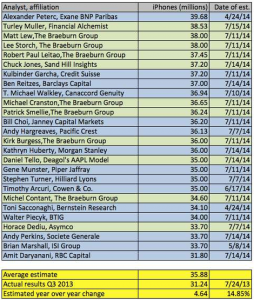

Apple Inc (NASDAQ: AAPL)’s third quarter sales have analysts reporting a wide range of figures. Predictions for the company’s iPhone sales are anywhere between 31.8 million to 39.7 million units.

According to Electronista, the following analysts have released their predictions:

This huge range of estimates means that it is nearly impossible to call an accurate figure for the company’s third quarter. The estimation range is almost 8 million units, which is about $5 billion difference in revenue (given that the average going price for an iPhone is roughly $600). Taking into account the $300 Apple’s iPhone contributes to pre tax profit (give or take a bit), it is estimated that Apple pays taxes at about a 26% rate, and thus over $1 billion of income for the company is at risk.

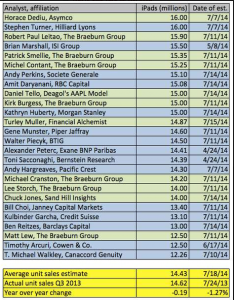

As for iPads, analysts’ calls are not that much more accurate, ranging fro 12 to 16 million iPads. The 4 million units difference translates to abot $1.6 billion in revenue, but means less material profits than the iPhone to the tech company.

However, it seems that these approximations are generally stretched. The growth for the smartphone market has slowed down this year, with an estimated growth around 20% year over year. Growth in China is particularly weak. According to Kantar World Panel, Apple is losing its market shares in many countries around the world. Slower growth and decreasing market share do not lead to more unit sales.

A method Apple has been using to bolster sales in the latest quarters is by selling the iPhone 4S in emerging markets for discounted prices. By selling the aged iPhone, Apple can maintain its market share, but does not significantly help its net income. Some analysts estimated that 10 million of the company’s second quarter sales of 43 million were from the 4S models. While that quarter was a success for the company, the sales would have been disappointing had it not been for those 10 million iPhone 4S sales to keep the company’s head above the water.

Despite the high number of units sold, the average selling prices actually decreased. Thus, Apple’s year over year profit increased only slightly in the second quarter. Earnings per share increased, mainly due to share buybacks.

Apple’s competition against Samsung, another powerful force in the industry, has not subsided in the smartphone and tablet market. The South Korean electronics company reported a softer June quarter, attributing its weakening sales to slower growth and growing competition. It is only natural that to assume that Apple is pressured by these same factors.

