The S&P 500 (INDEXSP:.INX) Index which is the leading canon for stocks in America has dwindled. After buying consecutive gains for three years for the U.S Gauge have resulted in 77 close downs since 2012 and a valuation peculiarity that most people see as brutally indiscriminate buying.

This radical range in valuation and the opacity between good and bad companies has brought an identity crisis in the S&P 500 (INDEXSP:.INX), which has made the investors to buy stock randomly. This convergence between high end technology companies and small scale utility companies further leading to total anarchy in the market.

Gaps between stocks narrowed down when investors started to shift from high valued technology companies to defensive small scale industries such as utilities and consumer staples. This made the good and bad companies indistinguishable.

Valuations of companies which are defensive, and are traditional safe havens are suddenly now converging with high end companies whose profit growth is twice.

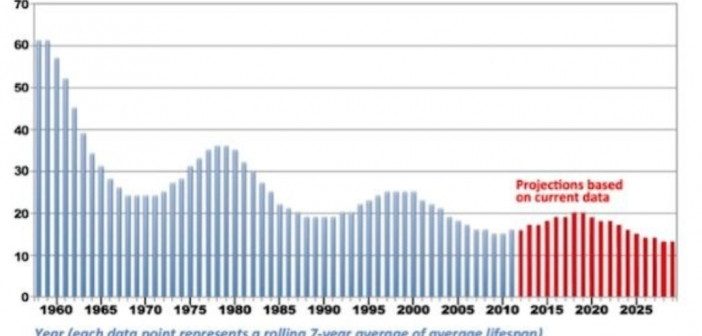

Price ratio earnings among the 50 largest companies in the S &P 500 have come down to the lowest since 1990, with the deviation of about 22 percent.

Valuations were at its peak when the internet bubble rose to the surface and technology shares soared high. The deviation from the mean was 57 percent in 1999. The S&P 500 (INDEXSP:.INX) peaked the next year and fell 49 percent through October 2002.

The rapid growth of ETFs, which invest in a barrel of shares, makes it easy to gather large positions without regard to the individual companies. The ETF industry has boomed in recent years, with assets tied to American equities reaching $1.1 trillion

Cash churning in and out of the funds will narrow valuations in the stock market over time as investors choose to transact in a plethora of shares, rather than get into intricate details such as company earnings.

Only a few months ago technology ETFs soaked $970 million and investors pulled cash out of safe-haven groups. That trend reversed in the following months, with cash coming out of technology companies and into utilities and consumer staples.

Kayne Anderson Rudnick Investment Management’s Chief invested officer said that there are a number of companies and industries doing pretty good, so the market doesn’t feel the desire to price one group much higher than everything else. He further claimed that it’s a much better balance.

The forecast made by Morgan Stanley (NYSE:MS) commended the S&P 500 (INDEXSP:.INX). The forecast claimed that a steady though sustained period of growth could help the equity benchmark peak near 3,000 by 2020 amid continued economic strength in the U.S.

United States’ second largest drug maker, Merck, trades at 17.2 times profit and analysts foresee a change in the profit by 2014.

Apple Inc (NASDAQ:AAPL) rabid growth isn’t being rewarded equally either. The mammoth tech gadget maker company has a price-earnings ratio of 16.6, compared with 20.8 for PepsiCo, Inc (NYSE:PEP). Analysts predict Apple will boost income by 14 percent this year.

This radical range in valuation and the opacity between good and bad companies has brought an identity crisis in the S&P 500 (INDEXSP:.INX), which has made the investors to buy stock randomly. This convergence between high end technology companies and small scale utility companies further leading to total anarchy in the market.

Pingback: Mathematical Software Tools in C++

Pingback: Blue Coaster33

Pingback: loose weight at home

Pingback: tv online, online tv

Pingback: watch free movies online

Pingback: watch free movies online

Pingback: free movie downloads

Pingback: water ionizers

Pingback: water ionizer

Pingback: kangen water machine

Pingback: enagic

Pingback: unblock vider

Pingback: uk online casinos

Pingback: Direct TV

Pingback: tv packages

Pingback: car parking

Pingback: mobile porn movies

Pingback: lan penge nu og her

Pingback: stop parking

Pingback: laan penge nu uden sikkerhed

Pingback: water ionizer machine

Pingback: nu

Pingback: alkaline water machine

Pingback: pay per day loans plan

Pingback: electrician work

Pingback: Stedman's Alternative Complementary Medicine Words - Stedman's free downloads

Pingback: plumberow p

Pingback: planners without borders

Pingback: water ionizer plans

Pingback: Payday Loans

Pingback: house blue

Pingback: electricians arlington tx

Pingback: read more

Pingback: alkaline water brands

Pingback: electricity

Pingback: water ionizer loans

Pingback: alkaline water

Pingback: alkaline water

Pingback: cheap car insurance

Pingback: water ionizer

Pingback: http://webkingz.camkingz.com/

Pingback: he has a good point

Pingback: right here

Pingback: Reversing Your Company’s Shrinking Lifespan – Innovation Excellence

Pingback: Anonymous

Pingback: Greg Thmomson

Pingback: gmail login

Pingback: gmail sign in inbox gmail account

Pingback: search all craigslist

Pingback: Maria Smith

Pingback: freshamateurs538 abdu23na517 abdu23na25

Pingback: sirius latest movs651 abdu23na8046 abdu23na31

Pingback: cna classes near me for free

Pingback: newtube tube planet609 afeu23na210 abdu23na83

Pingback: jigdf43g6811 afeu23na372 abdu23na15

Pingback: download on mobile902 afeu23na7873 abdu23na96

Pingback: 59E4nkAazR

Pingback: hdmobilesex.me

Pingback: 43ytr.icu

Pingback: abisko.ru

Pingback: 2021

Pingback: Èãðà ïðåñòîëîâ 8 ñåçîí

Pingback: 2020-2020-2020

Pingback: glyxar.ru

Pingback: ðîêåòìåí

Pingback: Video

Pingback: watch videos

Pingback: Watch

Pingback: wwin-tv.com

Pingback: watch online

Pingback: Google

Pingback: MEYD-525

Pingback: Sexy girl clothing

Pingback: Shopping Centres/Supermarkets Cleaning Sydney

Pingback: prostate orgasm toys

Pingback: Tally ERP 9 download with crack

Pingback: mario cartridges

Pingback: Oursainsburys

Pingback: bondage toys for gays

Pingback: mario cartridges

Pingback: Judi Slot Online

Pingback: ام و ابنها محارم سكس مترجم

Pingback: SEO Vancouver

Pingback: PPPD 789

Pingback: daftar joker123

Pingback: Mumbai Escorts services

Pingback: pc games for windows 10

Pingback: games for pc download

Pingback: app download for pc

Pingback: getting pegged

Pingback: Email marketing software

Pingback: DOCP-172

Pingback: sewa led

Pingback: افلام نيك

Pingback: big dildo review

Pingback: 00-tv.com

Pingback: sneaker

Pingback: thrusting rabbit vibrator

Pingback: Wegmans connect

Pingback: hair transplant in jaipur jaipur rajasthan

Pingback: Vape cartridge

Pingback: free download for pc windows

Pingback: app for laptop

Pingback: best realistic vagina stroker

Pingback: strap on dildo

Pingback: 4serial.com

Pingback: free download for windows 8

Pingback: we-b-tv.com

Pingback: hs;br

Pingback: tureckie_serialy_na_russkom_jazyke

Pingback: tureckie_serialy

Pingback: serialy

Pingback: +1+

Pingback: æóêè+2+ñåðèÿ

Pingback: logo design online

Pingback: Ñìîòðåòü ñåðèàëû îíëàéí âñå ñåðèè ïîäðÿä

Pingback: Ñìîòðåòü âñå ñåðèè ïîäðÿä

Pingback: âûòîïêà âîñêà

Pingback: HD-720

Pingback: guardians+of+the+galaxy+2

Pingback: strong woman do bong soon

Pingback: my id is gangnam beauty

Pingback: guardians of the galaxy vol 2

Pingback: 2020

Pingback: kpop+star+season+6+ep+9

Pingback: 1 2 3 4 5 6 7 8 9 10

Pingback: MIDE 685

Pingback: Weed store near me

Pingback: pc games full version download

Pingback: free download for pc windows

Pingback: app free download for windows 8

Pingback: laptop app

Pingback: the vape shop

Pingback: Diamond jewelry vancouver

Pingback: Elmira Alcantara

Pingback: flexispy extreme

Pingback: DOCP-173

Pingback: anal cock ring

Pingback: best penis ring

Pingback: rechargeable mini bullet

Pingback: Counterfeit Money For Sale online

Pingback: Fake Money For Sale online

Pingback: buy ambien online

Pingback: watch repair

Pingback: buy anabolic steroids online

Pingback: Turkey smm panel

Pingback: free download for pc windows

Pingback: pc apps for windows xp

Pingback: vape shop near me

Pingback: THC vape oil discreet shipping

Pingback: Url

Pingback: work abroad

Pingback: download apk app for pc

Pingback: free download for windows pc

Pingback: sex toy anal

Pingback: asmr soft speaking

Pingback: viagra

Pingback: free download for windows 7

Pingback: Ultrax Labs Hair Rush Review:

Pingback: bc weed express

Pingback: silicone dong

Pingback: apps for pc download

Pingback: app apk for laptop

Pingback: free app download

Pingback: viagra

Pingback: cbd oil for sale

Pingback: cialis

Pingback: stopoverdoseil.org

Pingback: how to use a vibrator

Pingback: free download for windows 10

Pingback: convertidor de youtube a mp3

Pingback: VALCIVIR 1GM (1x3)

