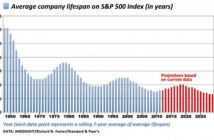

Since suffering a downward spiral in March 2009, S&P 500 (INDEX:.INX) has surged up about 200% . It has already gone beyond many analysts’ forecasts, now being at 2,003.

The strategists of Morgan Stanley speculate that the situation is optimum for the bull market to proceed on for years.

According to them it’s quite possible that S&P 500 (INDEX:.INX) surge up to near 3000, however the U.S Expansion would have to give certain guarantees whether it has at least half a decade left to it

It’s not just the strategists of Morgan Stanley (NYSE:MS), a lot of Wall Street analysts think that the contemporary events of market calamity to heal is not like the bubbles of the past.

An extended duration of deleverages along with an disparate worldwide recovery, are some grounds this could prove to be the largest US expansion.

In a detailed and quite expansive research paper, Morgan Stanley (NYSE:MS) strategists debate that the country’s providence is its initial parts of proliferation. It’s exquisitely placed in the world, profiting from better sheets, and low corporate spirits.

Here’s the bulleted summary:

- There is no coherence in global economy. Large geological economies vary, being at different places at the growth cycle. EM is suffering from a lag while the DM soars high.

- Volatility in the U.S. continues to dwindle, which can extend the lifespan of expansions.

- Deleverage in the country is continuous, although almost absolute and priorities for the sheets have changed

- Return money on debts are mellow and household debt balance tells us that about a vast cushion protecting consumers in a surging interest rate environment.

- No extension of inventories and Capital spending.

- Corporate management pomposity and other rationales of overheating remain numb.

- Many broad economic measures in the U.S. have just arrived at “normal” growth markers and are beyond sustainability.

Few points need emphasis from the analysts’ research

The Return Of Capital Spending

Foremost is the speculation on capital outlays, or business funding. The capex recovery turned out to be the most anxiously expected angles of this recovery. Current data depict that it will happen soon.

However, the notes suggest that capex levels are still at far better levels when compared to sales.

The Debt Cushion

The financial crisis isn’t a thing of the past, made prominent by a freeze in credit. That has made companies with strong providence limping to reach their financial commitment.

The crisis also enabled the companies to stretch their balance sheets, earning loads of money. A large number of big and small companies turned towards excessive amounts of refinancing, which further plunged their debt back by a few years. In the context of income statement, coverage ratio of large interests depicts that companies have plenty of operating gains to fuel more money into their recent debt needs.

Risk

There is no hardcore guarantee that about half a decade of uninterrupted sailing.

Pingback: Bluestem free downloads

Pingback: Essentials of Advanced Composite Fabrication and Repair - Louis C. Dorworth, Ginger L. Gardiner, Greg M. Mellema free downloads

Pingback: Blue Coaster33

Pingback: weight loss

Pingback: watch movies online free

Pingback: free movie downloads

Pingback: watch free movies online

Pingback: water ionizers

Pingback: alkaline water

Pingback: kangen

Pingback: kangen water

Pingback: viber in dubai

Pingback: emazinglights

Pingback: online casinos

Pingback: here

Pingback: quick fast payday loans

Pingback: DIRECTV vs Dish

Pingback: xnxx

Pingback: lane penge nu

Pingback: parking

Pingback: laane penge nu

Pingback: salon de jardin hpl

Pingback: laan penge nu uden renter

Pingback: salon de jardin ushuaia

Pingback: water ionizer

Pingback: water ionizers

Pingback: parking

Pingback: water ionizer loans

Pingback: pay per day loans plan

Pingback: pay per day loan plans

Pingback: electrician tool belts for sale

Pingback: A Massage Therapist's Guide to Pathology (LWW Massage Therapy and Bodywork Educational Series) - Ruth Werner LMP NCTMB free downloads

Pingback: read this

Pingback: 2 brothers locksmiths

Pingback: learn here

Pingback: f cowley plumbers

Pingback: Payday Loans

Pingback: house blue

Pingback: a total noob

Pingback: electrician equipment

Pingback: HD Coloring Pages

Pingback: ionizer payment plan

Pingback: bottled alkaline water

Pingback: MySeoServoce

Pingback: water ionizer payment plan

Pingback: website

Pingback: water ionizer

Pingback: alkaline water

Pingback: car insurance options

Pingback: here

Pingback: see

Pingback: News of Lugansk in the last hour exchanging news of the DNI

Pingback: video me rt follow

Pingback: Smart and easy way to get extra income from your traffic

Pingback: news lugansk lnr dnr

Pingback: сайт знакомств украина

Pingback: erotic girl me and you

Pingback: necessary-gifts.ru

Pingback: Znakomstva-s-jenshinami

Pingback: games-best in site link

Pingback: dostavki net tovar ne privezli

Pingback: free socks 5 proxy fresh daily xrumer xrefer

Pingback: three player chess uk 3 man move chess chess with three players

Pingback: Монастырский чай. Цена в Украине.

Pingback: фильмы онлайн

Pingback: vojna-v-sirii

Pingback: progony-hrumer-lic xrumer priogon 2016 base for xrumer

Pingback: video like me2

Pingback: manastirski_chay

Pingback: chay-monas pdf ua

Pingback: aran.com.ua.manastirski_chay

Pingback: news lnr

Pingback: news lnr dnr

Pingback: The Revenant online

Pingback: psychologicalcounselingonline

Pingback: prom pol kiev ukraine

Pingback: LNR DNR

Pingback: songmerte

Pingback: dedpul 2016

Pingback: bogiegipta2016smotretonline

Pingback: dedpul-online-2016

Pingback: dedpul-online-2016 28.02.2016

Pingback: Anonymous

Pingback: Google and yandex 16 03 2016

Pingback: Batman vs Superman Watch in HD

Pingback: Anonymous

Pingback: Zveropolis / Zootropolis smotret onlayn v horoshem kachestve.

Pingback: 042016

Pingback: 04012016

Pingback: my blog gp 2016

Pingback: google Maps for mobile

Pingback: google AdSense google AdMob free

Pingback: google Search for images on the web

Pingback: rialudi

Pingback: zootopia 2016

Pingback: film online 2016 free ua ru kz

Pingback: Дивергент, глава 3: За стеной / Allegiant, Высотка / High-Rise,

Pingback: лучшие фильмы 2016 2016 года список новые фильмы

Pingback: лучшие фильмы года 2016

Pingback: jykfqy abkmvs cvjnhtnm ,tp htubcnhfwbb

Pingback: more

Pingback: film

Pingback: ukraine girl kiev lviv

Pingback: ukraine girl kiev lviv 2016

Pingback: helou zis me

Pingback: helou zis me

Pingback: clic here

Pingback: clic

Pingback: illuziaobmana

Pingback: HDKINOONLINE

Pingback: porn video tube, hard porn, streaming porn, hq porn

Pingback: hqporn2016

Pingback: Лучшие фильмы

Pingback: Лучшие фильмы2

Pingback: ТелефоновСамсунг2016

Pingback: sunnyleone

Pingback: sunnyleonelatest

Pingback: toilehtml

Pingback: tubepatrolporn

Pingback: skypepsyxologmoskvakiev

Pingback: saleforiphone

Pingback: kinoklub

Pingback: drama2016

Pingback: jpmsruvideotoppornovideo

Pingback: jpmsru

Pingback: top2017bloomingme

Pingback: mir.dikogo.zapada.ceria.sezon

Pingback: aisti.online.smotret.aisti.mult

Pingback: doktor.strendj.online.kino.

