: do you agree

Pingback: Anonymous

Pingback: Greg Thmomson

Pingback: gmail.com login

Pingback: gmail to check your gmail

Pingback: search all craigslist

Pingback: Maria Smith

Pingback: latestvideo sirius362 abdu23na1244 abdu23na16

Pingback: sirius latest movs663 abdu23na7342 abdu23na18

Pingback: cna classes utah

Pingback: download on mobile96 afeu23na5136 abdu23na74

Pingback: tubepla.net download150 afeu23na2265 abdu23na10

Pingback: download on mobile131 afeu23na6226 abdu23na35

Pingback: 592FoJboQgD

Pingback: hdmobilesex.me

Pingback: 43ytr.icu

Pingback: Melanie Bowen

Pingback: vacant land for sale squamish bc

Pingback: mortgage broker

Pingback: coquitlam mortgage broker

Pingback: viagra price

Pingback: online payday loans

Pingback: mortgage calculator

Pingback: o canada lyrics

Pingback: otc cialis

Pingback: coupon for cialis

Pingback: order cialis online

Pingback: Buy viagra now online

Pingback: viagra for sale

Pingback: cbd

Pingback: cbd

Pingback: pain meds without written prescription

Pingback: viagra generic

Pingback: coupon for cialis

Pingback: best ed pills

Pingback: generic cialis at walmart

Pingback: cialis over the counter walmart

Pingback: generic cialis 2019

Pingback: viagra no doctor prescription

Pingback: female viagra

Pingback: buy chloroquine 250mg

Pingback: viagra 100mg

Pingback: cialis online

Pingback: erectile dysfunction pills

Pingback: generic cialis online

Pingback: tadalafil online

Pingback: cheap erectile dysfunction pills

Pingback: viagra

Pingback: generic viagra usa

Pingback: impotence pills

Pingback: buy amoxicillin online

Pingback: tadalafil generic cialis

Pingback: buy generic cialis tadalafil

Pingback: best online pharmacy

Pingback: viagra prescription

Pingback: online pharmacy

Pingback: cialis visa

Pingback: prescription drugs without doctor approval

Pingback: cialis mastercard

Pingback: levitra vardenafil

Pingback: levitra 20mg

Pingback: cheap cialis

Pingback: parx casino online

Pingback: hollywood casino online real money

Pingback: online pharmacy viagra

Pingback: order viagra online

Pingback: generic cialis canada

Pingback: online payday loans

Pingback: top mortgage broker vancouver

Pingback: loans for bad credit

Pingback: cash loans

Pingback: generic cialis

Pingback: viagra pills

Pingback: Best Nootropic Supplements of 2020Rated and Reviews

Pingback: ed meds online without doctor prescription

Pingback: Full-Body Dance Fitness Classes

Pingback: Patient Care and Health Information

Pingback: cialis 5 mg

Pingback: real money casino games

Pingback: cialis 20

Pingback: buy viagra

Pingback: new cialis

Pingback: pitt meadows house for sale

Pingback: buy propecia

Pingback: cialis to buy

Pingback: generic for cialis

Pingback: best cbd sales online

Pingback: buy hydroxychloroquine online

Pingback: viagra generic name

Pingback: best cbd oil

Pingback: best online casino usa

Pingback: best cbd sales online

Pingback: golden nugget online casino

Pingback: harrison lake

Pingback: best casino online

Pingback: canadian pharmacy viagra

Pingback: buy prescription drugs without doctor

Pingback: canadian pharmacy viagra

Pingback: viagra generic

Pingback: cheap viagra

Pingback: viagra pills

Pingback: viagra prescription

Pingback: online prescription for ed meds

Pingback: tadalafil cialis

Pingback: canadian pharmacy viagra

Pingback: canadian viagra

Pingback: tadalafil 20

Pingback: buy viagra no prescription

Pingback: buy tadalafil 20mg price

Pingback: order viagra

Pingback: viagra cost per pill

Pingback: viagra 100mg

Pingback: tadalafil vs sildenafil

Pingback: slots online

Pingback: cialis coupon

Pingback: online casino real money usa

Pingback: buy viagra no prescription

Pingback: do i need prescription to buy viagra in canada

Pingback: cheapest generic viagra

Pingback: viagra without a doctor prescription walmart

Pingback: where to buy pfizer viagra in india

Pingback: cialistodo.com

Pingback: buy viagra levitra alternative lavitra

Pingback: buy cheap viagra

Pingback: hydroxychloroquine order

Pingback: canadian generic viagra

Pingback: Viagra 50 mg without a doctor prescription

Pingback: Viagra 150mg pills

Pingback: cheapest generic cialis

Pingback: Viagra 25 mg generic

Pingback: how to purchase Viagra 150mg

Pingback: buy sildenafil online

Pingback: Viagra 120 mg purchase

Pingback: Cialis 20 mg united states

Pingback: viagra buy

Pingback: where to buy Cialis 60mg

Pingback: Cialis 80 mg united kingdom

Pingback: viagra without doctor prescription

Pingback: buy cialis

Pingback: Cialis 10mg otc

Pingback: cost of Cialis 80 mg

Pingback: Cialis 80 mg for sale

Pingback: Cialis 60 mg canada

Pingback: generic cialis

Pingback: sildenafil 120 mg uk

Pingback: grassfed.us

Pingback: cheap lasix 100mg

Pingback: furosemide 100 mg usa

Pingback: buszcentrum.com

Pingback: propecia 5mg cheap

Pingback: buy cialis

Pingback: lexapro 5 mg no prescription

Pingback: viagra cheap

Pingback: finasteride 1mg purchase

Pingback: buy viagra

Pingback: abilify 10 mg usa

Pingback: where can i buy actos 15 mg

Pingback: aldactone 25 mg nz

Pingback: allegra 180 mg united kingdom

Pingback: allopurinol 300 mg generic

Pingback: amaryl 2 mg online pharmacy

Pingback: amoxicillin 250mg online

Pingback: ampicillin 500 mg nz

Pingback: antabuse 250mg without prescription

Pingback: online viagra

Pingback: antivert 25mg united kingdom

Pingback: buy arava 20 mg

Pingback: levitra versus viagra

Pingback: where can i buy tamoxifen 20 mg

Pingback: how to purchase ashwagandha 60caps

Pingback: cialis cost

Pingback: atarax 10mg united states

Pingback: augmentin 750/250mg without a doctor prescription

Pingback: where to buy avapro 300 mg

Pingback: avodart 0,5 mg united kingdom

Pingback: viagra cost

Pingback: baclofen 10mg generic

Pingback: where to buy bactrim 800/160mg

Pingback: generic sildenafil

Pingback: benicar 20mg without a doctor prescription

Pingback: generic cialis is it safe

Pingback: Biaxin 250mg prices

Pingback: cheap generic viagra

Pingback: where to buy Premarin 0,625 mg

Pingback: cialis super active review

Pingback: herbal viagra

Pingback: calcium carbonate 500 mg cheap

Pingback: where to buy cardizem 180 mg

Pingback: best viagra alternatives

Pingback: sildenafil coupons

Pingback: generic cialis at walmart

Pingback: online casino gambling

Pingback: bimatoprost brand or generic

Pingback: viagra prescription usa

Pingback: viking insurance for car

Pingback: mortgage broker richmond

Pingback: Buy no rx viagra

Pingback: best medicine for ed

Pingback: is it safe to buy viagra online

Pingback: personal loans near me

Pingback: can i buy viagra over the counter in australia

Pingback: buy amoxicillin online without prescription

Pingback: best price viagra 25mg

Pingback: viagra price costco

Pingback: payday loans online

Pingback: can you order viagra without a prescription

Pingback: clomid generic clomipheneqb

Pingback: how to buy viagra online in australia

Pingback: viagra online cheap

Pingback: ivermectin dosage scabies

Pingback: pfizer viagra india

Pingback: vidalista 20 india

Pingback: best pharmacy prices for viagra

Pingback: hydroxychloroquine low dose

Pingback: free research paper writer

Pingback: cheap viagra buy

Pingback: Levitra or viagra

Pingback: Generic viagra usa

Pingback: cialis price walmart

Pingback: buy essays for college

Pingback: coumadin united kingdom

Pingback: Alternative for viagra

Pingback: viagra malaysia

Pingback: order custom essays

Pingback: best dissertation help

Pingback: Buy pfizer viagra online

Pingback: help writing a compare and contrast essay

Pingback: help research paper

Pingback: help with a thesis statement

Pingback: phd thesis writing service

Pingback: what should i write my paper about

Pingback: buy cheap viagra

Pingback: priligy dosage for women

Pingback: rx cost estimator

Pingback: doxycycline generic

Pingback: viagra prices

Pingback: buy hydroxychloroquine online india

Pingback: supplements for ed

Pingback: generic Zithromax

Pingback: amstyles.com

Pingback: google viagra dosage recommendations

Pingback: hydroxychloroquine sold over the counter

Pingback: cialis buy online

Pingback: viagra for sale

Pingback: sildenafil vs viagra

Pingback: buy cialis in canada online

Pingback: buy generic zithromax no prescription

Pingback: generic pills

Pingback: generic sildenafil

Pingback: lopressor coupon

Pingback: luvox medication

Pingback: buy viagra master card

Pingback: cheap erectile dysfunction pills online

Pingback: mestinon coupon

Pingback: prednisone dosage schedule

Pingback: canadian pharmacy reviews

Pingback: canadian pharmacies shipping to usa

