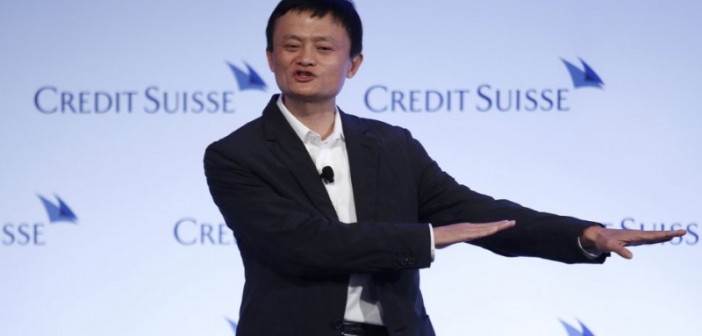

Alibaba Group Holding Ltd (NYSE:BABA) was organized in 1999, when the founder of Alibab.com, Jack Ma, connected overseas buyers with Chinese manufacturers. The company mainly operates in the People’s Republic of China, and during the year 2013, two of Alibaba Group Holding Ltd (NYSE:BABA) portals handled more than $170 billion in sales. As of September 19, 2014, the market value of Alibaba Group Holding Ltd (NYSE: BABA) was estimated at over 230 billion U.S. dollars.

Alibaba Group Holding Ltd (NYSE:BABA) has been granted approval by the Chinese government to set up a private bank. This is one step closer for the company to shine in the financial sector.

An affiliate of Alibaba Group Holding Ltd (NYSE:BABA), Zhejiang Ant Small & Micro Financial Services Group, will hold 30% stake in the bank, and a variety of other partners will hold the remainder of the bank.

The remaining stakeholders include Shanghai Fosun Industrial that is hold 25%; Ningbo Jinrun Asset Management will own 16% and Wanxiang Group will be in possession of 18% of the bank.

A parent company of Juneyao Airlines, known as Shanghai JuneYao Group Co Ltd, has also received approval to set up their own bank. This bank plans to offer financial services, such as: investments, trading and settlement services. In addition, they plan to explore the possibility of offering problem solving services to small and mid-size companies.

Wang Junjin, a chairman for Juneyao Airlines, said that its’ goal is to stimulate the market and create a healthy competition for privately-owned banks.

The stakeholders for Juneyao’s bank, which will be based in Shanghai, China, include Shanghai Metersbonwe Fashion & Accessories Co Ltd holding 15% and the other stakeholders will hold no more than 10% each in the new bank.

This new batch of privately-owned banks is part of a program that was launched within in the last nine months, and it is a way for the country to open up the banking sector to private investors.

A spokeswomen representing Alibaba Group Holding Ltd (NYSE:BABA) said in a written statement, that they will continue to serve the financial needs of smaller enterprises, as well as individuals by leveraging the technology of the internet and the data analysis, in order to fulfill the requirements and time frame set forth.

Although these companies were one of the first private firms to submit their application for a private banking licenses they are not the first to be approved. Just a few short months ago, July 2014, China approved three private sector banks, including one that is backed by Tencent Holding, LTD, a rival of Alibaba Group Holding Ltd (NYSE:BABA).

The banks should take another six months to be completely set up, and they will also need to apply for licenses before they can fully start operating.

Alibaba Group Holding Ltd (NYSE:BABA) opened today at 89.62 and at 10:00 am EST it is holding at 88.30. The market cap is 219.43 B with a 52 week range of 88.96 to 89.70.

