The main macro hedge fund belonging to the Fortress Investment Group LLC (NYSE:FIG) based in New York has lost 2.3% in a mere thirty day time span. If you falter on your bets regarding the economy don’t expect any less. In eight months Fortress Investment Group LLC (NYSE:FIG) has accumulated losses amounting to a total of 5.8%, with four months remaining in 2014 still, who knows where this number might reach. The informant requested confidentiality as the returns have not been made public as yet.

Why has it become so difficult to profit from trading? Well first of all the Central banks have pushed down the benchmarking interest rates resulting in a great decline in volatility hence the hedge fund managers who wager on the macroeconomic trends are finding it extremely hard to survive as no strategy seems to cater to the situation.

When there are broad stakes involved including equities, commodities, currencies, other assets as well as interest rates the average return for these hedge funds has been around a mere 1% this year as compared to a 2% where all hedge fund strategies were involved. This was reported by HFR Group from the data they had collected for Investment Advising in their Chicago based firm.

Fortress Investment Group LLC (NYSE:FIG) spokesperson Gordon Runte has refused to comment and so did Patrick Clifford who is the spokesperson for Tudor, the hedge fund with the Abernathy MacGreggor group based in Connecticut.

The macro strategies which Fortress Investment Group LLC (NYSE:FIG) was betting on didn’t come through for them as they were short US Treasuries and German bonds where they should have been long as they were expecting interest rates to rise. From a 2.56% yield on the 10 year US Treasury bonds at the end of July, the yield fell to 2.34% at the end of last month. Looking at the yields on 10 year German debt they experienced the same fate of decline from a 1.16% to 0.89% in the timespan of end July to end August.

Fortress Investment Group LLC (NYSE:FIG) was the first manager of publicly traded hedge-fund and private-equity in the US and as on June 30 has raked in about $63.8 Billion with only a mere $3.4 Billion contribution coming from its macro funds. This serves as a pretty dismal state of affairs which calls for Fortress (FFG) to reassess its standing.

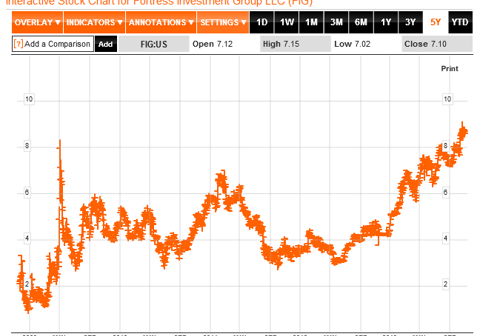

Fortress Investment Group LLC (NYSE:FIG) share prices fell 14% this year whence they had gone public at $18.5 in 2007 dropped 0.5% to $7.35 at the New York Stock Exchange. It made an announcement earlier in 2014 of Mike Novogratz of its macro funds sharing the spotlight with Jeffrey Fieg who left Citibank (C) to serve as the co-chief investment officer.

With investment firms speculating the central bank to start raising interest rates soon, they are ready to make up for lost time and lost profits no pun intended! Tiffany Wilding, the strategist from Morgan Stanley (NYSE:MS), specialist in Treasury Inflation Protected Securities was hired by the $13 Billion Tudor (TDR.H), run by Paul Tudor Jones himself.

Pingback: automatic likes Instagram

Pingback: บาคาร่า

Pingback: cartel disposable

Pingback: ks pod

Pingback: ขายคอนโด

Pingback: มวยพักยก

Pingback: รับทำวิจัย

Pingback: yehyeh.com

Pingback: mais vendidos eduzz

Pingback: โคมไฟ

Pingback: นำเข้าสินค้าจากจีน

Pingback: บาคาร่าเกาหลี

Pingback: Diyala Science

Pingback: ทำไมต้องเลือกเล่นสล็อตกับ Playtech สล็อต

Pingback: playtech เปิดให้เล่นพนันคาสิโน อะไรบ้าง ?

Pingback: megac4

Pingback: บุหรี่นอกเก็บเงินปลายทาง

Pingback: รับนำเข้าสินค้าจากจีน

Pingback: สล็อตวอเลท อัพเดทใหม่ ฝากถอนเงินไว

Pingback: m358 เว็บตรง อันดับ 1 ขวัญใจคนไทย

Pingback: Lsm65 เว็บคาสิโนเว็บตรง

Pingback: เว็บสล็อตตรงไม่ผ่านเอเย่นต์ เว็บแท้ จากยุโรป

Pingback: นิยาย

Pingback: ที่ดินเขาใหญ่

Pingback: เว็บตรงฝากถอนง่าย

Pingback: league88

Pingback: VOX Casino app

Pingback: หนังโป๊ซับไทย

Pingback: เกียรติบัตรออนไลน์

Pingback: ไอติมงานแต่ง

Pingback: เน็ต บ้าน ais

Pingback: ดูหนังคุณหนูหัวใจแกร่ง

Pingback: fear of god essentials

Pingback: cygnus 5 casino

Pingback: สี2in1

Pingback: Translation Services in Koh Samui