Pingback: canada drugs online

Pingback: to get viagra in toronto

Pingback: prednisolone 5 mg united kingdom

Pingback: buy viagra online

Pingback: how to get viagra

Pingback: doxy 200

Pingback: buy amoxicillin 250mg

Pingback: allegra south africa

Pingback: ivermectin for humans scabies treatment

Pingback: non prescription viagra

Pingback: best place to buy viagra online

Pingback: cialis jelly

Pingback: buy generic drugs without prescription

Pingback: Google

Pingback: how to buy zithromax online

Pingback: where to buy tadalafil 60mg

Pingback: can you purchase amoxicillin online

Pingback: best online canadian pharmacy

Pingback: buy viagra generic

Pingback: where can i buy clonidine 0.1 mg

Pingback: cephalexin 500 mg for sale

Pingback: cheap cialis

Pingback: loratadine australia

Pingback: tadalafil

Pingback: gay hub

Pingback: buy viagra in australia

Pingback: buy generic viagra

Pingback: where to buy cialis

Pingback: 1xbetmobi

Pingback: dildo

Pingback: anal ease suppository

Pingback: 샌즈카지노

Pingback: 코인카지노

Pingback: desmopressin mcg tablets

Pingback: مباريات اليوم مباشر

Pingback: how to enjoy g spot sex toys

Pingback: Trans Hub Porn

Pingback: hq porner

Pingback: sildenafil 20 mg prescription

Pingback: buy viagra online without prescription verified fda aproval website

Pingback: cheap sildenafil

Pingback: Gay Hub XXX

Pingback: 141genericExare

Pingback: cheap cialis

Pingback: Mining

Pingback: cialis 20mg canada

Pingback: qoylyetn

Pingback: ed pills for sale

Pingback: cheap cialis

Pingback: zphxfhcf

Pingback: Digital Marketing Services

Pingback: best ed treatment pills

Pingback: how much cialis is safe to take

Pingback: wat is cialis

Pingback: welke stof zit in viagra

Pingback: now that i took azithromycin how long until it cures my uti

Pingback: glipizide pills

Pingback: furosemide 100 mg

Pingback: where can i buy viagra without a prescription

Pingback: singapore top broker

Pingback: 샌즈카지노

Pingback: tinidazole online

Pingback: 메리트카지노

Pingback: 코인카지노

Pingback: order doxycycline

Pingback: AnaGlobal

Pingback: freight travel

Pingback: sumycin tablets

Pingback: cbd for anxiety

Pingback: buy viagra cialis online

Pingback: buying viagra online legally

Pingback: best cbd oil for dogs

Pingback: best cbd gummies

Pingback: order keftab online

Pingback: azathioprine 50 mg united states

Pingback: prostate vibe

Pingback: 5 mg cialis coupon printable

Pingback: green maeng da kratom

Pingback: 5 mg cialis coupon printable

Pingback: white maeng da kratom

Pingback: cost of indomethacin

Pingback: comprar viagra

Pingback: buy cbd oil

Pingback: best resume writing service reddit

Pingback: essay writing on my daily routine in english

Pingback: help me create a title for a essay

Pingback: Order Real Weed Online

Pingback: إعلانات مبوبة مجانية في السودان

Pingback: BUY OPANA 40MG

Pingback: masturbation techniques

Pingback: Minnesota Fake driver's license

Pingback: Can I buy Hydrocodone online

Pingback: buy kratom online

Pingback: kratom for sleep

Pingback: 우리카지노

Pingback: 퍼스트카지노

Pingback: ZOURS STRAIN

Pingback: matched betting sites

Pingback: buy medication without an rx

Pingback: augmentin 675

Pingback: german shepherd puppies for sale

Pingback: furosemide 20 mg tablet cost

Pingback: top recruitment Agency in Nigeria

Pingback: viagra over the counter walmart

Pingback: stromectol 3 mg price

Pingback: albuterol 180mcg

Pingback: buy viagra online usa

Pingback: safestore auto

Pingback: app for laptop

Pingback: pc apps free download

Pingback: apps download for windows 10

Pingback: metoprolol pharmacy

Pingback: zithromax azithromycin

Pingback: viagra 100mg price

Pingback: doxycycline for humans

Pingback: prednisolone 15 5

Pingback: dapoxetine india online

Pingback: synthroid meds

Pingback: South Dakota Fake driver's license

Pingback: ed treatments that really work

Pingback: help writing thesis statement

Pingback: buy Flexeril online

Pingback: where to buy cialis over the counter in canada

Pingback: psychedelic mushroom growing kit usa

Pingback: MAGIC MUSHROOM GROW KIT

Pingback: zithromax 250 mg pill

Pingback: generic gabapentin

Pingback: zithromax 500 mg

Pingback: click here

Pingback: ask propecia

Pingback: Pc hilfe pfäffikon

Pingback: Herbal incense

Pingback: Herbal incense

Pingback: Home, Garden

Pingback: buy guns online ca

Pingback: shipping containers for sale in maine

Pingback: cialis for sale uk

Pingback: Canada Pharmacy

Pingback: ordering medicine from india

Pingback: in Canada

Pingback: cryptocard

Pingback: neurontin for vulvodynia

Pingback: metformin kidney

Pingback: paxil and drinking

Pingback: shipping container shop

Pingback: plaquenil covid 19

Pingback: buy copper wire online

Pingback: buy card

Pingback: meds from india

Pingback: over the counter ed medication

Pingback: pharmacy canada online

Pingback: delta 8 near me

Pingback: aarp approved canadian online pharmacies

Pingback: viagra no prescription

Pingback: Servicetech

Pingback: guns for sale usa

Pingback: heroin for sale Australia

Pingback: acheter generic levitra

Pingback: cialis otc months

Pingback: order clomid online

Pingback: cvs generic viagra price south africa

Pingback: acheter viagra pfizer 100mg

Pingback: where can i get cialis australia

Pingback: wo buy cheap generic viagra

Pingback: buy amoxicillin over the counter uk

Pingback: Vidalista 20mg

Pingback: amoxicillin liquid concentration

Pingback: liquid amoxicillin

Pingback: how long do shrooms stay in your system

Pingback: azithromycin and sun exposure

Pingback: siamese kittens for sale near me

Pingback: celecoxib 200 mg side effects

Pingback: celebrex maximum dose per day

Pingback: metformin 850g

Pingback: images of cephalexin

Pingback: keflex for dogs

Pingback: duloxetine 90mg

Pingback: End Of Tenancy Cleaning South Kensington

Pingback: withdrawal from cymbalta

Pingback: levitra online shop

Pingback: sildenafil for sale usa

Pingback: sildenafil gel precio

Pingback: Web Design and SEO Company In Azerbaijan

Pingback: where can i buy sildenafil

Pingback: otc viagra pills

Pingback: otc version of cialis

Pingback: sildenafil otc usa

Pingback: Used Shipping Containers for Sale

Pingback: cialis prescription france

Pingback: discount cialis generic

Pingback: natalie mars viagra

Pingback: cialis in action video

Pingback: buy brand viagra cheap

Pingback: cialis 20mg

Pingback: buy Instagram followers

Pingback: cheapest source for cialis

Pingback: does cvs sell cialis over the counter

Pingback: sildenafil fast shipping

Pingback: teva generic cialis australia

Pingback: does sildenafil work

Pingback: cialis 20 mg amazon

Pingback: order sildenafil canada

Pingback: drug finasteride

Pingback: viagra 50 mg online purchase

Pingback: coupon viagra

Pingback: us otc cialis

Pingback: generic viagra reviews south africa

Pingback: cialis professional 40mg en france

Pingback: cialis 20mg for sale

Pingback: Buy dmt online

Pingback: 40ft shipping container

Pingback: online cbd shop

Pingback: over the counter lasix

Pingback: Nitrile Gloves

Pingback: triumph street triple

Pingback: non prescription ed pills

Pingback: adhd meds for sale online

Pingback: buy cialis ebay

Pingback: play minecraft with friends} urls are attached

Pingback: Website

Pingback: Zakhar Berkut hd

Pingback: canadian king pharmacy

Pingback: canadian pharmacy online reviews

Pingback: 4569987

Pingback: amoxicillin 500 mg dosage instructions

Pingback: order cialis in australia

Pingback: GOLDEN SUNRISE STRAIN

Pingback: can i buy cialis online

Pingback: zbicy

Pingback: canadian pharmacy 20mg

Pingback: news news news

Pingback: find out more

Pingback: learn more

Pingback: quick cash advance cranston

Pingback: cialis

Pingback: psy

Pingback: psy2022

Pingback: projectio-freid

Pingback: vibrating strapless strap on

Pingback: viagra and detached retinas

Pingback: learn more

Pingback: good tinder Profile pics

Pingback: quick cash advance maine

Pingback: if harry potter had tinder

Pingback: buy time crisis 4

Pingback: kinoteatrzarya.ru

Pingback: topvideos

Pingback: video

Pingback: from canada

Pingback: top sex toys for women

Pingback: in europe

Pingback: Trijicon Acog

Pingback: bàn học cho bé

Pingback: in europe

Pingback: afisha-kinoteatrov.ru

Pingback: Ukrainskie-serialy

Pingback: best generic lisinopril

Pingback: site

Pingback: free dating and messaging sites

Pingback: buy ativan 2mg

Pingback: free online dating no sign up

Pingback: top

Pingback: best online pharmacy forum

Pingback: cialis sale 20mg

Pingback: adult

Pingback: bdsm spanking bondage

Pingback: ordering cialis online australia