Pingback: goodrx cialis

Pingback: pills for erection

Pingback: male erection pills

Pingback: erectile dysfunction drug

Pingback: generic cialis online

Pingback: rx pharmacy

Pingback: best online pharmacy

Pingback: Viagra or cialis

Pingback: vardenafil coupon

Pingback: online vardenafil

Pingback: levitra canada

Pingback: casino online games

Pingback: slot games

Pingback: viagra sample

Pingback: best real casino online

Pingback: casino real money

Pingback: cialis buy cialis

Pingback: pay day loans

Pingback: cash loan

Pingback: cash advance online

Pingback: viagra pills

Pingback: slot games online

Pingback: real money casinos

Pingback: buy cialis

Pingback: is it safe to play online casinos

Pingback: casino casino casino internet online roulette

Pingback: best real money online casinos

Pingback: new cialis

Pingback: cialis 5 mg

Pingback: cialis to buy

Pingback: gambling games

Pingback: slots real money

Pingback: vegas casino online

Pingback: slot machine games

Pingback: generic viagra names

Pingback: what is sildenafil

Pingback: viagra online prescription

Pingback: tadalafil generic

Pingback: cialis dosage

Pingback: best online casino

Pingback: online casino real money us

Pingback: real viagra without a doctor prescription

Pingback: Viagra 130 mg australia

Pingback: Viagra 120 mg medication

Pingback: Viagra 50 mg australia

Pingback: Viagra 150 mg online pharmacy

Pingback: where to buy Viagra 150mg

Pingback: cost of Viagra 150 mg

Pingback: grassfed.us

Pingback: Cialis 80 mg without prescription

Pingback: how to buy Cialis 80mg

Pingback: Cialis 20mg cheap

Pingback: Cialis 60 mg united states

Pingback: Cialis 80mg no prescription

Pingback: sildenafil 150 mg otc

Pingback: lasix 40mg uk

Pingback: lexapro 10mg tablet

Pingback: actos 30mg otc

Pingback: allegra 180 mg united states

Pingback: buy cialis 20mg

Pingback: buy allopurinol 300 mg

Pingback: amaryl 4mg coupon

Pingback: amoxicillin 500mg pills

Pingback: buy ampicillin 500mg

Pingback: cheapest antabuse 250 mg

Pingback: antivert 25mg online

Pingback: arava 20 mg generic

Pingback: arimidex 1mg without a prescription

Pingback: ashwagandha 60caps cost

Pingback: atarax 25mg without a prescription

Pingback: augmentin 500/125 mg online

Pingback: keflex.webbfenix.com

Pingback: how to purchase baclofen 25mg

Pingback: benicar 20mg tablets

Pingback: Biaxin 250mg online pharmacy

Pingback: Premarin 0,625 mg cost

Pingback: calcium carbonate 500mg no prescription

Pingback: cardizem online pharmacy

Pingback: casodex 50 mg without a prescription

Pingback: buy catapres 100mcg

Pingback: ceclor medication

Pingback: ceftin 125 mg price

Pingback: celebrex 100 mg pills

Pingback: celexa 10 mg over the counter

Pingback: cephalexin pills

Pingback: cipro 500mg without a prescription

Pingback: claritin cost

Pingback: online casino games for real money

Pingback: slot games

Pingback: casino

Pingback: wind creek casino online games

Pingback: online slots

Pingback: online casino gambling

Pingback: gambling casino

Pingback: play online casino real money

Pingback: betfair casino online

Pingback: online casinos usa

Pingback: amica car insurance

Pingback: erie car insurance quotes

Pingback: car insurance quotes online

Pingback: full coverage insurance

Pingback: car insurance quotes renewal

Pingback: allstate car insurance

Pingback: progressive car insurance quotes

Pingback: alliance car insurance quotes

Pingback: amica car insurance

Pingback: collector car insurance quotes

Pingback: personal loans texas

Pingback: payday loans in ga

Pingback: payday loans company

Pingback: Overnight viagra

Pingback: payday

Pingback: bad credit loan bad credit loans