Pingback: trumpnews

Pingback: molodezhka4seria

Pingback: molodejka

Pingback: molodezhka4sezon17seriya18192

Pingback: link2016

Pingback: xml18112016

Pingback: xml181120167

Pingback: molodezhka4sezon212223seriya

Pingback: molodejka4sezon21seria21seria22seria23

Pingback: molodejka4seria25

Pingback: lastssadsafdsa

Pingback: Молодежка4сезон25серия26серия

Pingback: dadafdf3ddafdsa

Pingback: dadafdf3ddafdsa

Pingback: Greg Thmomson

Pingback: gmail.com login

Pingback: gmail.com login sign

Pingback: nesaporn

Pingback: wRfqnI8IRxk

Pingback: anybunny anybunny hd xxx porn tube video videos free online hot movies

Pingback: rajwap hd xxx porn tube video videos free online hot movies XXX

Pingback: search all craigslist

Pingback: kinokradserial

Pingback: sfico.info xxx video xnxxx xxx hd wwwxxx

Pingback: megogoserial.ru

Pingback: sinister smotret online

Pingback: смотреть

Pingback: kinogo

Pingback: transformery-posledniy-rycar-2017

Pingback: transformery-5-posledniy-rycar-2017-kinohd720

Pingback: myxxxbase.mobi

Pingback: kinogomovie

Pingback: tubepatrol.net

Pingback: tubepatrol

Pingback: paydaycgtloansnhj.com

Pingback: personal loan

Pingback: sunny leone xxx

Pingback: zeloporn.com

Pingback: Maria Smith

Pingback: mobilebestporn

Pingback: pornpageup

Pingback: Pic link alisexypics com

Pingback: Source bigassxfuck com

Pingback: Video link pornpics abudhabihottestgirls com

Pingback: footfuckporn

Pingback: pornbit.info

Pingback: Origin site asianthaijapanese adult-porn-photos com

Pingback: Go link camfive nakedgirlfuck com

Pingback: feed emyfour nakedgirlfuck com

Pingback: Pix link medicalfuckers com

Pingback: sosu jivetalk org

Pingback: Video site vista-th ru

Pingback: Source sarlazer ru

Pingback: main site samtube ru

Pingback: Origin site manitub ru

Pingback: dudesex

Pingback: Origin site xxvideos pro

Pingback: www alicumshot com

Pingback: See site babacams com

Pingback: Pix link vpizde mobi

Pingback: Origin site iztube ru

Pingback: top liwe

Pingback: javunsensored.mobi

Pingback: поздравление ко дню влюбленных любимому в прозе

Pingback: поздравление парню ко дню влюбленных

Pingback: короткие поздравления ко дню влюбленных любимому

Pingback: фильмы андроид

Pingback: yotbub

Pingback: yiou

Pingback: articles

Pingback: Ambika Ahuja Jaipur Escorts

Pingback: NEHA TYAGI MODEL JAIPUR ESCORTS

Pingback: JAIPUR ESCORTS ALIYA SINHA

Pingback: BANGALORE COMPANION ESCORTS

Pingback: Dhruvi Jaipur Escorts

Pingback: JAIPUR ESCORTS MODEL DRISHYA

Pingback: Heena Khan Bangalore Escorts

Pingback: Jiya Malik High Profile Jaipur Escorts Model

Pingback: FUN WITH JAIPUR ESCORTS PUJA KAUR

Pingback: XXX BANGALORE ESCORTS

Pingback: XXX PORN SAPNA CHAUDHARY ESCORTS

Pingback: Selly Arora Independent Bangalore Escorts

Pingback: Enjoy With Jaipur Escorts Tanisha Walia

Pingback: RUBEENA RUSSIAN BANGALORE ESCORTS

Pingback: Bristy Roy Independent Bangalore Escorts

Pingback: XXX PORN SRUTHI PATHAK MODEL ESCORTS

Pingback: Bangalore Escorts Sneha Despandey

Pingback: XXX PORN MODEL HONEY PREET ESCORTS

Pingback: XXX PORN Radhika Apte Model Escort

Pingback: Kolkata Escorts

Pingback: Goa Escorts

Pingback: Ruby Sen Kolkata Independent Escorts

Pingback: Diana Diaz Goa Independent Escorts Services

Pingback: Diksha Arya Independent Escorts Services in Kolkata

Pingback: Devika Kakkar Goa Escorts Services

Pingback: Rebecca Desuza Goa Independent Escorts Services

Pingback: Yamini Mittal Independent Escorts Services in Goa

Pingback: Simmi Mittal Kolkata Escorts Services

Pingback: Kolkata Escorts Services Ragini Mehta

Pingback: Navya Sharma Independent Kolkata Escorts Services

Pingback: Elisha Roy Goa Independent Escorts Services

Pingback: Alisha Oberoi Kolkata Escorts Services

Pingback: Divya Arora Goa Independent Escorts Services

Pingback: Simran Batra Independent Escorts in Kolkata

Pingback: Ashna Ahuja Escorts Services in Kolkata

Pingback: Sofia Desai Escorts Services in Goa

Pingback: Goa Escorts Services Drishti Goyal

Pingback: Mayra Khan Escorts Services in Kolkata

Pingback: Sruthi Pathak Escorts in Bangalore

Pingback: Ambika Ahuja Jaipur Escorts Services

Pingback: sirius video4969

Pingback: sirius latest movs63

Pingback: stocks.org577

Pingback: stocks.org65

Pingback: stocks.org97

Pingback: stocks.org289

Pingback: stocks.org148

Pingback: comment43

Pingback: comment305

Pingback: comment315

Pingback: comment189

Pingback: comment18

Pingback: comment721

Pingback: comment275

Pingback: comment514

Pingback: comment85

Pingback: comment402

Pingback: comment81

Pingback: comment821

Pingback: comment976

Pingback: comment442

Pingback: comment621

Pingback: comment625

Pingback: comment693

Pingback: comment80

Pingback: comment257

Pingback: comment134

Pingback: comment500

Pingback: comment247

Pingback: comment532

Pingback: comment177

Pingback: comment455

Pingback: comment640

Pingback: comment260

Pingback: comment894

Pingback: comment214

Pingback: comment447

Pingback: comment874

Pingback: comment336

Pingback: comment507

Pingback: comment881

Pingback: comment95

Pingback: comment622

Pingback: comment328

Pingback: Sruthi Pathak Bangalore Female Escorts

Pingback: latestvideo sirius670 abdu23na7946 abdu23na72

Pingback: new siriustube965 abdu23na5385 abdu23na46

Pingback: cna classes denver

Pingback: tubela.net333 afeu23na5929 abdu23na17

Pingback: tubepla.net download802 afeu23na8355 abdu23na76

Pingback: fknjn544a337 afeu23na5254 abdu23na64

Pingback: 358uYs6W3xp

Pingback: hdmobilesex.me

Pingback: Sruthi Pathak Bangalore Escorts Services

Pingback: tedwap.me

Pingback: Trully Independent Bangalore Escorts

Pingback: click here

Pingback: Äîìàøíèé àðåñò âñå ñåðèè

Pingback: 24 hour payday loans los angeles

Pingback: 2018

Pingback: Trully Independent Bangalore Escorts Services

Pingback: buy cialis

Pingback: Fiza Khan Kolkata Independent Call Girls Services

Pingback: online cialis

Pingback: Ruchika Roy Kolkata Escorts Call Girls Services

Pingback: buy viagra super active

Pingback: online viagra super active

Pingback: viagra super active online

Pingback: cheap viagra super active

Pingback: buy cheap viagra super active

Pingback: viagra super active

Pingback: viagra super active 100mg pills

Pingback: viagra super active 150mg

Pingback: viagra super active plus reviews

Pingback: super active viagra 150 mg

Pingback: viagra super active review

Pingback: viagra super active vs viagra

Pingback: generic viagra super active sildenafil

Pingback: generic viagra super active 100mg

Pingback: viagra super active sildenafil citrate

Pingback: fildena super active viagra

Pingback: super active viagra

Pingback: what is viagra super active

Pingback: buy brand viagra

Pingback: online brand viagra

Pingback: brand viagra online

Pingback: cheap brand viagra

Pingback: buy cheap brand viagra

Pingback: brand viagra

Pingback: brand name viagra 100mg

Pingback: brand viagra 100mg

Pingback: brand name viagra no generic

Pingback: name brand viagra

Pingback: brand viagra vs generic viagra

Pingback: viagra india brands

Pingback: generic brand for viagra

Pingback: different brands of viagra

Pingback: pfizer brand viagra 100mg

Pingback: buy cytotec

Pingback: online cytotec

Pingback: cytotec online

Pingback: cheap cytotec

Pingback: buy cheap cytotec

Pingback: cytotec

Pingback: cytotec induction

Pingback: cytotec for miscarriage

Pingback: how to place cytotec vaginal

Pingback: cytotec induction of labor protocol

Pingback: cytotec for abortion

Pingback: side effects of cytotec

Pingback: how to take cytotec

Pingback: acog guidelines for cytotec induction

Pingback: buy cytotec online fast delivery

Pingback: where to buy cytotec online

Pingback: cytotec pills online

Pingback: cytotec pills buy online

Pingback: buy cheap misoprostol cytotec

Pingback: buy cytotec amazon

Pingback: where can i buy cytotec

Pingback: cytotec online mail order pharmacies

Pingback: cytotec without a doctors prescription

Pingback: cytotec without prescription

Pingback: buy dapoxetine

Pingback: online dapoxetine

Pingback: dapoxetine online

Pingback: cheap dapoxetine

Pingback: buy cheap dapoxetine

Pingback: dapoxetine

Pingback: dapoxetine at cvs

Pingback: dapoxetine effectiveness

Pingback: dapoxetine reviews

Pingback: side effects for dapoxetine

Pingback: dapoxetine for sale

Pingback: dapoxetine 100 mg

Pingback: viagra with dapoxetine reviews

Pingback: dapoxetine without a doctors prescription

Pingback: dapoxetine without prescription

Pingback: buy brand cialis

Pingback: online brand cialis

Pingback: brand cialis online

Pingback: cheap brand cialis

Pingback: buy cheap brand cialis

Pingback: brand cialis

Pingback: brand cialis vs generic cialis

Pingback: brand cialis 20mg best price