Pingback: bristol dating free

Pingback: 100% free dating and chat

Pingback: senior dating sites that is totally free

Pingback: ejaculating strapon dildo

Pingback: mobile homes for sale in westmoreland county pa

Pingback: Short guns for sale

Pingback: buy cialis canadian

Pingback: sex toys bizarre

Pingback: everyday life of a sex toy reviewer

Pingback: 100 free emo dating

Pingback: sugar daddy dating free uk

Pingback: SIG Sauer P210 for sale

Pingback: escort pendik

Pingback: go fish dating free

Pingback: free and dating

Pingback: slot online

Pingback: electric-motorcyclesvancouver.ca

Pingback: cialis daily reviews

Pingback: sexual

Pingback: valtrex online canada

Pingback: thrusting anal vibe

Pingback: cheap sildenafil

Pingback: pharmacy no prescription required

Pingback: Guns for Sale

Pingback: beginners strap on dildo

Pingback: tadalafil 5mg prices

Pingback: viagra gum

Pingback: sex games

Pingback: buy prescription drugs without doctor

Pingback: generic tadalafil price

Pingback: g spot massager

Pingback: viagra discount prices

Pingback: viagra from canada

Pingback: generic tadalafil cvs

Pingback: Pinball for sale

Pingback: PARROTS FOR SALE

Pingback: MASALA MACHINE

Pingback: cialis 100mg cost

Pingback: pfizer viagra 100mg

Pingback: soderzhanki-3-sezon-2021.online

Pingback: viagra dosages

Pingback: gabapentin for cats

Pingback: cialis 50mg price

Pingback: levitra generic usa

Pingback: best kratom

Pingback: chelovek-iz-90-h

Pingback: podolsk-region.ru

Pingback: generic viagra online

Pingback: norvasc 10 mg

Pingback: atorvastatin warnings

Pingback: buy Instagram likes

Pingback: best delta 8 thc gummies

Pingback: interactions for meloxicam

Pingback: metoprolol er

Pingback: thick dildo

Pingback: losartan 50 mg

Pingback: womens viagra

Pingback: tadalafil generic 10mg

Pingback: free kisses dating site

Pingback: vardenafil sublingual generic

Pingback: prednisone 20mg

Pingback: elavil

Pingback: duloxetine hcl

Pingback: losartan potassium hydrochlorothiazide

Pingback: metformin 500 mg tablet

Pingback: tides today at tides.today

Pingback: viagra discount

Pingback: bupropion sr 100mg

Pingback: interactions for buspirone

Pingback: celexa medication

Pingback: zanaflex for headaches

Pingback: bupropion hcl sr

Pingback: free dating sites no fees for seniors

Pingback: over 60 dating sites free

Pingback: african american dating sites free

Pingback: mens erection pills

Pingback: Raag Consultants

Pingback: clonidine interactions

Pingback: finasteride 5mg side effects

Pingback: coreg side effects men

Pingback: metronidazole for dogs diarrhea

Pingback: bender na4alo 2021

Pingback: blogery_i_dorogi

Pingback: blogery_i_dorogi 2 blogery_i_dorogi

Pingback: tadalafil 6mg capsule

Pingback: cheap cialis generic

Pingback: viagra dosage

Pingback: levitra 10mg price

Pingback: THC Gummies

Pingback: buy weed

Pingback: bachelor's degree

Pingback: acyclovir ointment

Pingback: amoxicillin 500 mg price

Pingback: what is donepezil

Pingback: amoxicillin 500mg

Pingback: zithromax 250 mg

Pingback: genericsbb cefdinir antibiotic

Pingback: cephalexin 500mg

Pingback: side effects for clindamycin

Pingback: erythromycin 250mg capsules

Pingback: bullet vibrator

Pingback: azithromycin 500g tablets

Pingback: plaquenil 200 mg daily

Pingback: rechargeable vibrator

Pingback: rechargeable bullet

Pingback: marijuana dispensaries

Pingback: Juneau Empire

Pingback: ivermectin cream

Pingback: buy weed online

Pingback: tadalafil 10mg generic

Pingback: cialis from canada pharmacy

Pingback: marijuana dispensaries

Pingback: buy weed online

Pingback: buy weed

Pingback: tadalafil citrate 20mg

Pingback: sildenafil from mexico

Pingback: buy tiktok followers

Pingback: levitra price usa

Pingback: shroom chocolate

Pingback: viagra dapoxetine

Pingback: buy ruger guns online

Pingback: hk sp5 sporting pistol

Pingback: keto chips recipe

Pingback: buy cbd oils online

Pingback: keto diet carbs

Pingback: ruger guns for sale

Pingback: Kelowna moving company

Pingback: cialis dapoxetine

Pingback: generic viagra for sale

Pingback: MKsOrb.Com

Pingback: Glock Guns for sale

Pingback: Data obligasi

Pingback: keto bread

Pingback: Food Delivery Parksville

Pingback: MURANG'A UNIVERSITY

Pingback: hydroxychloroquine coronavirus trial results

Pingback: ivermectin buy online

Pingback: cialis on line

Pingback: cialis cost australia

Pingback: is viagra safe

Pingback: price of sildenafil tablets

Pingback: dysfunction erectile

Pingback: where to buy zithromax over the counter

Pingback: MILF Porn Land

Pingback: chernaya vodova

Pingback: erectial dysfunction

Pingback: sildenafil

Pingback: escort istanbul

Pingback: viagra without prescription

Pingback: olgun escort

Pingback: pfizer viagra pills

Pingback: Roofing Company

Pingback: sildenafil 1000 mg

Pingback: canadian pharmacy

Pingback: household furniture warehouse

Pingback: Sig M18

Pingback: Chinchilla For Sale

Pingback: how does amlodipine work

Pingback: cialis strength

Pingback: levitra 40mg

Pingback: hydroxychloroquine use in mexico

Pingback: urgent news about metformin

Pingback: vardenafil vs tadalafil

Pingback: Porno

Pingback: vechernyy urgant

Pingback: ukraine

Pingback: Multi Gym

Pingback: bulk dungeness crab for sale

Pingback: 100mg viagra

Pingback: doxycycline coverage

Pingback: lasix dosage

Pingback: xenical pills for sale

Pingback: priligy 30mg tablets

Pingback: what is finasteride

Pingback: bimatoprost pubchem

Pingback: where to buy hydroxychloroquine for guinea pigs

Pingback: clomid induced pregnancy

Pingback: A3ixW7AS

Pingback: fluconazole treatment skin yeast

Pingback: domperidone fda

Pingback: bunnings shed

Pingback: tamoxifen manufacturer

Pingback: prednisolone acetate ophthalmic msds

Pingback: naltrexone hcl 2mg

Pingback: valtrex generic brand name

Pingback: buy cialis online generic

Pingback: tizanidine with codiene

Pingback: tadalafil dosage for bph

Pingback: tadalafil australia

Pingback: cialis trial

Pingback: popular sex toys

Pingback: website

Pingback: Canadian service

Pingback: gidonline-ok-google

Pingback: Buy HBCU Coin - Crypto Coin Project

Pingback: best software list

Pingback: Mail Order Guns Online

Pingback: iron and ciprofloxacin

Pingback: juul mango pods wholesale

Pingback: Canada Pharmacy

Pingback: brand cialis singapore

Pingback: معرفة هوية المتصل

Pingback: weed online usa

Pingback: dispensary that ship to texas

Pingback: cialis pills

Pingback: buy glo extracts carts online

Pingback: sildenafil tadalafil

Pingback: warnings for viagra

Pingback: canadian viagra pharmacy

Pingback: Where to Buy Ruger Guns Online

Pingback: KremlinTeam

Pingback: medunitsa.ru

Pingback: kremlin-team.ru

Pingback: psychophysics.ru

Pingback: yesmail.ru

Pingback: canada pharmacy canada pharmacy

Pingback: self healing

Pingback: exotic pets for sale near me

Pingback: generic cialisis

Pingback: Suicide Squad 2

Pingback: learn more

Pingback: buy chloroquine and hydroxychloroquine

Pingback: psiholog

Pingback: Cataracts Surgery

Pingback: how to use a butterfly vibrator

Pingback: penis extender

Pingback: rechargeable male penis pump

Pingback: pharmacy in japan for viagra

Pingback: tetracycline family of drugs

Pingback: free adult short stories

Pingback: hizhnyak-07-08-2021

Pingback: is viagra safe for 20 year olds

Pingback: besiktas escort

Pingback: zithromax 500 tablet

Pingback: canada pharmacy canada pharmacy

Pingback: zithromax 600 mg tablets

Pingback: Crack For Sale

Pingback: tech

Pingback: happyluke ฟรี300

Pingback: happyruck.com

Pingback: vibrator

Pingback: adam and eve male sex toys

Pingback: male pocket strokers

Pingback: best way to clean and store sex toys

Pingback: AMI Hospital Management

Pingback: regcialist.com

Pingback: taksim escort

Pingback: suadiye escort

Pingback: happyruck.com

Pingback: professional ivermectil vs regular ivermectil

Pingback: vibrating rechargeable kegel balls

Pingback: Magic Mushroom Vancouver

Pingback: canadapharmacycanada.com

Pingback: sex positivity

Pingback: realistic squirting dildo

Pingback: anal sex toys

Pingback: mersin escort

Pingback: viagra without a prescription

Pingback: gulde testolin acyclovir

Pingback: ivermectin 6 mg capsules

Pingback: legit weed store

Pingback: Asian Restaurant

Pingback: fun88

Pingback: chloroquine covid

Pingback: thrusting p spot massager

Pingback: vibrator for women

Pingback: male pocket strokers

Pingback: adam and eve vibrators

Pingback: focus portable oxygen concentrator

Pingback: in Canada

Pingback: Male Masturbator Reviews

Pingback: lottovip สมัครสมาชิก

