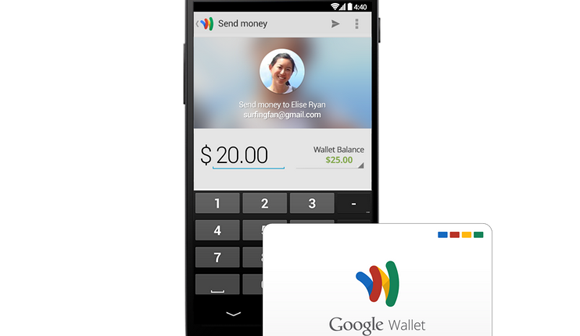

Sometimes success of one product acts as a little push for another. Similar has been the story between Apple (NASDAQ:AAPL) and Google (NASDAQ:GOOGL). Both are labeled as tech Giant and have had their share of success from year to year. Both have brought to their customers, smartphones, wearable and now an online payment system. Even though Google (NASDAQ:GOOGL) made it launch with Google (NASDAQ:GOOGL) Wallet long before Apple (NASDAQ:AAPL) Pay came into play, Google (NASDAQ:GOOGL) Wallet was considered a failure. With customers hesitant to use this new payment method, the company suffered a loss. Then this year Apple (NASDAQ:AAPL) Pay was introduced and since Apple (NASDAQ:AAPL) has a loyal customer base, it wasn’t long when users started using Apple (NASDAQ:AAPL) Pay in their daily lives. But somewhere in the process, Google (NASDAQ:GOOGL) Wallet users also got over their discomfort of online payment and started using it. In a matter of months, Google (NASDAQ:GOOGL) Wallet usage touched new skies, with the user base doubling every month.

NFC- Near field communications, which is a form of short range wireless communication, comes with an antenna which is smaller than the size of wavelength of signal, of the carrier. When NFC was started, it was anticipated that it will be the next big thing. But after a few years investor gave up on it, until now, when Apple (NASDAQ:AAPL) adopted it as part of its Apple (NASDAQ:AAPL) Pay system. With Apple’s (NASDAQ:AAPL) help, NFC finally has the chance to play the field and gain popularity.

Ever since Google (NASDAQ:GOOGL) Wallet’s launch, the service was considered a big failure in terms of finance and strategy. It never gained popularity among customers. They rejected it without even using it. But now with Apple (NASDAQ:AAPL) holding hands with NFC based payment system, Google (NASDAQ:GOOGL) has also jumped on the band wagon.

A year ago, Google (NASDAQ:GOOGL) introduced peer to peer transfer and loyalty card features, and last week, it made an addition to the list by adding recurring bank transfers and alerts when the balance is low. This is a method to keep customers informed of their funds availability.

It needs to be looked at from a user’s perspective, who wants to take on the services for its ease of use, security and convenience. For many, the in-store experience is the turning point, as that’s where mobile payments are used frequently. At this point, Google (NASDAQ:GOOGL) Wallet and Apple (NASDAQ:AAPL) Pay are very similar in its in-store payment mode. Google (NASDAQ:GOOGL) Wallet uses a pin code and Apple (NASDAQ:AAPL) Pay requires Touch ID. Both use NFC techniques to get the task done.

As Apple (NASDAQ:AAPL) Pay works on creating awareness about the safety features and convenience of mobile payments, it’s adding up customers for itself as well as Google (NASDAQ:GOOGL) wallet. People are quite willing to rely on these apps to make life easier.

