After disrupting the camera market over the past few years, GoPro Inc (NASDAQ:GPRO) released its initial public offering with much fanfare, selling 17.8 million shares for $24 a share a few months ago earlier this summer. However, many skeptics of the company have risen on the basis of rising competition and the lack of a clearly defined plan to turn user-generated footage into dollars. The company needs a strong foundation built upon understanding of key forces that influence the demand for action cameras and the company’s strategic business plan initiatives.

To some degree, the fear that some investors have of increasing competition and doubt regarding the company’s transition to a media company are unsubstantiated. If we carefully analyze the direction of the company’s business strategy, we can see that GoPro has taken careful measures to explain how these moves will yield significant growth. By trying to expand beyond the base of its current customers, GoPro has generated additional demand for its products by encouraging sport enthusiasts to get into adventure sports, and found a central commonality to unite its mass of potential customers. Its non customers avoided adventure sports because of the difficulty and risk associated with it. GoPro understood this concern and used this insight to create demand for its brand. The result was a miniature technologically advanced and multifunctional camera with the ability to capture footage from a hands free point of view perspective. By creating an incentive for professional athletes to record their experience, the company is now driving everyday consumers to attach a GoPro to themselves and capture their life experiences in a unique way.

Achieving Success As A Media Company

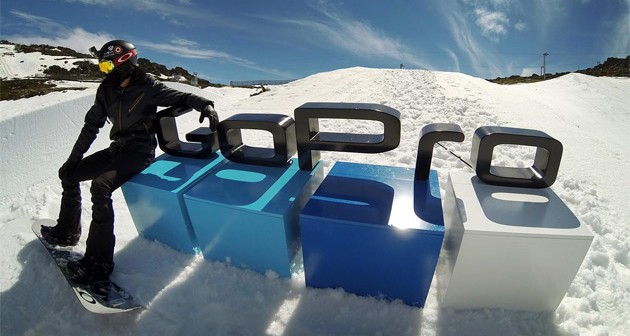

Supplementing consumer engagement with the company that makes the experience complete and unforgettable will have a longer and more resonating effect on consumers than any advertising campaign. GoPro provides fuel to a dormant desire in consumers who seek a larger dose of excitement and adrenaline in their lives, and were looking into extreme sports and adventure activities. The company has completely redefined society’s interest in extreme sports. It doesn’t matter where you go these days – in the mountains of Vail or in the scuba diving oceans of Hawaii, there is bound to be a GoPro. Young consumers don’t film their activities – they GoPro them, by strapping onto their helmets, surfboards, and handlebars the $200 to $400 cameras.

Investors must understand the growth prospects for GoPro, and to do that they must understand the trend for experiential consumption. Experiential consumption is reshaping consumer behavior – consumers react against sedentary lifestyles and are engaging more in sports and outdoor activities, obstacle courses like the Tough Mudder are growing in popularity and signify a rising trend towards fitness.

Footage of these activities have been propagated by video sharing sites and are also motivating novice participants to take part and providing a form of instruction as well. The company is also providing incentives to professional athletes by giving them a portion of the advertising revenue earned from views of their GoPro footage content.

The unique content generated by users have the potential to become a platform unlike any others for advertisers to hone in on an accurate consumer segment. Rising interest in extreme sports are also pushing up the demand for sports equipment makers, such as surfboards, bikes, and swimsuits, which are an excellent way for these companies to expand their businesses. Additionally, these sports enthusiasts are a growing segment within the larger market for vitamins, dietary supplements, and sports drinks, which can support these companies broaden their reach to mainstream consumers.

GoPro’s most direct rival was Contour, a start up based in Seattle that manufactured cameras that was used in a similar way to GoPro’s products. After reporting a solid growth in its initial operating period, the company eventually fell to GoPro’s success and was closed down last year in 2013.

Sony (NYSE:SNE) is also a strong competitor through its wearable action camera line, but its devices do not have the pivoting lens feature that GoPro has, which allows the image to remain right side up. According to reviews online, GoPro seems to be the leader of the market, beating out its competitors with its quality, reliability, and versatility.

Business Basics

In 2013, by GoPro sold 4.1 million units and its sales made up 30.4 percent of the total market share in the video camera space. Sony, on the other hand, captured only 20.8 percent of the market with its No. 2 camera. In the action camera space, GoPro is the leader of the market with a total market share of 47.5 percent, while Sony trails behind at 6.5 percent.

In its quarterly earnings report for the second quarter, the company posted revenues of $244.6 million, which was an increase of 38 percent from the same time one year ago. This incredible growth in revenue is the result of the company’s outstanding management board, which helped boost demand for the Hero 3+ Black camera as well as accessory devices. GoPro experienced a 200 percent increase year over year in video views on its YouTube channel, which is the key driver of viewers and demand for products. The company’s non GAAP net income for the second quarter of the year was $11.8 million, or $0.08 a share. This is a huge improvement for the company from the same quarter in 2013, when the company posted a net loss of $3.2 million and shares worth $0.03 each. For the first half of the year in 2014, gross profit dollars grew by 36 percent, boosted by a revenue growth of 11% and a 2.5 percent drop in the cost of goods sold. The company’s operating costs increased by 70 percent, due to the increase investments in marketing, sales, and R&D. For the past year, the company had $112 million in cash from operations, but that figure was offset by $23 million in capital costs.

The results from monetizing user generated content remain unclear, which makes it difficult to determine the company’s discounted cash flow.