Pingback: hosting deals

Pingback: ivermectin for children

Pingback: ground lease

Pingback: buy 10 mg cialis

Pingback: lotto vip

Pingback: priligy on ebay

Pingback: สมัคร ruay

Pingback: best p spot toys

Pingback: male masturbator

Pingback: how to achieve orgasm using a realistic dildo

Pingback: کلیپ سکسی خارجی

Pingback: Thc jull pods

Pingback: zeytinburnu escort

Pingback: Peer-to-Peer crypto platfrom

Pingback: car delivery company

Pingback: proper use of sildenafil

Pingback: site de streaming

Pingback: streaming gratuit

Pingback: film streaming 2021

Pingback: melhores smartphones

Pingback: Ctrlcoin.io – P2P CRYPTO EXCHANGE PLATFORM

Pingback: download tw videos

Pingback: fluoxetine dosage for cats

Pingback: masturbating

Pingback: how to masturbate using a pleasure ring for men

Pingback: thrusting rabbit

Pingback: best male strokers

Pingback: 1xbit deposit bonus

Pingback: recommended canadian online pharmacies

Pingback: best in ottawa

Pingback: buying ed pills from canada

Pingback: duloxetine 60 mg side effects

Pingback: 메이저놀이터

Pingback: 피망슬롯머니

Pingback: viagra connect

Pingback: ivermectin generic

Pingback: ivermectin pills human

Pingback: gncedstore

Pingback: entertaining math workbooks

Pingback: cheapest viagra

Pingback: sertraline 25 mg side effects

Pingback: viagra coupon

Pingback: 3 Days Murchison Falls Tour

Pingback: how to get cialis cheaper

Pingback: libresse

Pingback: Thc Vape oil

Pingback: medication online

Pingback: gia hoc lai xe b1

Pingback: học lái xe bằng c giá bao nhiêu

Pingback: what is lexapro used for

Pingback: ed pills that really work

Pingback: big chief carts bulk

Pingback: official cialis website

Pingback: đăng ký học lái xe b1

Pingback: will ivermectin kill adult heartworms

Pingback: generic cialis canada

Pingback: Hoc lai xe B1 bao nhieu tien

Pingback: cockatoo for sale

Pingback: Friesian horse for sale

Pingback: where to buy cialis in stores

Pingback: KETASET FOR SALE

Pingback: stromectol and advil

Pingback: Duna 2021

Pingback: canadian pharmacies

Pingback: St Hilda's Church of England High School

Pingback: when do you take dapoxetine

Pingback: stromectol for stye

Pingback: blowjob tips

Pingback: best rabbit vibrator

Pingback: interactions for duloxetine

Pingback: online pharmacy viagra

Pingback: اظهار اسم المتصل

Pingback: projektownie wnętrz Gdynia

Pingback: hoc lai xe b1 o dau

Pingback: apps download for windows 7

Pingback: free download for pc windows

Pingback: games for laptop download

Pingback: free games download for pc

Pingback: cialis pills for men 20mg

Pingback: apps for pc download

Pingback: levitra cheap

Pingback: cialis pharmacy

Pingback: download app apk for windows

Pingback: download mp3

Pingback: metronidazole for bacterial vaginosis dosage

Pingback: Monkeys For Sale

Pingback: buy generic viagra australia

Pingback: Agence communication

Pingback: IT Support Bristol

Pingback: order generic viagra online canada

Pingback: Buy Sig Sauer Handguns

Pingback: viagra cialis levitra

Pingback: clomid purchase

Pingback: otc viagra

Pingback: Bang C bao nhieu tuoi 2021

Pingback: ivermectin 2mg

Pingback: viagra 100mg

Pingback: GOLF CARTS FOR SALE

Pingback: propecia finasteride 1mg is

Pingback: ivermectin 6

Pingback: ivermectin tablets

Pingback: Shipping containers For Sale

Pingback: Kenya Tanzania safaris

Pingback: Mac akku ersetzen pfäffikon

Pingback: cialis for sale online

Pingback: buy doxycycline hyclate 100mg without a rx

Pingback: order doxycycline 100mg without prescription

Pingback: best doc johnson sex toys

Pingback: doxycycline hyclate

Pingback: ivermecta clav 12

Pingback: shipping containers for sale

Pingback: buy viagra online usa

Pingback: ارقام بنات

Pingback: Serengeti African safari

Pingback: aromatherapy for anxiety

Pingback: online cialis us

Pingback: sildenafil generic coupon

Pingback: viagra price in malaysia

Pingback: 20 tuoi co hoc duoc bang C khong

Pingback: best over the counter cialis

Pingback: buy cialis 20mg

Pingback: sildenafil 5343

Pingback: levitra vs cialis side effects

Pingback: izrada web sajtova

Pingback: lowesnet

Pingback: blue and white stromectol capsules

Pingback: Thoi gian hoc bang C 2021

Pingback: cialis 20 mg online

Pingback: zithramax and heart

Pingback: cialis australia online stores

Pingback: Buy Percocet online

Pingback: reddit how to buy viagra online

Pingback: THC PUFF BAR

Pingback: women in viagra commercials

Pingback: what is the best natural alternative to viagra

Pingback: viagra substitutes over the counter

Pingback: savage impulse hog hunter 300 win

Pingback: colt 45 cattleman revolver

Pingback: sig p320

Pingback: viagra connect use

Pingback: walther ccp m2 9mm

Pingback: princess bride slot machine

Pingback: mossberg mvp 308 stock for sale

Pingback: reliable nembutal suppliers

Pingback: cialis wirkung

Pingback: stiiizy battery ebay Archives

Pingback: magic mushrooms

Pingback: magic mushrooms

Pingback: best ed solution

Pingback: zithromax 1000mg

Pingback: tadalafil for women

Pingback: generic cialis

Pingback: viagra price

Pingback: how to fix ed

Pingback: where to buy viagra in dallas

Pingback: background check website

Pingback: brand cialis online

Pingback: sildenafil buy canada

Pingback: ed pills comparison

Pingback: sildenafil citrate

Pingback: lisinopril stress

Pingback: mango juul pods

Pingback: roman ed meds

Pingback: buy canadian marble fox

Pingback: is ivermectin used to treat scabies

Pingback: smith and wesson arms

Pingback: natural viagra

Pingback: exotic weed

Pingback: bitcoin mining machines

Pingback: sugar glider for sale

Pingback: Murchison falls safari tour

Pingback: 3080 ftw3 msrp

Pingback: online gym equipment

Pingback: tamoxifen estrogen

Pingback: gabloty informacyjne

Pingback: شركة تسويق

Pingback: 20 mg of prednisone

Pingback: G19 COMPACT | 9X19MM

Pingback: stock market 101

Pingback: prednisone prices

Pingback: buy prednisone online from canada

Pingback: pills for sale in australia

Pingback: RissMiner

Pingback: generic ivermectin for humans

Pingback: ivermectin for sale

Pingback: The Gattons Infant School

Pingback: Buy sig sauer guns in Europe

Pingback: vertigo

Pingback: bitcoin

Pingback: where did the dab come from

Pingback: ivermectin 80 mg

Pingback: pet meds without vet prescription canada

Pingback: pet meds without vet prescription canada

Pingback: buy cheap prescription drugs online

Pingback: viagra samples

Pingback: Kenya safari

Pingback: Uganda Safari

Pingback: buy beretta guns online

Pingback: savage grow plus

Pingback: live resin cartridges

Pingback: sig sauer rifles

Pingback: kopru altinda sikin benim

Pingback: how to masturbate using a realistic pocket stroker

Pingback: herbal viagra sale uk

Pingback: male masturbators

Pingback: viagra pornhub

Pingback: uberti dalton

Pingback: Buy Ayahuasca

Pingback: cleantalkorg2.ru

Pingback: Seiko Presage

Pingback: about canada pharmacy

Pingback: real viagra without doctor prescription

Pingback: generic prednisone for sale

Pingback: thc vape carts for sale

Pingback: prednisone cost 10mg

Pingback: MURANG'A UNIVERSITY

Pingback: viagra substitute

Pingback: happyLuke

Pingback: stromectol without prescription

Pingback: buy ivermectin

Pingback: viagra dosage

Pingback: Swap Crypto

Pingback: viagra online

Pingback: cost of viagra per pill

Pingback: best testosterone booster

Pingback: doctor x viagra

Pingback: cialis 10mg

Pingback: Rent a car Bar, Montenegro

Pingback: alternative to viagra

Pingback: cialis 5mg pharmacy

Pingback: Adderall For Sale Online

Pingback: mining rigs for sale

Pingback: generic for valtrex buy without a prescription

Pingback: sildenafil 50 mg

Pingback: natural alternatives to viagra

Pingback: Buy Alaskan Thunder Fuck Strain Online

Pingback: where can i buy generic valtrex

Pingback: CableFreeTV News

Pingback: valtrex uk over the counter

Pingback: Gorilla Trekking Trips

Pingback: valtrex prescription canada

Pingback: snorting viagra

Pingback: virtual visa card buy with cryptocurrency

Pingback: virtual card buy with bitcoin

Pingback: russian alphabet sounds

Pingback: cvs viagra

Pingback: skywalker og brass knuckles

Pingback: white hennessy for sale near me

Pingback: affiliate marketing millionaire

Pingback: buy undetectable counterfeit money online cheap

Pingback: ruger revolvers for sale

Pingback: roman viagra

Pingback: buy generic drugs online

Pingback: portable power stations for house reviews

Pingback: Veerteja Shiksha Samiti Senior Secondary School Khoor, Dantaramgarh, Sikar - 332023

Pingback: Hail Mary Emrhss Perumpilly Trippunithura, Mulanthuruthy, Ernakulam - 682314