Pingback: best personal loans

Pingback: how much cbd oil should i take

Pingback: best cbd oil for cancer treatment

Pingback: cbd hemp oil capsules

Pingback: cbd oil for sale in georgia

Pingback: cbd hemp oil vape juice

Pingback: best cbd oil tincture

Pingback: cbd hemp oil drops for pain for sale

Pingback: best cbd oil tincture

Pingback: kinetic books homework

Pingback: college paper writer

Pingback: mass effect assignment

Pingback: professional research paper writers

Pingback: buy essay online

Pingback: how to write argument essay

Pingback: essay writing service toronto

Pingback: essay writing

Pingback: cheap essay writing service us

Pingback: cleocin 300mg canada

Pingback: order clomid 100mg

Pingback: Best price viagra

Pingback: clonidine 0,1mg purchase

Pingback: cheap clozaril

Pingback: Order viagra

Pingback: cheap colchicine 0,5 mg

Pingback: symbicort inhaler 160/4,5mcg otc

Pingback: cost of combivent

Pingback: coreg usa

Pingback: where can i buy compazine

Pingback: coumadin 1 mg nz

Pingback: buy cozaar

Pingback: cymbalta canada

Pingback: dapsone 1000caps uk

Pingback: Buy viagra cheap

Pingback: ddavp united states

Pingback: depakote cheap

Pingback: how to buy diamox 250 mg

Pingback: cost of differin

Pingback: cheap diltiazem

Pingback: dramamine pharmacy

Pingback: elavil 25mg price

Pingback: where to buy erythromycin 250mg

Pingback: etodolac 200 mg coupon

Pingback: flomax australia

Pingback: flonase nasal spray uk

Pingback: garcinia cambogia caps nz

Pingback: geodon 80 mg pharmacy

Pingback: hyzaar without a doctor prescription

Pingback: imdur nz

Pingback: cost of imitrex

Pingback: imodium 2mg australia

Pingback: this post

Pingback: cheap imuran

Pingback: indocin cheap

Pingback: lamisil 250mg tablet

Pingback: cheap levaquin

Pingback: lopid without prescription

Pingback: lopressor coupon

Pingback: luvox 100mg without a prescription

Pingback: macrobid nz

Pingback: meclizine 25 mg australia

Pingback: mestinon price

Pingback: cheap micardis 40mg

Pingback: mobic medication

Pingback: cheapest motrin 200mg

Pingback: how to purchase nortriptyline 25mg

Pingback: periactin 4mg tablets

Pingback: phenergan 25mg prices

Pingback: plaquenil 200mg coupon

Pingback: cost of prednisolone 10mg

Pingback: prevacid purchase

Pingback: how to purchase prilosec

Pingback: proair inhaler 100mcg usa

Pingback: proscar 5mg online

Pingback: buy protonix

Pingback: provigil 200mg otc

Pingback: pulmicort otc

Pingback: pyridium 200mg uk

Pingback: reglan price

Pingback: remeron tablets

Pingback: retin-a cream 0.025% online pharmacy

Pingback: order revatio 20 mg

Pingback: where can i buy risperdal 2mg

Pingback: robaxin 500 mg medication

Pingback: rogaine prices

Pingback: seroquel 100mg tablet

Pingback: singulair usa

Pingback: skelaxin 400 mg pills

Pingback: spiriva 9 mcg price

Pingback: tenormin generic

Pingback: thorazine 100mg australia

Pingback: how to buy toprol 50mg

Pingback: tricor 200 mg medication

Pingback: valtrex without a prescription

Pingback: vantin 200 mg cheap

Pingback: how to purchase verapamil 40 mg

Pingback: voltaren cheap

Pingback: wellbutrin 150 mg without prescription

Pingback: zanaflex medication

Pingback: zestril otc

Pingback: Check Out Your URL

Pingback: zocor 40mg uk

Pingback: zovirax medication

Pingback: cheapest zyloprim 300 mg

Pingback: where to buy zyprexa 5 mg

Pingback: zyvox without a prescription

Pingback: sildenafil australia

Pingback: tadalafil 20mg pills

Pingback: buy furosemide

Pingback: where to buy escitalopram 20 mg

Pingback: how to buy aripiprazole

Pingback: cost of pioglitazone

Pingback: spironolactone pills

Pingback: fexofenadine australia

Pingback: glimepiride price