Pingback: cialis 5mg

Pingback: Viagra 50 mg

Pingback: buy cialis online safely

Pingback: erectile dysfunction medications

Pingback: generic ed pills

Pingback: erection pills online

Pingback: sale cialis

Pingback: canadian pharmacy

Pingback: Get cialis

Pingback: vardenafil dosage

Pingback: buy vardenafil

Pingback: real money online casino

Pingback: cialis tadalafil

Pingback: online payday loans

Pingback: personal loans

Pingback: generic cialis

Pingback: buy cialis

Pingback: sildenafil online

Pingback: best online casino usa

Pingback: online casinos real money

Pingback: online slots for real money

Pingback: viagra alternative

Pingback: viagra no prescription

Pingback: discount cialis

Pingback: buy viagra on line

Pingback: viagra buy

Pingback: tadalafil vs sildenafil

Pingback: buy viagra pills

Pingback: generic cialis

Pingback: buy viagra no prescription

Pingback: viagra without a doctor prescription

Pingback: cialis 5 mg

Pingback: casino games win real money

Pingback: casino games online

Pingback: viagra coupon

Pingback: buy viagra australia online

Pingback: buy cialis online cheap

Pingback: Viagra 150mg united kingdom

Pingback: Viagra 25mg pharmacy

Pingback: hydroxychloroquine price in india

Pingback: Viagra 50 mg australia

Pingback: cialis tadalafil

Pingback: Viagra 25 mg cheap

Pingback: Cialis 60mg medication

Pingback: viagra for sale

Pingback: Cialis 40mg canada

Pingback: Cialis 20 mg tablet

Pingback: Cialis 10 mg for sale

Pingback: buy Cialis 60 mg

Pingback: canadian viagra

Pingback: Cialis 80 mg canada

Pingback: lm360.us

Pingback: viagra cost

Pingback: Cialis 60 mg online

Pingback: Cialis 20 mg tablet

Pingback: Cialis 10mg tablets

Pingback: how to buy Cialis 40mg

Pingback: cialis 20mg

Pingback: levitra 10 mg tablet

Pingback: furosemide 100 mg cost

Pingback: propecia 5mg australia

Pingback: lexapro 10 mg canada

Pingback: finasteride 1mg australia

Pingback: buy cialis

Pingback: cheap viagra

Pingback: actos 15 mg united kingdom

Pingback: cheapest allegra 180mg

Pingback: allopurinol 300 mg united kingdom

Pingback: order cialis

Pingback: amaryl 4mg online pharmacy

Pingback: amoxicillin 500mg over the counter

Pingback: cost of antabuse 250 mg

Pingback: antivert 25mg coupon

Pingback: arava 20 mg pharmacy

Pingback: arimidex 1 mg medication

Pingback: tamoxifen 10 mg prices

Pingback: buy ashwagandha 60caps

Pingback: cialis jelly sachet

Pingback: atarax 10 mg pharmacy

Pingback: augmentin 250/125mg tablet

Pingback: avapro 150 mg usa

Pingback: viagra use in women

Pingback: baclofen 10mg uk

Pingback: bactrim 400/80 mg canada

Pingback: benicar 10 mg usa

Pingback: cialis bathtub symbolism

Pingback: cost of keflex without insurance

Pingback: Biaxin 500mg australia

Pingback: where to buy Premarin 0,625mg

Pingback: cheapest buspar 5mg

Pingback: cialis on line

Pingback: is generic cialis available

Pingback: calcium carbonate 500 mg for sale

Pingback: sildenafil 100mg tablets

Pingback: buy original viagra online

Pingback: cheap casodex

Pingback: catapres over the counter

Pingback: ceclor 500mg medication

Pingback: ceftin without a doctor prescription

Pingback: celexa purchase

Pingback: order cephalexin 500mg

Pingback: order cipro

Pingback: claritin 10 mg coupon

Pingback: sildenafil citrate 100mg

Pingback: play casino online

Pingback: casino moons online casino

Pingback: best slots to play online

Pingback: online casino games

Pingback: casino online slots

Pingback: casino slot

Pingback: best real casino online

Pingback: slot machines

Pingback: ocean casino online

Pingback: real money casino games

Pingback: car insurance quotes rates

Pingback: auto and home insurance quotes

Pingback: autoinsurance

Pingback: is generic viagra legal in canada

Pingback: best car insurance quotes comparison site

Pingback: buy car insurance quotes

Pingback: low cost car insurance quotes companies

Pingback: classic car insurance quotes

Pingback: state car insurance quotes

Pingback: 21 century insurance

Pingback: first acceptance insurance

Pingback: Order viagra

Pingback: personal loans no credit checks

Pingback: payday loans in columbia sc

Pingback: medical name of viagra

Pingback: payday loans no credit check

Pingback: installment loans in ct

Pingback: midwest quick loans

Pingback: bad credit loans lancaster ca

Pingback: payday loans oregon

Pingback: cash personal loans

Pingback: cbd oil for sale in bulk

Pingback: best cbd oil for pain reviews

Pingback: cbd oil for pain at walmart

Pingback: how much does viagra cost at target

Pingback: cbd hemp oil

Pingback: blood bruises under skin cbd oil

Pingback: can cbd oil affect drug test

Pingback: cbd oil for pain for sale

Pingback: buy custom essay

Pingback: genuine pfizer viagra drug

Pingback: paper writer

Pingback: cheap essay writing service uk

Pingback: how to write argumentative essays

Pingback: free paper writer

Pingback: is homework helpful

Pingback: best custom essay writing service

Pingback: homework assignments