Pingback: Reva University

Pingback: hotel terminus the life and times of klaus barbie

Pingback: Buy Ezbencx Clobenzorex

Pingback: cheap online generic drugs

Pingback: cialis risks and side effects

Pingback: luxury vibrator

Pingback: couples sex toys

Pingback: cialis strength levels

Pingback: Magic Mushroom Grow Kit

Pingback: walther ppk 380 9mm for sale

Pingback: browning buckmark contour manual

Pingback: DailyCBD

Pingback: beretta 92fs compact for sale

Pingback: how to take 20 mg cialis

Pingback: goodrx sildenafil

Pingback: Uganda Safari Holidays

Pingback: buy pentobarbital

Pingback: buy Fake and authentic driving licence

Pingback: Buy 2L GBL Cleaner

Pingback: ecigarettes

Pingback: buy viagra cheap

Pingback: hydroxychloroquine nz

Pingback: where to buy e-cigarettes online usa

Pingback: viagra sildenafil

Pingback: THC Oil for Sale

Pingback: Slots

Pingback: barrett gun store

Pingback: ri3284 n

Pingback: stiiizy cartridge

Pingback: sildenafil revatio

Pingback: sig sauer p226 legion

Pingback: ivermectin price comparison

Pingback: stiiizy flavors

Pingback: one up mushroom bar

Pingback: takeout restaurants

Pingback: sildenafil 50

Pingback: sig sauer guns

Pingback: hydroxychloroquine generic name

Pingback: zip 22 for sale

Pingback: BUY GUNS ONLINE

Pingback: ivermectin canada

Pingback: uca.com.vn

Pingback: Source

Pingback: buy shrooms online

Pingback: buy gbl online florida

Pingback: stromectol 3 mg

Pingback: gbl for sale

Pingback: Opana for sale online

Pingback: ivermectin 50ml

Pingback: DIY Home Projects

Pingback: click website

Pingback: tadalafil 30mg liquid

Pingback: is 20mg cialis equal to 100mg viagra

Pingback: viagra sampleviagra cialis

Pingback: Cohiba

Pingback: beezle extract cartridges

Pingback: azithromycin cost

Pingback: Независимое бюро информации и аналитики

Pingback: Website design

Pingback: crock ruger arms

Pingback: how to enjoy g spot sex toys

Pingback: aabbx.store

Pingback: vibrator

Pingback: huge dildos

Pingback: vibrating butt plug

Pingback: russian bookstore

Pingback: buy uk driving license

Pingback: new ed pills

Pingback: best male enhancement pills

Pingback: Motorcycle Boots

Pingback: ZYDONE FOR SALE

Pingback: canada sex toys

Pingback: sildenafil dose

Pingback: ne-smotrite-naverx

Pingback: 2eighty-five

Pingback: kel tec 380 review

Pingback: rechargeable vibrator

Pingback: hydromax watches

Pingback: mossberg 590 nightstick

Pingback: arrogant

Pingback: Dead-Inside

Pingback: mossberg shockwave 20 ga

Pingback: beretta apx for sale

Pingback: buying cialis

Pingback: cialis from canada

Pingback: Krt vape

Pingback: Krt disposable vape

Pingback: tadalafil india manufacturers

Pingback: ivermectin 3

Pingback: sildenafil pills uk

Pingback: graphics card online shopping

Pingback: krt vape cartridges

Pingback: where to buy gamma butyrolactone

Pingback: real viagra tablets

Pingback: canadian pharmacy online viagra

Pingback: hi point carbine 9mm

Pingback: Levitra Oral Jelly

Pingback: vibrators for women

Pingback: sex toys for women

Pingback: Mount Kilimanjaro Tanzania

Pingback: Bitcoin address wallet

Pingback: stromectol sales

Pingback: albuterol discount

Pingback: ivermectin tablets order

Pingback: roman tadalafil

Pingback: sildenafil amazon

Pingback: sildenafil citrate

Pingback: ivermectin online

Pingback: ivermectin otc

Pingback: credit card to bitcoin

Pingback: combivent 250 mg

Pingback: how to get ivermectin

Pingback: Aspirin

Pingback: pharmacy cheap no prescription

Pingback: Primaquine

Pingback: News

Pingback: where can you buy ivermectin

Pingback: tadalafil cost cvs

Pingback: tadalafil generico farmacias del ahorro

Pingback: oral ivermectin cost

Pingback: order Oxycodone online

Pingback: ivermectin iv

Pingback: Benelli M1 Super 90

Pingback: stromectol price us

Pingback: stromectol buy uk

Pingback: ivermectin cream uk

Pingback: ivermectin lotion for scabies

Pingback: ivermectin price canada

Pingback: ivermectin 50 mg

Pingback: where to get ivermectin

Pingback: cryptocard

Pingback: where to purchase ivermectin

Pingback: where can i buy ivermectin

Pingback: how to get ivermectin

Pingback: ivermectin cost

Pingback: how to get ivermectin

Pingback: ivermectin 3 mg tabs

Pingback: 3rpUI4X

Pingback: ivermectin kaufen

Pingback: ivermectin 50ml

Pingback: uliocx

Pingback: 34tfA26

Pingback: 3J6w3bD

Pingback: 3GrvxDp

Pingback: 3rrZhf7

Pingback: 3L1poB8

Pingback: my-vse-mertvy-2022

Pingback: scrap car removal

Pingback: ivermectin tablets for sale

Pingback: best mortgage rates

Pingback: tadalafil otc

Pingback: buy prednisone 5mg pills

Pingback: online pharmacy tadalafil

Pingback: xm855

Pingback: mixing provigil with levitra

Pingback: zithromax z-pak price without insurance

Pingback: viagra connect online

Pingback: cialis shelf life

Pingback: - do si dos strain

Pingback: cialis dose

Pingback: thelottovip

Pingback: buy cialis collins

Pingback: how to get cheap sildenafil online

Pingback: Colt Python

Pingback: how to buy sildenafil tablets

Pingback: best canadian online pharmacy

Pingback: sildenafil pills for men

Pingback: generic cialis

Pingback: how to get cialis without a prescription

Pingback: india pharmacy cialis

Pingback: cialis daily prescription

Pingback: thuб»‘c prednisone 20mg

Pingback: molnupiravir india

Pingback: no prescription cialis

Pingback: best personal massager

Pingback: fleshlight realistic male stroker

Pingback: how to use g spot vibrator

Pingback: generic cialis pills on line

Pingback: tadalafil spc

Pingback: cialis 20mg online

Pingback: ivermectin australia

Pingback: cialis coupon

Pingback: cialis tablets

Pingback: tinidazole

Pingback: erythromycin optha

Pingback: erythromycin betta

Pingback: how to buy cialis without a prescription

Pingback: order ivermectin 3mg online

Pingback: Magnum Research Desert Eagle for sale

Pingback: purchase cialis online no prescription

Pingback: Russia launches Ukraine

Pingback: ivermectin 5 mg

Pingback: z.globus-kino.ru

Pingback: price of doxycycline

Pingback: PS5 Digital Edition

Pingback: ivermectin 3mg tabs

Pingback: augmentin antibiotico

Pingback: coupon for cialis

Pingback: ethambutol

Pingback: cost of ivermectin medication

Pingback: augmentin class

Pingback: what happens if you take viagra and you don't need it

Pingback: zithromax pack

Pingback: ciprofloxacin hydrochlorothiazide

Pingback: mini-14 for sale

Pingback: palladium ore

Pingback: celecoxib 50 mg

Pingback: ivermectin 12mg pills

Pingback: PlayStation 5 Disc

Pingback: minocycline generic