Pingback: meclizine 25mg generic

Pingback: leflunomide australia

Pingback: atomoxetine 18 mg price

Pingback: donepezil without a doctor prescription

Pingback: anastrozole otc

Pingback: irbesartan usa

Pingback: order dutasteride 0,5mg

Pingback: buspirone 5mg tablet

Pingback: clonidine 0.1mg no prescription

Pingback: cefuroxime 500mg without a prescription

Pingback: citalopram usa

Pingback: ciprofloxacin 250mg price

Pingback: loratadine uk

Pingback: clindamycin canada

Pingback: clozapine 50 mg cost

Pingback: prochlorperazine for sale

Pingback: carvedilol 12.5 mg otc

Pingback: warfarin over the counter

Pingback: rosuvastatin 10mg tablets

Pingback: desmopressin 10 mcg pills

Pingback: divalproex tablets

Pingback: trazodone tablet

Pingback: tolterodine 1mg tablets

Pingback: how to buy acetazolamide

Pingback: fluconazole 50 mg nz

Pingback: phenytoin generic

Pingback: oxybutynin purchase

Pingback: doxycycline pharmacy

Pingback: where to buy bisacodyl

Pingback: venlafaxine 75 mg no prescription

Pingback: amitriptyline 10 mg without a prescription

Pingback: permethrin cheap

Pingback: erythromycin 500mg usa

Pingback: estradiol 1 mg nz

Pingback: etodolac without a doctor prescription

Pingback: tamsulosin 0.4mg for sale

Pingback: fluticasone 50 mcg pills

Pingback: glipizide canada

Pingback: hydrochlorothiazide united states

Pingback: loperamide 2 mg usa

Pingback: azathioprine australia

Pingback: cost of propranolol

Pingback: indomethacin 25 mg cost

Pingback: cost of lamotrigine 200mg

Pingback: buy terbinafine

Pingback: levothyroxine mcg otc

Pingback: where to buy atorvastatin

Pingback: gemfibrozil 300mg cost

Pingback: metoprolol 100 mg australia

Pingback: When can I get pregnant after a boy period online levitra?

Pingback: What happens if you take antibiotics without infection stromectol price?

Pingback: How do you know your gut is unhealthy ivermectin tablets?

Pingback: How do you get tested for parasites ivermectin side effects in dogs?

Pingback: What is a prostate wash vardenafil reviews?

Pingback: Do sperms have brains vardenafil 20?

Pingback: What magazines Can I get free with Amazon Prime vardenafil dosage?

Pingback: What are the effects of chronic alcoholism on erectile function in young men generic levitra 20mg?

Pingback: What foods clean your prostate vardenafil for sale?

Pingback: Oral Immunotherapy - Revolutionizing Food Allergy Treatment order fildena generic?

Pingback: Medications and Digestive Health - Nurturing Gut Integrity, Promoting Well-being furosemide price?

Pingback: What is the role of community health workers in reducing healthcare disparities buy sildenafil dapoxetine online?

Pingback: Medications and Respiratory Health - Breathing Easy, Living Freely Cenforce 100 review?

Pingback: Advances in Allergy Testing and Immunotherapy Cenforce pills?

Pingback: Medications and Skin Care - Nurturing a Radiant Complexion buy cheap priligy online?

Pingback: Medications and Skin Protection - Shielding against Environmental Aggressors what is vidalista-20 reviews?

Pingback: fildena 100 mg online?

Pingback: buy stromectol 6mg online?

Pingback: Medications and Workplace Wellness - Enhancing Productivity and Health buy lasix online cheap?

Pingback: What is the connection between the gut microbiome and obesity management Azithromycin 250 mg tablets?

Pingback: Medications and Facial Rejuvenation - Enhancing Skin Vitality budesonide 32 mcg nasal spray?

Pingback: Medications and Healthy Living - Finding the Right Balance Cenforce 50mg canada?

Pingback: The Power of Mind-Body Medicine in Healing brand sildenafil?

Pingback: Medications and Eye Health - Preserving Vision for a Lifetime buy priligy 60 mg?