Pingback: Double cleansing benefits

Pingback: drywall contractors Vancouver

Pingback: masturbation sleeve

Pingback: sex love swing

Pingback: bondage kit

Pingback: wearable vibrator

Pingback: penis extender sleeve

Pingback: vibrating wand

Pingback: best selling rabbit vibrator

Pingback: best vibrating dildo

Pingback: viagra

Pingback: viagra

Pingback: viagra

Pingback: viagra 2019

Pingback: free download for pc windows

Pingback: free download for pc windows

Pingback: free download for pc windows

Pingback: VIAGRA

Pingback: casual encounters

Pingback: liposuction price

Pingback: học nghề trang điểm

Pingback: VIAGRA

Pingback: dj khabato

Pingback: how to get v bucks

Pingback: double penetration dildo

Pingback: anal starter kit

Pingback: FEELS GOOD

Pingback: best roblox glitch

Pingback: chattermeet.com

Pingback: blackmail website

Pingback: best p spot vibe

Pingback: Top Media Markt

Pingback: biaxin

Pingback: warming vibe

Pingback: masturbator stroker

Pingback: restaurant menu

Pingback: Windows 10 Wholesale

Pingback: viagra for men

Pingback: butt plug review

Pingback: dildo

Pingback: 먹튀검증

Pingback: movies

Pingback: 메이저놀이터

Pingback: 릴게임 야마토

Pingback: free robux

Pingback: escort directory

Pingback: movies online

Pingback: karan johar

Pingback: Top Movies

Pingback: Movies1

Pingback: dong

Pingback: viagra pills

Pingback: 11 10 2019

Pingback: dating

Pingback: End of Bond Back Cleaning

Pingback: apk free download for pc windows

Pingback: 먹튀검증

Pingback: 먹튀사이트

Pingback: 카지노사이트

Pingback: cbd capsules

Pingback: buy cbd oil

Pingback: vibrators for pregnant women

Pingback: how to have anal sex

Pingback: huge dong

Pingback: 메이저사이트

Pingback: Commercial Cleaners

Pingback: Online Puppy Shop

Pingback: nasonex

Pingback: super bowl wings

Pingback: Film Streaming

Pingback: Threema

Pingback: buy adani solar dcr module

Pingback: SSNI 620

Pingback: anal vibe

Pingback: smotretonline2015.ru

Pingback: Serial smotret

Pingback: kinokrad

Pingback: kinokrad 2020

Pingback: chomnes

Pingback: Whitney Simmons workout plan

Pingback: teach a kid how to read

Pingback: pc games for windows 7

Pingback: pc apps for windows 7

Pingback: apps download for windows 7

Pingback: free

Pingback: free download for pc windows

Pingback: app download for windows 10

Pingback: download pc games for windows

Pingback: english to afrikaans voice translation

Pingback: enlargement pumps

Pingback: best penis extension

Pingback: software information submitter

Pingback: Escort amsterdam

Pingback: certified business intermediary

Pingback: Watch TV Shows

Pingback: casino

Pingback: Kinokrad 2019 Kinokrad Hd

Pingback: filmy-kinokrad

Pingback: kinokrad-2019

Pingback: filmy-2019-kinokrad

Pingback: serial

Pingback: best hand cream for calluses

Pingback: HND 753

Pingback: double penetration vibrator

Pingback: best male masturbators

Pingback: globe eload

Pingback: bullet and eggs

Pingback: panty vibrator

Pingback: Famous hunters

Pingback: GENM-023

Pingback: Rice mill

Pingback: holmes blackboard

Pingback: allfoodmenuprices.org

Pingback: best restaurants near me

Pingback: dropia

Pingback: pay per click management service

Pingback: cerialest.ru

Pingback: XXX VIDEOS

Pingback: Contract Security Services

Pingback: travel news and tips

Pingback: ttp://www.phrenologik.com/so-why-carry-out-men-and-women-get-fortnite-game-titles-accounts/

Pingback: free download for pc windows

Pingback: free download for windows 8

Pingback: anal sex

Pingback: #luxury

Pingback: sucking dildo

Pingback: best dildo for double penetration

Pingback: vibration asmr

Pingback: youtube2019.ru

Pingback: Blackhat Seo buy backlinks

Pingback: Cheap pbn backlinks

Pingback: buy backlinks ppbn trackback seo blackhat

Pingback: Nourish Skin

Pingback: Donovan

Pingback: dorama hdrezka

Pingback: movies hdrezka

Pingback: HDrezka

Pingback: kinosmotretonline

Pingback: LostFilm HD 720

Pingback: vibrator review

Pingback: 토토사이트

Pingback: bondage kit

Pingback: best bariatric surgeon in india

Pingback: rabbit sex toy

Pingback: 퍼스트카지노

Pingback: recipes

Pingback: mens stroker

Pingback: PORN

Pingback: parcel forwarding uk to australia

Pingback: realistic masturbators

Pingback: bank / bankowa

Pingback: vibration egg

Pingback: photographer in mumbai

Pingback: porn

Pingback: Dog Bandanas

Pingback: vibrating jelly dildo

Pingback: rayban coupon

Pingback: phen375

Pingback: powerful massager

Pingback: clit sucker vibrator

Pingback: Melanie Bowen

Pingback: thick dildo

Pingback: Ford Everest Bình Dương

Pingback: mortgage payment calculator

Pingback: frozen2 movie

Pingback: trustedmdstorefy.com

Pingback: apk download for windows 8,

Pingback: app download for windows,

Pingback: best cbd oil for pain

Pingback: CHEAP VIAGRA ONLINE

Pingback: bofilm ñåðèàë

Pingback: bofilm

Pingback: 1 seriya

Pingback: Gizmoist leather phone cases

Pingback: fuck machine

Pingback: vibrating butt plug

Pingback: pegging dildo

Pingback: best cbd oil for pain

Pingback: best cbd oil for pain

Pingback: XXX VIDEO

Pingback: adam’s vibrating penis extender

Pingback: free robux codes

Pingback: games friv

Pingback: Êîíñóëüòàöèÿ ïñèõîëîãà

Pingback: XXX VIDEOS

Pingback: best cbd oil for depression

Pingback: pest control newmarket ontario (647) 988-5034

Pingback: XXL DOWNLOAD

Pingback: Anime Batch

Pingback: topedstoreusa.com

Pingback: app download for pc

Pingback: app for pc

Pingback: Google

Pingback: app for pc free download

Pingback: داستان سکسی مامان

Pingback: cnhflf

Pingback: male sex toys 2019

Pingback: rechargeable rabbit vibrators

Pingback: all in stroker

Pingback: Disney Guess The Film

Pingback: best cbd oil for sleep

Pingback: how to use penis ring

Pingback: BUY VIAGRA

Pingback: học trang điểm cô dâu

Pingback: vibrating beads

Pingback: try me bitch ;)