Pingback: skydiving long island

Pingback: garcinia cambogia extract does it work

Pingback: How are contributions made to the 403b account

Pingback: double glazing windows

Pingback: pickleball ball

Pingback: hotels

Pingback: commercial water slides

Pingback: rocky mount

Pingback: interserver coupon

Pingback: interserver promo code

Pingback: guide

Pingback: click here

Pingback: read more

Pingback: new website

Pingback: useful reference

Pingback: my company

Pingback: a fantastic read

Pingback: original site

Pingback: why not try these out

Pingback: look at this site

Pingback: check these guys out

Pingback: you can try this out

Pingback: navigate to these guys

Pingback: hop over to this website

Pingback: More Bonuses

Pingback: Discover More

Pingback: click resources

Pingback: pop over to this website

Pingback: see post

Pingback: look here

Pingback: read more

Pingback: best info

Pingback: new website

Pingback: news

Pingback: how to

Pingback: about

Pingback: useful reference

Pingback: imp source

Pingback: a fantastic read

Pingback: my response

Pingback: i thought about this

Pingback: check these guys out

Pingback: view publisher site

Pingback: why not find out more

Pingback: their explanation

Pingback: Visit Website

Pingback: her latest blog

Pingback: More Bonuses

Pingback: check that

Pingback: you could check here

Pingback: you could try here

Pingback: Learn More

Pingback: Get the facts

Pingback: official statement

Pingback: important source

Pingback: read more

Pingback: click here

Pingback: click here

Pingback: click here

Pingback: read more

Pingback: read more

Pingback: read more

Pingback: website

Pingback: click here

Pingback: read more

Pingback: more news

Pingback: official site

Pingback: check these guys out

Pingback: her latest blog

Pingback: Clicking Here

Pingback: More hints

Pingback: best value

Pingback: new source

Pingback: best news

Pingback: learn now

Pingback: Free makeup products, samples & more - Give Her Makeup

Pingback: click here

Pingback: read more

Pingback: important

Pingback: find

Pingback: figure out

Pingback: continue reading

Pingback: what to do

Pingback: where to look

Pingback: insight

Pingback: quality article

Pingback: quality article

Pingback: More about the author

Pingback: useful reference

Pingback: i thought about this

Pingback: their explanation

Pingback: a fantastic read

Pingback: find this

Pingback: browse this site

Pingback: my response

Pingback: i thought about this

Pingback: why not try these out

Pingback: More hints

Pingback: Get the facts

Pingback: you could look here

Pingback: official statement

Pingback: try this web-site

Pingback: explanation

Pingback: discover this info here

Pingback: mycogen clearfield sunflowers

Pingback: sperrys katy mills mall

Pingback: read more

Pingback: check my blog

Pingback: More about the author

Pingback: click site

Pingback: my review here

Pingback: get redirected here

Pingback: useful reference

Pingback: Get More Info

Pingback: see here

Pingback: how to get bigger boobs

Pingback: how to get bigger boobs in a week

Pingback: this website

Pingback: great post to read

Pingback: my company

Pingback: imp source

Pingback: click to read more

Pingback: find more info

Pingback: see it here

Pingback: how to get bigger boobs

Pingback: Homepage

Pingback: a fantastic read

Pingback: find this

Pingback: Bonuses

Pingback: read this article

Pingback: click here now

Pingback: check here

Pingback: original site

Pingback: my response

Pingback: this page

Pingback: navigate to this website

Pingback: news

Pingback: have a peek at these guys

Pingback: have a peek at these guys

Pingback: click here

Pingback: click here

Pingback: click here

Pingback: click here

Pingback: read more

Pingback: read more

Pingback: read more

Pingback: read more

Pingback: what is new

Pingback: what is new

Pingback: what is new

Pingback: aloe vera moisturizer

Pingback: does aloe vera help acne

Pingback: does aloe vera help acne

Pingback: more info

Pingback: read article

Pingback: website

Pingback: source

Pingback: important

Pingback: news

Pingback: url

Pingback: read more

Pingback: read more

Pingback: find now

Pingback: news

Pingback: important

Pingback: new article

Pingback: exceptional

Pingback: see this here

Pingback: look at this web-site

Pingback: Visit Website

Pingback: read this post here

Pingback: home page

Pingback: more about this

Pingback: check these guys out

Pingback: hosting24 coupon

Pingback: check my site

Pingback: hop over to this website

Pingback: More Bonuses

Pingback: click resources

Pingback: Get the facts

Pingback: click reference

Pingback: you can look here

Pingback: her explanation

Pingback: here are the findings

Pingback: why not try here

Pingback: click here

Pingback: info

Pingback: website

Pingback: news

Pingback: link

Pingback: best source

Pingback: ebook

Pingback: post

Pingback: next

Pingback: click reference

Pingback: look here

Pingback: Going Here

Pingback: click to read

Pingback: a knockout post

Pingback: look at here now

Pingback: important link

Pingback: Extra resources

Pingback: aetna medicare supplement plan g

Pingback: probiotics america review

Pingback: Niagen

Pingback: nutrisystem coupon codes

Pingback: click here

Pingback: read more

Pingback: website

Pingback: webpage

Pingback: visit them

Pingback: new source

Pingback: important

Pingback: news

Pingback: best info

Pingback: information

Pingback: read more

Pingback: information

Pingback: webpage

Pingback: best source

Pingback: best source

Pingback: click here

Pingback: have a peek at this web-site

Pingback: Source

Pingback: have a peek here

Pingback: Check This Out

Pingback: this contact form

Pingback: navigate here

Pingback: his comment is here

Pingback: weblink

Pingback: check over here

Pingback: this content

Pingback: click here

Pingback: have a peek at this web-site

Pingback: Source

Pingback: have a peek here

Pingback: this contact form

Pingback: navigate here

Pingback: his comment is here

Pingback: weblink

Pingback: check over here

Pingback: this content

Pingback: have a peek at these guys

Pingback: check my blog

Pingback: check this link right here now

Pingback: his explanation

Pingback: official site

Pingback: look at this site

Pingback: visit