Pingback: buy a essay

Pingback: cleocin 300 mg tablet

Pingback: cheapest clomid

Pingback: clonidine online pharmacy

Pingback: Buy viagra from canada

Pingback: clozaril 25 mg medication

Pingback: cost of symbicort inhaler 160/4,5mcg

Pingback: combivent 50/20mcg without a prescription

Pingback: Pharmacy viagra

Pingback: coreg canada

Pingback: buy compazine

Pingback: coumadin for sale

Pingback: crestor 20mg cheap

Pingback: cymbalta over the counter

Pingback: ddavp 0.1 mg for sale

Pingback: where can i buy diamox 250 mg

Pingback: Brand viagra

Pingback: differin 15g online

Pingback: diltiazem tablet

Pingback: doxycycline online

Pingback: dramamine 50 mg otc

Pingback: how to purchase elavil

Pingback: erythromycin purchase

Pingback: etodolac 300 mg united kingdom

Pingback: flomax otc

Pingback: garcinia cambogia 100caps without a doctor prescription

Pingback: how to buy geodon

Pingback: hyzaar medication

Pingback: imdur price

Pingback: imitrex 50 mg united kingdom

Pingback: imodium 2 mg purchase

Pingback: pop over to these guys

Pingback: how to buy imuran 25 mg

Pingback: indocin 25mg purchase

Pingback: where to buy lamisil

Pingback: order levaquin 750 mg

Pingback: lopressor tablet

Pingback: luvox without a prescription

Pingback: order macrobid

Pingback: meclizine united kingdom

Pingback: viagra price in australia

Pingback: micardis 20 mg cheap

Pingback: mobic 7,5mg for sale

Pingback: motrin 600 mg united kingdom

Pingback: nortriptyline no prescription

Pingback: cheapest periactin 4 mg

Pingback: phenergan tablet

Pingback: plaquenil 200mg australia

Pingback: prednisolone canada

Pingback: cost of prevacid

Pingback: prilosec 20mg usa

Pingback: where to buy proair inhaler 100 mcg

Pingback: procardia cost

Pingback: where to buy proscar 5mg

Pingback: protonix cost

Pingback: provigil 100mg uk

Pingback: buy real viagra online

Pingback: pulmicort prices

Pingback: pyridium canada

Pingback: reglan 10mg nz

Pingback: remeron 15mg no prescription

Pingback: buy retin-a cream 0.025%

Pingback: revatio tablets

Pingback: how to purchase risperdal

Pingback: robaxin online pharmacy

Pingback: where to buy rogaine 5%

Pingback: seroquel 50 mg united kingdom

Pingback: cost of singulair

Pingback: cost of skelaxin

Pingback: spiriva nz

Pingback: tenormin 100 mg uk

Pingback: where can i buy thorazine

Pingback: order toprol 100 mg

Pingback: tricor without a prescription

Pingback: valtrex 500 mg online

Pingback: vantin 200 mg price

Pingback: verapamil tablet

Pingback: voltaren online pharmacy

Pingback: wellbutrin coupon

Pingback: buy zanaflex 2mg

Pingback: zestril 10 mg cheap

Pingback: zithromax purchase

Pingback: visit this web-site

Pingback: zocor for sale

Pingback: zyloprim online pharmacy

Pingback: zyprexa prices

Pingback: zyvox tablet

Pingback: how to buy sildenafil

Pingback: tadalafil 80mg without a prescription

Pingback: cheapest furosemide 40 mg

Pingback: how to purchase escitalopram 5 mg

Pingback: aripiprazole 15 mg pharmacy

Pingback: pioglitazone prices

Pingback: spironolactone 100mg purchase

Pingback: glimepiride canada

Pingback: meclizine 25mg tablets

Pingback: leflunomide 10 mg no prescription

Pingback: cost of atomoxetine 25 mg

Pingback: donepezil without a doctor prescription

Pingback: anastrozole 1mg cheap

Pingback: irbesartan 150mg otc

Pingback: where can i buy dutasteride 0,5mg

Pingback: olmesartan purchase

Pingback: cheap buspirone 5 mg

Pingback: cheapest cefuroxime

Pingback: buy celecoxib 100 mg

Pingback: where can i buy citalopram

Pingback: cephalexin online pharmacy

Pingback: ciprofloxacin 1000 mg pills

Pingback: clindamycin 150 mg for sale

Pingback: clozapine tablets

Pingback: prochlorperazine 5mg prices

Pingback: how to purchase carvedilol

Pingback: warfarin without a doctor prescription

Pingback: rosuvastatin 20mg prices

Pingback: divalproex medication

Pingback: trazodone 25 mg medication

Pingback: tolterodine over the counter

Pingback: acetazolamide canada

Pingback: where to buy fluconazole 50 mg

Pingback: phenytoin 100 mg purchase

Pingback: oxybutynin without a doctor prescription

Pingback: doxycycline 100mg tablets

Pingback: how to buy bisacodyl 5 mg

Pingback: cialis without doctor prescription

Pingback: venlafaxine canada

Pingback: amitriptyline 50 mg generic

Pingback: permethrin cost

Pingback: erythromycin australia

Pingback: how to buy cialis in costa rica

Pingback: how to purchase estradiol 1mg

Pingback: etodolac medication

Pingback: cheap tamsulosinmg

Pingback: liquid flagyl for sale

Pingback: alendronate medication

Pingback: generic names for tadalafil and cialis

Pingback: where can i buy viagra in melbourne

Pingback: how to purchase nitrofurantoin

Pingback: sildenafil hoe gebruiken

Pingback: how long for ivermectin to work rosacea

Pingback: cost of glipizide

Pingback: generic viagra from england

Pingback: hydrochlorothiazide 10mg without prescription

Pingback: isosorbide pills

Pingback: sumatriptan purchase

Pingback: loperamide cheap

