Hello, It’s Richard Baxter here. I want to share with you some quick stock tips that allowed me to make tremendous profits. If you follow me in my journey, you’re gonna make lots of profits like me. A lot of information out on the web can be deceiving or inaccurate. I don’t want you to fall along that same place.

Take everything you read with a grain of salt.

Test things out with paper trading or a virtual account. A good one I recommend is at: vt.optionsxpress.com

Once you’re ready to do the real thing, then start small, let’s say $1,000 and you’ll be good.

ALWAYS start off with paper trading so that you can build confidence, and follow my advice.

Doing those two things, and you’ll never lose money ![]()

Thanks for subscribing, I’ll be sending you a 7 day course on in depth stock tips.

First off, I want to start you with the basic details. If you know nothing about stock trading don’t worry, I’ll teach you everything you need to know.

This is the first basic rule I would like to teach.

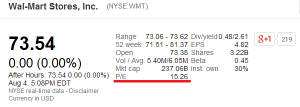

- Price to Earnings Ratio - The most important indicator to determine how expensive or cheap a stock is, is by looking at the price to earnings ratio or the P/E. You take the price of the stock and divide it by the annual net income. If a stock is $10.00 and the income is $100 million, and there are 100 million shares outstanding, then the earnings per share is $1 per share. You take the share price of $10 and divide it by $1.00, and you get a Price to Earnings Ratio of 10.00.

- Peer Group Evaluation - Stocks with higher Price to Earnings compared to their peer groups (stocks in the same industry or class), are usually considered more expensive, while stocks with lower price to earnings are considered cheaper.

- Finding Bargain Stocks - The most effective method of finding stocks with good safety margin (that means, when you invest, the chance it will drop is little since it’s already at the bottom), is by finding stocks with low P/E. The stock needs to have good fundamentals. When the market realizes it’s true worth, the stock price will rise, to match the P/E of its peer group. Not all stocks with low P/E are good stocks to buy. You have to analyze if they have enough resources, a good future, good management, ability to overcome competitors, any pending technologies being developed, or catalysts that could make the stock company’s earnings go up, and thus the price.

That’s all for now. Wait for your emails. We will give you more information.

Where to find a list of stocks with low P/E and good fundamentals?

See: List of Catalysts that could make a stock price go up