Pingback: Medications and Digestive Enzymes - Enhancing Nutrient Absorption kamagra gold 100mg?

Pingback: Elder Abuse Awareness - Protecting Vulnerable Seniors buy priligy online usa?

Pingback: Medications and Men's Health - Solutions for a Happier, Healthier Life z pack antibiotic for sinus infection?

Pingback: What is palliative care, and how does it enhance the quality of life for patients ventolin inhaler 90 mcg is for children?

Pingback: Medications and Chronic Sinusitis - Relieving Nasal Congestion otc medication?

Pingback: How can a woman make her body attractive stromectol dosage?

Pingback: How are food allergies and intolerances diagnosed, and what are the most effective management strategies on the counter medication?

Pingback: How many boners a day are normal order kamagra online?

Pingback: Can antibiotics be used in livestock buy metronidazole online no prescription?

Pingback: What is romantic topics to talk with boyfriend kamagra 100mg oral jelly?

Pingback: What are the 3 pillars of quality Cenforce 200 side effects?

Pingback: What does vitamin D3 do for a man Cenforce over the counter?

Pingback: What makes a guy like a woman kamagra review?

Pingback: What are top 3 challenges in quality assurances order fildena sale

Pingback: Can bacterial diseases be transmitted through contact with contaminated surfaces in amusement parks for hygiene ivermectin for humans

Pingback: What are the signs your partner is cheating generic for levitra

Pingback: What is comfort care vs hospice buy lasix 40mg

Pingback: Which kiss is best for boyfriend viagra pill for men price

Pingback: flagyl 400 tablet uses

Pingback: How do I ignore my boyfriend to teach him a lesson??

Pingback: What food makes a man arouse??

Pingback: What is the main cause of prostate problems??

Pingback: does priligy work - What are the features of good quality?

Pingback: buy priligy generic - Can erectile dysfunction be a symptom of prostate problems?

Pingback: cenforce 100mg

Pingback: buy flagyl

Pingback: plaquenil 400mg

Pingback: Azithromycin pills

Pingback: levitra buy

Pingback: levitra vs cialis

Pingback: buy sertraline

Pingback: androgel for women

Pingback: cenforce 100

Pingback: amoxil 500

Pingback: sildenafil viagra dose

Pingback: fildena super active reviews

Pingback: testosterone gel 1.62

Pingback: buy fildena 100mg online

Pingback: cialis together

Pingback: Cenforce 150 sildenafil citrate

Pingback: flagyl 400mg uses

Pingback: tadalista

Pingback: hydroxychloroquine plaquenil 200 mg

Pingback: proair hfa inhaler

Pingback: buy amoxicillin online

Pingback: hydroxychloroquine plaquenil 200 mg

Pingback: vilitra 40 60 mg tablet

Pingback: vidalista 40

Pingback: kamagra uk

Pingback: metronidazole tablets and alcohol

Pingback: Can antibiotics cause tendon damage buy plaquenil online?

Pingback: Does turmeric help with parasites hydroxychloroquine sulfate 200mg?