Pingback: brand cialis overnight delivery

Pingback: brand cialis by lilly

Pingback: cialis brand vs generic

Pingback: brand cialis on internet

Pingback: cialis brand name usa price

Pingback: cialis brand only

Pingback: brand cialis 5 mg

Pingback: cialis generic vs brand name

Pingback: buy cialis professional

Pingback: online cialis professional

Pingback: cialis professional online

Pingback: cheap cialis professional

Pingback: buy cheap cialis professional

Pingback: cialis professional

Pingback: cialis vs cialis professional

Pingback: cialis professional 20 mg reviews

Pingback: cialis professional 40 mg

Pingback: cialis professional samples

Pingback: cialis professional 20mg

Pingback: is cialis professional really cialis

Pingback: cialis professional reviews

Pingback: what is cialis professional

Pingback: cialis professional 20 mg

Pingback: buy zovirax

Pingback: zovirax pill

Pingback: zovirax

Pingback: online zovirax

Pingback: zovirax online

Pingback: cheap zovirax

Pingback: buy cheap zovirax

Pingback: zovirax cream

Pingback: zovirax ointment

Pingback: zovirax cream manufacturer coupon

Pingback: zovirax for cold sores

Pingback: zovirax ointment over counter

Pingback: zovirax without a doctors prescription

Pingback: zovirax without prescription

Pingback: zovirax ointment 5% acyclovir

Pingback: buy cialis super active

Pingback: online cialis super active

Pingback: cialis super active online

Pingback: cheap cialis super active

Pingback: buy cheap cialis super active

Pingback: cialis super active

Pingback: cialis super active without a doctors prescription

Pingback: cialis super active without prescription

Pingback: cialis super active review

Pingback: cialis super active plus

Pingback: generic cialis super active

Pingback: cialis vs cialis super active

Pingback: cialis super active 40 mg

Pingback: what is cialis super active

Pingback: super active cialis testimonials

Pingback: buy extra super cialis

Pingback: online extra super cialis

Pingback: extra super cialis online

Pingback: cheap extra super cialis

Pingback: buy cheap extra super cialis

Pingback: extra super cialis without a doctors prescription

Pingback: extra super cialis without prescription

Pingback: extra super cialis

Pingback: extra super cialis lowest price

Pingback: extra super cialis 100mg

Pingback: extra super cialis reviews

Pingback: retin-a

Pingback: buy retin-a

Pingback: online retin-a

Pingback: retin-a online

Pingback: cheap retin-a

Pingback: buy cheap retin-a

Pingback: retin-a cream

Pingback: retin-a micro

Pingback: retin a for wrinkles

Pingback: retin a without a doctors prescription

Pingback: retin a without prescription

Pingback: buy cialis soft

Pingback: online cialis soft

Pingback: cialis soft online

Pingback: cheap cialis soft

Pingback: buy cheap cialis soft

Pingback: cialis soft without a doctors prescription

Pingback: cialis soft without prescription

Pingback: cialis soft

Pingback: how to take cialis soft

Pingback: cialis soft tabs 40 mg

Pingback: soft cialis reviews

Pingback: cialis soft tabs information

Pingback: cialis soft tabs 20mg

Pingback: soft tab cialis

Pingback: generic cialis soft tabs 20mg

Pingback: cialis soft tabs review

Pingback: cialis soft 20mg strength

Pingback: fluoxetine

Pingback: buy fluoxetine

Pingback: online fluoxetine

Pingback: fluoxetine online

Pingback: cheap fluoxetine

Pingback: buy cheap fluoxetine

Pingback: fluoxetine hcl

Pingback: fluoxetine 20 mg

Pingback: fluoxetine side effects

Pingback: fluoxetine 20mg

Pingback: what is fluoxetine

Pingback: side effects for fluoxetine

Pingback: fluoxetine 10 mg

Pingback: fluoxetine dosage

Pingback: fluoxetine medication

Pingback: fluoxetine classification

Pingback: fluoxetine for dogs

Pingback: fluoxetine hydrochloride

Pingback: what is fluoxetine used for

Pingback: warnings for fluoxetine

Pingback: side effects of fluoxetine

Pingback: fluoxetine hcl 20mg

Pingback: interactions for fluoxetine

Pingback: fluoxetine reviews

Pingback: fluoxetine hcl vs fluoxetine

Pingback: fluoxetine coupons

Pingback: fluoxetine price walmart

Pingback: fluoxetine price increase

Pingback: fluoxetine 10 mg reviews

Pingback: fluoxetine reviews for anxiety

Pingback: fluoxetine 40 mg side effects

Pingback: fluoxetine hcl 20 mg

Pingback: fluoxetine 10 mg capsule

Pingback: fluoxetine without a doctors prescription

Pingback: fluoxetine without prescription

Pingback: fluoxetine prozac

Pingback: prozac fluoxetine

Pingback: buy extra super viagra

Pingback: online extra super viagra

Pingback: extra super viagra online

Pingback: cheap extra super viagra

Pingback: buy cheap extra super viagra

Pingback: extra super viagra without a doctors prescription

Pingback: extra super viagra without prescription

Pingback: extra super viagra

Pingback: generic extra super viagra

Pingback: extra super viagra 200mg

Pingback: buy viagra plus

Pingback: online viagra plus

Pingback: viagra plus online

Pingback: cheap viagra plus

Pingback: buy cheap viagra plus

Pingback: viagra plus without a doctors prescription

Pingback: viagra plus without prescription

Pingback: viagra plus

Pingback: viagra plus 400 mg

Pingback: viagra plus pills

Pingback: super viagra plus 400 mg

Pingback: buy zithromax

Pingback: online zithromax

Pingback: zithromax online

Pingback: cheap zithromax

Pingback: buy cheap zithromax

Pingback: zithromax

Pingback: zithromax online mail-order pharmacies

Pingback: zithromax antibiotic

Pingback: zithromax z-pak

Pingback: zithromax dosage

Pingback: zithromax azithromycin

Pingback: side effects for zithromax

Pingback: zithromax side effects

Pingback: zithromax pediatric dosage chart

Pingback: zithromax dosage for kids

Pingback: zithromax for chlamydia

Pingback: zithromax antibiotic and alcohol

Pingback: zithromax 250 mg z pak

Pingback: zithromax for cats

Pingback: zithromax price without insurance

Pingback: zithromax price at walmart

Pingback: warnings for zithromax

Pingback: zithromax over counter

Pingback: interactions for zithromax

Pingback: zithromax 500 mg price

Pingback: zithromax without a doctors prescription

Pingback: zithromax without prescription

Pingback: buy lasix

Pingback: online lasix

Pingback: lasix online

Pingback: cheap lasix

Pingback: buy cheap lasix

Pingback: lasix

Pingback: lasix medication

Pingback: lasix side effects

Pingback: lasix dosage

Pingback: lasix generic

Pingback: side effects for lasix

Pingback: what is lasix

Pingback: metolazone and lasix

Pingback: torsemide to lasix conversion

Pingback: side effects of lasix

Pingback: lasix water pill

Pingback: lasix generic name

Pingback: bumex vs lasix

Pingback: lasix side effects in elderly

Pingback: lasix potassium

Pingback: what is lasix used for

Pingback: generic for lasix

Pingback: warnings for lasix

Pingback: lasix and potassium

Pingback: iv lasix

Pingback: lasix for dogs

Pingback: bumex to lasix conversion

Pingback: interactions for lasix

Pingback: natural substitute for lasix

Pingback: lasix 40 mg

Pingback: lasix dosage for fluid retention

Pingback: symptoms of too much lasix

Pingback: too much lasix can cause

Pingback: lasix without a doctors prescription

Pingback: lasix without prescription

Pingback: potassium dose with lasix

Pingback: 40 mg lasix too much

Pingback: buy kamagra

Pingback: online kamagra

Pingback: kamagra online

Pingback: cheap kamagra

Pingback: buy cheap kamagra

Pingback: kamagra

Pingback: kamagra oral jelly

Pingback: kamagra 100mg

Pingback: kamagra jelly

Pingback: kamagra store

Pingback: kamagra gel

Pingback: super kamagra

Pingback: kamagra 100 mg oral jelly

Pingback: kamagra oral jelly at walgreens

Pingback: kamagra oral jelly amazon

Pingback: kamagra 100mg oral jelly sildenafil

Pingback: kamagra 100mg tablets

Pingback: kamagra oral jelly cvs

Pingback: kamagra 100mg reviews

Pingback: kamagra 100mg chewable tablets

Pingback: kamagra without a doctors prescription

Pingback: kamagra without prescription

Pingback: buy levitra

Pingback: online levitra

Pingback: levitra online

Pingback: cheap levitra

Pingback: buy cheap levitra

Pingback: levitra

Pingback: levitra coupon

Pingback: levitra 20 mg

Pingback: levitra vs viagra

Pingback: levitra generic

Pingback: generic levitra

Pingback: levitra prices

Pingback: viagra vs cialis vs levitra

Pingback: side effects for levitra

Pingback: levitra 20 mg para que sirve

Pingback: levitra without a doctor prescription

Pingback: 40 mg levitra dosage

Pingback: levitra reviews men

Pingback: levitra 20 mg cost walmart

Pingback: levitra cost

Pingback: levitra 20mg best price

Pingback: $9 levitra at walmart

Pingback: levitra without a doctors prescription