Pingback: Buy viagra discount

Pingback: discount cialis

Pingback: Alternative for viagra

Pingback: canadian pharmacy cialis 20mg

Pingback: erection pills viagra online

Pingback: male erection pills

Pingback: ed medications

Pingback: cvs pharmacy

Pingback: pharmacy online

Pingback: Real cialis online

Pingback: Cialis in usa

Pingback: vardenafil 20 mg

Pingback: vardenafil generic

Pingback: levitra dosage

Pingback: best online casino usa

Pingback: free viagra

Pingback: casinos

Pingback: live casino slots online

Pingback: online loans

Pingback: personal loan

Pingback: viagra cost

Pingback: new cialis

Pingback: online casino usa

Pingback: best real money online casinos

Pingback: cialis 5 mg

Pingback: generic for cialis

Pingback: cialis internet

Pingback: virtual bingo ball machine

Pingback: viagra online prescription free

Pingback: nellie

Pingback: casino game

Pingback: casino games win real money

Pingback: canadian pharmacy viagra

Pingback: buy viagra new york

Pingback: female viagra

Pingback: buy viagra online cheapest

Pingback: cialis 10mg

Pingback: buy viagra

Pingback: viagra buy

Pingback: viagra dosage

Pingback: buy viagra uk cheap

Pingback: Viagra 120mg without a prescription

Pingback: Viagra 50mg otc

Pingback: Viagra 130 mg tablets

Pingback: cost of Viagra 50 mg

Pingback: Viagra 130 mg prices

Pingback: Viagra 200mg without prescription

Pingback: cheap viagra

Pingback: Cialis 20 mg without prescription

Pingback: Cialis 80mg online

Pingback: Cialis 40 mg australia

Pingback: cheapest levitra 10 mg

Pingback: furosemide 100 mg tablets

Pingback: propecia 5mg no prescription

Pingback: lexapro 20mg canada

Pingback: actos 15mg cost

Pingback: aldactone 100 mg generic

Pingback: Trust tnStore

Pingback: allopurinol 300 mg coupon

Pingback: amaryl 4mg coupon

Pingback: amoxicillin 500 mg canada

Pingback: strattera 25 mg cost

Pingback: aricept 10mg cost

Pingback: tamoxifen 20 mg tablet

Pingback: augmentin 250/125 mg purchase

Pingback: avapro 150mg generic

Pingback: avodart 0,5mg over the counter

Pingback: bactrim 400/80 mg united states

Pingback: cheapest benicar 40 mg

Pingback: cialis 20 mg best price

Pingback: Premarin 0,625mg purchase

Pingback: calcium carbonate 500 mg canada

Pingback: how to buy casodex

Pingback: ceclor over the counter

Pingback: where can i buy celebrex

Pingback: cephalexin cheap

Pingback: cipro uk

Pingback: viagra canada online pharmacy

Pingback: claritin 10 mg otc

Pingback: best online casino

Pingback: gambling casino

Pingback: ed man man ed

Pingback: where to buy pure organic cbd oil

Pingback: can money buy you happiness essay

Pingback: order symbicort inhaler 160/4,5mcg

Pingback: crestor 20mg otc

Pingback: depakote 500 mg pharmacy

Pingback: order etodolac

Pingback: flomax 0,2 mg cheap

Pingback: hyzaar over the counter

Pingback: imodium united states

Pingback: click this

Pingback: lopid 300 mg price

Pingback: where can i buy luvox 100 mg

Pingback: vantin coupon

Pingback: furosemide 40 mg purchase

Pingback: donepezil 5 mg united kingdom

Pingback: where to buy buspirone 10mg

Pingback: where to buy clonidine

Pingback: cefuroxime united kingdom

Pingback: loratadine no prescription

Pingback: where can i buy clozapine 100mg

Pingback: desmopressin 0.1 mg without prescription

Pingback: oxybutynin 2.5mg canada

Pingback: 141generic2Exare

Pingback: cost of estradiol 2mg

Pingback: tamsulosin 0.4mg cheap

Pingback: wat kost sildenafil

Pingback: how long does ivermectin take to kill scabies

Pingback: cialis contrareembolso en espaГ±a

Pingback: propranolol 10mg no prescription

Pingback: buy indomethacin 75 mg

Pingback: how to buy terbinafine 250 mg

Pingback: levofloxacin without a doctor prescription

Pingback: atorvastatin cheap

Pingback: amoxicillin oral

Pingback: furosemide 160 mg

Pingback: buy zithromax cheap

Pingback: ivermectin ebay

Pingback: ventolin over the counter nz

Pingback: clotrimazole without a prescription

Pingback: doxycycline teeth staining

Pingback: prednisolone acetate drops

Pingback: clomid ovulation calculator

Pingback: metoclopramide canada

Pingback: dapoxetine forum

Pingback: synthroid expiration

Pingback: free propecia

Pingback: buy neurontin 100mg

Pingback: metformin package insert

Pingback: plaquenil for covid

Pingback: What are the five needs of a man levitra 5 mg?

Pingback: Sepsis - A Silent Killer in Healthcare vardenafil?

Pingback: Medications and Mental Resilience - Strengthening Emotional Well-being purchase Cenforce online?

Pingback: Medications and Gut Health - Balancing Microbes, Enhancing Digestion dapoxetine 60 mg price?

Pingback: Medications - Unlocking New Possibilities in Disease Management stromectol 12mg tablets?

Pingback: Medications and Healthy Habits - A Comprehensive Approach to Well-being hydroxychloroquine sulfate 200 mg tablet?