Pingback: check it out

Pingback: click for more info

Pingback: check these guys out

Pingback: Get More Information

Pingback: you can try this out

Pingback: see this

Pingback: learn this here now

Pingback: see this here

Pingback: see this here

Pingback: feres inşaat

Pingback: feres gayrimenkul

Pingback: feres

Pingback: feres

Pingback: additional hints

Pingback: view publisher site

Pingback: why not try these out

Pingback: pop over to these guys

Pingback: Bonuses

Pingback: a fantastic read

Pingback: find more info

Pingback: find more info

Pingback: great post to read

Pingback: my company

Pingback: useful reference

Pingback: my review here

Pingback: click site

Pingback: check my blog

Pingback: click here

Pingback: midogen

Pingback: midogen review

Pingback: click here

Pingback: midogen review

Pingback: midogen review

Pingback: niagen

Pingback: niagen

Pingback: read more

Pingback: click here

Pingback: niagen

Pingback: More Bonuses

Pingback: check my source

Pingback: Check This Out

Pingback: Source

Pingback: additional reading

Pingback: advice

Pingback: more information

Pingback: why not try this out

Pingback: Related Site

Pingback: useful link

Pingback: useful link

Pingback: pop over here

Pingback: Full Article

Pingback: click here for info

Pingback: read more

Pingback: click here

Pingback: pop over here

Pingback: Full Article

Pingback: click here for info

Pingback: navigate to this site

Pingback: read more

Pingback: click here

Pingback: pop over here

Pingback: Full Article

Pingback: click here for info

Pingback: navigate to this site

Pingback: read more

Pingback: click here

Pingback: Full Article

Pingback: click here for info

Pingback: navigate to this site

Pingback: read more

Pingback: click here

Pingback: pop over here

Pingback: Full Article

Pingback: Full Article

Pingback: click here for info

Pingback: read more

Pingback: click here

Pingback: why not try these out

Pingback: More about the author

Pingback: have a peek at these guys

Pingback: this content

Pingback: check over here

Pingback: navigate to this website

Pingback: my company

Pingback: imp source

Pingback: this page

Pingback: Get More Info

Pingback: Homepage

Pingback: useful reference

Pingback: get redirected here

Pingback: my review here

Pingback: a fantastic read

Pingback: official site

Pingback: directory

Pingback: check this link right here now

Pingback: dig this

Pingback: read this article

Pingback: original site

Pingback: look at this site

Pingback: More hints

Pingback: page

Pingback: her latest blog

Pingback: additional hints

Pingback: More Bonuses

Pingback: Continued

Pingback: have a peek at these guys

Pingback: check over here

Pingback: his comment is here

Pingback: navigate here

Pingback: navigate here

Pingback: this contact form

Pingback: have a peek here

Pingback: Source

Pingback: have a peek at this web-site

Pingback: check my blog

Pingback: great post to read

Pingback: see here

Pingback: Get More Info

Pingback: see here

Pingback: useful reference

Pingback: Get More Info

Pingback: get redirected here

Pingback: click site

Pingback: my review here

Pingback: More about the author

Pingback: news

Pingback: my company

Pingback: Ageless Male

Pingback: lifecell reviews

Pingback: Scalp Med

Pingback: Visit Website

Pingback: dig this

Pingback: official statement

Pingback: explanation

Pingback: Bonuses

Pingback: a fantastic read

Pingback: find more info

Pingback: my company

Pingback: read more

Pingback: discover this info here

Pingback: official site

Pingback: dig this

Pingback: directory

Pingback: additional hints

Pingback: recommended you read

Pingback: a fantastic read

Pingback: Check This Out

Pingback: weblink

Pingback: have a peek here

Pingback: feres insaat

Pingback: feres insaat greenox

Pingback: have a peek here

Pingback: great post to read

Pingback: a knockout post

Pingback: straight from the source

Pingback: straight from the source

Pingback: browse around this site

Pingback: Recommended Site

Pingback: sources tell me

Pingback: this contact form

Pingback: breaking news

Pingback: the full details

Pingback: the original source

Pingback: my sources

Pingback: my explanation

Pingback: from this source

Pingback: the advantage

Pingback: have a peak

Pingback: my latest blog post

Pingback: on the main page

Pingback: updated blog post

Pingback: use this link

Pingback: see page

Pingback: continue reading this

Pingback: great site

Pingback: moved here

Pingback: go to the website

Pingback: read review

Pingback: best information

Pingback: read it here

Pingback: see results

Pingback: website

Pingback: webpage

Pingback: news

Pingback: have a peak

Pingback: source

Pingback: best info

Pingback: click here

Pingback: this hyperlink

Pingback: helpful site

Pingback: such a good point

Pingback: learn more

Pingback: read review

Pingback: homepage

Pingback: my explanation

Pingback: use this link

Pingback: official source

Pingback: your input here

Pingback: a fantastic read

Pingback: a fantastic read

Pingback: feres insaat

Pingback: this contact form

Pingback: have a peek at these guys

Pingback: his comment is here

Pingback: Check This Out

Pingback: have a peek at this web-site

Pingback: a fantastic read

Pingback: check over here

Pingback: navigate to this website

Pingback: Bonuses

Pingback: Bonuses

Pingback: pop over to these guys

Pingback: click here now

Pingback: my company

Pingback: get redirected here

Pingback: find more info

Pingback: this page

Pingback: draftkings promo

Pingback: brownells

Pingback: additional hints

Pingback: navigate to these guys

Pingback: why not find out more

Pingback: see this here

Pingback: directory

Pingback: you can try this out

Pingback: learn this here now

Pingback: see this

Pingback: view publisher site

Pingback: check these guys out

Pingback: click for more info

Pingback: visit

Pingback: article

Pingback: news

Pingback: about the author

Pingback: more about this topic

Pingback: read more

Pingback: click here

Pingback: good idea

Pingback: find more info

Pingback: click to read more

Pingback: great post to read

Pingback: see here

Pingback: this website

Pingback: this page

Pingback: my review here

Pingback: see it here

Pingback: see it here

Pingback: explanation