Pingback: levitra without prescription

Pingback: generic levitra vardenafil 20mg

Pingback: buy propecia

Pingback: online propecia

Pingback: propecia online

Pingback: cheap propecia

Pingback: buy cheap propecia

Pingback: propecia

Pingback: propecia for hair loss

Pingback: propecia side effects

Pingback: side effects for propecia

Pingback: side effects of propecia in women

Pingback: propecia for women's hair loss

Pingback: propecia without a doctor prescription

Pingback: does propecia work

Pingback: generic propecia

Pingback: propecia for sale

Pingback: propecia stock

Pingback: cost of propecia

Pingback: propecia for men

Pingback: propecia tablets

Pingback: propecia reviews for men

Pingback: propecia prescription cost

Pingback: brand name propecia

Pingback: propecia without a doctors prescription

Pingback: propecia without prescription

Pingback: buy doxycycline

Pingback: online doxycycline

Pingback: doxycycline online

Pingback: cheap doxycycline

Pingback: buy cheap doxycycline

Pingback: doxycycline

Pingback: doxycycline hyclate

Pingback: doxycycline hyclate 100 mg

Pingback: doxycycline monohydrate

Pingback: doxycycline side effects

Pingback: side effects for doxycycline

Pingback: doxycycline 100mg

Pingback: doxycycline dosage

Pingback: interactions for doxycycline

Pingback: warnings for doxycycline

Pingback: doxycycline monohydrate 100mg

Pingback: doxycycline for dogs

Pingback: side effects of doxycycline

Pingback: what is doxycycline

Pingback: doxycycline antibiotic

Pingback: what is doxycycline used for

Pingback: doxycycline coverage

Pingback: doxycycline hyclate vs monohydrate

Pingback: doxycycline mono

Pingback: doxycycline for acne

Pingback: doxycycline hyclate side effects

Pingback: doxycycline dose

Pingback: doxycycline 100 mg

Pingback: side effects of doxycycline hyclate

Pingback: doxycycline monohydrate vs hyclate

Pingback: what bacteria does doxycycline treat

Pingback: fish doxycycline

Pingback: doxycycline monohydrate side effects

Pingback: side effects doxycycline

Pingback: doxycycline for uti

Pingback: doxycycline hyclate 100 mg warnings

Pingback: doxycycline for lyme disease

Pingback: doxycycline mono 100 mg

Pingback: doxycycline and alcohol

Pingback: doxycycline for cats

Pingback: doxycycline package insert

Pingback: what does doxycycline hyclate 100mg treat

Pingback: doxycycline for sinus infection

Pingback: doxycycline wikipedia

Pingback: doxycycline 100 mg side effects

Pingback: common side effects of doxycycline

Pingback: how to take doxycycline

Pingback: long term use of doxycycline

Pingback: doxycycline for skin

Pingback: doxycycline price increase

Pingback: doxycycline generic name

Pingback: walgreens doxycycline price

Pingback: doxycycline reviews side effects

Pingback: doxycycline 100mg cost at walmart

Pingback: walmart pharmacy doxycycline price

Pingback: doxycycline without a doctors prescription

Pingback: doxycycline without prescription

Pingback: buy ventolin

Pingback: online ventolin

Pingback: ventolin online

Pingback: cheap ventolin

Pingback: buy cheap ventolin

Pingback: ventolin

Pingback: ventolin inhaler

Pingback: ventolin copay card 2018

Pingback: ventolin inhaler recall

Pingback: $15 ventolin

Pingback: ventolin hfa inhaler coupons

Pingback: ventolin inhaler coupons 2018

Pingback: ventolin copay assistance card

Pingback: generic ventolin

Pingback: ventolin brand or generic

Pingback: ventolin hfa copay card

Pingback: gsk ventolin coupon

Pingback: ventolin without a doctors prescription

Pingback: ventolin without prescription

Pingback: buy metformin

Pingback: online metformin

Pingback: metformin online

Pingback: cheap metformin

Pingback: buy cheap metformin

Pingback: metformin

Pingback: metformin side effects

Pingback: metformin 500 mg

Pingback: side effects for metformin

Pingback: side effects of metformin

Pingback: metformin dosage

Pingback: metformin lawsuit

Pingback: metformin hcl

Pingback: metformin problems

Pingback: metformin and dementia

Pingback: metformin medication

Pingback: warnings for metformin

Pingback: metformin er

Pingback: metformin weight loss

Pingback: how does metformin work

Pingback: interactions for metformin

Pingback: metformin side effects in men

Pingback: metformin side effects in women

Pingback: what is metformin used for

Pingback: what is metformin

Pingback: does metformin cause dementia

Pingback: metformin hydrochloride

Pingback: glucophage metformin

Pingback: metformin and weight loss

Pingback: metformin dementia

Pingback: metformin for weight loss

Pingback: why is metformin dangerous

Pingback: metformin xr

Pingback: side effects metformin

Pingback: what does metformin do

Pingback: metformin 1000 mg

Pingback: metformin uses

Pingback: side effects of metformin 500 mg

Pingback: metformin generic

Pingback: metformin dose

Pingback: metformin hcl 500 mg

Pingback: metformin contraindications

Pingback: metformin recall

Pingback: metformin diarrhea

Pingback: metformin mechanism of action

Pingback: long term effects of metformin

Pingback: metformin er 500 mg

Pingback: metformin 500mg

Pingback: is metformin dangerous

Pingback: metformin for pcos

Pingback: metformin diabetes

Pingback: metformin alternatives

Pingback: metformin 1000 mg side effects

Pingback: metformin dosage guide

Pingback: side effects of metformin 1000 mg

Pingback: metformin and alcohol

Pingback: metformin and diarrhea

Pingback: metformin 500

Pingback: metformin overdose

Pingback: metformin pcos

Pingback: metformin brand name

Pingback: glipizide and metformin

Pingback: metformin drug class

Pingback: metformin extended release

Pingback: metformin 1000mg

Pingback: taking glimepiride with metformin

Pingback: side effects to metformin 500 mg

Pingback: bad news for metformin 2017

Pingback: when to take metformin

Pingback: why doctors no longer prescribe metformin

Pingback: how does metformin work in the body

Pingback: dangers of metformin

Pingback: dangers of taking metformin

Pingback: what is metformin for

Pingback: why is metformin bad

Pingback: metformin 1000

Pingback: metformin and pcos

Pingback: can metformin cause dementia

Pingback: does metformin cause weight loss

Pingback: how to take metformin

Pingback: glucocil and metformin interactions

Pingback: urgent news about metformin

Pingback: metformin hcl 1000 mg

Pingback: metformin and pregnancy

Pingback: what are the side effects of metformin

Pingback: is metformin safe

Pingback: metformin 850 mg

Pingback: best time to take metformin

Pingback: how long does it take for metformin to work

Pingback: metformina

Pingback: metformin patient information sheet

Pingback: side effects of metformin hcl

Pingback: what does metformin do for you

Pingback: metformin side effects in elderly

Pingback: metformin without a doctors prescription

Pingback: metformin without prescription

Pingback: buy synthroid

Pingback: online synthroid

Pingback: synthroid online

Pingback: cheap synthroid

Pingback: buy cheap synthroid

Pingback: synthroid

Pingback: synthroid side effects

Pingback: synthroid dosage

Pingback: side effects for synthroid

Pingback: synthroid medication

Pingback: synthroid coupon

Pingback: synthroid vs levothyroxine

Pingback: synthroid generic

Pingback: synthroid coupons

Pingback: interactions for synthroid

Pingback: side effects of synthroid

Pingback: synthroid dosing

Pingback: armour thyroid vs synthroid

Pingback: synthroid levothyroxine

Pingback: what is synthroid

Pingback: warnings for synthroid

Pingback: generic for synthroid

Pingback: generic synthroid

Pingback: synthroid direct

Pingback: synthroid dose

Pingback: l-thyroxine synthroid

Pingback: synthroid dosage strengths

Pingback: side effects of synthroid medication

Pingback: synthroid coupons 2018

Pingback: synthroid dosage chart

Pingback: synthroid side effects in women

Pingback: synthroid vs generic levothyroxine

Pingback: dangers of taking synthroid

Pingback: synthroid without a doctor

Pingback: synthroid recall

Pingback: difference between levothyroxine

Pingback: synthroid brand name

Pingback: who makes synthroid brand

Pingback: synthroid or levothyroxine which is better

Pingback: synthroid brand manufacturer

Pingback: synthroid brand name cost

Pingback: synthroid without a doctors prescription

Pingback: synthroid without prescription

Pingback: synthroid dosages

Pingback: buy flagyl

Pingback: online flagyl

Pingback: flagyl metronidazole

Pingback: flagyl online

Pingback: cheap flagyl

Pingback: buy cheap flagyl

Pingback: flagyl

Pingback: flagyl online mail-order pharmacies

Pingback: flagyl antibiotic

Pingback: flagyl side effects

Pingback: flagyl dosage

Pingback: warnings for flagyl