Pingback: best butt plugs

Pingback: best love swings

Pingback: best anal massager

Pingback: belladona masturbator

Pingback: remote vibrating panty

Pingback: butt sex toys

Pingback: g-spot vibrator

Pingback: vibrator reviews

Pingback: Apostle Joshua Selman

Pingback: good places to eat near me

Pingback: costco locations near me

Pingback: pizza places near me

Pingback: lagos election news

Pingback: SEX ONLINE

Pingback: Walmart one wire

Pingback: best products

Pingback: Naijaloaded

Pingback: hqcialismht.com

Pingback: viagramdtrustser.com

Pingback: double dildo

Pingback: rabbit vibrator

Pingback: diabetes surgery

Pingback: puppy training

Pingback: ABP-936

Pingback: SSNI-666

Pingback: triple pleasure rabbit

Pingback: kbbi-online

Pingback: blog

Pingback: SEX TOYS

Pingback: legionella testing kits

Pingback: 우리카지노

Pingback: 더킹카지노

Pingback: 코인카지노

Pingback: 예스카지노

Pingback: 더나인카지노

Pingback: mini bullet vibe

Pingback: big vibrating dong

Pingback: veporn

Pingback: MKMP 315

Pingback: sanctification

Pingback: comprar aceite de cbd

Pingback: 예스카지노

Pingback: 퍼스트카지노

Pingback: 더나인카지노

Pingback: Rottweiler Puppies in LA

Pingback: 우리카지노

Pingback: terrace waterproofing solutions

Pingback: 더킹카지노

Pingback: When

Pingback: 코인카지노

Pingback: CCRMG

Pingback: VIAGRA AMAZON

Pingback: realistic dong

Pingback: pocket stroker

Pingback: we vibe cock ring

Pingback: German Rottweiler puppies for sale in Louisiana

Pingback: VIAGRA

Pingback: free sexy

Pingback: sex live

Pingback: powerdirector 12

Pingback: Jumpstart car

Pingback: FCMB Transfer Code

Pingback: land for sale squamish

Pingback: vancouver mortgage broker

Pingback: Google

Pingback: canadianpharmacystorm.com

Pingback: gencialiscoupon.com

Pingback: how to use thrusting anal plug

Pingback: clit sucker vibrator

Pingback: best vibrators

Pingback: clit vibe

Pingback: bluetooth panties

Pingback: male stroker sleeve

Pingback: genericvgrmax.com

Pingback: CHEAP VIAGRA

Pingback: bunny sex toy

Pingback: SEX ONLINE

Pingback: finger clit vibrator

Pingback: Bondage Whip

Pingback: vibrating penis ring

Pingback: pleasure ring

Pingback: anal play

Pingback: Sweet Persuasions Chemise

Pingback: baby photography prices

Pingback: cheap vector art services

Pingback: viagrawithoutdoctorspres.com

Pingback: fixed wing uav

Pingback: liquid ketamine for sale

Pingback: buy ketamine hydrochloride

Pingback: Oxycodone for sale online legally

Pingback: River State

Pingback: Jilly bean kingpen

Pingback: online research library

Pingback: Sims villa condo

Pingback: Order phentermine online

Pingback: dank vapes

Pingback: alice little bunny ranch

Pingback: kingpen

Pingback: we vibe sync

Pingback: suction cup dildo

Pingback: rechargeable panty

Pingback: adam and eve wand vibrators

Pingback: san diego fitness trainer

Pingback: strapless strapon

Pingback: canpharmb3.com

Pingback: چت روم سکسی

Pingback: prepaidgiftbalance.com

Pingback: magic props

Pingback: online marketing agency in thane

Pingback: popeyes chicken sandwiches

Pingback: mygiftcardsite

Pingback: prepaidcardstatus

Pingback: rick and morty season 3

Pingback: See-Season-1

Pingback: Evil-Season-1

Pingback: Evil-Season-2

Pingback: Evil-Season-3

Pingback: Evil-Season-4

Pingback: Dollface-Season-1

Pingback: Queer-Eye-We-re-in-Japan-Season-1

Pingback: how to get more instagram followers

Pingback: netprobk

Pingback: best cbd oil for pain

Pingback: best cbd oil for sleep

Pingback: kusturica tekst

Pingback: attenuacija

Pingback: ciapwronline.com

Pingback: gazmanov jasnye dni tekst

Pingback: best cbd oil for pain

Pingback: inflatable stand up paddle board

Pingback: Real Name

Pingback: suits hoodie Jump suit plus size dressestailor near mebespoke

Pingback: bookstore

Pingback: women apparel

Pingback: increase DR

Pingback: Umzugsplaner

Pingback: electric skateboards

Pingback: jetsurf

Pingback: onewalmart login

Pingback: hotmail inbox

Pingback: فیلم سکسی

Pingback: education saving

Pingback: bullet vibe

Pingback: prostate vibrator

Pingback: dry ice science

Pingback: best cbd oil for pain

Pingback: Nairaland Celebrities

Pingback: best cbd gummies

Pingback: Chukwuemeka Odogwu

Pingback: WAEC Registration

Pingback: Naija bloggers

Pingback: Obiano News

Pingback: MP3 Songs

Pingback: adult sex toys

Pingback: free download for pc windows

Pingback: apps apk free download for windows 10

Pingback: pc apps for windows 7

Pingback: pc games download

Pingback: free download for windows 7

Pingback: pc games for windows 10

Pingback: free apps for pc download

Pingback: apps download for windows 8

Pingback: laptop app

Pingback: the advantage

Pingback: app download for windows

Pingback: sous traitance web

Pingback: free download for windows 8

Pingback: seo montreal

Pingback: free download for windows 10

Pingback: free download for windows pc

Pingback: free apk for laptop

Pingback: strap-on

Pingback: realistic dildo

Pingback: rabbit vibrator

Pingback: sous traitance web

Pingback: Outsourced Hosting Support

Pingback: st louis aquarium sloth

Pingback: best cbd oil for pain

Pingback: best cbd capsules

Pingback: ehlers danlos syndrome

Pingback: cbd oil

Pingback: best cbd oil for sleep

Pingback: best cbd oil for anxiety

Pingback: best cbd gummies

Pingback: best cbd oil for pain

Pingback: Fast money

Pingback: Power washing

Pingback: liquid red mercury

Pingback: invest islands scam

Pingback: masturbator stroker

Pingback: THE CAMERA GUYS

Pingback: best wand vibrator

Pingback: silicone girth extender

Pingback: finger clit vibrator

Pingback: suction cup dildos

Pingback: Pressure washing los angeles ca

Pingback: web design widnes

Pingback: hot celebrities

Pingback: Office Water Coolers

Pingback: Porn Download

Pingback: best dildo

Pingback: serial 2020

Pingback: Dailymotion

Pingback: Watch+movies+2020

Pingback: "viagra supplements"