Pingback: dildo with balls

Pingback: ivermectin 12 mg over the counter

Pingback: gungoren escort

Pingback: cialis daily vs regular cialis

Pingback: cryptocurrency card

Pingback: ivermectin pour-on for human lice

Pingback: sex toys accessories

Pingback: glo carts bulk

Pingback: yahoo

Pingback: pc games for windows 8

Pingback: free app download

Pingback: pc games download

Pingback: yutub

Pingback: reliable online buy viagra

Pingback: pc games for windows 10

Pingback: MFT Token

Pingback: embutidos ezequiel

Pingback: full version pc games download

Pingback: clitoral stimulator

Pingback: all about masturbation

Pingback: discount cialis

Pingback: packaging supply companies near you

Pingback: can i buy cialis without prescription pay pal

Pingback: Glock 19

Pingback: Uganda safaris tours

Pingback: hydroxychloroquine buy

Pingback: learn more

Pingback: Krt carts

Pingback: junk car towing

Pingback: FLINTLOCK PISTOL FOR SALE

Pingback: BERETTA 92FS FOR SALE

Pingback: penis girth sleeve

Pingback: Best Restaurants

Pingback: windows fernwartung hombrechtikon

Pingback: anita

Pingback: smotretonlaynfilmyiserialy.ru

Pingback: macaw parrot for sale

Pingback: purchase clomid

Pingback: cialis prices at walmart pharmacy

Pingback: Google

Pingback: buy backlinks

Pingback: clomid 40 mg

Pingback: thrusting massager

Pingback: listen here

Pingback: cryptocurrency virtual card

Pingback: where can i buy clomid pills in south africa

Pingback: Oahidur Islam Roman

Pingback: sex advice

Pingback: tadalafil at walmart

Pingback: Pinball machines for sale

Pingback: one up chocolate bar

Pingback: best medication for ed

Pingback: over the counter ed

Pingback: filmfilmfilmes

Pingback: Haupia strain

Pingback: gRh9UPV

Pingback: Bubblegum Haupia Strain

Pingback: ivermectin fleas

Pingback: Platinum haupia

Pingback: ivermectin cream before and after

Pingback: Bubble hash

Pingback: Moroccan hash

Pingback: Litto

Pingback: Bubble hash

Pingback: economics

Pingback: dog antibiotics without vet prescription

Pingback: hydroxychloroquine brand name

Pingback: is it illegal to buy prescription drugs online

Pingback: 9-05-2022

Pingback: TopGun2022

Pingback: Xvideos

Pingback: XVIDEOSCOM Videos

Pingback: buy cheap prescription drugs online

Pingback: ivanesva

Pingback: hydroxychloroquine immunosuppressant

Pingback: cialis 20 mg price

Pingback: antiparasitic drugs ivermectin

Pingback: viagra cost per pill

Pingback: Netflix

Pingback: Zvezdy-v-Afrike-2-sezon-14-seriya

Pingback: Krylya-nad-Berlinom

Pingback: FILM

Pingback: designchita.ru

Pingback: YA-krasneyu

Pingback: design-human.ru

Pingback: designmsu.ru

Pingback: vkl-design.ru

Pingback: irida-design.ru

Pingback: how does cialis work

Pingback: Intimsiti-v-obhod-blokirovok

Pingback: psy-

Pingback: ivermectin for gapeworm

Pingback: moskva psiholog online

Pingback: slovar po psihoanalizu laplansh

Pingback: psy online

Pingback: Gz92uNNH

Pingback: رگلاتور و مانومتر

Pingback: uels ukrain

Pingback: do-posle-psihologa

Pingback: stromectol 15 mg

Pingback: bahis siteleri

Pingback: DPTPtNqS

Pingback: qQ8KZZE6

Pingback: D6tuzANh

Pingback: SHKALA TONOV

Pingback: Øêàëà òîíîâ

Pingback: russianmanagement.com

Pingback: 3Hk12Bl

Pingback: 3NOZC44

Pingback: 01211

Pingback: tor-lyubov-i-grom

Pingback: film-tor-2022

Pingback: hd-tor-2022

Pingback: hdorg2.ru

Pingback: Psikholog

Pingback: netstate.ru

Pingback: Link

Pingback: tor-lyubov-i-grom.ru

Pingback: AdultChatSex

Pingback: chelovek soznaniye mozg

Pingback: learning about sex cams

Pingback: bit.ly

Pingback: buy stromectol for humans canada

Pingback: bucha killings

Pingback: War in Ukraine

Pingback: Ukraine news live

Pingback: The Latest Ukraine News

Pingback: University of Embu

Pingback: Turkana University College

Pingback: School of Pure and Applied Sciences Embu University

Pingback: stromectol austria

Pingback: viagra

Pingback: stats

Pingback: revatio

Pingback: Ukraine-war

Pingback: movies

Pingback: gidonline

Pingback: mir dikogo zapada 4 sezon 4 seriya

Pingback: purchase stromectol online

Pingback: filles nues

Pingback: web

Pingback: find more info

Pingback: film.8filmov.ru

Pingback: cialis from canada to usa

Pingback: Anonymous

Pingback: liusia-8-seriiaonlain

Pingback: smotret-polnyj-film-smotret-v-khoroshem-kachestve

Pingback: cialis over the counter at walmart

Pingback: filmgoda.ru

Pingback: rodnoe-kino-ru

Pingback: abisko.ru

Pingback: confeitofilm

Pingback: stat.netstate.ru

Pingback: sY5am

Pingback: Dom drakona

Pingback: JGXldbkj

Pingback: aOuSjapt

Pingback: psikholog moskva

Pingback: A片

Pingback: pornoizle}

Pingback: Usik Dzhoshua 2 2022

Pingback: Dim Drakona 2022

Pingback: TwnE4zl6

Pingback: psy 3CtwvjS

Pingback: lalochesia

Pingback: film onlinee

Pingback: programma peredach na segodnya

Pingback: psycholog-v-moskve.ru

Pingback: psycholog-moskva.ru

Pingback: 3qAIwwN

Pingback: video-2

Pingback: sezons.store

Pingback: socionika-eniostyle.ru

Pingback: psy-news.ru

Pingback: 000-1

Pingback: 3SoTS32

Pingback: 3DGofO7

Pingback: لوازم جانبی موتور سیکلت

Pingback: MUST school of agriculture

Pingback: wwwi.odnoklassniki-film.ru

Pingback: buy hydroxychloroquine online

Pingback: rftrip.ru

Pingback: essaywritingservice

Pingback: hydroxychloroquine tablets

Pingback: MUT

Pingback: Murang'a University of Technology

Pingback: dolpsy.ru

Pingback: kin0shki.ru

Pingback: 3o9cpydyue4s8.ru

Pingback: mb588.ru

Pingback: generic kamagra 100 mg

Pingback: history-of-ukraine.ru news ukraine

Pingback: newsukraine.ru

Pingback: edu-design.ru

Pingback: tftl.ru

Pingback: brutv

Pingback: site 2023

Pingback: SpytoStyle.Com

Pingback: murang'a university

Pingback: sitestats01

Pingback: 1c789.ru

Pingback: cttdu.ru

Pingback: 1703

Pingback: hdserial2023.ru

Pingback: what is cialis used for

Pingback: serialhd2023.ru

Pingback: matchonline2022.ru

Pingback: kamagra without a doctor

Pingback: What are QA responsibilities with kamagra next day delivery?

Pingback: What percentage of smokers quit successfully zyban for weight loss?

Pingback: bit.ly/3OEzOZR

Pingback: vidalista by centurion

Pingback: bit.ly/3gGFqGq

Pingback: bit.ly/3ARFdXA

Pingback: bit.ly/3ig2UT5

Pingback: bit.ly/3GQNK0J

Pingback: What are the top 5 diet pills and a hoodia for weight loss?

Pingback: How many times should a man release sperm in a day or how to get viagra?

Pingback: vardenafil tablets 20 mg best price

Pingback: order stromectol 3mg online cheap

Pingback: bep5w0Df

Pingback: www

Pingback: Can a normal boy get pregnant generic viagra blue pill 100?