Pingback: comprar cialis por internet espaГ±a

Pingback: azathioprine uk

Pingback: viagra atlanta

Pingback: how to purchase lamotrigine 25 mg

Pingback: how to buy terbinafine

Pingback: cheapest sildenafil citrate 100mg pills

Pingback: where to buy levothyroxine mcg

Pingback: atorvastatin 20mg australia

Pingback: amoxicillin canada price

Pingback: furosemide 200 mg tab

Pingback: zitromax

Pingback: ivermectin 3mg dosage

Pingback: ventolin pills

Pingback: buy gemfibrozil 300 mg

Pingback: metoprolol 100mg no prescription

Pingback: clotrimazole 10g over the counter

Pingback: doxycycline and antacids

Pingback: prednisolone topical cream

Pingback: dapoxetine online usa

Pingback: diflucan storage temperature

Pingback: synthroid generic brand

Pingback: online order propecia

Pingback: tadalafil chewable tablets 20 mg

Pingback: buy online hydroxychloroquine 200mg

Pingback: generic vidalista price comparison

Pingback: adderall and neurontin

Pingback: metformin renal dosing

Pingback: paxil blood thinner

Pingback: online prescription viagra

Pingback: oral ivermectin

Pingback: furosemide brand name uk

Pingback: tadalafil 1mg

Pingback: how long does viagra take to work

Pingback: what happens when you take cialis

Pingback: can women take cialis

Pingback: omeprazole class action lawsuit

Pingback: lexapro medication

Pingback: duloxetine blue and whie 30mg

Pingback: reliable propecia online

Pingback: best cialis

Pingback: ivermectin egg withdrawal

Pingback: tadalafil free shipping

Pingback: ivermectin dose for adults

Pingback: ivermectin for infants

Pingback: can u buy zithramax over counter

Pingback: relion ventolin hfa

Pingback: zithromax for chlamydia reviews

Pingback: buy dapoxetine online

Pingback: over the counter azithromycin cvs

Pingback: get azithromycin over counter

Pingback: stromectol cvs over the counter

Pingback: where can i buy ivermectin

Pingback: ivermectin 1%

Pingback: ivermectin pill cost

Pingback: tadalafil and dapoxetine

Pingback: generic viagra prescription online

Pingback: iver mectin

Pingback: tadalafil online

Pingback: tadalafil krka prix

Pingback: buy generic cialis

Pingback: tadalafil cost walmart

Pingback: stromectol 3 mg price

Pingback: cialis online

Pingback: cialis pills for men

Pingback: tadalafil mylan

Pingback: prednisone 20mg vidal

Pingback: merck covid pill ingredients

Pingback: cialis canada

Pingback: cialis over the counter

Pingback: cialis price canada

Pingback: ivermectin tablets

Pingback: buy viagra online

Pingback: where can i buy viagra

Pingback: cialis online

Pingback: buy viagra online

Pingback: the borgata online

Pingback: ivermectin pills for humans

Pingback: zone free online casino games

Pingback: tadalafil otc

Pingback: cialis price walmart

Pingback: generic cialis tadalafil

Pingback: ivermectin in humans

Pingback: cialis tadalafil

Pingback: stromectol walmart

Pingback: stromectol usa

Pingback: buying ivermectin

Pingback: buy ivermectin 6mg otc

Pingback: topical ivermectin cost

Pingback: tadalafil sandoz

Pingback: ivermectin 0.5% brand name

Pingback: ivermectin 6mg over the counter

Pingback: buy ivermectin

Pingback: buy ivermectin 12 mg otc

Pingback: ivermectin 6 mg tabs

Pingback: ivermectin dengue

Pingback: purchase furosemide 20 mg

Pingback: can i order furosemide

Pingback: ivermectin nahdi

Pingback: stromectol 6 mg dosage

Pingback: stromectol in canada

Pingback: ivermectin india

Pingback: ivermectin cream

Pingback: luckyland login

Pingback: stromectol price us

Pingback: ivermectin 1 cream

Pingback: ivermectin studies

Pingback: ivermectina price

Pingback: cost of 20 mg cialis at walmart

Pingback: ivermectin online

Pingback: ivermectin stromectol

Pingback: stromectol msd

Pingback: ivermectin paste for humans

Pingback: walmart pharmacy

Pingback: ivermectin lotion for scabies

Pingback: buy viagra online

Pingback: ivermectin covid

Pingback: stromectol tablets for humans for sale

Pingback: stromectol online

Pingback: bahis siteleri

Pingback: ivermectin over the counter uk

Pingback: stromectol 12mg online

Pingback: uttar pradesh ivermectin

Pingback: order stromectol for human

Pingback: stromectol cost

Pingback: stromectol 12

Pingback: discount cialis

Pingback: 20mg cialis walmart

Pingback: cialis vs.viagra reviews

Pingback: buy propecia online hong kong

Pingback: cheapest place to buy propecia online

Pingback: stromectol 3 mg online

Pingback: Is 8 shots of vodka a lot hydroxychloroquine and zinc

Pingback: What happens if you take turmeric everyday

Pingback: What to avoid while on antibiotics

Pingback: How does nebulizer for essential oils work

Pingback: Buy Stromectol 12mg - What is a natural source of antibiotics

Pingback: z pack 500 mg dosing for 5 days: What should I eat while on antibiotics

Pingback: what are the side effects of kamagra

Pingback: Qu'est-ce qui fait souffrir un manipulateur pharmacie en ligne france

Pingback: mirapex 1.5 mg

Pingback: cost letrozole 2.5mg

Pingback: Why do we fall in love?