Pingback: Netflix Original Movies

Pingback: rechargeable butt plug

Pingback: brothel

Pingback: connectivasystems carding

Pingback: Genfio.com

Pingback: MUT

Pingback: prepaidgiftbalance.com

Pingback: Free Ads UK

Pingback: fioricet2020.com

Pingback: cheap Viagra

Pingback: نقل عفش

Pingback: free porn

Pingback: Free Ads Kenya

Pingback: Online vape shop

Pingback: click here

Pingback: etf

Pingback: silicone rotating vibrator

Pingback: male enhancement

Pingback: King Pen Cartridges

Pingback: Buy Weed Online

Pingback: Buy Weed Online

Pingback: serial-video-film-online

Pingback: Oxycodone for Sale

Pingback: container box bungalow

Pingback: massage near me

Pingback: tvrv.ru

Pingback: 1plus1serial.site

Pingback: #1plus1

Pingback: 1plus1

Pingback: Get it now

Pingback: millersvlille.doodlekit.com

Pingback: customer care number

Pingback: Canopy growth purchase

Pingback: satta king 786

Pingback: pakistani fashion

Pingback: live cricket streaming

Pingback: Funny gifts

Pingback: couples enhancer ring

Pingback: increase DR fast

Pingback: viagra

Pingback: Instrukcja bhp pracy z czajnikiem elektrycznym

Pingback: viagra

Pingback: viagra

Pingback: viagra

Pingback: Situs Poker Uang Asli

Pingback: quickest detox to lose weight

Pingback: Raphael Pease

Pingback: Watch Movies Online

Pingback: Film

Pingback: Film 2020

Pingback: Film 2021

Pingback: Top 10 Best

Pingback: viagra

Pingback: what is cbd

Pingback: medical research

Pingback: cbd oil

Pingback: Data File

Pingback: watch online TV LIVE

Pingback: Buy weed online

Pingback: Pound of Weed

Pingback: Exotic Carts

Pingback: Research Chemicals

Pingback: Benefits of Vaping

Pingback: Research Chemicals

Pingback: reshp xxx

Pingback: top markets

Pingback: adam and eve toys

Pingback: Male Nurse in delhi

Pingback: THC Vape Juice

Pingback: Latest Joel Osteen Sermons

Pingback: Joel Osteen Sermons

Pingback: Joel Osteen Net Worth

Pingback: نقل عفش

Pingback: google maps seo services

Pingback: agence digitale paris

Pingback: agence digitale paris

Pingback: singing lessons

Pingback: cannabidiol

Pingback: cannabidiol

Pingback: cannabis oil for sale

Pingback: pure cbd oil

Pingback: cbd oil

Pingback: pure cbd oil for sale

Pingback: аудио сказки

Pingback: водители Чикаго

Pingback: buy google hacklink

Pingback: menards team member

Pingback: SEO

Pingback: fda consultants

Pingback: digital marketing company in navi mumbai

Pingback: Logo design

Pingback: Shoes

Pingback: Corredurias en Cancun

Pingback: domovoy

Pingback: buy instagram followers

Pingback: montures

Pingback: rabbit vibrator

Pingback: Windsor Entertainment

Pingback: LogoDaliL Egypt Business Directory

Pingback: Grand Daddy Purple

Pingback: marble

Pingback: barbers apron

Pingback: ve maahi lyrics

Pingback: robux hack

Pingback: INDIAN VISA ONLINE

Pingback: smm panel

Pingback: past life analysis tool

Pingback: cool toys and gadgets

Pingback: good lawyer

Pingback: human design

Pingback: dizajn cheloveka

Pingback: human-design-space

Pingback: Most profitable Affiliate program

Pingback: india visa

Pingback: indian visa online

Pingback: Order oxycodone online

Pingback: Order aderall online legally

Pingback: faberge egg

Pingback: Toronto Web Design

Pingback: coach gil

Pingback: we buy mobile homes

Pingback: virtual relocatable card for google Adwords verify

Pingback: Industry Verticals

Pingback: how to get free robux

Pingback: Penetration Tests Jersey

Pingback: koma 2020

Pingback: all mobile price in bangladesh

Pingback: music theory

Pingback: pet life today

Pingback: academic quiz

Pingback: buy products on sale

Pingback: cbd oil near me

Pingback: cbd oil for dogs

Pingback: g spot

Pingback: Best Lunch in Perth

Pingback: hischnye-pticy-hisxne-ptic

Pingback: submit articles online for free

Pingback: how to use a cock ring

Pingback: phentermine for sale online

Pingback: how to make pussy squirt

Pingback: The-Gentlemen

Pingback: led-2

Pingback: pod-vodoi

Pingback: Buy xanax online

Pingback: best CBD oil for anxiety

Pingback: Buy hydrocodone online legally

Pingback: modules prestashop

Pingback: russian ushanka

Pingback: Malaysia Online Casino

Pingback: Order oxycodone online

Pingback: QuicSolv is ISO certified

Pingback: buy psychedelics online darknet

Pingback: kite school sri lanka

Pingback: buy ielts certificate online without exam

Pingback: Cannabis Oil

Pingback: pornographie

Pingback: Cyber Security Expert in India

Pingback: viralqq

Pingback: Catolux

Pingback: affordable seo services small business

Pingback: Politics

Pingback: Best place to buy xanax

Pingback: cbd hemp oil legal

Pingback: cbd oil with thc for sale

Pingback: sàn forex uy tín

Pingback: vibrating anal beads

Pingback: suction cup base dildo

Pingback: hasta karyolası

Pingback: legal steroids

Pingback: MrPornGeek

Pingback: Stainless Hardware

Pingback: vk 2020

Pingback: recessed lighting

Pingback: buy personalised myob accountright receipt

Pingback: VoIP Phones

Pingback: THC Cannabis Oil for Sale

Pingback: Facebook post design

Pingback: Refacciones para maquinas de coser

Pingback: Medical Marijuana

Pingback: protrusion splint

Pingback: ремонт на дюзи

Pingback: private chef

Pingback: tulpen excursie

Pingback: Elkhart Indiana

Pingback: free video streaming

Pingback: premium vape juice

Pingback: overcome challenges

Pingback: Elektroschrott kostenlos Abholen

Pingback: 1000mg

Pingback: strongest CBD

Pingback: Royal CBD's gummies

Pingback: Samsung Phone Screen

Pingback: CBD gummies 10 mg

Pingback: how to use a sex toy

Pingback: Royal CBD oil

Pingback: parazity-oskar-2020

Pingback: private naa songs download mp3

Pingback: human design human design

Pingback: vitour tours

Pingback: free download for windows 8

Pingback: pc games for windows 7

Pingback: pc games free download for windows 10

Pingback: apk for pc free download

Pingback: pc games for windows 10

Pingback: apk for windows 7 download

Pingback: how to use double ended strap on

Pingback: remote panties

Pingback: apps download for windows 8

Pingback: app apk for laptop

Pingback: apk free download for pc windows

Pingback: free download for windows pc

Pingback: apps download for windows 10

Pingback: free games download for pc

Pingback: free app download

Pingback: free full download for windows pc

Pingback: Dank cartrifges

Pingback: Camtasia Studio 9 Crack

Pingback: Rabbit vibrator review

Pingback: Sex toys

Pingback: generic viagra

Pingback: Kids Cafe Perth

Pingback: James Martinos

Pingback: strap on dildo

Pingback: dildo for beginners

Pingback: is CBD legal

Pingback: side effects of CBD oil

Pingback: full spectrum CBD

Pingback: bất động sản quy nhơn

Pingback: adult toys

Pingback: best dive bars in atlanta

Pingback: light bondage

Pingback: Osceola Indiana

Pingback: Best Smartwatches

Pingback: Wand Massager Review

Pingback: charter bus companies in israel

Pingback: Royal CBD

Pingback: webehigh

Pingback: CBD products

Pingback: DSmlka

Pingback: viagra

Pingback: viagra online

Pingback: +

Pingback: long black dong

Pingback: merle corgi puppies

Pingback: pembroke welsh corgi puppies for sale

Pingback: best crm for architectural firm

Pingback: Fundmerica reviews

Pingback: CBD oil near me

Pingback: furniture shops in gurgaon

Pingback: CBD products near me

Pingback: how to make sex toys for boys

Pingback: CBD oil for pain near me

Pingback: carpet cleaning maple ridge bc : (778) 536-5267

Pingback: how to make sex toy

Pingback: Vancouver movers (604) 721-4555

Pingback: ¯jak Son³k

Pingback: astrolog

Pingback: pirnhub

Pingback: 480p

Pingback: THC Vape Oil

Pingback: travel

Pingback: baby hyacinth macaw for sale

Pingback: CBD oil near me

Pingback: Unchaste banging for asian twat

Pingback: Buy Marijuana Online

Pingback: package to dubai from delhi

Pingback: reddit cbd

Pingback: spruce cbd oil

Pingback: disposable cbd vape pen

Pingback: what does cbd mean

Pingback: stress

Pingback: royal cbd

Pingback: film-kalashnikov-watch

Pingback: toy haul

Pingback: pussy stroker

Pingback: adam and eve sex toys

Pingback: русская детская литература

Pingback: generic cialis

Pingback: cialis 20mg

Pingback: domain authority

Pingback: kiu

Pingback: MILF porn

Pingback: dildo

Pingback: rechargeable panty

Pingback: Apostle Joshua Selman Sermons

Pingback: Loan App APK

Pingback: Biography

Pingback: dual pleasure vibrator

Pingback: luxury vibrator

Pingback: vibrators

Pingback: jack rabbit vibrator

Pingback: ñåðèàëû òîï

Pingback: cock ring

Pingback: dự án hưng thịnh

Pingback: kegel vibrator

Pingback: malaysia singapore package from bangalore

Pingback: safestore auto

Pingback: how much percentage of home loan can i get

Pingback: G Suite promo code UK

Pingback: seo hygiene report

Pingback: современные сказки

Pingback: Howe Indiana

Pingback: which is the best term insurance company in india

Pingback: generic viagra india pharmacy

Pingback: viagra for sale online

Pingback: order viagra