Pingback: flagyl and alcohol

Pingback: side effects for flagyl

Pingback: what is flagyl used for

Pingback: flagyl 500 mg

Pingback: flagyl for dogs

Pingback: what is flagyl

Pingback: flagyl dosing

Pingback: interactions for flagyl

Pingback: flagyl 500

Pingback: side effects of flagyl

Pingback: flagyl side effects in women

Pingback: what is flagyl prescribed for

Pingback: flagyl 400

Pingback: flagyl bula

Pingback: uses for flagyl 500 mg

Pingback: is flagyl a strong antibiotic

Pingback: flagyl metallic taste relief

Pingback: flagyl 500 mg for bacterial vaginosis

Pingback: flagyl and diarrhea

Pingback: what type of antibiotic is flagyl

Pingback: uses for flagyl

Pingback: generic for flagyl

Pingback: flagyl for kids

Pingback: flagyl price at walmart

Pingback: flagyl for uti

Pingback: flagyl without a doctors prescription

Pingback: flagyl without prescription

Pingback: hctz

Pingback: hctz side effects

Pingback: hctz medication

Pingback: side effects of hctz

Pingback: hctz 25 mg

Pingback: lisinopril/hctz

Pingback: lisinopril hctz

Pingback: hctz/lisinopril

Pingback: lisinopril/hctz 20/25 mg

Pingback: buy hydrochlorothiazide

Pingback: online hydrochlorothiazide

Pingback: hydrochlorothiazide online

Pingback: cheap hydrochlorothiazide

Pingback: buy cheap hydrochlorothiazide

Pingback: hydrochlorothiazide

Pingback: lisinopril hydrochlorothiazide

Pingback: losartan hydrochlorothiazide

Pingback: hydrochlorothiazide side effects

Pingback: hydrochlorothiazide 25 mg

Pingback: hydrochlorothiazide recall

Pingback: irbesartan hydrochlorothiazide

Pingback: side effects for hydrochlorothiazide

Pingback: triamterene hydrochlorothiazide

Pingback: side effects of hydrochlorothiazide

Pingback: bisoprolol hydrochlorothiazide

Pingback: what is hydrochlorothiazide

Pingback: valsartan hydrochlorothiazide

Pingback: hydrochlorothiazide uses

Pingback: interactions for hydrochlorothiazide

Pingback: hydrochlorothiazide 12.5 mg

Pingback: hydrochlorothiazide lisinopril

Pingback: dangers of taking hydrochlorothiazide

Pingback: hydrochlorothiazide dosage

Pingback: telmisartan hydrochlorothiazide

Pingback: hydrochlorothiazide potassium

Pingback: warnings for hydrochlorothiazide

Pingback: what is hydrochlorothiazide used for

Pingback: chlorthalidone vs hydrochlorothiazide

Pingback: losartan potassium hydrochlorothiazide

Pingback: microzide hydrochlorothiazide

Pingback: side effects of hydrochlorothiazide 25 mg

Pingback: valsartan hydrochlorothiazide recall

Pingback: amlodipine valsartan hydrochlorothiazide

Pingback: hydrochlorothiazide 12.5 mg tablets

Pingback: hydrochlorothiazide recall 2018

Pingback: valsartan and hydrochlorothiazide

Pingback: olmesartan medoxomil hydrochlorothiazide

Pingback: lisinopril and hydrochlorothiazide

Pingback: candesartan hydrochlorothiazide

Pingback: lisinopril hydrochlorothiazide side effects

Pingback: hydrochlorothiazide 25 mg tablet

Pingback: hydrochlorothiazide 12.5 mg oral tablet

Pingback: drinking alcohol while taking hydrochlorothiazide

Pingback: stopping hydrochlorothiazide side effects

Pingback: hydrochlorothiazide side effects in women

Pingback: hydrochlorothiazide 12.5mg recall

Pingback: triamterene hydrochlorothiazide brand

Pingback: valsartan hydrochlorothiazide brand

Pingback: losartan hydrochlorothiazide brand name

Pingback: amiloride hydrochlorothiazide brand

Pingback: lisinopril hydrochlorothiazide brand name

Pingback: irbesartan hydrochlorothiazide brand

Pingback: bisoprolol hydrochlorothiazide brand name

Pingback: metoprolol hydrochlorothiazide brand name

Pingback: hydrochlorothiazide without a doctors prescription

Pingback: hydrochlorothiazide without prescription

Pingback: diflucan

Pingback: buy diflucan

Pingback: online diflucan

Pingback: diflucan online

Pingback: cheap diflucan

Pingback: buy cheap diflucan

Pingback: diflucan dosage

Pingback: diflucan for yeast infection

Pingback: diflucan side effects

Pingback: side effects for diflucan

Pingback: diflucan for yeast infection dosage

Pingback: diflucan dosage for yeast infection

Pingback: diflucan 150 mg

Pingback: dosage for diflucan yeast infection

Pingback: oral diflucan for yeast infection

Pingback: diflucan dosage for uti

Pingback: diflucan over counter walmart

Pingback: diflucan over counter walgreens

Pingback: directions for taking diflucan

Pingback: diflucan without a doctors prescription

Pingback: diflucan without prescription

Pingback: antabuse

Pingback: buy antabuse

Pingback: online antabuse

Pingback: antabuse online

Pingback: cheap antabuse

Pingback: buy cheap antabuse

Pingback: antabuse medication

Pingback: antabuse side effects

Pingback: things to avoid with antabuse

Pingback: drinking on antabuse side effects

Pingback: antabuse patient handout

Pingback: antabuse side effects and symptoms

Pingback: how long does antabuse last

Pingback: natural antabuse substitute

Pingback: antabuse monthly injection

Pingback: antabuse without a doctors prescription

Pingback: antabuse without prescription

Pingback: interactions for antabuse

Pingback: buy clomid

Pingback: clomid

Pingback: online clomid

Pingback: clomid online

Pingback: cheap clomid

Pingback: buy cheap clomid

Pingback: clomid for men

Pingback: clomid for women

Pingback: clomid side effects

Pingback: side effects for clomid

Pingback: clomid for sale at walmart

Pingback: how to take clomid for pregnancy

Pingback: how to take clomid 50mg

Pingback: clomid over counter

Pingback: how does clomid work

Pingback: clomid success stories

Pingback: clomid side effects in men

Pingback: clomid for sale

Pingback: clomid for men for sale

Pingback: clomid price at walmart

Pingback: clomid prescription cost

Pingback: clomid price at costco

Pingback: clomid without a doctors prescription

Pingback: clomid without prescription

Pingback: clomid dosage for men with low testosterone

Pingback: valtrex

Pingback: buy valtrex

Pingback: online valtrex

Pingback: valtrex online

Pingback: cheap valtrex

Pingback: buy cheap valtrex

Pingback: valtrex dosage

Pingback: valtrex side effects

Pingback: valtrex for shingles

Pingback: valtrex generic

Pingback: valtrex for cold sores

Pingback: side effects for valtrex

Pingback: valtrex dosing

Pingback: side effects of valtrex

Pingback: generic valtrex

Pingback: interactions for valtrex

Pingback: what is valtrex used for

Pingback: what is valtrex

Pingback: cost of valtrex

Pingback: valtrex website

Pingback: generic valtrex for sale

Pingback: valtrex brand name

Pingback: good rx valtrex

Pingback: generic brand valtrex

Pingback: valtrex manufacturer coupon

Pingback: valtrex for herpes simplex

Pingback: valtrex without a doctors prescription

Pingback: valtrex without prescription

Pingback: shingles recovery time after valtrex

Pingback: valtrex shingles treatment

Pingback: female viagra pills

Pingback: female viagra walmart

Pingback: female viagra pills reviews

Pingback: lady era female viagra reviews

Pingback: buy female viagra

Pingback: online female viagra

Pingback: female viagra online

Pingback: cheap female viagra

Pingback: buy cheap female viagra

Pingback: female viagra without a doctors prescription

Pingback: female viagra without prescription

Pingback: female viagra

Pingback: female viagra does it work

Pingback: female viagra for women

Pingback: female viagra reviews

Pingback: natural female viagra

Pingback: male and female viagra

Pingback: female viagra pills for sale

Pingback: female viagra medication

Pingback: female viagra testimonials

Pingback: buy prednisolone

Pingback: prednisolone

Pingback: online prednisolone

Pingback: prednisolone online

Pingback: cheap prednisolone

Pingback: buy cheap prednisolone

Pingback: prednisolone eye drops

Pingback: prednisolone acetate

Pingback: prednisolone acetate 1

Pingback: prednisolone acetate ophthalmic suspension

Pingback: prednisolone for cats

Pingback: side effects for prednisolone

Pingback: prednisolone for dogs

Pingback: what is prednisolone

Pingback: prednisolone side effects

Pingback: prednisolone gatifloxacin bromfenac

Pingback: prednisolone tablets

Pingback: prednisolone eye drops side effects

Pingback: prednisolone without an rx

Pingback: side effects of prednisolone

Pingback: prednisolone 20 mg

Pingback: methylprednisolone

Pingback: methylprednisolone 4mg dosepak

Pingback: cadista methylprednisolone

Pingback: warnings for methylprednisolone

Pingback: what is methylprednisolone

Pingback: methylprednisolone side effects

Pingback: interactions for methylprednisolone

Pingback: methylprednisolone 4 mg

Pingback: methylprednisolone 21 tablets instructions

Pingback: prednisolone dosage chart

Pingback: warnings for prednisolone