Pingback: 24hours-news

Pingback: rusnewsweek

Pingback: uluro-ado

Pingback: Meds prescribing information. Short-Term Effects. aripiprazole 10mg tab?

Pingback: irannews.ru

Pingback: klondayk2022

Pingback: fildena 100

Pingback: You stated this perfectly. how much is paxil tablet?

Pingback: Drugs information. Marque names. buy avodart from canada?

Pingback: tqmFEB3B

Pingback: Medicines prescribing information. Long-Term Effects. avodart?

Pingback: Lincoln Georgis

Pingback: 2022-film

Pingback: fue

Pingback: future university

Pingback: future university egypt

Pingback: جامعة المستقبل

Pingback: future university

Pingback: fue

Pingback: Leandro Farland

Pingback: جامعة المستقبل

Pingback: future university egypt

Pingback: fue

Pingback: جامعة المستقبل

Pingback: fue

Pingback: future university egypt

Pingback: How to fix Roblox error code 610

Pingback: Who is Herobrine in Minecraft

Pingback: How to Run Linux on a Chromebook in 2022

Pingback: Hostinger Review

Pingback: Chat GPT- 9 Best Things To Know About Chat Gpt

Pingback: جامعة المستقبل

Pingback: جامعة المستقبل

Pingback: Medicines information. Brand names. In USA can i order propecia without dr prescription?

Pingback: Pencil Packing Job

Pingback: fue

Pingback: future university

Pingback: future university

Pingback: future university egypt

Pingback: canadian king pharmacy

Pingback: exipure buy

Pingback: جامعة المستقبل

Pingback: future university

Pingback: cipro

Pingback: low-row

Pingback: machines musculation

Pingback: leg extensions machine

Pingback: callisthenie

Pingback: eric flag

Pingback: butterfly musculation

Pingback: mangalib

Pingback: free chat now

Pingback: chat blink

Pingback: reputation defenders

Pingback: ed pills otc

Pingback: dapoxetine uk

Pingback: جامعة المستقبل

Pingback: reliable online drugstore

Pingback: medicine from canada with no prescriptions

Pingback: MILFCity

Pingback: Madelyn Monroe Masturbating

Pingback: Cory Chase MILFCity

Pingback: Lila Lovely BBW

Pingback: premium-domains-list

Pingback: Assignment Writing Tips

Pingback: Assignment Help Tutors

Pingback: Last Minute Assignment Help

Pingback: Write my essay

Pingback: Assignment Writing

Pingback: Academic Writing Service

Pingback: valentine pillow

Pingback: valentine pillow

Pingback: valentine gift for her

Pingback: valentine gift for her

Pingback: valentines gift

Pingback: organic sunblocks

Pingback: x

Pingback: 9xflix

Pingback: xnxx

Pingback: 123movies

Pingback: xxx

Pingback: over the counter antibiotic

Pingback: Medicine information for patients. medicine hydroxychloroquine?

Pingback: At what age do men start to decline price tadalafil 10mg?

Pingback: What is included in a men's wellness exam warnings for tadalafil?

Pingback: over the counter muscle relaxer

Pingback: How do I treat my wife like a queen sildenafil prescriptions over internet?

Pingback: How do men pick their wives sildenafil citrate 100 mg generic?

Pingback: Can a man with ED still come sildenafil 100mg?

Pingback: How can I express my love without saying it sildenafil 100mg price?

Pingback: Click Here

Pingback: What time should I go to bed if I wake up at 6 sildenafil?

Pingback: How does a man feel love 150 mg sildenafil dose safe?

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Which drink is good for sperm sildenafil interaction with other drugs?

Pingback: Click Here

Pingback: Best Electric Vehicles

Pingback: zithromax buy online

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: How do I text romantic sildenafil?

Pingback: How do you know when a guy is playing with you sildenafil?

Pingback: buy kamagra 100mg oral jelly

Pingback: tania kamagra

Pingback: dapoxetine and sildenafil

Pingback: What are the 4 types of intimacy buy dapoxetine 30mg for sale

Pingback: stromectol prices

Pingback: Can you tell if you have a parasite from a blood test without ivermectin 1 topical cream

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: How many hours after antibiotics can I drink and stromectol 0.1

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: robotics case study

Pingback: no code robotics

Pingback: Click Here

Pingback: robotics case study

Pingback: Click Here

Pingback: where to get generic avodart

Pingback: Click Here

Pingback: Reputation Defenders

Pingback: Who is the carrier of syphilis such as benefits of hydroxychloroquine for arthritis

Pingback: Reputation Defenders

Pingback: Reputation Defenders

Pingback: Reputation Defenders

Pingback: Reputation Defenders

Pingback: What antibiotics should diabetics avoid such as ivermectin 1 topical cream

Pingback: Click Here

Pingback: Reputation Defenders

Pingback: Click Here

Pingback: What a man wants in a woman he wants to marry buy dapoxetine online

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: how long does a 20 gram tube of retin a last

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: geschenke für männer zum 60 geburtstag

Pingback: geschenke für teenager

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: grand rapids teeth whitening

Pingback: grand rapids same day crowns

Pingback: Click Here

Pingback: grand rapids dentist

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Referral Program

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: sildenafil 100mg for sale

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Can an infection come back after antibiotics zithromax z pak warnings

Pingback: Click Here

Pingback: Click Here

Pingback: sibluevi.com reviews

Pingback: Can you eat yogurt with antibiotics plaquenil 200mg price

Pingback: kinokrad

Pingback: 온라인 슬롯 머신

Pingback: How much antibiotic can I take in a day does hydroxychloroquine cause hair loss

Pingback: viagra online netherlands

Pingback: batmanapollo

Pingback: What should you eat after taking antibiotics

Pingback: premium-domains-for-sale

Pingback: premium-domain-broker

Pingback: batmanapollo.ru - psychologist

Pingback: original cialis uk

Pingback: batmanapollo psychologist

Pingback: free website for small business

Pingback: how to start

Pingback: cardano nft projects

Pingback: rent ad

Pingback: running bottoms

Pingback: 20 mg Cialis canada - Scwcmd.com

Pingback: How do you tell if a girl is flirting with you - is Azithromycin a steroid

Pingback: nationwide

Pingback: Google reviews

Pingback: elizavetaboyarskaya.ru

Pingback: buy kamagra oral jelly online

Pingback: Australia Porn Stars

Pingback: femara without prescription

Pingback: reputation defenders

Pingback: cheap stromectol How quickly does turmeric reduce inflammation?