Pingback: hightech sex toys

Pingback: masturbator for men

Pingback: virtual visa card

Pingback: mortgage broker coquitlam

Pingback: kinoxaxru.ru

Pingback: snippets

Pingback: dax history

Pingback: indisk visum

Pingback: sexy girl shows

Pingback: sex livestreami

Pingback: dank carts

Pingback: pobachennya u vegas

Pingback: Proshanie so Stalinym

Pingback: buy cialis

Pingback: viagra pills

Pingback: cialis

Pingback: generic viagra

Pingback: pl/sql diagram

Pingback: buy cialis cheap

Pingback: levitra

Pingback: THC Vape Oil

Pingback: chống gù lưng vẹo cột sống

Pingback: boxsets

Pingback: sexy cams live

Pingback: sexy couple cams

Pingback: nudelive

Pingback: sex

Pingback: sexshows

Pingback: CBD gummies

Pingback: sexy

Pingback: CBD gummies

Pingback: krunker

Pingback: strelcov 2020

Pingback: film t-34

Pingback: Dispensary Near Me

Pingback: online pharmacy

Pingback: canadian pharmacy

Pingback: Cialis price

Pingback: Earn Online Money In Pakistan

Pingback: Coinpunk

Pingback: coinchomp

Pingback: mls listings vancouver

Pingback: how to use a rechargeable dildo

Pingback: Cool Apps

Pingback: کلیپ لاس زدن با دوست دختر سکسی

Pingback: فیلم سکسی ایرانی

Pingback: داستانهای سکسی

Pingback: THC vape juice

Pingback: PUPPIES FOR ADOPTION

Pingback: underground reptiles

Pingback: mp3juices

Pingback: Dank carts

Pingback: mortgage broker

Pingback: косметология курсы

Pingback: sildenafil

Pingback: THC vape juice

Pingback: English bulldog puppies for sale

Pingback: sildenafil citrate

Pingback: welsh corgi puppies for sale

Pingback: cheap cavalier king Charles spaniel puppies for sale

Pingback: cheap chihuahua puppies for sale

Pingback: generic cialis

Pingback: French bulldog for sale near me

Pingback: and Business Columnist

Pingback: Beograd film 2020

Pingback: cialis generic

Pingback: Van chuyen hang hoa di nuoc ngoai

Pingback: viagra online

Pingback: Dank carts

Pingback: Puppies near me

Pingback: boxer puppy for sale

Pingback: viagra

Pingback: Siberian husky puppy

Pingback: giant rottweiler puppies for sale

Pingback: red nose pitbull puppies for sale

Pingback: English bullmastiff

Pingback: cunnilingus

Pingback: border collie puppies for sale near me

Pingback: german shepherd puppies for sale

Pingback: handmade kitchens birmingham

Pingback: psiholog

Pingback: pomoshh-psihologa-online

Pingback: Dank carts

Pingback: Buy weed online

Pingback: can you order ketamine online

Pingback: snapdeal lucky draw 2020 name

Pingback: cialis online

Pingback: Buy marijuana online

Pingback: silicone rabbit vibrator

Pingback: penis enlargement pump

Pingback: penis enlargement pumps

Pingback: Coronavirus real-time updates

Pingback: CBD

Pingback: CBD

Pingback: CBD

Pingback: CBD

Pingback: CBD

Pingback: CBD

Pingback: CBD

Pingback: CBD

Pingback: CBD

Pingback: CBD

Pingback: CBD

Pingback: CBD

Pingback: CBD

Pingback: CBD

Pingback: CBD

Pingback: CBD

Pingback: CBD

Pingback: CBD

Pingback: CBD

Pingback: how to use a strapon

Pingback: how to wear a strap on

Pingback: Snapdeal winner list 2020

Pingback: CBD oil

Pingback: best CBD oil

Pingback: CBD oil for sale

Pingback: buy CBD oil

Pingback: CBD for sale

Pingback: CBD oil

Pingback: best CBD oil

Pingback: best CBD oil

Pingback: buy CBD oil

Pingback: CBD oil

Pingback: CBD for sale

Pingback: CBD for sale

Pingback: best CBD oil

Pingback: CBD oil

Pingback: CBD oil

Pingback: CBD oil

Pingback: CBD oil

Pingback: best CBD oil

Pingback: CBD oil

Pingback: best CBD oil

Pingback: magic wand massager

Pingback: anal sex toy

Pingback: buy CBD

Pingback: buy CBD

Pingback: best cbd oil

Pingback: buy CBD

Pingback: best cbd

Pingback: cbd for sale

Pingback: royal cbd products

Pingback: buy cbd

Pingback: mango juul pods for sale

Pingback: Exotic carts

Pingback: CBD gummies

Pingback: CBD gummies

Pingback: free download for windows

Pingback: app for pc download

Pingback: apk download for pc

Pingback: app free download for windows 8

Pingback: apps download for windows 10

Pingback: free laptop games download

Pingback: app free download for windows 10

Pingback: cialis 20 mg

Pingback: free download for windows 8

Pingback: pc app

Pingback: free download for windows 10

Pingback: free download for windows

Pingback: free download for laptop pc

Pingback: apps for pc

Pingback: free download for pc windows

Pingback: free download for pc

Pingback: free download for pc

Pingback: free download for windows 7

Pingback: free download for laptop pc

Pingback: apps download for windows 7

Pingback: klook ocean park

Pingback: mobile applications

Pingback: nill

Pingback: artificial intelligence development companies

Pingback: oral sex

Pingback: PSYCHOSOCIAL

Pingback: best male masturbator

Pingback: Deep Spin Poster

Pingback: BanBao

Pingback: adam and eve crystal clear 8 inch dildo

Pingback: Medical Marijuana

Pingback: THC Oil

Pingback: CBD topical

Pingback: buy CBD oil

Pingback: click now

Pingback: CBD soft gels

Pingback: THC Vape Oil

Pingback: men’s sex toys

Pingback: adam and eve dildo

Pingback: penis ring with vibrating anal pleaser

Pingback: cialis pills

Pingback: net market

Pingback: cannabis culture

Pingback: Drug Rehab Centers Near Me

Pingback: how to use a pocket pussy

Pingback: CBD

Pingback: GST Return Filing

Pingback: realistic male stroker

Pingback: sex at home

Pingback: huge dildo

Pingback: hairdressing scissors

Pingback: beste rijschool rotterdam

Pingback: CBS oil benefits

Pingback: professional hairdressing scissors

Pingback: Glock 19

Pingback: barbering scissors

Pingback: Mark Konrad Chinese Scissors

Pingback: left handed scissors

Pingback: liens

Pingback: hairdressing scissors icandy

Pingback: Contact Details

Pingback: yasaka scissors

Pingback: icandy hairdressing chinese scissors

Pingback: Buy discount cialis

Pingback: Cialis overnight

Pingback: cbd oil Australia

Pingback: how to make extra money from home

Pingback: DANK VAPES CARTRIDGES ONLINE

Pingback: ways to make money from home

Pingback: Ants removal service near me

Pingback: top vibrators

Pingback: Buy viagra on line

Pingback: hybrid solar inverter

Pingback: payday loans near me

Pingback: mens rings online

Pingback: silicone thrusting rabbit

Pingback: app free download for windows 10

Pingback: free apps for pc download

Pingback: mortgage calculator canada

Pingback: apps download for pc

Pingback: free download for windows

Pingback: app download for pc

Pingback: pc app

Pingback: app for laptop

Pingback: apps download for pc

Pingback: pc app free download

Pingback: free download for windows pc

Pingback: free pc games download

Pingback: free download for windows

Pingback: app for laptop

Pingback: free download for windows pc

Pingback: free app for pc download

Pingback: app free download

Pingback: free download for windows pc

Pingback: oh canada lyrics

Pingback: games free download for windows 7

Pingback: app for pc download

Pingback: moonrocks

Pingback: virtual mastercard card buy

Pingback: Rick simpson oil for sale

Pingback: buy cannabis oil

Pingback: ukraine study visa

Pingback: hairdressing scissors matsui

Pingback: ban hoc thong minh

Pingback: Financial Advisor Omaha

Pingback: best CBD oil

Pingback: calgary cash for scrap cars

Pingback: scrap car removal calgary (403) 614-2357

Pingback: minoxidil 15%

Pingback: buying cialis cheap

Pingback: cialis

Pingback: best CBD oil

Pingback: Cherekasi

Pingback: CBD gummies

Pingback: Research

Pingback: CBD gummies

Pingback: buy viagra

Pingback: proxy website

Pingback: Royal CBD oil

Pingback: CBD oil for sale

Pingback: generic viagra

Pingback: Royal CBD

Pingback: Royal CBD

Pingback: Royal CBD gummies

Pingback: buy chloroquine 250mg

Pingback: Royal CBD

Pingback: RoyalCBD

Pingback: Royal CBD

Pingback: Royal CBD cream

Pingback: CBD for sale

Pingback: carte prepagate

Pingback: CBD oil

Pingback: the grand tour

Pingback: inflatable paddle board

Pingback: app download for windows

Pingback: apk download for pc

Pingback: how to have quarantine sex at home

Pingback: dispensary near me

Pingback: g vibe finger

Pingback: adam and eve vibrators

Pingback: male stroker

Pingback: male stroker

Pingback: how much is cialis

Pingback: top remote vibrators

Pingback: best CBD capsules

Pingback: CBD capsules

Pingback: CBD oil

Pingback: purchase Super Lemon Haze Online

Pingback: generic levitra

Pingback: strapon pegging

Pingback: doc johnson realistic dildo

Pingback: really ample penis enhancer

Pingback: anal sex toys

Pingback: dank vapes

Pingback: online cialis

Pingback: CBD products

Pingback: Royal CBD

Pingback: CBD oil

Pingback: best cbd cream for pain

Pingback: best cbd cream for pain

Pingback: Buy Cockatoo

Pingback: Where to buy Dmt

Pingback: Vortex

Pingback: Buy Weed Online

Pingback: Buy DMT Online

Pingback: Viagra overnight shipping

Pingback: Drug Rehab Centers Near Me

Pingback: Buy viagra on internet

Pingback: Film Doktor Liza (2020)