Pingback: generic priligy india pharmacy?

Pingback: Medications and Facial Rejuvenation - Enhancing Skin Vitality order Cenforce 100mg?

Pingback: Medications and Skin Care - Nurturing a Radiant Complexion vidalista 10 mg?

Pingback: Medications and Hair Health - Nurturing Strong and Vibrant Locks kamagra gold?

Pingback: Cutting-edge Medications Improve Quality of Life for Patients levitra no prescription?

Pingback: Advancements in Medications Drive Medical Progress dapoxetine usa?

Pingback: Comment se passe l'accouplement chez l'Homme prix tadalafil 20mg?

Pingback: How do you make a baby viagra 150 mg pills?

Pingback: Is it normal for a guy to release quickly cost of viagra per pill?

Pingback: What is the best medicine for nighttime wheezing ventolin hfa

Pingback: Can you take turmeric every day Azithromycin for std

Pingback: furosemide 100mg tablet

Pingback: dapoxetine

Pingback: metronidazole flagyl 500 mg tablet

Pingback: albuterol mdi

Pingback: vidalista 10

Pingback: Azithromycin prices

Pingback: plaquenil generic 200 mg coupon

Pingback: how does albuterol work

Pingback: ivermectin tablets

Pingback: Cenforce 200 mg

Pingback: plaquenil generic

Pingback: Can antibiotics be used for brain infections hydroxychloroquine sulfate?