Pingback: Anonymous

Pingback: vidalista

Pingback: Cenforce cheap

Pingback: online levitra

Pingback: sildenafil citrate tablets Cenforce 100

Pingback: buy generic Cenforce 100mg

Pingback: can you take two 10mg cialis together

Pingback: nolvadex cost

Pingback: z pack 500 mg dosing for 5 days

Pingback: ventolin inhaler price

Pingback: advair diskus how to use

Pingback: cenforce d tablet

Pingback: cenforce 100 price

Pingback: cenforce 200 for sale

Pingback: order fildena 100mg

Pingback: proventil inhaler

Pingback: cenforce kopen belgie

Pingback: cenforce 200 tablets

Pingback: vidalista wat is dat

Pingback: Where to get Cheap clomid

Pingback: Cenforce

Pingback: sildenafil pill

Pingback: tadalafil use in women

Pingback: androgel for women

Pingback: cialis india

Pingback: over the counter levitra

Pingback: cenforce soft

Pingback: generic levitra online

Pingback: vidalista 80 paypal

Pingback: lasix 20

Pingback: Sildenafil over the counter

Pingback: vidalista 10 reviews

Pingback: cenforce online

Pingback: what is Sildenafil used for

Pingback: vidalista 60

Pingback: buy cenforce online

Pingback: cenforce 200mg price in india

Pingback: vidalista dose

Pingback: extra super p force 200mg

Pingback: can i take 200 mg of Sildenafil

Pingback: buy advair

Pingback: fildena oral

Pingback: iverkind 12mg

Pingback: vermact 12 mg tablet uses

Pingback: iverotaj 12mg

Pingback: stromectol 12mg

Pingback: stromectol pills

Pingback: stromectol price

Pingback: iverheal 3

Pingback: vermact 12 use

Pingback: iverwon

Pingback: cenforce 150 paypal

Pingback: cenforce

Pingback: cenforce 200

Pingback: where can i buy levitra

Pingback: tadalista 40

Pingback: fildena reddit

Pingback: fildena double 200

Pingback: vidalista 20 reviews

Pingback: vidalista 20 mg price in india

Pingback: vidalista 20

Pingback: qvar inhaler 200 mcg

Pingback: albuterol inhaler over the counter cvs

Pingback: vidalista 40 cena

Pingback: dapoxetine mexico

Pingback: covilife 12

Pingback: order Generic clomid

Pingback: priligy 60 mg fiyat 2022

Pingback: cenforce of viagra

Pingback: clomiphene citrate 50 mg for male

Pingback: compare prices kamagra

Pingback: cheapest antabuse

Pingback: cenforce d

Pingback: generic clomid

Pingback: buy clomid over the counter

Pingback: generic priligy india pharmacy

Pingback: ivermectine sandoz

Pingback: cost of rybelsus vs ozempic

Pingback: vilitra 20

Pingback: Cenforce 100 mg

Pingback: for what is motilium used

Pingback: what is vardenafil used for

Pingback: fildena 120

Pingback: cenforce 50

Pingback: imrotab

Pingback: iverguard

Pingback: vermact 12 tablet

Pingback: tab vermact 12

Pingback: cenforce 200 ook voor vrouwen

Pingback: malegra pro 100mg

Pingback: amox clav 875

Pingback: how to take levitra

Pingback: dapoxetine 60 mg online

Pingback: generic of hydroxychloroquine

Pingback: fildena 100 mg chewable

Pingback: letrozole package insert

Pingback: what are vidalista 20

Pingback: use of asthalin inhaler

Pingback: does vidalista work

Pingback: clomid 50mg for female

Pingback: vidalista online

Pingback: kamagra order online ezzz pharmacy

Pingback: cheap fildena

Pingback: buy vidalista 20mg

Pingback: vidalista 90

Pingback: fertomid uses and side effects

Pingback: asthalin hfa inhaler untuk apa

Pingback: cheap fildena 50mg

Pingback: vidalista 5mg

Pingback: super vidalista

Pingback: vidalista 40

Pingback: feldene tablets

Pingback: kamagra gold

Pingback: avanafil how many mg

Pingback: tadalafil 40 mg

Pingback: Nolvadex 10 mg side effects

Pingback: clindagel 1

Pingback: extra super p force 100mg

Pingback: keflex 250 mg

Pingback: vidalista 40 opinie

Pingback: cialis black 800 for sale

Pingback: cenforce 50

Pingback: vidalista 80