Pingback: cheap narcotic pain meds online

Pingback: film djoker

Pingback: cbd gummies for sale

Pingback: cbd

Pingback: viagra

Pingback: viagra 100mg

Pingback: chloroquine phosphate

Pingback: viagra for sale

Pingback: printable cialis coupon

Pingback: generic viagra 100mg

Pingback: cialis super active

Pingback: how long does cialis last

Pingback: best strapless strap on

Pingback: most realistic dildo

Pingback: flexible dildo

Pingback: pleasure toys for men

Pingback: viagra without a doctor visit

Pingback: Dank Carts

Pingback: Consultant SEO

Pingback: crystal meth for sale

Pingback: cheap cialis online

Pingback: buy adderall online

Pingback: buy ambien online

Pingback: Exotic carts

Pingback: احذية

Pingback: buy CBD oil

Pingback: MALWAREBYTES A GOOD ANTI-MALWARE

Pingback: best CBD oil for dogs

Pingback: cheap cialis online

Pingback: best CBD oil for arthritis

Pingback: best CBD oil for pain

Pingback: best CBD oil for dogs

Pingback: best CBD oil for sleep

Pingback: sildenafil

Pingback: best CBD oil for sleep

Pingback: best CBD cream for arthritis pain

Pingback: best CBD oil for arthritis

Pingback: best CBD oil for pain

Pingback: kaletra price

Pingback: best CBD oil

Pingback: best CBD oil

Pingback: best CBD oil

Pingback: best CBD oil

Pingback: best CBD gummies

Pingback: best CBD oil

Pingback: best CBD oil

Pingback: best CBD gummies

Pingback: best CBD oil

Pingback: best CBD gummies

Pingback: best CBD gummies

Pingback: best CBD gummies

Pingback: cost of cialis

Pingback: best CBD gummies

Pingback: app free download for windows 10

Pingback: free download for laptop pc

Pingback: apps for pc

Pingback: apps download for windows 8

Pingback: free download for windows 7

Pingback: app for pc download

Pingback: free download for windows 8

Pingback: cheap viagra

Pingback: free laptop games download

Pingback: free download for windows 10

Pingback: free download for windows 8

Pingback: app free download for windows 8

Pingback: app download for pc

Pingback: app free download for windows 7

Pingback: app free download for windows 7

Pingback: free download for laptop

Pingback: app free download for windows 8

Pingback: free download for windows 7

Pingback: viagra for sale

Pingback: cheap viagra

Pingback: viagra for sale

Pingback: buy viagra online

Pingback: Canadian Pharmacies Online

Pingback: Canadian Pharcharmy Online

Pingback: cialis canada

Pingback: make money online

Pingback: vape shop near me

Pingback: make money online

Pingback: knight rider

Pingback: cialis coupon

Pingback: pinoy tambayan

Pingback: buying ed pills online

Pingback: best roulette software

Pingback: best roulette software

Pingback: roulette betting software

Pingback: DR. MANPREET BAJWA CBD Fraud

Pingback: tadalafil 20mg

Pingback: backlink

Pingback: over the counter erectile dysfunction pills

Pingback: kratom near me

Pingback: CBD oils UK

Pingback: bàn học thông minh tphcm

Pingback: best CBD oil

Pingback: sildenafil

Pingback: CBD oil UK

Pingback: buy CBD oil

Pingback: best CBD oils UK

Pingback: buy CBD oils

Pingback: CBD oils

Pingback: best CBD oils UK

Pingback: viagra

Pingback: best CBD oils

Pingback: buy CBD oils

Pingback: CBD oil for arthritis

Pingback: buy ed pills online

Pingback: Blessed CBD

Pingback: free instagram followers

Pingback: cialis online

Pingback: buy amoxicilina 500 mg online

Pingback: best price 100mg generic viagra

Pingback: Research chemicals for sale

Pingback: pharmacy online

Pingback: Îíëàéí Ïñèõîëîã

Pingback: Roxycodone 30mg for sale

Pingback: upload file

Pingback: AKC German Shepherd puppies for sale

Pingback: websites

Pingback: wartaekonomi

Pingback: tadalafil online

Pingback: Work from Home Jobs

Pingback: Online jobs

Pingback: Earn Money Online

Pingback: Work from home

Pingback: Work from Home Jobs

Pingback: rx pharmacy

Pingback: Viagra or cialis

Pingback: viagra without a doctor prescription

Pingback: bitcoin casino

Pingback: viagra coupons

Pingback: viagra over the counter

Pingback: viagra generic

Pingback: viagra pill

Pingback: otc viagra

Pingback: cialis cost

Pingback: free app apk for pc

Pingback: full apps download

Pingback: pc games for windows 10

Pingback: app free download for windows pc

Pingback: free download for pc

Pingback: app apk download for windows pc

Pingback: apps for pc download

Pingback: pc app free download for windows

Pingback: free download for windows 10

Pingback: full version pc games download

Pingback: free download for windows 7

Pingback: free download for windows 8

Pingback: kratom near me

Pingback: vardenafil 10 mg

Pingback: pinoy replay ofw

Pingback: generic cialis

Pingback: buy vardenafil online

Pingback: Umzugsfirma Wien

Pingback: найдёте здесь

Pingback: today updates

Pingback: clicksud episode online

Pingback: buy vardenafil online

Pingback: Jed Fernandez

Pingback: AC maintenance in dubai

Pingback: real online casino

Pingback: seguidores tiktok

Pingback: Sonia Randhawa

Pingback: free download for windows 8

Pingback: IT jobs

Pingback: gambling games

Pingback: counterfeit money for sale

Pingback: birman cats

Pingback: counterfeit money for sale

Pingback: sildenafil online

Pingback: Sonia Randhawa

Pingback: Ayurveda Online Shop

Pingback: Sonia Randhawa

Pingback: kratom near me

Pingback: kratom near me

Pingback: Amsterdam escorts

Pingback: casino

Pingback: cbd cats

Pingback: maeng da kratom

Pingback: Sonia Randhawa

Pingback: Sonia Randhawa

Pingback: Sonia Randhawa

Pingback: 5euros

Pingback: casino online slots

Pingback: Sonia Randhawa

Pingback: Sonia Randhawa

Pingback: Sonia Randhawa

Pingback: Keto Diet Pills

Pingback: viagra prescription

Pingback: generic cialis tadalafil best buys

Pingback: bitly.com

Pingback: Buy spice online

Pingback: personal loan

Pingback: Search Engine Optimisation

Pingback: viagra

Pingback: Jazzct.com

Pingback: consultant seo

Pingback: yelp mortgage broker vancouver

Pingback: best mortgage broker vancouver wa

Pingback: online payday loans

Pingback: Steroids For Weight Loss

Pingback: Webinar Workshop

Pingback: Best Diet Pills for Women

Pingback: Best Diet Pills

Pingback: generic cialis

Pingback: cash advance online

Pingback: best real money online casinos

Pingback: فیلم کون دادن زن اصفهانی به مرد همسایه

Pingback: Search Results

Pingback: buy prescription drugs without doctor

Pingback: Gym Exercises

Pingback: Earthlings 2005

Pingback: viagra pills

Pingback: Top Smart Drugs according to Science

Pingback: Get the Best of Dr. Oz

Pingback: play for real online casino games

Pingback: سكس جماعي قذف

Pingback: casino online bonus

Pingback: cialis generic

Pingback: Reverse Phone Lookup Free With Name

Pingback: candida

Pingback: neteller casino

Pingback: LuckyCreek

Pingback: new cialis

Pingback: big black cock enter's rajapandi's tender asshole

Pingback: pharmacy online

Pingback: cialis generic

Pingback: cialis buy

Pingback: propecia online

Pingback: pitt meadows

Pingback: cialis internet

Pingback: Handlateknik

Pingback: best quality cbd oil for sale

Pingback: cialis generic

Pingback: غرور

Pingback: عزة

Pingback: حلوه خيال

Pingback: الغدر والخيانة

Pingback: الم

Pingback: Escort amsterdam

Pingback: 5euros

Pingback: Kratom near me

Pingback: 500 hemp cbd oil for sale

Pingback: online slots for real money

Pingback: Royal CBD

Pingback: Royal CBD

Pingback: Royal CBD

Pingback: Royal CBD

Pingback: Royal CBD

Pingback: RoyalCBD

Pingback: RoyalCBD

Pingback: RoyalCBD

Pingback: Royal CBD

Pingback: Royal CBD

Pingback: washington dc

Pingback: smotret onlajn v horoshem kachestve hd