Pingback: Anonymous

Pingback: dapoxetine

Pingback: buy sildenafil sale

Pingback: priligy tablets

Pingback: Cenforce 200

Pingback: tadalafil online

Pingback: buy redihaler

Pingback: Zithromax generic name

Pingback: advair diskus 500/50

Pingback: advairdiskus

Pingback: cenforce 150

Pingback: ivermectin where to buy

Pingback: buy Cenforce without prescription

Pingback: Viagra

Pingback: Sildenafil Viagra

Pingback: vidalista 60 mg on amazon

Pingback: sildenafil pill

Pingback: vidalista 60

Pingback: buy extra super p force

Pingback: how to take Sildenafil 20 mg

Pingback: cheap generic levitra

Pingback: vidalista 40 amazon

Pingback: vidalista professional

Pingback: hydroxychlor 200 mg

Pingback: buy furosemide water pill

Pingback: durvet duramectin equine wormer paste 12 tubes

Pingback: stromectol 3 mg

Pingback: cheap kamagra 100mg

Pingback: vermovent

Pingback: stromectol for scabies

Pingback: stromectol 12mg

Pingback: iverheal 12mg tab

Pingback: stromectol pills

Pingback: hydroxychloroquine 200 mg

Pingback: Qvar dosing

Pingback: dapoxetine 60 mg price

Pingback: vilitra 20 еЉ№жћњ

Pingback: prednisolone 1 eye drops

Pingback: order furosemide pill

Pingback: cenforce 200mg

Pingback: vidalista 40 reviews

Pingback: vidalista

Pingback: extra super tadarise 100mg

Pingback: rybelsus class

Pingback: rybelsus coupon

Pingback: vidalista 60

Pingback: kamagra sildenafil

Pingback: levitra professional

Pingback: citadep 10 mg tablet uses

Pingback: citalopram 10mg

Pingback: asthalin inhaler content

Pingback: s citadep

Pingback: vidalista 20mg online

Pingback: safe vidalista dosage

Pingback: stromectol for humans

Pingback: ivermite 6mg uses for lice

Pingback: ivera 12mg

Pingback: scavista medicine

Pingback: cenforce

Pingback: levitra

Pingback: Antibiotic medication

Pingback: super p force price indiamart

Pingback: suhagra 100mg benefits

Pingback: not ovulating on femara

Pingback: vidalista 60 mg on amazon

Pingback: safe vidalista dosage

Pingback: loniten 2.5 mg for hair loss

Pingback: buy fildena

Pingback: black tadalafil 80mg

Pingback: zhewitra 40

Pingback: mychelle kamagra instagram

Pingback: tadalista 40mg

Pingback: buy hydroxychloroquine

Pingback: ventolin hfa side effects

Pingback: cialis oral jelly erfahrungen

Pingback: cialis daily when to take

Pingback: buy levitra at walmart

Pingback: probenecid probalan

Pingback: reviews isotroin 10

Pingback: duralast 60 mg online

Pingback: vilitra 60mg

Pingback: poxet dapoxetine

Pingback: cenforceindia.com

Pingback: otcalbuterol.net

Pingback: kmgra.com

Pingback: filitra 20mg

Pingback: assurans 20 mg side effects

Pingback: cialis on female

Pingback: cenforce 100 miglior prezzo

Pingback: pfizer viagra pills

Pingback: filitra 10 mg

Pingback: what color are viagra pills

Pingback: kamaforman.wordpress.com

Pingback: viasuper.wordpress.com

Pingback: samscainfo.wordpress.com

Pingback: lasiinfo.wordpress.com

Pingback: parasithelp.wordpress.com

Pingback: ivercid tablet uses

Pingback: ofevinfo.wordpress.com

Pingback: cenforinfo.wordpress.com

Pingback: buy azithromycin 250 mg treatment

Pingback: forum.hcpforum.com/priligy

Pingback: vigrakrs.com

Pingback: how can i get viagra pills

Pingback: ivercon

Pingback: otclevitra.com

Pingback: kamagra oral jelly where to buy

Pingback: buy cenforce 100 online

Pingback: restasis vs xiidra

Pingback: sildamax online reviews

Pingback: tab silagra 10

Pingback: Fildena 100 mg purple buy

Pingback: does 60 mg of priligy work

Pingback: rybelsus weight loss

Pingback: malegra oral jelly 100mg

Pingback: buy amoxicillin cvs

Pingback: super kamagra 160mg

Pingback: extra super p force tablet

Pingback: pharmacy technician online program

Pingback: oral jelly 100mg kamagra price

Pingback: sildenafil order

Pingback: buy advair diskus

Pingback: cialis professional online

Pingback: 2017 reddit where buy priligy

Pingback: Sildenafil

Pingback: sertraline and propranolol

Pingback: vardenafil 10 mg

Pingback: vilitra 20 mg

Pingback: tadalista 5

Pingback: order generic Cenforce

Pingback: ciprodex otic generic

Pingback: beclomethasone dipropionate

Pingback: fluorometholone acetate ophthalmic suspension uses

Pingback: buy priligy

Pingback: acular eye drops price

Pingback: sildalis vs viagra

Pingback: tolvaptan in later stage autosomal dominant polycystic kidney disease

Pingback: malegra oral jelly use

Pingback: ventolinof.com

Pingback: priligyforte.com

Pingback: albuterolotc.com

Pingback: cialismalew.com

Pingback: tadalafilendy.com

Pingback: duricefzsu.com

Pingback: vidalista.lol

Pingback: vidalista1.website3.me

Pingback: zithromaxday.com

Pingback: priligype.com

Pingback: hitabs.com/fildena

Pingback: clairepatella.com/forums/users/stromectol/

Pingback: cathopic.com/@probenecid

Pingback: where to Buy Tamoxifen online

Pingback: ivermite

Pingback: covimectin 12 price

Pingback: order sildenafil 50mg

Pingback: Azithromycin over counter

Pingback: stromectol 3mg

Pingback: Vidalista 40

Pingback: valif oral jelly 20 mg

Pingback: canada Levitra

Pingback: oral jelly 100mg kamagra price

Pingback: fertomid

Pingback: cialis generique lilly

Pingback: +38 0950663759 – Владимир (Сергей) Романенко, Одесса – Обман! В объявлении «как новый», в руках — брак. ТВАРЬ перестал отвечать.

Pingback: Fildena 200mg

Pingback: Fildena Ч—Ч•Ч•ЧЄ Ч“ЧўЧЄ

Pingback: what does Levitra look like

Pingback: metronidazole 500 mg antibiotic side effects

Pingback: testosterone gel for men

Pingback: Fildena reddit

Pingback: Ventolin inhaler blue