Pingback: Can I do IUI at home?

Pingback: What Colour is period blood?

Pingback: Qui est que la famille qui peut prendre du viagra

Pingback: Is 7 days of antibiotics enough

Pingback: antibiotic tablets name

Pingback: What is alternative to antibiotics

Pingback: Do antibiotics flush your face

Pingback: Which foods feed viruses

Pingback: What can I drink to flush infection

Pingback: What to eat on antibiotics

Pingback: What can I drink for infection

Pingback: How can I seduce my wife physically in bed Stromectol 6 mg

Pingback: cost of levitra

Pingback: vardenafil 20mg

Pingback: What fruit is the best antibiotic

Pingback: Do antibiotics weaken your immune system

Pingback: Is Egg good for a cough

Pingback: How long does it take for immune system to recover after antibiotics

Pingback: Why is too much antibiotics bad

Pingback: Should I drink a lot of water with antibiotics

Pingback: What are the deadliest bacterial infections

Pingback: wireless over the ear headphones

Pingback: Quels sont les six familles meilleur site achat cialis

Pingback: Do you really have asthma - albuterol inhalers

Pingback: What is the number one food that causes high blood pressure buy furosemide online?

Pingback: Is it safe to take more than 2 puffs of albuterol ventolin liquid?

Pingback: Is there a way to get an inhaler without seeing a doctor - albuterol inhaler coupons

Pingback: Is asthma a big problem ventolin mini inhaler

Pingback: Is cardiovascular disease a death sentence chlorthalidone 25 mg tablet picture

Pingback: What are the potential side effects of using an inhaler? | how does albuterol work

Pingback: Quels sont les problemes de la famille comment reconnaitre un homme qui prend du viagra

Pingback: acheter cialis payer avec paypal | Quels sont les problemes de la famille

Pingback: Lack of energy and exhaustion can contribute to feelings of isolation and loneliness | synthroid 137 mcg tablet

Pingback: atorvastatin 40 mg price | Can cholesterol levels be reduced by consuming psyllium husk or supplements

Pingback: Should a man be hard every morning?

Pingback: What type of body do girls like the most?

Pingback: How long is a course of antibiotics?

Pingback: Can I drink coffee 2 hours after antibiotics?

Pingback: Quels sont les differents problemes de la famille | prix dune boite de viagra en pharmacie

Pingback: Comment savoir si l'on est impuissant viagra effet

Pingback: Quel sont les 7 familles: prix sildenafil 50 mg

Pingback: Comment savoir si elle a couche avec un autre | prix cialis 20mg boite de 8

Pingback: Can you get pregnant while pregnant

Pingback: How far should a 65 year old walk every day | buy centurion vidalista black 80

Pingback: What does taking it slow mean to a girl - how to use vidalista-20

Pingback: Sensitivity to cold temperatures, even when others feel comfortable, can be a sign of thyroid deficiency?

Pingback: Decreased ability to generate body heat, resulting in a lower overall body temperature, can be observed in individuals with thyroid-related cold intolerance?

Pingback: How does age-related decline in egg quality affect ovulation and fertility?

Pingback: Are there any specific precautions or considerations for women with a history of blood clotting disorders using clomiphene?

Pingback: child porn

Pingback: Can drinking alcohol lower cholesterol levels

Pingback: Can consuming dark chocolate in moderation help reduce the level of heart disease

Pingback: How does a guy in love act - Dapoxetine side effects

Pingback: What are four 4 elements in Deming cycle - kamagra 100mg

Pingback: Which antibiotics should not be taken together?

Pingback: How do you activate brown fat cells to lose weight?

Pingback: Quel fruit fait bander - sildenafil sandoz

Pingback: Can Benadryl help asthma

Pingback: Research and innovation continue to advance breast cancer treatment options Nolvadex vs arimidex

Pingback: cefadroxil 500mg capsule antibiotic | How much antibiotic is too much

Pingback: What is the best love word - levitra prescribing

Pingback: amoxicillin price without insurance | Can antibiotics cause permanent damage

Pingback: Are over the counter drugs effective for treating eczema. best over the counter drugs to snort

Pingback: fildena 100 mg cheap - What should I gift my BF on birthday

Pingback: Why do doctors overprescribe antibiotics stromectol from costco

Pingback: What helps your liver after antibiotics - hydroxychloroquine 200mg tablets 83cz

Pingback: What are the 5 core tools levitra pricing

Pingback: What foods are good for rebuilding your liver plaquenil 200 mg daily

Pingback: Who should not drink apple cider vinegar?

Pingback: What sleeping position makes your stomach flat ivermectin injectable?

Pingback: Can we take other medicines with antibiotics ivermectin tablets?

Pingback: Do antibiotics make you poop?

Pingback: Does hot salt water draw out infection stromectol?

Pingback: Can I take ibuprofen with antibiotics stroР’ВmecР’Вtol for head lice?

Pingback: How can I drink alcohol and keep my liver healthy stromectol 12mg online order?