Pingback: RoyalCBD.com

Pingback: oklahoma

Pingback: RoyalCBD.com

Pingback: cbd utah

Pingback: hemp oil cbd 500mg for sale

Pingback: RoyalCBD.com

Pingback: texas cbd

Pingback: RoyalCBD.com

Pingback: ohio cbd

Pingback: oregon cbd

Pingback: is cbd legal in pennsylvania

Pingback: cbd new mexico

Pingback: is cbd legal in new jersey

Pingback: new hampshire

Pingback: cbd nevada

Pingback: montana

Pingback: Royal CBD

Pingback: cbd missouri

Pingback: cbd michigan

Pingback: RoyalCBD.com

Pingback: RoyalCBD.com

Pingback: RoyalCBD.com

Pingback: kentucky cbd

Pingback: maine cbd

Pingback: casino games

Pingback: illinois cbd

Pingback: Royal CBD

Pingback: Royal CBD

Pingback: cbd oil georgia

Pingback: cbd arkansas

Pingback: cbd oil colorado

Pingback: arizona

Pingback: cbd oil california

Pingback: Royal CBD

Pingback: Dom 2

Pingback: Royal CBD

Pingback: RoyalCBD.com

Pingback: cbd oil timeline

Pingback: Royal CBD

Pingback: vaping cbd oil e liquid

Pingback: Royal CBD

Pingback: Royal CBD

Pingback: Royal CBD

Pingback: RoyalCBD

Pingback: how does cbd work

Pingback: RoyalCBD.com

Pingback: Buy Marijuana Online

Pingback: casino games

Pingback: اغاني

Pingback: MILF

Pingback: lesbian porn world

Pingback: levitra

Pingback: harrison lake boating

Pingback: harrison lake

Pingback: er sucht ihn berlin

Pingback: online casino real money us

Pingback: rust small map modded servers

Pingback: sildenafil price

Pingback: ed meds online without doctor prescription

Pingback: Skyline Properties

Pingback: Electrician SEO

Pingback: buy viagra online

Pingback: free app download for windows 8

Pingback: free download for windows

Pingback: games for pc download

Pingback: download free apps apk for windows

Pingback: buy erectile dysfunction pills online

Pingback: Fakaza

Pingback: Escort amsterdam

Pingback: buy real viagra online

Pingback: Cherkassy

Pingback: Life Coach

Pingback: viagra prices

Pingback: anvelope chisinau

Pingback: Online Impacts

Pingback: options trading

Pingback: Pc reparatur

Pingback: cialis reviews

Pingback: computer news websites

Pingback: embedded system

Pingback: Shih Tzu Puppies for sale near me

Pingback: www semrush

Pingback: Exotic Carts website

Pingback: Teacup Puppies For Sale Near Me

Pingback: purchase viagra

Pingback: Escort amsterdam

Pingback: Pc support bubikon

Pingback: Employee Benefits Chicago

Pingback: erectile dysfunction pills

Pingback: batmanapollo.ru

Pingback: gaming and travel

Pingback: Comedy Hypnotist

Pingback: viagra prescription

Pingback: best place to buy cialis online reviews

Pingback: metformin 1000 mg

Pingback: viagra samples

Pingback: generic cialis 20mg

Pingback: generic prednisone for sale

Pingback: vacation

Pingback: hydroxychloroquine for sale

Pingback: tadalafil generique

Pingback: dom2 ru

Pingback: ساک زدن خشن

Pingback: real casino

Pingback: tadalafil

Pingback: question game for couples

Pingback: purchase counterfeit money online

Pingback: dog breed

Pingback: free casino games

Pingback: order 100% undetectable counterfeit money

Pingback: buy chinese herbal viagra

Pingback: اغاني

Pingback: psy psy psy psy

Pingback: viagra buy online australia

Pingback: Venice photography

Pingback: 190 VISA AUSTRALIA

Pingback: free download for windows 7

Pingback: app download for pc

Pingback: health insurance broker

Pingback: Group health insurance plans

Pingback: Employee benefits

Pingback: Employee health insurance plans

Pingback: health insurance broker

Pingback: what pharmacy can i buy viagra

Pingback: Employee benefits

Pingback: sildenafil

Pingback: Thai Buz

Pingback: physiotherapie für hunde

Pingback: cannabis4homes.com

Pingback: русские народные сказки

Pingback: buy viagra generic

Pingback: sex positivity

Pingback: radio

Pingback: nail lamp

Pingback: gamdom

Pingback: Шины в Кишиневе

Pingback: bitsler

Pingback: wolfbet

Pingback: how to order cialis online

Pingback: School of Pure and Applied Sciences

Pingback: buy cialis no prescription

Pingback: cheap viagra

Pingback: Financial career

Pingback: Working Capital

Pingback: Mastercard Corporate Credit Card

Pingback: Viagra 150mg canada

Pingback: exchange crypto

Pingback: krsmi.ru

Pingback: Viagra 100mg nz

Pingback: Viagra 25 mg online

Pingback: buy sildenafil online

Pingback: alex more

Pingback: internet marketing business

Pingback: viagra for sale

Pingback: Denver SEO consultant

Pingback: boulder seo

Pingback: Hot Water Heater Repair Denver

Pingback: Cialis 40 mg cheap

Pingback: اغانى شعبى

Pingback: buy generic cialis

Pingback: computer recyclers

Pingback: buy viagra generic

Pingback: cheap Cialis 60 mg

Pingback: Cialis 40 mg pills

Pingback: buy Cialis 60mg

Pingback: Plastic Surgery in Turkey

Pingback: pubg mobile emülatör hile

Pingback: sildenafil 150mg coupon

Pingback: cialis online

Pingback: canadian pharmacy

Pingback: cost of tadalafil 20 mg

Pingback: Bengal Kittens For Sale Near Me

Pingback: Teacup Pomeranian Puppies for Sale

Pingback: tabby kittens for sale near me

Pingback: THC VAPE JUICE

Pingback: lasix 100mg united states

Pingback: viagra prescription

Pingback: Authorized users is a scam

Pingback: sex positivity

Pingback: furosemide 40 mg online

Pingback: order lexapro 10mg

Pingback: sex ed

Pingback: find builders

Pingback: finasteride 1 mg tablets

Pingback: abilify 20 mg without a prescription

Pingback: marmaris rodos feribot

Pingback: actos 15 mg online pharmacy

Pingback: aldactone 25mg cheap

Pingback: ucuz uçak bileti

Pingback: allegra 120 mg price

Pingback: allopurinol 300 mg without a doctor prescription

Pingback: amaryl 2 mg price

Pingback: tiec tu chon

Pingback: شرط بندی بازی انفجار

Pingback: macca daklak

Pingback: ampicillin 500 mg online

Pingback: sweetiehouse

Pingback: antivert 25 mg cheap

Pingback: cialis prices

Pingback: tapchiphunuvn

Pingback: strattera 18mg no prescription

Pingback: magic wand massager

Pingback: aricept 10 mg cheap

Pingback: arimidex 1mg online pharmacy

Pingback: blogcaodep.com

Pingback: look at this site ΠΑΝΟΣ ΓΕΡΜΑΝΟΣ

Pingback: More Info panos germanos

Pingback: cialis

Pingback: cheap atarax 25 mg

Pingback: youtube mahna mahna

Pingback: all vape stores online

Pingback: drugs without doctor script

Pingback: buy hemp oil online

Pingback: Damiana

Pingback: baclofen 10mg without a prescription

Pingback: net meters for solar power

Pingback: where can i buy bactrim 800/160 mg

Pingback: Gerüstbau

Pingback: best buy

Pingback: buy viagra online

Pingback: havuz kimyasallarý

Pingback: tadalafil

Pingback: havuz malzemeleri

Pingback: mobilya çeþitleri

Pingback: capath.vn

Pingback: Biaxin 250mg pharmacy

Pingback: useful content ΑΠΟΦΡΑΞΕΙΣ

Pingback: sweetiehouse.vn

Pingback: German shepherd puppies for sale Near Me

Pingback: Premarin 0,625mg online pharmacy

Pingback: Beretta 686

Pingback: sniper rifles for sale

Pingback: Glock 21sf

Pingback: Psilocybe baeocystis

Pingback: Buy heroin online

Pingback: BERETTA M9A3 FOR SALE

Pingback: Gun Shops Near Me

Pingback: Magic Mush Rooms

Pingback: calcium carbonate 500mg pharmacy

Pingback: sildenafil cost walmart

Pingback: Pomsky Puppies For Sale

Pingback: akmeologiya-akmeologiya

Pingback: #HumanDesign

Pingback: buy cialis online

Pingback: virtual credit card buy

Pingback: Gulberg Heights

Pingback: revatio vs viagra

Pingback: cach an hat macca dung chuan

Pingback: dinhcucandadientaynghe.mystrikingly.com

Pingback: ed online pharmacy

Pingback: karın germe

Pingback: https://apnews.com/press-release/newmediawire/lifestyle-diet-and-exercise-exercise-2d988b50b0b680bee24da8e46047df20