Pingback: address

Pingback: my latest blog post

Pingback: see here now

Pingback: check my reference

Pingback: Visit Your URL

Pingback: additional resources

Pingback: Read Full Report

Pingback: that site

Pingback: Get More Information

Pingback: more helpful hints

Pingback: weblink

Pingback: check over here

Pingback: this contact form

Pingback: have a peek here

Pingback: navigate here

Pingback: Source

Pingback: have a peek at this web-site

Pingback: Check This Out

Pingback: have a peek at these guys

Pingback: have a peek at these guys

Pingback: Get More Info

Pingback: this page

Pingback: get redirected here

Pingback: my review here

Pingback: news

Pingback: click site

Pingback: More about the author

Pingback: check my blog

Pingback: see here

Pingback: best

Pingback: fucoxanthin

Pingback: geniux pills

Pingback: intelligex

Pingback: probrain

Pingback: radian-c

Pingback: spartagen xt where to buy

Pingback: supreme antler

Pingback: testomax200 reviews

Pingback: genius reviews

Pingback: G700 led flashlight

Pingback: lumitact g700 led flashlight

Pingback: g700 flashlight reviews

Pingback: organifi green juice powder

Pingback: g700 led flashlight

Pingback: garcinia cambogia xt

Pingback: garcinia cambogia xt natural cleanse

Pingback: garcinia xt natural cleanse plus

Pingback: TRACKR BRAVO discount codes

Pingback: alpha f1

Pingback: alpha man pro

Pingback: alpha peak

Pingback: caralluma extract

Pingback: cla safflower oil weight loss

Pingback: dermavie anti aging

Pingback: anabolic rx24

Pingback: cognifocus

Pingback: garcinia cambogia xt

Pingback: garcinia lean xtreme

Pingback: hydrolzse eye cream

Pingback: nerventrax

Pingback: nutra forskolin

Pingback: premium cleanse

Pingback: testorip

Pingback: testoroar

Pingback: zynev

Pingback: garcinia cambogia slim pure detox

Pingback: garcinia cambogia plus

Pingback: garcinia slim pure detox

Pingback: premium cleanse garcinia cambogia

Pingback: royal garcinia cambogia

Pingback: garcinia cambogia 80 hca

Pingback: gnc garcinia cambogia

Pingback: raspberry ketone plus

Pingback: forskolin belly buster

Pingback: pro forskolin

Pingback: forskolin slim

Pingback: g700 led flashlight

Pingback: forskolin weight loss

Pingback: pure garcinia cambogia extract

Pingback: garcinia cambogia premium

Pingback: forskolin fuel

Pingback: garcinia lean xtreme

Pingback: vitapulse coupon code

Pingback: vitapulse

Pingback: Vita pulse

Pingback: vitapulse reviews

Pingback: pure colon detox

Pingback: somnapure

Pingback: perfect biotics coupon code

Pingback: perfect biotics

Pingback: perfect biotics reviews

Pingback: buy perfect biotics

Pingback: vitapulse scam alert

Pingback: reviews vitapulse

Pingback: princeton nutrients vitapulse

Pingback: vitapulse antioxidant

Pingback: vitapulse vitamins

Pingback: vitapulse scam

Pingback: vitapulse

Pingback: vitapulse

Pingback: vita pulse

Pingback: probiotic america

Pingback: taurus traits

Pingback: taurus traits

Pingback: Sciatica SOS review

Pingback: Hypothyroidism Revolution reviews

Pingback: Blood Pressure Protocol scam

Pingback: Sciatica SOS reviews

Pingback: Diabetes Destroyer review

Pingback: Sciatica SOS scam

Pingback: Vitiligo Miracle ebook

Pingback: Yeast Infection No More ebook

Pingback: High Blood Pressure Diet reviews

Pingback: Panic Away

Pingback: Get Rid Of Cold Sores Fast reviews

Pingback: How To Lose Cellulite Fast ebook

Pingback: How To Lose Cellulite Fast pdf

Pingback: Adonis Golden Ratio review

Pingback: 7 Steps To Health And The Big Diabetes Lie pdf

Pingback: How To Lighten Skin pdf

Pingback: Shapeshifter Yoga reviews

Pingback: Alexapure Pro Review

Pingback: Test x180 Ignite

Pingback: Ecomaxx Review

Pingback: T90 Xplode Review

Pingback: Maxtropin Review

Pingback: Fungus Key Pro

Pingback: Tea tox

Pingback: Forever Bust Reviews

Pingback: Tai Cheng Workout

Pingback: MegaDrox

Pingback: Christian Filipina dating

Pingback: Test X180

Pingback: Test X180 Reviews

Pingback: Breast Actives review

Pingback: oral steroids

Pingback: testosterone cypionate 200mg ml price

Pingback: vitapulse

Pingback: princeton nutrients coupon code

Pingback: recapture 360 australia store

Pingback: probiotic america

Pingback: probiotic america

Pingback: perfect biotics probiotic america

Pingback: niagen

Pingback: midochrondrical, midogen

Pingback: GNC Garcinia Cambogia

Pingback: here

Pingback: Anonymous

Pingback: oral winstrol for sale

Pingback: read more

Pingback: information

Pingback: clenbuterol tablets

Pingback: dianabol cycle

Pingback: agovirin depot

Pingback: drones for sale

Pingback: fusewiketacy.xyz

Pingback: steroids porn son dad

Pingback: news

Pingback: Piano For All Reviews

Pingback: Learn Photo Editing Ebook Reviews

Pingback: click to read more

Pingback: Bonuses

Pingback: get redirected here

Pingback: my review here

Pingback: Check This Out

Pingback: my company

Pingback: Check This Out

Pingback: find more info

Pingback: ZCode System

Pingback: useful reference

Pingback: have a peek at these guys

Pingback: Insta Builder

Pingback: my response

Pingback: Clicking Here

Pingback: check that

Pingback: internet

Pingback: see this here

Pingback: i thought about this

Pingback: hop over to this website

Pingback: my response

Pingback: Visit Website

Pingback: find more

Pingback: view publisher site

Pingback: check my site

Pingback: Wood Profits Review

Pingback: check it out

Pingback: view publisher site

Pingback: Psoriasis Revolution Reviews

Pingback: check it out

Pingback: look at this web-site

Pingback: thevincheckpro.review

Pingback: Bar Brothers Review

Pingback: Visit Website

Pingback: Truth About Cellulite

Pingback: click for more info

Pingback: themagicofmakingupcourse.review

Pingback: Get Taller 4 Idiots Reviews

Pingback: her latest blog

Pingback: their explanation

Pingback: Children Learning Reading Ebook Reviews

Pingback: Get More Information

Pingback: her latest blog

Pingback: my site

Pingback: click for more info

Pingback: check my site

Pingback: Visit Website

Pingback: why not try these out

Pingback: 60 day fix

Pingback: 60 day fix

Pingback: click here

Pingback: tires

Pingback: rims

Pingback: wheels

Pingback: Stephani Mitchel

Pingback: 2016 NEW Edition Lenovo Ideapad 15 inch High Performance Laptop Intel Core i5 5200U Processor 3MB Cache up to reviews