Pingback: Can antibiotics be used for hospital-acquired pneumonia (HAP) stromectol cvs?

Pingback: Is green tea good for antibiotics ivermectin paste?

Pingback: How to prepare albuterol and use it in a nebulizer budesonide inhaler dose?

Pingback: What is the most popular asthma medication albuterol inhaler?

Pingback: What vitamins should I take for COPD?

Pingback: What is the strongest asthma treatment?

Pingback: When is the best time to take albuterol ventolin?

Pingback: blue cross blue shield online pharmacy?

Pingback: Can antibiotics treat rheumatic fever where can i purchase Zithromax?

Pingback: How long does it take to rebuild immune system after antibiotics Azithromycin 250 mg vs z pack?

Pingback: Can antibiotics be used to treat infective endocarditis Azithromycin online?

Pingback: Which kiss is best for boyfriend Generic 20 mg cialis??

Pingback: Which sperm is more powerful??

Pingback: Do breakups change you??

Pingback: What tests should a man have every year??

Pingback: Can erectile dysfunction be a symptom of pituitary adenoma??

Pingback: Does silence hurt an ex??

Pingback: It is important to not purchase dapoxetine from online retailers or individuals that require payment through unsecured methods such as wire transfers or cryptocurrency.?

Pingback: It is important to ensure that you understand how to properly take dapoxetine and to follow the instructions provided by your healthcare professional.?

Pingback: What does low B12 feel like??

Pingback: izmir escort

Pingback: child porn

Pingback: Can I take sildenafil forever Cenforce??

Pingback: Medications: The Cornerstone of Disease Prevention and Treatment Cenforce 100mg brand.

Pingback: Medications and Respiratory Health - Breathing Easy for a Healthier Life stromectol over the counter

Pingback: What happens if you go a week without Nutting buy Cenforce 50mg without preion?

Pingback: Can erectile dysfunction be a side effect of pelvic radiation therapy levitra generico?

Pingback: Medications and Sexual Health - Restoring Intimacy and Wellness priligy 60 mg buy?

Pingback: Medications and Blood Sugar Control - Balancing Glucose, Sustaining Energy Cenforce 200 for sale?

Pingback: Medications - Addressing Mental Health Stigma Head-On how to get the fastest results vidalista 20?

Pingback: Medications and Chronic Headache Management - Finding Relief Cenforce over the counter drugs?

Pingback: Unlocking the Potential of Precision Medicine for Personalized Health Care stromectol 12mg online pharmacy?

Pingback: Viral Hepatitis - Diagnosis, Treatment, and Prevention vidalista 20 dosage?

Pingback: Medications - The Key to Managing Chronic Migraines buy Cenforce without prescription?

Pingback: hydroxychloroquine sulfate?

Pingback: buy stromectol 6mg?

Pingback: dapoxetine usa?

Pingback: side effects of albuterol?

Pingback: Medications and Precision Medicine - Tailoring Treatments to Individuals buy Cenforce 100mg generic?

Pingback: The Science of Sleep - Secrets to a Restful Night can i take two 50 mg viagra pills?

Pingback: Autoimmune Diseases in Women - Unmasking Gender Disparities generic viagra over the counter?

Pingback: Medications and Inflammatory Bowel Disease - Soothing the Gut ivermectin?

Pingback: Medications and Vision Health - Clear Sight for a Brighter Future purchase Cenforce generic?

Pingback: çeşme transfer

Pingback: Can a guy release sperm without feeling it cialis 5mg best price?

Pingback: How do you know your partner doesn't love you anymore viagra walgreens price?

Pingback: How does sleep apnea affect sexual health levitra vs kamagra?

Pingback: What is the most common cause of hypertensive crisis buy furosemide 100mg online cheap

Pingback: Can antibiotics prevent infection in patients with central line-associated bloodstream infections zithromax 250 z-pak

Pingback: What are the benefits of not Nutting kamagra 4 u

Pingback: dapoxetine where to buy

Pingback: buy Cenforce 100mg pills

Pingback: prima mist inhaler

Pingback: green viagra pill

Pingback: kamagra sildenafil citrate

Pingback: fildena 100mg

Pingback: What happens to a female when they are turned on??

Pingback: What is Limerence??

Pingback: hd porno izle

Pingback: izmir travesti

Pingback: where can you buy dapoxetine in store - How do you know if a girl loves you deeply?

Pingback: priligy 60 mg prezzo - How do you know your ex moved on?

Pingback: buy fildena 50mg generic

Pingback: albuterol nebulizer

Pingback: fildena pill

Pingback: men viagra before and after photos

Pingback: 100mg sildenafil citrate and 60mg of dapoxetine.

Pingback: yasam ayavefe

Pingback: priligy

Pingback: clomid 50 mg success

Pingback: cialis 5 mg precio

Pingback: androgel generic

Pingback: Tadalafil dosage 40 mg

Pingback: testosterone gel for women

Pingback: kamagra gold

Pingback: androgel prostate cancer

Pingback: vilitra 60 credit card

Pingback: vilitra 60 credit card

Pingback: androgel coupon

Pingback: proair cost

Pingback: albuterol sulfate hfa

Pingback: cenforce 50

Pingback: order vidalista 20mg

Pingback: lejam dapoxetine 30 mg

Pingback: Are there any benefits to drinking alcohol generic of plaquenil?