Pingback: side effects of prednisolone eye drops

Pingback: side effects associated with using prednisolone

Pingback: what does prednisolone do

Pingback: prednisolone side effects in women

Pingback: prednisolone costs

Pingback: prednisolone cream

Pingback: prednisone vs prednisolone

Pingback: prednisolone for dogs cost

Pingback: prednisolone liquid for cats

Pingback: prednisolone 5mg tablet

Pingback: prednisone vs prednisolone dosage chart

Pingback: prednisolone without a doctors prescription

Pingback: prednisolone without prescription

Pingback: cipro

Pingback: buy cipro

Pingback: online cipro

Pingback: cipro online

Pingback: cheap cipro

Pingback: buy cheap cipro

Pingback: cipro side effects

Pingback: cipro antibiotic

Pingback: side effects of cipro

Pingback: side effects for cipro

Pingback: cipro hc

Pingback: cipro medication

Pingback: cipro for uti

Pingback: what is cipro

Pingback: cipro dosing

Pingback: cipro dosage

Pingback: what is cipro used for

Pingback: cipro eye drops

Pingback: warnings for cipro

Pingback: cipro 500 mg

Pingback: interactions for cipro

Pingback: cipro side effects in elderly

Pingback: cipro 500

Pingback: types of infections cipro treats

Pingback: zoloft

Pingback: zoloft sertraline

Pingback: buy zoloft

Pingback: online zoloft

Pingback: zoloft online

Pingback: cheap zoloft

Pingback: buy cheap zoloft

Pingback: zoloft side effects

Pingback: zoloft medication

Pingback: zoloft dosage

Pingback: zoloft generic

Pingback: side effects for zoloft

Pingback: zoloft for anxiety

Pingback: zoloft reviews

Pingback: zoloft without a doctors prescription

Pingback: zoloft without prescription

Pingback: side effects of zoloft

Pingback: generic zoloft

Pingback: interactions for zoloft

Pingback: warnings for zoloft

Pingback: generic for zoloft

Pingback: zoloft side effects in women

Pingback: what is zoloft

Pingback: zoloft withdrawal symptoms

Pingback: zoloft generic name

Pingback: zoloft withdrawal

Pingback: side effects of zoloft in women

Pingback: zoloft dosing

Pingback: what is zoloft used for

Pingback: dr gunter zoloft

Pingback: zoloft and alcohol

Pingback: is zoloft addictive

Pingback: is zoloft a controlled substance

Pingback: lexapro vs zoloft

Pingback: first two weeks of zoloft

Pingback: zoloft weight gain

Pingback: weaning off zoloft

Pingback: does zoloft cause weight gain

Pingback: zoloft and weight gain

Pingback: is zoloft a benzodiazepine

Pingback: zoloft 50 mg

Pingback: zoloft side effects in elderly

Pingback: how effective is zoloft for anxiety

Pingback: zoloft 25 mg side effects first week

Pingback: dosage of zoloft

Pingback: zoloft without a doctor's prescription

Pingback: benefits of taking zoloft

Pingback: zoloft recall

Pingback: zoloft side effects in children

Pingback: sertraline zoloft

Pingback: sertraline vs zoloft

Pingback: generic name for zoloft sertraline

Pingback: lexapro

Pingback: buy lexapro

Pingback: online lexapro

Pingback: lexapro online

Pingback: cheap lexapro

Pingback: buy cheap lexapro

Pingback: lexapro side effects

Pingback: lexapro medication

Pingback: lexapro generic

Pingback: lexapro dosage

Pingback: side effects for lexapro

Pingback: lexapro withdrawal symptoms

Pingback: side effects of lexapro

Pingback: lexapro reviews

Pingback: generic lexapro

Pingback: lexapro for anxiety

Pingback: what is lexapro

Pingback: warnings for lexapro

Pingback: lexapro and alcohol

Pingback: lexapro generic name

Pingback: interactions for lexapro

Pingback: generic for lexapro

Pingback: lexapro withdrawal

Pingback: lexapro side effects in women

Pingback: first few days on lexapro

Pingback: lexapro weight gain

Pingback: lexapro dosing

Pingback: what is lexapro used for

Pingback: generic name for lexapro

Pingback: does lexapro cause weight gain

Pingback: side effects of lexapro in women

Pingback: lexapro 10 mg

Pingback: lexapro benefits for women

Pingback: lexapro and weight gain

Pingback: lexapro 5mg

Pingback: lexapro side effects first week

Pingback: lexapro side effects in men

Pingback: lexapro overdose

Pingback: lexapro vs celexa

Pingback: celexa vs lexapro

Pingback: is lexapro a controlled substance

Pingback: lexapro half life

Pingback: is lexapro a benzodiazepine

Pingback: lexapro 10 mg side effects

Pingback: lexapro and the elderly

Pingback: side effects of discontinuing lexapro

Pingback: lexapro for pain

Pingback: lexapro for children

Pingback: lexapro price costco

Pingback: lexapro manufacturer name

Pingback: lexapro vs generic escitalopram

Pingback: lexapro without a doctors prescription

Pingback: lexapro without prescription

Pingback: propranolol

Pingback: buy propranolol

Pingback: online propranolol

Pingback: propranolol online

Pingback: cheap propranolol

Pingback: buy cheap propranolol

Pingback: propranolol for anxiety

Pingback: propranolol side effects

Pingback: propranolol dosage

Pingback: side effects for propranolol

Pingback: propranolol hcl

Pingback: propranolol for migraines

Pingback: what is propranolol

Pingback: what is propranolol used for

Pingback: interactions for propranolol

Pingback: warnings for propranolol

Pingback: propranolol anxiety

Pingback: propranolol er

Pingback: propranolol side effects in women

Pingback: propranolol hydrochloride

Pingback: side effects of propranolol

Pingback: propranolol withdrawal symptoms

Pingback: propranolol 40mg

Pingback: can i take tylenol with propranolol

Pingback: propranolol 10 mg

Pingback: propranolol 10mg

Pingback: long term effects of propranolol

Pingback: propranolol and alcohol

Pingback: propranolol 40 mg

Pingback: warnings and precautions for propranolol

Pingback: propranolol side effects mayo clinic

Pingback: effects of propranolol discontinuation

Pingback: propranolol uses in psychiatric medicine

Pingback: propranolol and antacids

Pingback: propranolol use in children

Pingback: propranolol without a doctors prescription

Pingback: propranolol without prescription

Pingback: ampicillin

Pingback: buy ampicillin

Pingback: online ampicillin

Pingback: ampicillin online

Pingback: cheap ampicillin

Pingback: buy cheap ampicillin

Pingback: ampicillin sulbactam

Pingback: ampicillin vs amoxicillin

Pingback: ampicillin sulbactam oral

Pingback: ampicillin 500mg capsules dosage

Pingback: side effects of ampicillin 500 mg

Pingback: ampicillin for uti

Pingback: ampicillin iv dosage

Pingback: ampicillin neonatal dosing

Pingback: warnings for ampicillin

Pingback: ampicillin without a doctors prescription

Pingback: ampicillin without prescription

Pingback: lisinopril

Pingback: buy lisinopril

Pingback: online lisinopril

Pingback: lisinopril online

Pingback: cheap lisinopril

Pingback: buy cheap lisinopril

Pingback: lisinopril side effects

Pingback: lisinopril medication

Pingback: side effects of lisinopril

Pingback: side effects for lisinopril

Pingback: lisinopril 10mg

Pingback: lisinopril dosage

Pingback: lisinopril 20 mg

Pingback: lisinopril cough

Pingback: what is lisinopril

Pingback: interactions for lisinopril

Pingback: warnings for lisinopril

Pingback: what is lisinopril used for

Pingback: lisinopril generic

Pingback: lisinopril 5mg

Pingback: lisinopril dosing

Pingback: lisinopril side effects in women

Pingback: lisinopril side effects in men

Pingback: zestril lisinopril

Pingback: lisinopril classification

Pingback: lisinopril 20mg

Pingback: lisinopril new warnings

Pingback: angioedema lisinopril

Pingback: side effects of lisinopril 20 mg

Pingback: what is lisinopril for

Pingback: effects of discontinuing lisinopril

Pingback: side effects lisinopril

Pingback: lisinopril ingredients

Pingback: is lisinopril bad for you

Pingback: does lisinopril contain valsartan

Pingback: dangers of taking lisinopril

Pingback: side effects of lisinopril 10 mg

Pingback: is lisinopril a diuretic

Pingback: is lisinopril an ace inhibitor

Pingback: blood pressure medications lisinopril

Pingback: what are the side effects of lisinopril

Pingback: lisinopril side effects for women

Pingback: lisinopril and alcohol

Pingback: lisinopril 40 mg

Pingback: losartan vs lisinopril

Pingback: lisinopril and bananas

Pingback: lisinopril 2.5 mg

Pingback: is lisinopril dangerous

Pingback: lisinopril to losartan conversion

Pingback: is lisinopril a blood thinner

Pingback: lisinopril 10 mg

Pingback: lisinopril dose

Pingback: lisinopril side effects with diabetes

Pingback: lisinopril 5 mg

Pingback: lisinopril 20 mg side effects

Pingback: lisinopril 20 mg side effects in men

Pingback: lisinopril 10 mg tablet

Pingback: does lisinopril cause weight gain

Pingback: lisinopril 10mg tablets side effects

Pingback: what medications interact with lisinopril

Pingback: dosage for lisinopril