Pingback: Can you impregnate without sperm?

Pingback: vsovezdeisrazu

Pingback: How often do guys get hard a day?

Pingback: What is PDCA used for priligy dapoxetine

Pingback: Is it possible to overdose on albuterol ventolin for sale

Pingback: Quels sont les hommes les plus infideles dangers du viagra apres 70 ans

Pingback: What does taking turmeric daily do where can you buy ivermectin

Pingback: How much gap should you leave between antibiotics Hydroxychloroquine mechanism of action

Pingback: price bcons garden

Pingback: Who is the king of antibiotics

Pingback: 2023 Books

Pingback: How many days of antibiotics is too much

Pingback: 2023

Pingback: Which antibiotics cause stomach upset

Pingback: What happens if you don't take antibiotics for an infection

Pingback: Are antibiotics bad for you

Pingback: death redcords

Pingback: online memorial

Pingback: obituaries

Pingback: rip

Pingback: census records

Pingback: How fast do antibiotics work

Pingback: Can I take vitamins with antibiotics

Pingback: Can I eat banana with antibiotics

Pingback: How do I know if I need antibiotics Stromectol 3mg tablets

Pingback: buy levitra 20mg

Pingback: What to eat while taking antibiotics

Pingback: levitra

Pingback: amazon viagra pills

Pingback: Can an infection come back after antibiotics

Pingback: How long do antibiotics last

Pingback: ipsychologos

Pingback: Who is the strongest antibiotic

Pingback: Can antibiotics change your body

Pingback: What time of day is best to take antibiotics

Pingback: yug-grib.ru

Pingback: studio-tatuage.ru

Pingback: Can antibiotics cause hepatitis

Pingback: bose headphones - Treblab

Pingback: What is the strongest antibiotic for bacterial infection

Pingback: football bet winning formula

Pingback: bit.ly/pamfir-pamfir-2023-ua-pamfir

Pingback: ivermectin pills for humans Do men notice cellulite?

Pingback: bose bluetooth speaker

Pingback: Comment s'appelle la femme de maman cialis 10mg prix pharmacie

Pingback: How did she get pregnant if pulled out ivermectin dose for scabies?

Pingback: Chirurgiens esthétique Tunisie

Pingback: Chirurgie esthétique Tunisie

Pingback: Chirurgie Tunisie

Pingback: black over ear earbuds

Pingback: National Chi Nan University

Pingback: over the counter ed drugs

Pingback: Prix du Viagra en pharmacie en France

Pingback: Is it bad to take 4 puffs of albuterol how can i get ventolin now

Pingback: How much albuterol is safe in a day which is better ventolin or flovent

Pingback: What is the number one medication for asthma | ventolin inhaler online

Pingback: Can a blocked artery clear itself long term side effects of furosemide

Pingback: What triggers asthma - glaxosmithkline ventolin

Pingback: cialis farmacia senza ricetta

Pingback: poip-nsk.ru - Movie Watch

Pingback: film.poip-nsk.ru - film online

Pingback: top academic partnership egypt

Pingback: نجاح الهيئة التدريسية

Pingback: Civility

Pingback: Alumni network

Pingback: FUE Chairman

Pingback: افضل جامعه فى مصر

Pingback: Private university

Pingback: Human Resources Management program

Pingback: Withdrawal and Add/Drop Dates

Pingback: Innovation and development

Pingback: كلية إدارة الأعمال في مصر

Pingback: how to buy doxycycline without a prescription

Pingback: Local

Pingback: كلية الاقتصاد

Pingback: order doxycycline

Pingback: fue

Pingback: Department of Pharmacy Practice and Clinical Pharmacy

Pingback: Dissolution apparatus

Pingback: pharmacists

Pingback: قسم علم الأحياء الدقيقة والمناعة

Pingback: أفضل جامعة لدراسة الصيدلة

Pingback: Dental Veneers

Pingback: Supportive learning environment

Pingback: كلية طب الاسنان كام سنة

Pingback: هل دراسة طب الفم والاسنان سهلة

Pingback: academic programs at the College of Engineering

Pingback: نظام التعليم

Pingback: fue contact

Pingback: FCIT Future University Egypt

Pingback: FCIT Future University Egypt

Pingback: Contact Information Faculty of Computers and Information Technology

Pingback: Computer Science Education

Pingback: Petroleum Engineers

Pingback: Diversity and inclusion

Pingback: video.vipspark.ru

Pingback: vitaliy-abdulov.ru

Pingback: برامج الإقامة في طب الأسنان

Pingback: Dental Continuing Education

Pingback: عملية التقديم لجامعة المستقبل

Pingback: Admission requirements for future university

Pingback: Application deadlines for future university

Pingback: استمارة طلب التقديم بجامعة المستقبل

Pingback: Transcript requirements for future university

Pingback: vipspark.vipspark.ru

Pingback: certified canadian pharmacy

Pingback: Learn Even more

Pingback: cipro pharmacy

Pingback: ciprofloxacin mail online

Pingback: PhD programmes

Pingback: TVET Programmes

Pingback: Quel est le mois le plus dangereux de la grossesse sildenafil pfizer

Pingback: Pourquoi un parent est toxique: tadalafil 5mg avis

Pingback: Feeling physically and mentally drained can result in decreased ability to adapt to changes and challenges | over the counter thyroid medicine

Pingback: atorvastatin calcium 40mg tab | How does chronic stress affect heart function and increase the risk of heart disease

Pingback: How can I drink alcohol and keep my liver healthy?

Pingback: KCSE Past Papers

Pingback: Is milk good for liver?

Pingback: What should diabetics stay away from?

Pingback: تصميم مواقع الويب

Pingback: How do I know if I need antibiotics?

Pingback: Quelle est la cle du bonheur familial sildenafil 100 mg

Pingback: Comment savoir si elle a couche avec un autre acheter levitra generique en ligne

Pingback: Comment s'appelle l'amour d'une mere viagra achat

Pingback: What makes a man stay in a relationship

Pingback: Why are men bigger vidalista reviews

Pingback: Increased reliance on caffeine or stimulants to combat fatigue can be indicative of thyroid deficiency-related lack of energy?

Pingback: Changes in the scalp's overall health and condition, such as increased dryness or oiliness, can be observed in individuals with thyroid-related hair loss?

Pingback: What is the impact of excessive exposure to volatile organic compounds (VOCs) on ovulation?

Pingback: What is the relationship between insulin levels and ovulation?

Pingback: How does clomiphene affect the cervical mucus quality in women?

Pingback: child porn

Pingback: What are the benefits of maintaining a healthy blood lipid profile, including triglycerides and LDL particle size, for heart health

Pingback: Does cholesterol affect the immune response and inflammation

Pingback: sms onay

Pingback: What men need most in marriage - chinese viagra pills

Pingback: What do men find attractive - Dapoxetine tablet

Pingback: Political Science

Pingback: Intellectual independence

Pingback: Should you take antibiotics before or after food?

Pingback: What to avoid while on antibiotics?

Pingback: Information Technology

Pingback: Quand la famille est toxique | viagra generique sans ordonnance

Pingback: top university in egypt

Pingback: Inhaler Slam Poetry: Rhymes for Your Airways ventolin hfa

Pingback: Do antibiotics increase risk of stroke | cefadroxil same as keflex

Pingback: erection pills online

Pingback: Can impotence cause death | canadian pharmacy levitra

Pingback: where to buy viagra over the counter in las vegas | What over the counter drugs can help with menstrual pain in teenagers

Pingback: fildena 50mg canada - Can you impregnate without sperm

Pingback: how can i get generic propecia price

Pingback: What is the main cause of inflammation in the body | where can i buy plaquenil without a doctor prescription

Pingback: Stromectol price

Pingback: ventolin inhaler cupon

Pingback: How do you make a guy feel lit | vardenafil 10mg tablets