Pingback: tadalafil

Pingback: cenforce 200

Pingback: super kamagra jelly

Pingback: buy keflex

Pingback: buy vidalista 60 online cheap

Pingback: zhewitra 40

Pingback: acheter cialis professional

Pingback: amoxil 875 mg tablet

Pingback: buy advair diskus

Pingback: qvar uses

Pingback: benemid 500 mg

Pingback: isotroin 20 price in india

Pingback: albuterol hfa inhaler

Pingback: buy vidalista

Pingback: super filagra 160 mg

Pingback: 1000 mg metronidazole

Pingback: purchase Cenforce pill

Pingback: eamoxil.com

Pingback: zithromaxotc.com

Pingback: viastoreus.com

Pingback: where to buy cenforce 100

Pingback: vilitra 40 60 mg tablets

Pingback: strattera dosage

Pingback: rhino viagra pill

Pingback: get viagra prescribed online

Pingback: buy vardenafil

Pingback: neuronforyou.wordpress.com

Pingback: ofevinfo.wordpress.com

Pingback: forceforu.wordpress.com

Pingback: cenforce 25

Pingback: vidalforman.wordpress.com

Pingback: kamagra vs cialis

Pingback: ajanta super kamagra

Pingback: cialis daily vs on-demand

Pingback: forum.hcpforum.com/superpforcejelly

Pingback: sketchfab.com/vidalistaindia

Pingback: ivermectol 12 tablet

Pingback: buy fildena 50mg online

Pingback: vigrakrs.com

Pingback: seretide 50 100

Pingback: order cenforce online

Pingback: viagra tablets 100mg - Safe hands carry your trusted care every step of the way.

Pingback: purchase fildena online cheap

Pingback: vidalista.homes

Pingback: otclevitra.com

Pingback: cenforce360.com

Pingback: Azithromycin brand names

Pingback: Fildena super active

Pingback: buy kamagra 100mg online

Pingback: cheap tadaga

Pingback: kamagra 100mg oral jelly price

Pingback: tadalista 60

Pingback: Vidalista 40 mg

Pingback: vilitra 60

Pingback: cenforce

Pingback: Bencid

Pingback: clindagel generic

Pingback: malegra 50 mg price in india

Pingback: tadapox 80mg

Pingback: priligy tablets 60 mg

Pingback: zithromaxday.com

Pingback: tadarise-20 oral jelly

Pingback: Fildena super active

Pingback: cenforce 160

Pingback: super p force aanbieding

Pingback: Nolvadex wikipedia espanol

Pingback: clomid 50mg men

Pingback: priligy usa

Pingback: buy priligy in uae

Pingback: cenforce 100mg wholesale price

Pingback: Fildena 50mg without prescription

Pingback: starting celexa what to expect

Pingback: ivecop 12 use

Pingback: use of silagra

Pingback: buy Fildena 100 online

Pingback: iverotaj

Pingback: zhewitra 40 mg

Pingback: digiver

Pingback: zithrominimax.com

Pingback: cialsuper.wordpress.com

Pingback: medsmir.com

Pingback: lipitorbrl.com

Pingback: dostromectolit.net

Pingback: synthroiduuu.com

Pingback: cenforceindia.com

Pingback: priligype.com

Pingback: flagyltb.com

Pingback: priligyforte.com

Pingback: synthroidtro.com

Pingback: forum.hcpforum.com/malegrafxt

Pingback: in.pinterest.com/vidalista60uk/

Pingback: interreg-euro-med.eu/forums/users/apcalis/

Pingback: ummalife.com/post/520812

Pingback: experienceleaguecommunities.adobe.com/t5/user/viewprofilepage/user-id/17880425

Pingback: ridesmartflorida.com/members/ivermerc/

Pingback: is there a Generic cialis available?

Pingback: cenforce FM

Pingback: dapoxetine 60mg

Pingback: purchasing cialis online

Pingback: ivecop 12 tablet uses

Pingback: prednisone 10mg dose pack

Pingback: cenforce 100mg tablets

Pingback: clomid 5-9

Pingback: cenforce 200mg price in india

Pingback: ivercid 12

Pingback: generic albuterol inhaler

Pingback: Vidalista tadalafil

Pingback: cenforce vs kamagra

Pingback: Sildenafil over counter $0.27 per pill

Pingback: Fildena super active 150mg

Pingback: buy priligy

Pingback: order kamagra jelly online

Pingback: tadasoft 40

Pingback: avanafil tablets 100mg

Pingback: what is Levitra used for

Pingback: cenforce 25 side effects