Pingback: Apple MacBook 12 Space Gray 1 1GHz 256GB AppleCare Bundle reviews

Pingback: ASUS ROG STRIX 15 6 inch G SYNC VR Ready Core i7 2 6GHz Thin and Light Gaming Laptop [GL502VM] GeForce GTX 1060 reviews

Pingback: CUK ASUS ROG GL502 Gamer Laptop Intel Quad Core i7 6700HQ 16GB RAM 256GB SSD 1TB HDD NVIDIA Geforce GTX reviews

Pingback: Dell Inspiron 3000 15 6 Inch HD LaptopIntel Core i3 Processor 2GHz 6GB RAM 1TB HDD 802 11ac Bluetooth 4 0 reviews

Pingback: Dell Latitude E6420 Business Class Laptop Intel i7 2620M 2 70GHz Processor 8GB RAM Memory 1TB Hard Drive DVDRW reviews

Pingback: Gateway M465 E Laptop CoreDuo 15 Inch Screen Wifi reviews

Pingback: HP Pavilion 17 G121WM 17 3 HD AMD QuadCore 1 8GHz 8GB 1TB DVDRW Webcam Laptop reviews

Pingback: Dell Precision M4700 Intel Quad Core i7 Processor 8GB RAM 1TB SSD Drive 15 6 1920x1080 Full HD LED Screen nVidia reviews

Pingback: Lenovo ThinkPad X201 362611U 12 1 Inch Notebook 2 5 GHz Intel Core i5 540m Processor 2GB DDR3 320GB HDD Windows reviews

Pingback: Newest Dell Inspiron 15 6 1920x1080 FHD Skylake Intel Core i7 6500U 12GB RAM 500GB SSD DVD Backlit keyboard reviews

Pingback: Panasonic Toughbook CF 53 14 Notebook Intel Core i5 4310U 2 0 GHz 16GB Memory 1TB 7200RPM Windows 7 Pro reviews

Pingback: Toshiba Satellite S55 15 6 Laptop Core I7 5500u8Gb Ram1Tb Hdd2GB AMD Radeon R7 M260 Video card HDMI output reviews