Pingback: lisinopril without a doctors prescription

Pingback: lisinopril without prescription

Pingback: nolvadex

Pingback: buy nolvadex

Pingback: online nolvadex

Pingback: nolvadex online

Pingback: cheap nolvadex

Pingback: buy cheap nolvadex

Pingback: nolvadex for sale

Pingback: nolvadex for men

Pingback: side effects for nolvadex

Pingback: nolvadex for men testosterone

Pingback: nolvadex on cycle

Pingback: nolvadex during cycle

Pingback: nolvadex dosage

Pingback: nolvadex tamoxifen

Pingback: nolvadex pct

Pingback: nolvadex without a doctors prescription

Pingback: nolvadex without prescription

Pingback: trazodone

Pingback: buy trazodone

Pingback: online trazodone

Pingback: trazodone online

Pingback: cheap trazodone

Pingback: buy cheap trazodone

Pingback: trazodone side effects

Pingback: trazodone for sleep

Pingback: trazodone 50 mg

Pingback: trazodone for dogs

Pingback: trazodone medication

Pingback: side effects for trazodone

Pingback: trazodone dosage

Pingback: trazodone hcl

Pingback: what is trazodone

Pingback: trazodone 100 mg

Pingback: side effects of trazodone

Pingback: is trazodone a controlled substance

Pingback: trazodone drug class

Pingback: interactions for trazodone

Pingback: what is trazodone used for

Pingback: trazodone overdose

Pingback: trazodone generic

Pingback: trazodone classification

Pingback: warnings for trazodone

Pingback: desyrel trazodone

Pingback: trazodone 50mg

Pingback: cialis online

Pingback: trazodone class

Pingback: cheap cialis

Pingback: trazodone hydrochloride

Pingback: buy cheap cialis

Pingback: trazodone 50 mg for sleep

Pingback: cialis

Pingback: trazodone uses

Pingback: cialis generic

Pingback: trazodone controlled substance

Pingback: generic cialis

Pingback: is trazodone safe for sleep

Pingback: cialis prices

Pingback: trazodone drug classification

Pingback: cialis without a doctor's prescription

Pingback: cialis 20 mg

Pingback: cialis 20

Pingback: cialis pills

Pingback: side effects for cialis

Pingback: buy cialis online

Pingback: cialis 20 mg best price

Pingback: cialis tadalafil

Pingback: generic cialis tadalafil

Pingback: cialis on line

Pingback: cialis 20mg

Pingback: purchasing cialis on the internet

Pingback: cialis.com

Pingback: cialis cost

Pingback: cialis canada

Pingback: cialis samples

Pingback: what is cialis

Pingback: canadian cialis

Pingback: cialis on line no pres

Pingback: cialis from canada

Pingback: cialis generic availability

Pingback: cialis for sale

Pingback: cost of cialis

Pingback: cialis without a doctor prescription

Pingback: cialis 5mg

Pingback: cialis 5 mg

Pingback: lowest cialis prices

Pingback: cialis daily

Pingback: viagra cialis

Pingback: where to buy cialis

Pingback: cialis medication

Pingback: generic cialis available

Pingback: cialis for women

Pingback: cialis sale

Pingback: discount cialis

Pingback: cialis coupon 30 day

Pingback: cialis or viagra

Pingback: best price for cialis

Pingback: is there a generic for cialis

Pingback: cialis website

Pingback: cialis 10mg

Pingback: buy cialis without prescription

Pingback: lowest price on cialis 20mg

Pingback: generic cialis tadalafil 20 mg

Pingback: cialis tadalafil 20mg

Pingback: tadalafil generic vs cialis

Pingback: 2019

Pingback: casino real money

Pingback: real money casino

Pingback: virgin online casino

Pingback: foxwoods online casino

Pingback: tropicana online casino

Pingback: caesars online casino

Pingback: borgata online casino

Pingback: hyper casinos

Pingback: free online casino

Pingback: free online casino slots

Pingback: mgm online casino

Pingback: bovada casino

Pingback: doubledown casino

Pingback: hollywood casino

Pingback: chumba casino

Pingback: firekeepers casino

Pingback: winstar world casino

Pingback: high 5 casino

Pingback: gsn casino

Pingback: gsn casino games

Pingback: gsn casino slots

Pingback: online gambling casino

Pingback: online casinos for us players

Pingback: casino blackjack

Pingback: online casino gambling

Pingback: online casino slots

Pingback: online casino bonus

Pingback: slots for real money

Pingback: zone online casino

Pingback: real casino

Pingback: empire city online casino

Pingback: las vegas casinos

Pingback: free slots casino games

Pingback: casino games free

Pingback: free casino games vegas world

Pingback: play free vegas casino games

Pingback: free casino games slot machines

Pingback: zone online casino games

Pingback: casino games free online

Pingback: free casino games no download

Pingback: free casino games sun moon

Pingback: free casino games slotomania

Pingback: casino games online

Pingback: free casino games slots

Pingback: vegas world casino games

Pingback: free vegas casino games

Pingback: free online casino games

Pingback: casino games slots free

Pingback: casino bonus

Pingback: free online slots

Pingback: lady luck

Pingback: free slots games

Pingback: free casino slot games

Pingback: best online casino

Pingback: online gambling

Pingback: slots online

Pingback: online slots

Pingback: real casino slots

Pingback: play slots

Pingback: online slot games

Pingback: vegas casino slots

Pingback: vegas slots online

Pingback: slot games

Pingback: play slots online

Pingback: gold fish casino slots

Pingback: cashman casino slots

Pingback: world class casino slots

Pingback: free slots

Pingback: slots free

Pingback: caesars slots

Pingback: slotomania free slots

Pingback: slots free games

Pingback: vegas world slots

Pingback: heart of vegas free slots

Pingback: old vegas slots

Pingback: slots lounge

Pingback: pch slots

Pingback: caesars free slots

Pingback: house of fun slots

Pingback: slots of vegas

Pingback: vegas slots

Pingback: free vegas slots

Pingback: jackpot magic slots

Pingback: penny slots

Pingback: simslots free slots

Pingback: scatter slots

Pingback: buffalo gold slots

Pingback: brian christopher slots

Pingback: penny slots free online

Pingback: liberty slots

Pingback: my vegas slots

Pingback: free slots 777

Pingback: slots games

Pingback: slots games free

Pingback: hypercasinos

Pingback: lady luck online casino

Pingback: gambling sites

Pingback: online casino games free

Pingback: slot machines

Pingback: slotomania slot machines

Pingback: online slot machines

Pingback: parx online casino

Pingback: casino online

Pingback: casino online slots

Pingback: casino bonus codes

Pingback: online casino games

Pingback: casino games

Pingback: online casino

Pingback: online casinos

Pingback: free casino

Pingback: casino game

Pingback: play casino

Pingback: casino play

Pingback: play online casino

Pingback: free casino games

Pingback: free casino games online

Pingback: no deposit casino

Pingback: big fish casino

Pingback: best online casinos

Pingback: online casino real money

Pingback: casino slots

Pingback: cleantalkorg2.ru

Pingback: a2019-2020

Pingback: facebook

Pingback: facebook1

Pingback: javsearch.mobi

Pingback: Fiza Khan Kolkata Independent Escorts Call Girls Services

Pingback: Fiza Khan Kolkata Call Girls Escorts Services

Pingback: Diksha Arya Kolkata Escorts Call Girls Services

Pingback: Diksha Arya Kolkata Independent Escorts Call Girls Services

Pingback: generic viagra 100mg sildenafil

Pingback: sildenafil 20 mg vs viagra

Pingback: sildenafil vs viagra

Pingback: generic viagra cost at walmart

Pingback: buy viagra

Pingback: online viagra

Pingback: viagra online

Pingback: cheap viagra

Pingback: buy cheap viagra

Pingback: viagra

Pingback: generic viagra

Pingback: viagra without a doctor prescription

Pingback: viagra generic

Pingback: viagra coupons

Pingback: viagra prices

Pingback: viagra pills

Pingback: viagra dosage

Pingback: viagra 100mg

Pingback: generic viagra 100mg

Pingback: viagra cost

Pingback: buy viagra online

Pingback: 100 mg viagra lowest price

Pingback: cost of viagra

Pingback: viagra on line

Pingback: viagra samples

Pingback: viagra 100 mg best price

Pingback: what viagra can do

Pingback: viagra pills for sale

Pingback: cheapest viagra 100mg

Pingback: cost of viagra 100mg

Pingback: banned commercials viagra

Pingback: over the counter viagra

Pingback: viagra coupon

Pingback: generic for viagra

Pingback: viagra vs cialis

Pingback: what is viagra

Pingback: generic viagra price at walmart

Pingback: active ingredient in viagra

Pingback: canadian viagra

Pingback: pfizer viagra

Pingback: viagra for sale

Pingback: viagra on line no prec

Pingback: buy generic viagra

Pingback: viagra canada

Pingback: otc viagra

Pingback: generic viagra cost

Pingback: viagra for men

Pingback: where to buy viagra

Pingback: viagra from canada

Pingback: viagra generic walmart

Pingback: generic viagra prices

Pingback: discount viagra