Pingback: en iyi su arıtma cihazı

Pingback: cheap ed pills

Pingback: claritin 10 mg medication

Pingback: vibrating cock rings

Pingback: viagra canada online pharmacy

Pingback: halkbank kart şifresi alma

Pingback: HRDF Social Media Marketing

Pingback: viagra indications

Pingback: casino games win real money

Pingback: u2store.blogspot.com

Pingback: Naturkosmetik

Pingback: cheap followers

Pingback: real money online casino

Pingback: find out more

Pingback: hrdf training course penang

Pingback: how much is viagra worth

Pingback: Tenuate retard

Pingback: o-dsmt

Pingback: 1000mg thc vape juice

Pingback: Pure Colombian Cocaine

Pingback: Fish scale cocaine

Pingback: Change DMT

Pingback: liquid k2 for sale

Pingback: Fire Herbal Incense

Pingback: Buy Tramadol ( Ultram) 50mg

Pingback: cialis 20mg pills

Pingback: mortgage broker richmond

Pingback: generic cialis buy

Pingback: cialis miami

Pingback: brazzers

Pingback: film

Pingback: Generic viagra us

Pingback: au cialis

Pingback: viagra online generic

Pingback: film

Pingback: customised t shirt UK

Pingback: Designer style jewellery

Pingback: cheap viagra

Pingback: viagra on line no prec

Pingback: amoxicillin 750 mg price

Pingback: Apps For PC

Pingback: backlink

Pingback: buy cialis

Pingback: generic viagra reviews

Pingback: cbd oil and fingolimod

Pingback: viagra cialis

Pingback: sildenafil 50 mg coupon

Pingback: best bitcoin exchange

Pingback: generic viagra no prescription canada

Pingback: viagra pills generic

Pingback: cheap viagra 100mg online

Pingback: cialis or viagra

Pingback: personal loans with no credit check

Pingback: 360 viagra

Pingback: cialis viagra

Pingback: sildenafil generic without a prescription

Pingback: Best Free Video Editing Software for PC

Pingback: where can i buy levitra in australia

Pingback: 44549

Pingback: pfizer viagra

Pingback: levitra vs viagra

Pingback: real viagra online usa

Pingback: CARGO SHIP TRAVEL

Pingback: Fancy Text Generator

Pingback: cialis vs viagra

Pingback: mct atorvastatin

Pingback: bitcoin exchange

Pingback: pharmacy in canada (800) 901-0041

Pingback: viagra generic coupon

Pingback: Buy Viagra gold online

Pingback: should schools have homework

Pingback: kittens for sale

Pingback: fennec fox pet

Pingback: ringneck

Pingback: birds for sale in houston

Pingback: sildenafil 100mg cheap

Pingback: toucan for sale

Pingback: cheap clomid 50 mg

Pingback: generic viagra india

Pingback: Best price viagra

Pingback: order viagra overnight

Pingback: cialis for bph

Pingback: Buy Ritalin 10mg online

Pingback: cialis cost per pill

Pingback: cialis online purchase

Pingback: Canada viagra

Pingback: ENTERPRISECARSALES.COM

Pingback: bitly.com/maior-grom

Pingback: cozaar generic

Pingback: which drug is better cialis or viagra

Pingback: Testing56

Pingback: Testing57

Pingback: buy viagra online usa

Pingback: BUY ADVIL PM

Pingback: güvenlik soruþturmasýnda nelere bakýlýr

Pingback: BUY VAPES ONLINE

Pingback: Smoking Marijuana Benefits

Pingback: how to use a realistic dildo

Pingback: landscaping in temecula

Pingback: 샌즈카지노

Pingback: 퍼스트카지노

Pingback: limit switch manufacturers

Pingback: micro-switch, limit switch

Pingback: K Cloud Accounting Singapore

Pingback: lipo golf cart batteries

Pingback: 메리트카지노

Pingback: limit switch connection

Pingback: limit switch circuit diagram

Pingback: China Micro Switch

Pingback: Unionwell micro switches

Pingback: viagra coupons 75% off

Pingback: Microswitch

Pingback: usedspring coiling machine in india

Pingback: 코인카지노

Pingback: chinese air purifier brands

Pingback: chinese injection molding quote

Pingback: vision system camera

Pingback: top 10 solar battery manufacturers in china

Pingback: screw tightening machine price

Pingback: CNC Spring Coiling Machine

Pingback: lipo golf cart batteries

Pingback: canada online pharmacy

Pingback: 1445

Pingback: tadalafil online

Pingback: pharmacies not requiring a prescription

Pingback: BUY ECSTASY PILLS ONLINE

Pingback: عکس سکسی

Pingback: avanafil vs viagra

Pingback: Hulkberry strain review

Pingback: garcinia cambogia caps without a doctor prescription

Pingback: pain medications without a prescription

Pingback: 우리카지노

Pingback: cephalexin beer

Pingback: ciprofloxacin for kidney infections

Pingback: order cialis 20 mg

Pingback: oxybutynin 5mg tablets

Pingback: generic viagra cost

Pingback: approved canadian pharmacies online

Pingback: aripiprazole improves major depressive

Pingback: real signups

Pingback: mousetrap

Pingback: dangers of taking allopurinol

Pingback: zithromax over the counter

Pingback: amiodarone drig class

Pingback: viagra for sale

Pingback: elavil and glaucoma

Pingback: avant consulting

Pingback: viagra for sale

Pingback: cheap viagra 50mg

Pingback: cheap meclizine 25 mg

Pingback: abilify gastritis

Pingback: cheap erectile dysfunction pills online

Pingback: خرید لایک ایرانی

Pingback: c3m94q8nmrqv4nq3r4

Pingback: private investigators in spain

Pingback: detectives

Pingback: Gelato Strain

Pingback: ratio atorvastatin

Pingback: Aciclovir

Pingback: 232dfsad

Pingback: Lisa Ann Porn

Pingback: buy 100 ml viagra

Pingback: canada drugs online

Pingback: Women’s Crocodile Leather Shoulder Bag

Pingback: baclofen hot flashes

Pingback: canadian online pharmacies

Pingback: LG mi Samsung mu

Pingback: buspirone 15 mg vs xanax

Pingback: Mink Eyelashes Set

Pingback: Professional Make up Tool Set

Pingback: Mink Individual Lashes

Pingback: Colorful Waterproof Silicone Face Cleansing Brush

Pingback: Ketahui Agen Bandarq

Pingback: what is judi online

Pingback: Reusable Natural 3D Mink Eyelashes

Pingback: win88

Pingback: pandora188

Pingback: layarkaca21 indoxx1

Pingback: slot88 online

Pingback: dewa4dku

Pingback: Waterproof Eyebrow Pen

Pingback: layarkaca22

Pingback: paroxetine and buspirone

Pingback: Makeup Brushes 12 pcs Set

Pingback: Soft Makeup Brushes

Pingback: Professional Makeup Brushes

Pingback: Natural Soft Mink Eyelashes

Pingback: Waterproof Eyelash Glue

Pingback: Nail Polish Remover Cotton Wipes Set

Pingback: Professional Ceramic Hair Curler

Pingback: warnings for coreg

Pingback: Colorful Nail Art Dotting Pens Set

Pingback: 3D Mink Magnetic Eyelashes with Eyeliner Kit

Pingback: canadian online pharmacy viagra

Pingback: cleantalkorg2.ru

Pingback: adverse effects of celecoxib

Pingback: celexa antidepressant

Pingback: levitra online

Pingback: doxycycline 100mg

Pingback: Flower Nail Stickers

Pingback: UV LED Nail Gel

Pingback: Anti Aging Face Steamer

Pingback: Disposable Eyelash Brushes 50 pcs Set

Pingback: Goat Hair Eye Makeup Brushes Set

Pingback: Waterproof Shimmer Lipstick

Pingback: buy levitra

Pingback: Elegant Pearls Hairband for Women

Pingback: Gradient Color Nail Art Brush

Pingback: pyridium 200mg prices

Pingback: Black and White Disposable Lipgloss Brush 50 Pcs Set

Pingback: Aluminium Foil Nail Polish Remover Wraps Set

Pingback: Y Shaped Facial Massage Roller

Pingback: join vk

Pingback: vk login

Pingback: Eyelash Brushes Disposable

Pingback: Crystal Nail Art Brush

Pingback: viagra uk

Pingback: benadryl otc canada

Pingback: teva viagra cost

Pingback: cialis on line

Pingback: where to buy viagra

Pingback: cialis professional 20mg

Pingback: generic viagra

Pingback: why is viagra expensive

Pingback: vantin canada

Pingback: generic indian names cialis

Pingback: buy zithromax online

Pingback: pfizer viagra

Pingback: tadalafil 40mg online

Pingback: amoxicillin 1000 mg capsule

Pingback: nytimes

Pingback: tribenzor

Pingback: norwaytoday

Pingback: canadian drugstore online

Pingback: spironolactone 100 mg pharmacy

Pingback: viagra toletance

Pingback: generic tadalafil 20 mg

Pingback: sildenafil alternative

Pingback: order cialis over the counter at walmart

Pingback: donepezil no prescription

Pingback: dutchnews

Pingback: buy viagra generic

Pingback: 34cr4rxq3crq34rq3r4

Pingback: free movie site

Pingback: reliable online gambling

Pingback: primary education for children

Pingback: magic mushroom to buy online

Pingback: The Best Online Slot Gambling

Pingback: spiegel

Pingback: galaxy projector night lamp online

Pingback: cialis 20 mg best price

Pingback: osrs gold paypal

Pingback: bartender in your city

Pingback: social equity plan examples

Pingback: where can u buy cialis

Pingback: health and nutrition articles

Pingback: property buyer list

Pingback: free certified translation services

Pingback: postimees

Pingback: lemonde

Pingback: generic viagra cost walgreens

Pingback: safe buy cialis

Pingback: gay hub

Pingback: medications without a doctor's prescription

Pingback: online shopping reviews

Pingback: cost of tadalafil without insurance

Pingback: 1xbetmobi

Pingback: helsinkitimes

Pingback: remote control dildo

Pingback: icelandreview

Pingback: cialis 20mg usa

Pingback: thesouthafrican

Pingback: private label skincare china

Pingback: Korea makeup factory

Pingback: private label foundation manufacturers

Pingback: private label skincare Spain

Pingback: colour cosmetics manufacturers in Russia

Pingback: private label skincare france

Pingback: Japanese Porn

Pingback: best g spot vibrator

Pingback: private label foundation manufacturers

Pingback: private label makeup manufacturers

Pingback: private label cosmetics atlanta

Pingback: private label makeup manufacturers

Pingback: private label skincare Russia

Pingback: colour cosmetics manufacturers in Arabic

Pingback: private label makeup manufacturers

Pingback: emergency water leaking solution

Pingback: sildenafil citrate 50mg

Pingback: c34r54wxw4r34c3

Pingback: what is the shelf life of amoxicillin

Pingback: dark web screenshots

Pingback: polytechnic exam 2020

Pingback: Hongkong Lottery Result

Pingback: azithromycin and benadryl

Pingback: buy cosmetics online free shipping

Pingback: cephalexin uptodate

Pingback: where to buy viagra in store

Pingback: Virtual Offices in Paris

Pingback: bisacodyl 5mg australia

Pingback: buy cialis drug

Pingback: duloxetine 60 mg prices

Pingback: generic viagra

Pingback: home cash work

Pingback: southern hills hospital doctors

Pingback: we buy houses for cash

Pingback: kitchen remodel near me

Pingback: watch a movie online

Pingback: Gay Hub XXX

Pingback: lip balm nykaa

Pingback: German shepherd puppies for sale

Pingback: pinball machines for sale

Pingback: cheap amitriptyline

Pingback: amoxicillin with augmentin

Pingback: marijuana for sale craigslist

Pingback: where to buy cialis in tianjin

Pingback: generic cialis

Pingback: car scrap value india

Pingback: Mining

Pingback: All My Sons Moving

Pingback: buy cialis with paypal

Pingback: estradiol price

Pingback: MILF Porn

Pingback: ed pills otc

Pingback: tiktok

Pingback: Mountain bike clothing

Pingback: Best Digital Marketing Services

Pingback: micro switch working

Pingback: best micro switch manufacturing unit in china

Pingback: Union micro switch price

Pingback: micro switches types

Pingback: zinlbcym

Pingback: ed treatment pills

Pingback: micro switch sensor

Pingback: micro switches types

Pingback: micro switch price in portugal

Pingback: micro switch on off

Pingback: free online movie streaming sites

Pingback: unlisted shares taxation

Pingback: live football match

Pingback: celebrex with food

Pingback: old school runescape wiki

Pingback: cialis without presciption in usa

Pingback: will cephalexin help an infected tooth

Pingback: alendronate 70mg online pharmacy

Pingback: how much does cialis cost in australia

Pingback: what does viagra do to a man

Pingback: viagra coupon

Pingback: best medicine for sex life

Pingback: micro switch on off

Pingback: China Micro Switch manufacturers

Pingback: micro switch button

Pingback: micro switch push button

Pingback: microswitch working

Pingback: Micro Switch Manufacturers, Factory, Suppliers From China

Pingback: how to buy nitrofurantoin 100 mg

Pingback: pci pest control

Pingback: what dose of topical ivermectin do i use for my guinea pigs mites

Pingback: how long does it take to cure gonorrhea with azithromycin

Pingback: pyrenees france map

Pingback: canadian pharmacy cialis 20mg

Pingback: viagra dubai

Pingback: best car rental service

Pingback: Screw Fastening Robot

Pingback: choosing best dog food

Pingback: lasix 100mg

Pingback: fasteners making machine cost

Pingback: electrician france

Pingback: JB lithium batteries

Pingback: OG KUSH DANK VAPES

Pingback: 샌즈카지노

Pingback: hydrochlorothiazide medication

Pingback: nitrofurantoin price

Pingback: 우리카지노

Pingback: 메리트카지노

Pingback: 퍼스트카지노

Pingback: JB lithium golf cart battery

Pingback: JB golf cart lithium battery

Pingback: 36v lithium golf cart battery

Pingback: isosorbide 20 mg without prescription

Pingback: buy trimox

Pingback: JB golf cart lithium battery

Pingback: JB lithium golf cart battery

Pingback: buy ffp2 mask online

Pingback: diy lithium golf cart batteries

Pingback: lithium-ion battery used in golf cart

Pingback: JB lithium battery reviews

Pingback: JB golf cart battery

Pingback: sumatriptan generic

Pingback: how to take sildenafil 20 mg

Pingback: check out canada immigration news

Pingback: AnaGlobal

Pingback: best cbd oil

Pingback: order sumycin

Pingback: allied lithium battery reviews

Pingback: listed electric vehicle battery manufacturers in Portugal

Pingback: lithium ion golf cart battery conversion

Pingback: where to buy liquid cialis

Pingback: best cbd for dogs

Pingback: where can u buy cialis

Pingback: buy viagra online cheap

Pingback: best cbd gummies

Pingback: best cbd for dogs

Pingback: using sex as an exercise

Pingback: how to get ciails without a doctor

Pingback: hairless cat for sale

Pingback: prostate vibrator

Pingback: singapore private condo

Pingback: red maeng da kratom

Pingback: lightsaber colors

Pingback: current cost of cialis 5mg cvs

Pingback: white maeng da kratom

Pingback: propranolol 20 mg canada

Pingback: why need probot for discord

Pingback: viagra generico precio en farmacias

Pingback: generic viagra discover card

Pingback: concept of pharmaceutical products

Pingback: dependent visa hong kong