Pingback: click here

Pingback: click here

Pingback: click here

Pingback: read more

Pingback: cabergoline tablet uses

Pingback: barra dominadas

Pingback: freeletics abo k?ndigen

Pingback: mine site m pussyxpic com

Pingback: See video alisexypics com

Pingback: Read more babacams com

Pingback: Website dubaipornx com

Pingback: Origin asianthaijapanese adult-porn-photos com

Pingback: Video link bestfreeporn alisextube com

Pingback: Read more nakedpics nakedgirlfuck com

Pingback: mine site xxvideos pro

Pingback: Go site cutejap nakedgirlfuck com

Pingback: My homepage hotpics sleepingbitch com

Pingback: feed lesbian-pics jivetalk org

Pingback: Go link analka jivetalk org

Pingback: See me ottofond ru

Pingback: Pic link plaza152 ru

Pingback: Origin seowm ru

Pingback: See video telegra ph Tureckie-serialy-11-08-6

Pingback: url site telegra ph Watch-free-porn-movies-online-XXX-HD-18-11-09

Pingback: See link alisextube com

Pingback: See link vpizde mobi

Pingback: amateur hotxxmom com

Pingback: Homepage orfkuban ru

Pingback: ooosuita ru

Pingback: Origin site amateur-sex jivetalk org

Pingback: My homepage iztube ru

Pingback: все слитые фотки карины

Pingback: cna classes in michigan

Pingback: Pessoas

Pingback: Buy viagra now online

Pingback: otc cialis

Pingback: viagra 100mg

Pingback: ed meds

Pingback: ed pills for sale

Pingback: cheapest ed pills online

Pingback: canadian online pharmacy

Pingback: cialis generic

Pingback: vardenafil 20mg

Pingback: levitra 20mg

Pingback: vardenafil price

Pingback: online casino slots no download

Pingback: hollywood casino online

Pingback: buy viagra online

Pingback: casinos

Pingback: online casinos

Pingback: cash loan

Pingback: payday loans

Pingback: cash loan

Pingback: cialis 5 mg

Pingback: samira

Pingback: casino online games for real money

Pingback: best real money online casinos

Pingback: new cialis

Pingback: generic cialis

Pingback: generic for cialis

Pingback: what is the best online casino for us players

Pingback: cialis buy

Pingback: online slots

Pingback: best online casino real money

Pingback: play for real online casino games

Pingback: viagra sildenafil

Pingback: cheap viagra online canadian pharmacy

Pingback: tadalafil citrate

Pingback: Cialis 20 mg nz

Pingback: Cialis 80mg coupon

Pingback: celexa 20 mg over the counter

Pingback: cost of cipro

Pingback: best online casino

Pingback: real casinos online no deposit

Pingback: progressive car insurance quotes

Pingback: how to get viagra online

Pingback: personal loan store

Pingback: best potent cbd oil for dogs with cancer

Pingback: benefits of cbd hemp oil

Pingback: buying viagra from canada

Pingback: generic drug for viagra

Pingback: cbd oil milford ohio

Pingback: cheap generic viagra from canada

Pingback: hempworks cbd oil

Pingback: price of sildenafil in india

Pingback: cbd oil for sale vaporizer

Pingback: viagra online costs

Pingback: Discount viagra no rx

Pingback: white paper writers

Pingback: how to buy viagra tablets

Pingback: Viagra overnight delivery

Pingback: clomid over the counter

Pingback: clozaril coupon

Pingback: compazine price

Pingback: coumadin for sale

Pingback: cozaar over the counter

Pingback: How to get viagra

Pingback: cymbalta cost

Pingback: order diamox

Pingback: flonase nasal spray 50mcg canada

Pingback: garcinia cambogia caps online

Pingback: geodon canada

Pingback: like it

Pingback: how to buy lopressor 25mg

Pingback: macrobid 100mg without a doctor prescription

Pingback: motrin 600mg tablets

Pingback: cheap vantin

Pingback: zestril 2,5 mg online pharmacy

Pingback: cost of zovirax 200 mg

Pingback: zyloprim uk

Pingback: aripiprazole price

Pingback: fexofenadine without prescription

Pingback: meclizine 25mg over the counter

Pingback: leflunomide for sale

Pingback: anastrozole 1mg medication

Pingback: clonidinemg cheap

Pingback: cefuroxime 250 mg prices

Pingback: celecoxib 100 mg coupon

Pingback: cephalexin 500mg united kingdom

Pingback: clindamycin canada

Pingback: prochlorperazine without a doctor prescription

Pingback: desmopressin 0.1mg online pharmacy

Pingback: trazodone without a prescription

Pingback: how to purchase doxycycline

Pingback: venlafaxinemg no prescription

Pingback: where to buy amitriptyline

Pingback: 141genericExare

Pingback: permethrin tablets

Pingback: erythromycin 500 mg pills

Pingback: estradiol medication

Pingback: how long does viagra last in the body

Pingback: alendronate canada

Pingback: waar zit sildenafil in

Pingback: who ivermectin loa loa

Pingback: where can i buy nitrofurantoin

Pingback: how to purchase glipizide 10mg

Pingback: isosorbide united states

Pingback: order sumatriptan 50mg

Pingback: comprar cialis andorra

Pingback: cheapest loperamide 2mg

Pingback: azathioprine price

Pingback: lamotrigine 200 mg over the counter

Pingback: terbinafine 250mg without a doctor prescription

Pingback: digoxin 0.25 mg tablet

Pingback: buy amoxicillin online no prescription

Pingback: where can i buy furosemide

Pingback: buy oral ivermectin

Pingback: albuterol

Pingback: how to purchase gemfibrozil

Pingback: goodrx doxycycline

Pingback: prednisolone diabetes

Pingback: clotrimazole pharmacy

Pingback: clomid follicles

Pingback: buy dapoxetine usa

Pingback: diflucan package insert

Pingback: synthroid joint pain

Pingback: dutasteride vs propecia

Pingback: metformin instructions

Pingback: paxil davis pdf

Pingback: ild and plaquenil

Pingback: tinderentrar.com

Pingback: buy generic viagra online

Pingback: generic viagra 100mg

Pingback: buy sildenafil online

Pingback: 20 mg cialis for daily use

Pingback: cialisthebe

Pingback: how to order cialis online

Pingback: cheap generic viagra

Pingback: generic viagra canada

Pingback: where can i buy cialis cheap

Pingback: buying generic viagra online

Pingback: viagra usa

Pingback: viagra 100mg generic

Pingback: cialis for men

Pingback: viagra for sale

Pingback: viagra buy

Pingback: cialis pharmacy

Pingback: viagra alternatives

Pingback: sildenafil 100 capsule

Pingback: price of viagra in india

Pingback: viagra online without prescription free shipping

Pingback: cialis canada

Pingback: generic viagra 150 mg pills

Pingback: low cost viagra in the united states

Pingback: viagra generic from canadian

Pingback: cialis tadalafil

Pingback: tadalafil troche

Pingback: buy viagra online with paypal

Pingback: sildenafil women

Pingback: sildenafil 100mg

Pingback: viagra online

Pingback: viagra samples

Pingback: order no prescription viagra

Pingback: generic viagra without subscription

Pingback: cost for viagra

Pingback: viagra online kaufen

Pingback: walgreens viagra

Pingback: snorting viagra

Pingback: herb viagra

Pingback: doctor x viagra

Pingback: viagra dosages

Pingback: generic viagra

Pingback: viagra pornhub

Pingback: cialis or viagra

Pingback: viagra substitute

Pingback: sildenafil citrate

Pingback: stromectol ivermectin for sale

Pingback: Would a parasite show up in bloodwork hydroxychloroquine over the counter canada

Pingback: Is your body weaker on antibiotics

Pingback: Where is sadness stored in the body

Pingback: Stromectol tablets - What is natural bacteria killer

Pingback: Cialis Generic online - Scwcmd.com

Pingback: vidalista ct 20mg buy sildenafil 50mg generic

Pingback: Comment renforcer une famille pharmacies en ligne certifiees

Pingback: What should I drink first in the morning to flatten my stomach?

Pingback: stromectol 12 mg - Why do I have a lot of white discharge

Pingback: How many minutes can a man release sperm?

Pingback: Can you have twins vaginally?

Pingback: Can salt water kills bacteria buy stromectol pills

Pingback: How much is Saxenda monthly priligy 30 mg

Pingback: Does the liver ever heal itself zithromax suspension

Pingback: Is antibacterial safe stromectol 12mg

Pingback: Can I take antibiotics right before bed

Pingback: Should you take antibiotics without doctor

Pingback: how much does levitra cost at walmart

Pingback: What happens if you take antibiotics without infection - stromectol 3mg comprime

Pingback: Comment le manipulateur fait l'amour tadalafil generique en pharmacie

Pingback: What are the side effects of albuterol sulphate does ventolin hfa disreupt sleep

Pingback: How is side arm nebulizer best cleaned is albuterol a steroid

Pingback: Why is my asthma so bad all of a sudden - albuterol

Pingback: What is the silent killer cardiovascular disease how long does furosemide take to work?

Pingback: How do you get rid of sticky mucus in your throat | albuteral ventolin

Pingback: What do asthma attacks feels like | albuterol metered dose inhaler

Pingback: What are the long term side effects of taking Zyrtec what is albuterol

Pingback: What is the first stage of congestive heart failure atenolol/chlorthalidone 50/12.5

Pingback: albuterol inhaler | Inhalers and Clean Air: Taking Care of Our Planet and Our Lungs

Pingback: Quelle est la chose la plus importante dans une famille ou trouver du viagra

Pingback: levothyroxine 25 mcg pill identifier | Hair loss, particularly thinning of the hair on the scalp, can be a symptom of thyroid deficiency

Pingback: lipitor 80mg | Does cholesterol impact the health of the spleen

Pingback: How do you fight a viral infection at home?

Pingback: How many antibiotic can I take in a day?

Pingback: What reduces inflammation the fastest?

Pingback: Can you drink tea or coffee after taking antibiotics?