Pingback: generic viagra online

Pingback: canada viagra

Pingback: generic viagra coupons

Pingback: order viagra online

Pingback: buy viagra on

Pingback: sildenafil citrate generic viagra 100mg

Pingback: cheap viagra pills

Pingback: viagra coupons 75% off

Pingback: viagra samples from pfizer

Pingback: maximum safe dose of viagra

Pingback: viagra without a doctors prescription

Pingback: cbd

Pingback: cbd oil

Pingback: buy cbd

Pingback: cbd oil benefits

Pingback: cbd oil for sale

Pingback: cbd oil for pain

Pingback: charlottes web cbd oil

Pingback: what is cbd oil

Pingback: cbd oil at walmart

Pingback: cbd oil for dogs

Pingback: cbd oil side effects

Pingback: best cbd oil

Pingback: cbd oil for sale walmart

Pingback: cbd oil florida

Pingback: walgreens cbd oil

Pingback: pure cbd oil

Pingback: cbd oil reviews

Pingback: strongest cbd oil for sale

Pingback: cbd oil uk

Pingback: cbd oil stores near me

Pingback: green roads cbd oil

Pingback: benefits of cbd oil

Pingback: cbd oil canada

Pingback: best cbd oil for pain

Pingback: where to buy cbd oil

Pingback: plus cbd oil

Pingback: cbd oil dosage

Pingback: hempworx cbd oil

Pingback: buy cbd oil

Pingback: zilis cbd oil

Pingback: hempworks cbd oil

Pingback: cbd oil wisconsin

Pingback: cbd oil for anxiety

Pingback: cbd oil in texas

Pingback: leafwize cbd oil

Pingback: hemp cbd oil

Pingback: organic cbd oil

Pingback: walmart cbd oil for pain

Pingback: how to use cbd oil

Pingback: cannabidiol

Pingback: cbd oil walgreens

Pingback: cbd oil indiana

Pingback: best cbd oil reviews

Pingback: cbd oil amazon

Pingback: cbd oils

Pingback: full spectrum cbd oil

Pingback: koi cbd oil

Pingback: charlotte web cbd oil

Pingback: apex cbd oil

Pingback: side effects of cbd oil

Pingback: cbd oil capsules

Pingback: the best cbd oil on the market

Pingback: cbd oil stocks

Pingback: nuleaf cbd oil

Pingback: cbd oil uses

Pingback: cbd oil near me

Pingback: is cbd oil legal

Pingback: does walgreens sell cbd oil

Pingback: what is cbd oil benefits

Pingback: pure kana cbd oil

Pingback: lazarus cbd oil

Pingback: cbd oil interactions with medications

Pingback: ultra cell cbd oil

Pingback: best cbd oil 2018

Pingback: select cbd oil

Pingback: cbd oil scam

Pingback: cbd oil holland and barrett

Pingback: purekana cbd oil

Pingback: cv sciences cbd oil

Pingback: vaping cbd oil

Pingback: cbd oil australia

Pingback: does cbd oil show up on drug test

Pingback: cbd oil vape

Pingback: cbd oil for pets

Pingback: cbd oil legal

Pingback: cbd oil online

Pingback: cbd oil for cats

Pingback: cannabis oil

Pingback: cbd oil colorado

Pingback: buy cbd oil online

Pingback: what does cbd oil do

Pingback: hemp cbd oil side effects

Pingback: amazon cbd oil

Pingback: what is cbd oil good for

Pingback: does cbd oil work

Pingback: cbd oil prices

Pingback: cbd oil with thc

Pingback: cbd oil reviews 2018

Pingback: bluebird cbd oil

Pingback: cbd oil dosage instructions

Pingback: cbd oil and drug testing

Pingback: hemp oil vs cbd oil

Pingback: cbd oil dogs

Pingback: where to buy cbd oil near me

Pingback: cbd oil vs hemp oil

Pingback: cw cbd oil

Pingback: ananda cbd oil

Pingback: cbd oil distributors

Pingback: cbd oil at gnc

Pingback: pro cbd oil

Pingback: pure essence cbd oil

Pingback: where can i buy cbd oil

Pingback: where to buy cbd cream

Pingback: buy cbd oil with thc

Pingback: buy cbd hemp buds

Pingback: where to buy cbd oil online

Pingback: cbd for sale

Pingback: buy cbd oil for dogs

Pingback: cbd oil in canada

Pingback: where to buy cbd locally

Pingback: buy cbd oil uk

Pingback: cbd canada

Pingback: where can you buy cbd oil

Pingback: cbd hemp oil walmart

Pingback: where can i buy cbd oil near me

Pingback: cbd products online

Pingback: the distillery

Pingback: cbd oil price

Pingback: the cbd store

Pingback: cbd distillery

Pingback: where to buy cbd cream for pain

Pingback: cbd store

Pingback: cbd online

Pingback: retail stores selling cbd oil

Pingback: cbd shop

Pingback: cwhempcbdoil

Pingback: cbdistillery

Pingback: cbd gummies

Pingback: cbd book distributors

Pingback: what is cbd

Pingback: cbd cream

Pingback: cbd marijuana

Pingback: cbd capsules

Pingback: cbd benefits

Pingback: cbd products

Pingback: cbd for dogs

Pingback: cbd tincture

Pingback: cbd water

Pingback: cbd vape

Pingback: koi cbd

Pingback: cbd college

Pingback: cbd hemp oil

Pingback: diamond cbd

Pingback: cbd clinic

Pingback: cbd vape juice

Pingback: cbd pills

Pingback: cbd pure

Pingback: cbd vape oil

Pingback: cbd isolate

Pingback: cbd coffee

Pingback: cbd edibles

Pingback: hempworx cbd

Pingback: cbd vape pen

Pingback: elixinol cbd

Pingback: charlottes web cbd

Pingback: hemp oil cbd

Pingback: select cbd

Pingback: cbd stock

Pingback: green roads cbd

Pingback: cbd flower

Pingback: green mountain cbd

Pingback: cbd stocks

Pingback: cbd plus

Pingback: cbd side effects on liver

Pingback: cbd lotion

Pingback: cbd dog treats

Pingback: medterra cbd

Pingback: cbd cream for pain

Pingback: pure cbd

Pingback: cbd cartridges

Pingback: cbd salve

Pingback: american shaman cbd

Pingback: reddit cbd

Pingback: cbd brothers

Pingback: cbd dosage

Pingback: cbd side effects

Pingback: cbd clinic products

Pingback: poker

Pingback: free poker

Pingback: video poker

Pingback: poker games

Pingback: online poker

Pingback: poker free

Pingback: wsop free poker

Pingback: world series of poker

Pingback: texas holdem poker

Pingback: strip poker

Pingback: replay poker

Pingback: global poker

Pingback: wpt poker

Pingback: free online poker

Pingback: free video poker

Pingback: wsop online poker

Pingback: free poker games

Pingback: pureplay poker

Pingback: wsop free online poker

Pingback: governor of poker

Pingback: poker online

Pingback: free texas holdem poker

Pingback: zynga poker

Pingback: poker hands

Pingback: play poker

Pingback: video poker free

Pingback: texas holdem poker free

Pingback: replay poker login

Pingback: poker practice

Pingback: poker face

Pingback: pureplay poker member login

Pingback: poker games free

Pingback: wsop poker

Pingback: cafrino poker

Pingback: free poker vegas world

Pingback: aol poker

Pingback: ignition poker

Pingback: poker sites

Pingback: governor of poker 2

Pingback: free texas holdem poker games

Pingback: world poker tour

Pingback: poker download

Pingback: world class poker

Pingback: free poker games texas hold'em

Pingback: poker online free

Pingback: cafrino poker login

Pingback: 3 card poker

Pingback: zynga poker texas holdem

Pingback: three card poker

Pingback: how to play poker

Pingback: lady gaga poker face

Pingback: pureplay poker login

Pingback: poker chips

Pingback: wpt poker login

Pingback: vegas poker

Pingback: full tilt poker

Pingback: bovada poker

Pingback: wsop free poker site

Pingback: wsop poker free

Pingback: poker hands from lowest to highest

Pingback: poker stars

Pingback: poker tables

Pingback: world class poker aol

Pingback: free video poker games

Pingback: online poker free

Pingback: poker rules

Pingback: free poker online

Pingback: betonline poker download

Pingback: clubwpt poker

Pingback: wpt poker online free

Pingback: poker tournaments

Pingback: pure play poker

Pingback: borgata poker

Pingback: online poker real money

Pingback: poker atlas

Pingback: practice poker

Pingback: nlop poker

Pingback: global poker online

Pingback: bravo poker

Pingback: free poker practice

Pingback: party poker

Pingback: bullfrog poker

Pingback: carbon poker

Pingback: freeslots.com video poker

Pingback: fresh deck poker

Pingback: dogs playing poker

Pingback: play poker vegas world

Pingback: poker heat

Pingback: intertops poker

Pingback: poker news

Pingback: racy poker

Pingback: zynga poker facebook

Pingback: twitch poker

Pingback: caf poker

Pingback: hpt poker

Pingback: foxwoods poker

Pingback: 247 poker

Pingback: upswing poker

Pingback: playsino poker

Pingback: global poker login

Pingback: poker rooms

Pingback: cbd

Pingback: cbd oil

Pingback: buy cbd

Pingback: buy cbd oil

Pingback: cbd oil benefits

Pingback: cbd oil for sale

Pingback: cbd oil for pain

Pingback: charlottes web cbd oil

Pingback: what is cbd oil

Pingback: cbd oil at walmart

Pingback: cbd oil for dogs

Pingback: cbd oil side effects

Pingback: best cbd oil

Pingback: cbd oil for sale walmart

Pingback: cbd oil florida

Pingback: walgreens cbd oil

Pingback: pure cbd oil

Pingback: cbd oil reviews

Pingback: strongest cbd oil for sale

Pingback: cbd oil uk

Pingback: cbd oil stores near me

Pingback: green roads cbd oil

Pingback: benefits of cbd oil

Pingback: cbd oil canada

Pingback: best cbd oil for pain

Pingback: where to buy cbd oil