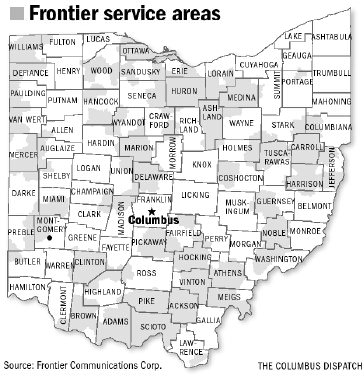

Frontier Communications Corp (NASDAQ:FTR) is a communications company engaged in providing services to rural areas, small and medium-sized towns in the United States. They also offer voice, data, and television services and products for residential and business owners. Earning announcement for Q3 2014 comes out on November 3, 2014 at 4:30pm Eastern Time.

Shares of the company opened at $6.44 in the morning, and closed $6.35 today, losing 1.40%. Its most recent deal includes a partnership with T-Mobile for its 700 mhz spectrum band. The specific financial terms were not revealed. Location covered includes Rochester, New York and 1.51 million POPs. Frontier won’t be using any existing airwaves still under constructions, so this expansion won’t result in loss to any existing subscribers. The deal is currently pending the Federal Communications Commission (FCC) regulatory approval.

The company has been making effort to improve top-line growth, increase subscriber base and continue to provide attractive dividends to investors. At 6.10%, any incentive to purchase and hold the stock is quickly realized. In 2014, Frontier Communications Corp (NASDAQ:FTR) has been focused on improving its net broadband subscribers, adding 177,100 for a total of 1.93 million. Since Q2 or 2011, the company has been showing a steady year over year growth.

The company has been using funds from the FCC to help finance its growth in rural areas, bringing broadband to 70,000 homes, and upgrading 30,000 existing homes

FCC.gov promotes the Connect America Fund (CAF):

“Broadband has gone from being a luxury to a necessity for full participation in our economy and society – for all Americans. This reform will expand the benefits of high-speed Internet to millions of consumers in every part of the country by transforming the existing USF into a new Connect America Fund (CAF) focused on broadband.”

The AT&T deal in the 4th quarter of 2014 will add 415,000 new broadband connections to its subscriber base. These new customer acquisition may show up in the November 3rd earning call.

The company is looking to expand and provide Wi-Fi services to local businesses through a Government grant of $2 billion until the end of 2016 (source). Although margin was down by 3.4% in the 2nd quarter of 2014, overall expansion efforts have brought top and bottom-line growths.

Investors have been cheering on this dividend champion stock, which is seeing a steady increase in subscribers base, and steady payout. Even CFO John Jureller states during the 2nd quarter of 2014 conference call:

“We continue to focus on our free cash flow generation and maintaining a comfortable dividend payout ratio for our shareholders.”

The company’s year over year strong cash flow growth at approximately $30 million a year have supported this dividend increase as well with no significant long term debt maturing. Many investors are still bullish on the company due to high subscribers base growth, strong cash flow, and stable dividends.

Pingback: 3challenged

Pingback: judi slot

Pingback: las vegas scooter rentals

Pingback: raptor789

Pingback: บริการรับจด อย

Pingback: Virtual Tour

Pingback: click reference

Pingback: รับงานเชื่อมเหล็ก

Pingback: สมัคร สล็อตออนไลน์

Pingback: เสื้อยูนิฟอร์ม

Pingback: ชีสเค้กทุเรียน

Pingback: ฟิล์มกรองแสง

Pingback: escape from tarkov exploits

Pingback: Guns For Sale

Pingback: เดิมพันอีสปอร์ต กับ PINNACLE เล่นง่าย

Pingback: wing888

Pingback: สล็อตเกาหลี

Pingback: Telegram中文版

Pingback: Cash giveaway

Pingback: เว็บพนัน faw99 เปิดให้บริการ อะไรบ้าง ?

Pingback: KC9 สล็อต เว็บตรงไม่ผ่านเอเย่นต์

Pingback: thailand tattoo

Pingback: Podívat se zde

Pingback: ufa789

Pingback: prebuilt pc for gaming hyderabad

Pingback: Steven

Pingback: scammers

Pingback: แนะนำ เกมยิงปลา lsm99 เดิมพันง่าย

Pingback: เครื่องทําสเลอปี้

Pingback: 1win

Pingback: altogel

Pingback: best slot Book of Ra 2025

Pingback: รับทำวีซ่า

Pingback: elephant sanctuary chiang mai

Pingback: Thaimassage in Zürich

Pingback: brians club

Pingback: Aster Dex

Pingback: แบบบ้านหรู

Pingback: เน็ตบ้านทรู

Pingback: ขายส่งเนยถั่ว

Pingback: 123bet login

Pingback: EA Forex

Pingback: จำนำรถ

Pingback: Huhn

Pingback: https://www.foodwastedryer.co.uk/127876-2/

Pingback: clothing manufacturer

Pingback: บาคาร่าเกาหลี

Pingback: ร้านเพชร

Pingback: ไซด์ไลน์