Bank of America (NYSE: BAC) is on the path to a bright future. Several recent decisions and instances suggest that the company is finally moving on from its past as a criticized company and surge ahead. The bank was heavily involved in the financial crisis and mortgage excesses, and as a result has gotten in trouble with the United States government. However, it seems like the company is finally putting those issues to rest and is preparing itself to take an advantageous position in the market.

Last week, Bank of America increased its common stock dividend for the first time in 7 years. This signified a turning point for the company – the bank was capable of raising its dividend because of the efforts taken to improve its finances, such as its balance sheets, capital, and liquidity. The increase in its dividends also means that the company is complying with government regulations.

Earlier this year, at the end of April, Bank of America reported that it had recorded false regulatory capital ratios to the United States Federal Reserve. As a result, the company was forced to put on hold its plans to increase its quarterly dividend from $0.01 to $0.50. The company also had to buy back a total of $4 billion in common stock.

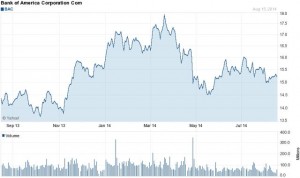

The chart below shows that the bank’s stock was rising before this misreport, meaning that investors were anticipating the events to come. As government regulation hurdles are cleared, the company is then able to develop its growth. The company continues to add value for shareholders by repurchasing shares and through dividends. The combination of these efforts can push the company to the ranks of other companies in the banking and investment space.

Additionally, Bank of America’s book value grew last quarter, and is finally beginning to approach a reliable value. These positive changes pushed the stock up, but then only to be brought down by the company’s mistake. However, this seems to be a great opportunity for investors to buy into the stock, because it seems like the company is heading up.

Bank of America will be further supported by its growing interest rates. While rates have remained conservative for now and have fell back due to the Ukraine incident, once the geopolitical incident becomes old news the rates should be back on their upwards track. Increased interest rates will positively affect Bank of America’s net interest margin and boost its earnings. With more capital, the Bank will invest in value creation and growth for shareholders.

Bank Of America Is Left With One COO

Yesterday, Bank of America announced that the company’s highest paid senior manager, Thomas K. Montag, will become the single chief operating officer of Bank of America. The former co-COO, David Darnell, will is relocating to Florida.

Darnell, the 61 year old former co-COO, will be the company’s vice chairman and still keep his responsibilities for managing the bank’s worldwide wealth, investment activities, and business banking. The company’s chief executive officer Brian T. Moynihan, made this announcement via an internal memo.

Montag and Darnell have shared the responsibilities of COO since 2011. Montag will be responsible for managing the company’s investment banking operations and capital markets businesses.

Moynihan, the 51 year old CEO, explained that Darnell wished to continue providing strategic leadership for the company, while he moved to Tampa, Florida with his family. In his new role, the former co-COO will be involved across the company to manage the company’s customer strategy operations. Darnell has extensive experience and knowledge in Bank of America’s client relationships, businesses, and markets.

Montag joined Bank of America in 2009 when the takeover of Merril Lynch & Co. happened.

This move is a strategic move for Montag; it emphasizes his importance in the company by making him the sole member of his position and the highest earner on multiple occasions. As for Darnell, analysts predict that he will retire soon.

A Bank of America spokesperson did not immediately respond to a request for comment on Darnell’s plans.

Montag and Darnell took on the position of co-COO’s during an incident three years ago, when the head of the company’s wealth and investment management businesses, Sallie L. Krawcheck, was booted from the company.

Other switch ups in the company include the leader of the company’s preferred and small business banking Dean Athanasia, and the head of retail banking Thong Nguyen, who will now be a part of the bank’s management team and report directly to the CEO.

Montag’s promotion included a raise in pay of 6.9 percent to $15.5 million. Darnell’s new position yielded a 5.3 percent raise to $10 million. Moynihan received a raise of 17 percent, to $14 million.

The Company

Overall, Bank of America’s stock grew 7.1 percent through the past twelve months to $15.45.

Pingback: brainsclub

Pingback: 방콕 스타킹

Pingback: FR Interieurs

Pingback: https://www.postandcourier.com/sponsored/phenq-reviews-does-this-diet-pill-actually-work/article_1cdbfb1a-395f-11ee-9d97-33c51303c959.html

Pingback: 무료웹툰

Pingback: Biladd Alrafidain

Pingback: Homepage

Pingback: เว็บสล็อต

Pingback: sex girldie

Pingback: 22 CALIBER BULLETS FOR SALE

Pingback: 꽁머니 즉시지급

Pingback: zbet911

Pingback: slot true wallet

Pingback: ปั่นสล็อตเว็บใหญ่ ทดลองเล่นเกมฟรี

Pingback: the best thai massage in denver

Pingback: ไฮเบย์

Pingback: บาคาร่าเกาหลี

Pingback: th168

Pingback: ปั้มไลค์

Pingback: slot ค่ายใหญ่ครบวงจร

Pingback: bio ethanol fireplaces

Pingback: Dark168

Pingback: เด็กเอ็น

Pingback: https://www.fapjunk.com

Pingback: กระเช้า

Pingback: gratowin casino 50 free spins

Pingback: วางระบบเน็ตเวิร์ค ระยอง

Pingback: dewajudi88

Pingback: sp2s

Pingback: Buy Codeine in Sweden online

Pingback: ddiyala

Pingback: โคมไฟ

Pingback: aviator-dengi.babycity-shsad.kz

Pingback: ขอ ฆอ.

Pingback: นำเข้าสินค้าจากจีน