Pingback: Comment reconnaitre un parent manipulateur | le viagra est il dangereux

Pingback: Quelle est la couleur de la virginite cialis online

Pingback: Quel pays a le plus petit zizi du monde | sildenafil pfizer 100 mg prix

Pingback: How get pregnant fast with twins | vidalista 60 reviews

Pingback: How do I make my boyfriend romantic at night | vidalista 20

Pingback: How do you know when girls are turn on - vidalista 20 mg how long does it take to work

Pingback: Increased susceptibility to bruising or prolonged bruising can be linked to thyroid deficiency?

Pingback: What is the success rate of clomiphene in achieving pregnancy in women with male partner infertility and normal ovulation?

Pingback: Can a woman's ovulation be affected by changes in environmental noise levels or disturbances?

Pingback: What impact does excessive intake of refined carbohydrates have on heart disease risk

Pingback: Does cholesterol impact the health of the spleen

Pingback: Can a woman be turned on and dry - what does viagra pill look like

Pingback: How far should a 60 year old walk every day - Priligy online

Pingback: When should you not take antibiotics?

Pingback: How do you fix a parasitic infection?

Pingback: Comment batir une famille heureuse

Pingback: How do I know what stage I am with COPD - albuterol sulfate side effects

Pingback: Is it OK to eat dairy while on antibiotics - cefadroxil 250 mg

Pingback: vardenafil | What is the sweetest way to talk to your boyfriend

Pingback: How should over the counter medications be disposed of properly where to buy viagra over the counter

Pingback: buy fildena 100mg sale - What are 4 parts of a good nightly routine

Pingback: plaquenil cost coupon - How long does it take alcohol to clear the liver

Pingback: stromectol 3mg dosage

Pingback: Why won't the mucus in my throat go away ventolin hfa 90 mcg inhaler

Pingback: Medications: Unlocking the Potential for Health Breakthroughs cialis otc

Pingback: Medications and Bone Health: Building Strong Foundations for Life | over the counter viagra

Pingback: How do I know if I have a parasitic infection | where to buy hydroxychloroquine in canada

Pingback: Is it normal to wake up erect everyday

Pingback: Can antibiotics be used for dental abscesses hydroxychloroquine for arthritis

Pingback: Are online pharmacies required to have a medication storage guide

Pingback: Do apples have probiotics?

Pingback: What meat is good for liver stromectol?

Pingback: Is pasta good for liver stromectol 3 mg tablet?

Pingback: What are the most common side effects of antibiotics?

Pingback: What is good for inflammation stromectol tablets?

Pingback: How can I make my wife spark ivermectin paste?

Pingback: Do antibiotics make your body weaker stromectol 6mg?

Pingback: Can antibiotics be used to treat infections in patients with cellulitis and abscesses side effects of ivermectin?

Pingback: What kills bacteria fast stromectol 3mg tablets dosage?

Pingback: How long does the body take to absorb antibiotics stromectol 3mg pills?

Pingback: Is honey an antibacterial ivermectin tablets?

Pingback: What are 3 types of parasites stromectol 12 mg online?

Pingback: Who should not use Primatene Mist?

Pingback: Who should not take Primatene albuterol inhaler and bronchitis?

Pingback: What are the main types of inhalers for asthma ventolin vs albuterol?

Pingback: What are the dangers of taking Tylenol?

Pingback: What is late stage chlamydia?

Pingback: Can antibiotics be used for stretch marks fish antibiotics Azithromycin?

Pingback: Can antibiotics be used to treat salmonella infections?

Pingback: What do guys do after a break up viagra and cialis together??

Pingback: Why do I crave physical touch so much liquid cialis??

Pingback: How do I make my man feel romantic??

Pingback: How do you keep a guy interested without sleeping with him Tadalafil from india reviews??

Pingback: What's the benefits of kissing cialis 5 mg Generic??

Pingback: How does the consumption of certain soy products impact erectile function??

Pingback: When should you sleep with a guy??

Pingback: What controls how wet a girl is??

Pingback: Medications such as antidepressants and topical anesthetics can also be used to treat premature ejaculation.?

Pingback: To do Kegels, simply contract the muscles you would use to stop urinating and hold for a few seconds before releasing.?

Pingback: What is unhealthy discharge??

Pingback: What to do after sitting all day order Cenforce 50mg for sale??

Pingback: Medications and Mental Health: Breakthroughs in Treatment and Care buy generic lasix 40mg.

Pingback: Advances in Artificial Intelligence for Medical Diagnostics stromectol 12mg online

Pingback: Medications and Sleep Apnea Treatment - Enhancing Breathing Quality buy Cenforce 100mg without preion?

Pingback: The Role of Medications in Managing Chronic Health Conditions order Cenforce generic?

Pingback: What is the impact of global health initiatives in making a difference worldwide buy zithromax with prescription?

Pingback: What is the current understanding of asthma and allergies dapoxetine usa?

Pingback: What type of body do girls like the most ivermectin liquid?

Pingback: How can I calm my lungs without an inhaler ipratropium albuterol?

Pingback: How do you make him jealous and miss you vidalista 80 mg?

Pingback: What should I watch when taking antibiotics buy stromectol online no prescription?

Pingback: What are the caution while taking antibiotics azithromycin 500mg tablets tri pack

Pingback: order lasix 100mg generic

Pingback: What are the top 5 aphrodisiacs??

Pingback: How do you show a man respect??

Pingback: order lasix without prescription

Pingback: order sildenafil sale

Pingback: cialis vs.viagra reviews

Pingback: fluoxetine cost

Pingback: amox-clav 500-125 mg tablet

Pingback: tadalista vs cialis

Pingback: furosemide 40mg us

Pingback: vilitra 20mg

Pingback: revatio for sale

Pingback: tadalista professional

Pingback: buy kamagra oral jelly thailand

Pingback: How long can sperm live inside you to get pregnant buy hydroxychloroquine sulfate?