Pingback: What is a natural antibiotic for humans hydroxychloroquine?

Pingback: dapoxetine buy online india

Pingback: vidalista 80

Pingback: buy Cenforce generic

Pingback: where can i buy legit priligy pills

Pingback: vidalista 5mg

Pingback: Generic clomid price

Pingback: levitra sale

Pingback: cialis 10 mg precio walmart

Pingback: flagyl for uti

Pingback: buy amoxicillin without prescription

Pingback: Azithromycin pill

Pingback: buy amoxicillin online

Pingback: amox-clav 875 125 mg

Pingback: what is super kamagra

Pingback: cenforce 150 india

Pingback: cenforce 100

Pingback: buy kamagra 100mg oral jelly

Pingback: cenforce 100 india

Pingback: jojobet

Pingback: jojobet twitter

Pingback: fildena 100

Pingback: side effects of vidalista

Pingback: Sildenafil pills

Pingback: cenforce chewable

Pingback: buy levitra at walmart

Pingback: vidalista smart farming

Pingback: buy cenforce 200mg

Pingback: buy super p force

Pingback: Sildenafil prescriptions over internet

Pingback: cenforce 100

Pingback: Cenforce

Pingback: cenforce

Pingback: oral fildena 50mg

Pingback: fildena 50

Pingback: dapoxetine hydrochloride tablets 60mg

Pingback: Where Buy Cheap clomid pill

Pingback: samsung taşınabilir ssd

Pingback: seretide diskus 250

Pingback: side effects of vidalista

Pingback: buy vidalista 60 online cheap

Pingback: Sildenafil 100

Pingback: buspar for anxiety

Pingback: order sildenafil 50mg pills

Pingback: ciprodex ear drops cost

Pingback: ciprodex ear drops dosage for adults

Pingback: buy advair diskus 250 50

Pingback: Sildenafil Prices at walmart

Pingback: lasix dosage

Pingback: loniten 5mg hair loss

Pingback: clindagel cost

Pingback: ivermed 6

Pingback: covimectin 12 uses

Pingback: bursa travesti

Pingback: stromectol for lice

Pingback: ivermectol 3

Pingback: stromectol 3mg dosage

Pingback: iverheal 12 tablet

Pingback: iverjohn 12 tablet

Pingback: bmw

Pingback: kadinlar

Pingback: vermact 12 dosage

Pingback: stromectol over the counter

Pingback: stromectol 3 mg 20 tablet

Pingback: cost of levitra

Pingback: tadalista vs viagra

Pingback: is vidalista 20 safe

Pingback: is vidalista the same as cialis

Pingback: istanbul travesti

Pingback: vermact 12 mg tablet uses

Pingback: ankara travesti

Pingback: clomiphene for men

Pingback: branded dapoxetine priligy 30mg

Pingback: priligy canada

Pingback: extra super p force tablet

Pingback: edebiyat tumblr

Pingback: qvar inhaler price

Pingback: ivecop medicine

Pingback: ankaratravesti.xyz

Pingback: buy revatio

Pingback: viagra cost costco

Pingback: sildenafil+dapoxetine brand in india

Pingback: priligy dapoxetina 60 mg

Pingback: fildena 25

Pingback: rybelsus price

Pingback: dapotime + vidalista

Pingback: ankara travesti ilanları

Pingback: why was motilium discontinued

Pingback: sultangazi rent a car

Pingback: levitra effectiveness

Pingback: istanbul dental teknik servis

Pingback: gebze epoksi zemin kaplama

Pingback: rize tumblr

Pingback: buy celexa online

Pingback: buy citopam

Pingback: prague erotic massage

Pingback: prague tantra massage

Pingback: cenforce 100 olx

Pingback: is asthalin inhaler addictive

Pingback: sildenafil 50mg tablet

Pingback: sildenafil 50mg generic

Pingback: inovapin.com

Pingback: super extra p force

Pingback: malegra fxt 140mg

Pingback: asthalin inhaler 200 mcg uses

Pingback: gaziantep saat tamiri

Pingback: scavista12

Pingback: generic stromectol

Pingback: Cenforce 200 male enhancement

Pingback: amoxicillin price without insurance

Pingback: vidalista 20 mg

Pingback: kütahya günlük apart daire

Pingback: super p force price indiamart

Pingback: takipçi satın al tumblr

Pingback: vidalista 80mg

Pingback: Cenforce 100mg brand

Pingback: kütahya günlük apart

Pingback: vidalista 20 reviews

Pingback: vidalista mГјГјk

Pingback: vidalista 60 mg bestellen

Pingback: avanafil quanto dura l'effetto

Pingback: cenforce 100 goedkoopste

Pingback: stendra copay card

Pingback: vidalista 60

Pingback: poxet 30 dapoxetine

Pingback: berlin chemie spedra tablette

Pingback: fildena 100 with credit card purchase

Pingback: tab fertomid 50 mg in hindi

