The new tax changes are the major reason why you might feel your wallet is getting lighter. These tax changes were implemented in 2013 and have considerably increased the tax revenues that the Treasury earned. Every month, the receipts witness a rise as compared to the year 2013.

For the year 2014, it is reported that the collection of tax by the government is over $1.8 trillion which is almost 8 percent higher than the amount collected in 2013. Even after adjusting this amount for inflation, the revenue is much higher in comparison to last year.

These figures have been obtained from the “Monthly Treasury Statement of Receipts and Outlays of the United States Government”, which can be obtained by the general public each year. Comparisons are usually made at the end of July since the months after July show individual tax payers with lighter collections. However, September is a bit different and witnesses a sharp rise in revenues primarily because of taxpayers that are quarterly, corporate and on extension.

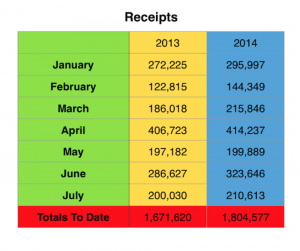

For the first 7 months, comparison of revenues earned for the year 2013 and 2014 can be viewed in the table below. All values are in millions.

The table clearly shows that the revenues earned in 2014 are higher than those earned in the year 2013. The major contributor of these earnings is the individual income tax, which amounts up to 46 percent of the total earnings. However, this does not mean that companies or businesses have to pay less as compared to individuals taxpayers. Income taxes for the corporate sector also contribute nearly 10 percent to the total receipts. The smallest contributors include the estate tax, gift taxes, social security, medicare taxes, custom duties and excise taxes.

No matter what the contributor of these tax revenues is, it is expected that the receipts will continue to rise and remain comparatively higher for the rest of 2014 and the next year. Moreover, no tax reform is expected to take place at the moment and hence, the tax rates will continue to remain the same, at least for the coming few months. It is predicted that the tax revenues would hit a new record of $3 trillion by the end of 2014.

However, it is important to note that even though revenues are rising, outlays are decreasing. The major federal government outlays are Department of Health and Human Services, the Department of Defense and Social Security Administration along with Treasury Debt Securities ranking as number fourth.

Although, the figures show that expenditures are decreasing, it does not mean that spending has stopped. Our outlays are still higher than our revenues and currently leave us with a fallback of more than $460 billion.

This might seem as a huge number but it is nearly 24 percent less as compared to our deficit last year during the same period. Thus, we still need to go a long distance until our budget reflects a surplus.

Pingback: Cake she hits different carts

Pingback: แทงบอลขั้นเทพ

Pingback: พัดลมหลังคา

Pingback: bonanza 178

Pingback: faceless youtube automation

Pingback: harem77

Pingback: ทัวร์ลาวใต้

Pingback: dul togel

Pingback: Winchester guns

Pingback: urb x incredibles

Pingback: ราคาบอลไหล คืออะไร

Pingback: free cam tokens

Pingback: chat room

Pingback: ธุรกิจงานศพ

Pingback: วิธีการแทง บอลชุด บอลสเต็ป

Pingback: painting service Auckland

Pingback: Angthong National Marine Park

Pingback: กระดาษสติ๊กเกอร์ความร้อน

Pingback: ปริ้นโบรชัวร์

Pingback: รวย168 เป็นเว็บสล็อตที่เชื่อถือได้หรือไม่

Pingback: clothing manufacturer

Pingback: Digital Download Clip Art PNG

Pingback: pg168

Pingback: บาคาร่าเกาหลี

Pingback: Best Tailor in Bangkok

Pingback: หนองใน

Pingback: เด็กเอ็น

Pingback: RB7 Slot ค่ายสล็อตน้องใหม่

Pingback: สีกราฟีน

Pingback: ต่อผมแท้