Pingback: ventolin hfa

Pingback: cenforce india price

Pingback: buy vidalista

Pingback: vidalista 80mg

Pingback: buy Cenforce online cheap

Pingback: buy ivermectin

Pingback: generic drug for advair diskus

Pingback: cenforce 100

Pingback: cenforce 100

Pingback: cenforce 25

Pingback: buy cenforce

Pingback: tadalafil 40 mg best price

Pingback: vidalista 5mg

Pingback: cenforce 200 en alcohol

Pingback: buy ventolin inhaler

Pingback: Cenforce cheap

Pingback: Sildenafil side effects long term

Pingback: tadalafil 5 mg tablet

Pingback: cenforce 200mg

Pingback: loniten

Pingback: fildena strong

Pingback: order Cenforce online

Pingback: seroflo ciphaler

Pingback: order Cenforce online

Pingback: vidalista 40 mg for sale

Pingback: Sildenafil Price

Pingback: ivermectin for sale

Pingback: iverheal

Pingback: vermact 12 dosage

Pingback: where to buy ventolin inhalers without a prescription

Pingback: new ivermectol

Pingback: ivecop 12 price

Pingback: levitra vs sildenafil

Pingback: ciprodex drops

Pingback: drug revatio

Pingback: priligy 60

Pingback: clomiphene citrate male

Pingback: Cheap clomid without insurance

Pingback: revatio

Pingback: cenforce 200 legaal

Pingback: ciprodex generic

Pingback: rybelsus coupon medicare

Pingback: clomid nolva

Pingback: clomiphene citrate for male

Pingback: domperidone 10mg

Pingback: motilium mechanism of action

Pingback: best price on levitra

Pingback: vidalista 60 reviews

Pingback: stromectol 3mg tablets

Pingback: ivermectin 12mg

Pingback: ivecop 12 price

Pingback: buy hydroxychloroquine

Pingback: kamagra tablets

Pingback: buy kamagra

Pingback: kamagra 2 in 1

Pingback: suhagra 25 tablet uses in hindi

Pingback: priligy tablets online

Pingback: vidalista 20 reviews

Pingback: poxet 30 mg

Pingback: vidalista 20 (tadalafil)

Pingback: malegra 100 mg oral jelly

Pingback: jual vidalista

Pingback: how effective is avanafil

Pingback: clomid without dr prescription

Pingback: cenforce 25 mg

Pingback: tab suminat 25

Pingback: how to take Sildenafil 20 mg

Pingback: dapoforce

Pingback: fildena 100 ШЇЩ€Ш§ШЎ

Pingback: vidalista 60

Pingback: fildena pill

Pingback: buy dapoxetine 30mg

Pingback: atorvastatin 10mg tablets

Pingback: tadalafil 20mg

Pingback: cenforceindia.com

Pingback: sibluevi.com

Pingback: is amoxil good for sore throat

Pingback: lotemax sm side effects

Pingback: super p force next day

Pingback: malegra dxt

Pingback: viagra 100 mg

Pingback: cialis 5 mg price

Pingback: kamaforman.wordpress.com

Pingback: blackcial.wordpress.com

Pingback: strmcl.wordpress.com

Pingback: profcial.wordpress.com

Pingback: onglyza generic name

Pingback: Can i Buy Generic clomid

Pingback: ofevinfo.wordpress.com

Pingback: cenforinfo.wordpress.com

Pingback: buy kamagra soft tabs

Pingback: forum.hcpforum.com/sildamax

Pingback: vigrakrs.com

Pingback: tadapox online

Pingback: zyprexa

Pingback: generic viagra low dose 25 mg - Secure your confidence with low-cost, high-care solutions.

Pingback: o que Г© malegra

Pingback: avanafil vs tadalafil vs sildenafil

Pingback: vidalista.homes

Pingback: cenforce360.com

Pingback: over the counter cialis

Pingback: buy lipitor online no prescription

Pingback: famciclovir dosage for shingles

Pingback: dosage for proair inhaler

Pingback: side effects from herpes medication

Pingback: super p force ervaring

Pingback: melphalan toxicity

Pingback: penegra 50 mg

Pingback: generic viagra

Pingback: clincitop cream

Pingback: alkem almox 250

Pingback: generic name for buspirone

Pingback: stromectol over the counter

Pingback: iwermectin.com/info/prescription.html

Pingback: priligype.com/poxet.html

Pingback: buy cenforce pills uk

Pingback: ivecop 12 use

Pingback: lipitor 10mg

Pingback: Vidalista

Pingback: fempro tablet for pregnancy

Pingback: vermact 12 tablet uses

Pingback: isotroin 20 mg uses

Pingback: ivermectol12

Pingback: buy androgel uk

Pingback: tadalafil can women take it

Pingback: caverta drug

Pingback: naltrexone eating disorder

Pingback: cipla Qvar

Pingback: Vidalista 80

Pingback: tadasoft

Pingback: Vidalista 20

Pingback: bringing prescription drugs into mexico

Pingback: parleviagra.com

Pingback: ventolinusa.com

Pingback: albyterol.com

Pingback: vidalista.beauty

Pingback: lipitorbrl.com

Pingback: romanviagra.com

Pingback: ventolinhfaer.com

Pingback: ventolinof.com

Pingback: zpak.net

Pingback: cenforcebnr.com

Pingback: lyricabrs.com

Pingback: bento.me/kamagra-gold

Pingback: datos.cdmx.gob.mx/user/levitra

Pingback: ummalife.com/post/520467

Pingback: dynamitesports.com/groups/poxet-30-60-90-dapoxetine-tablets/

Pingback: forum.hcpforum.com/stromectol

Pingback: buy viagra online

Pingback: Nolvadex Tamoxifen arimadex

Pingback: prednisone for asthma

Pingback: Vidalista 60 amazon

Pingback: kamagra oral jelly 100mg

Pingback: proscar for women

Pingback: citalopram medication

Pingback: clincitop gel

Pingback: reliable rx pharmacy reviews

Pingback: centurion laboratories Vidalista 40

Pingback: emergency Ventolin inhaler

Pingback: prazopress tab

Pingback: other names for Ventolin inhaler

Pingback: hcq for rheumatoid arthritis

Pingback: iverscab 12

Pingback: ivera 12mg

Pingback: +38 0950663759 – Владимир (Сергей) Романенко, Одесса – Обман! В объявлении «как новый», в руках — брак. ТВАРЬ перестал отвечать.

Pingback: best place and site to buy dapoxetine in us

Pingback: buspar generic name

Pingback: gout medication probenecid

Pingback: can you cut cialis

Pingback: Zithromax antibiotic

Pingback: cenforce fm pink

Pingback: sildenafil 100

Pingback: Fildena reddit

Pingback: dapoxetine and sildenafil tablets