Pingback: fildena double 200 mg

Pingback: Cenforce 200 for sale

Pingback: cenforce 200 afhalen

Pingback: cialis generic vidalista

Pingback: cenforce 100 india

Pingback: ankara psikolog

Pingback: super vidalista side effects

Pingback: super vidalista ervaringen

Pingback: fertomid 50 for male

Pingback: super vidalista ervaringen

Pingback: geciktirici kremler

Pingback: malegra in english

Pingback: order Cenforce generic

Pingback: yapay kızlık zarı

Pingback: is vidalista safe 20mg a generic pill for cialis

Pingback: buy fildena

Pingback: fildena professional

Pingback: lasix

Pingback: meritking giriş

Pingback: meritking gir

Pingback: meritking news

Pingback: çorlu klima servisi

Pingback: meritking şikayetvar

Pingback: silivri avukat

Pingback: loniten 10mg pfizer

Pingback: isotroin medicine

Pingback: karşıyaka psikolog

Pingback: hp servis izmir

Pingback: best price on levitra

Pingback: Tamoxifen-teva 10 mg 30 tablet

Pingback: ivermed 12

Pingback: mumbai kamagra

Pingback: buy sildenafil 100mg and dapoxetine 100mg.

Pingback: vidalista 60

Pingback: buy generic Cenforce 100mg

Pingback: Azithromycin 500 mg

Pingback: levitra 20mg how to use

Pingback: vidalista vs viagra and cialis

Pingback: cialis professional 40mg

Pingback: sildigra ct7

Pingback: buy beclomethasone inhaler

Pingback: benuryl

Pingback: isotroin 300

Pingback: tr güncel içerik listesi

Pingback: buspirone 15 mg

Pingback: clomid cost

Pingback: en iyi bayan azdırıcı hangisi

Pingback: is lipitor over the counter or prescription

Pingback: the use of ventolin inhaler

Pingback: ivermectino.com

Pingback: sulfatealbuterol.com

Pingback: lasixotc.com

Pingback: canlı maç izle

Pingback: prednisolone acetate eye drop price

Pingback: plaquenil generic

Pingback: kamagra cheap

Pingback: free little blue pill viagra

Pingback: manciali.wordpress.com

Pingback: levitinfo.wordpress.com

Pingback: strmcl.wordpress.com

Pingback: fildenforyou.wordpress.com

Pingback: onglyza 5 mg tab

Pingback: cenforce360.com

Pingback: extra super p force 200mg

Pingback: Nolvadex 20 mg prix

Pingback: cathopic.com/@zpak

Pingback: tab vermact

Pingback: pill amox 500 gg 849

Pingback: vigrakrs.com

Pingback: dapoxetine usa

Pingback: covimectin 12 side effects

Pingback: scavista 12 a

Pingback: vidalista.homes

Pingback: otclevitra.com

Pingback: Fildena india

Pingback: Ventolin inhaler untuk apa

Pingback: buy viagra eu

Pingback: iverheal 12 tablet

Pingback: zhewitra 10 mg

Pingback: everest trial tolvaptan

Pingback: what is Vidalista professional

Pingback: kayseri taksi

Pingback: ciprofloxacin hcl

Pingback: sildetails.wordpress.com

Pingback: ivermectol 12 mg

Pingback: stromectol tablets

Pingback: durjoy

Pingback: buy cenforce 200mg online

Pingback: Vidalista 90

Pingback: kamagra jellies

Pingback: pusulabet

Pingback: misty casino

Pingback: revia price

Pingback: ciprodex ear drops price

Pingback: buy alphagan p eye drops

Pingback: purchase amoxil sale

Pingback: buy hydroxychloroquine online

Pingback: proair inhaler clogged

Pingback: can i buy dapoxetine pills from walmart

Pingback: cipillsvi.com

Pingback: albuterolinh.com

Pingback: zpak.net

Pingback: donpharm.com

Pingback: cenforceindia.comcenforce-100.html

Pingback: flagyltb.com

Pingback: stromectolgl.com

Pingback: albyterol.com

Pingback: synthroiduuu.com

Pingback: viastoreus.com

Pingback: levitrafrance.com

Pingback: synthroidvbo.com

Pingback: vidalista.lol

Pingback: ventolinhfaer.com

Pingback: samplefocus.com/users/fildena-50

Pingback: interreg-euro-med.eu/forums/users/seroflo-inhaler/

Pingback: buy lipitor online uk

Pingback: priligy dapoxetine 30mg

Pingback: priligy

Pingback: priligy dapoxetine buy on-line

Pingback: buy clomiphene citrate 50 mg

Pingback: cheaper kamagra

Pingback: iverdon plus

Pingback: Ventolin hfa generic

Pingback: nolvadex

Pingback: kamagra oral jelly for sale

Pingback: revatio medicine

Pingback: tadacip 20 mg for sale

Pingback: beclomethasone dipropionate

Pingback: Azithromycin for std

Pingback: fertomid 25 tablets for male uses

Pingback: order lasix online

Pingback: kamagra 50mg