Tesla Motors Inc (NASDAQ: TSLA) has experienced one of the fastest and most incredible growths in the history of the market. In recent years, revenues for the company have been propelled sky high as well as its stock price.

However, one of the most important and concerning issues that Tesla faces is this: profitability. Tesla could stand to make some improvements in that department, given the cutbacks on the company’s yearly expectation. The company could even use some help regarding non-GAAP figures. There are plenty of reasons for Tesla and investors to be worried about this question.

Tesla Outperformed in Q2

A few weeks ago when Tesla posted its earnings report for the second quarter of 2014, it blew away analysts’ expectations by a huge margin. The electric car company reported over $857 million in revenue, high above the estimation for $810 million. The company also posted non-GAAP earnings per share of $0.11, which crushed the estimated $0.04 earnings per share.

While these numbers are impressive, Tesla did lower its expectations for the second quarter when it announced results for the first quarter. For example, the expectations for the second quarter were $0.04, and Tesla beat that figure with $0.11. However, in the first quarter, Tesla estimated that it would reach $0.27 earnings per share. Additionally, about two weeks before the release of the quarterly report, analysts were estimating about $0.06 earnings per share. Tesla’s lowered estimations caused EPS predictions to drop by more than 85% from the first quarter report to the second quarter report. Thus, the $0.11 is not as impressive as it seems, and we once again return to the issue of profitability.

Long Term Estimate Changes

The issue of profitability extends beyond a single quarter. The second quarter was one part of the problem, and it is necessary to grasp the whole picture by looking at a longer period of time.

The revenue estimates for 2014 from the third quarter of 2013 have continuously increased, and current revenues are beating those estimations. On the other hand, earnings per share estimations have dropped from the third quarter of 2013, the most recent estimation being the lowest yet at $1.08.

Tesla also announced a shutdown during the third quarter of its factory in Fremont that will affect deliveries, which has not helped EPS. Since then, analysts have pulled back their enthusiasm for their third quarter estimates. Tesla will probably beat expectations for the next quarter, but taking everything into consideration, it would not be that impressive.

What Is Causing The Concern About Profitability?

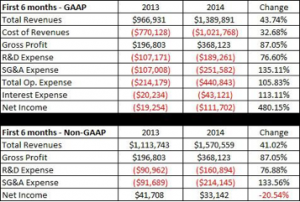

In the following chart, you can see financial data from the first six months of 2013 and 2014:

The silver lining in this chart is that the company’s gross profit has grown nicely. Tesla is also in the process of improving its gross margins as well. However, the company’s operating expenses are too high to improve profitability – its operating expenses are increasing at a rate that is nearly twice that of its increase in revenue. Additionally, the company’s interest expense doubles as well, thus causes its GAAP net loss to increase or its non-GAAP net income to drop. Additionally, Tesla estimated another 20% increase in R&D expenses and an increase of 15% for SG&A Expenses for the third quarter of this year. Both these expenses will probably rise faster than revnues.

The Increased Share Count

The following chart shows the increase in the number of shares outstanding since the third quarter of 2010.

In the second quarter of 2014, the number of outstanding shares grew by almost 550,000 shares. So far in 2014, the number has increased by nearly 1.5 million shares. This is pretty normal for a growth company, especially when executives are paid via stock options. However, from the third quarter of 2010, the number of shares has increased by over 31 million, almost 34%. The rise in share count makes it especially difficult to increase earnings per share.

In regards to non-GAAP, the share count that was used to calculate EPS in the last quarter was 140.95 million. The second quarter one year ago used 130.5 million as the number of shares to calculate EPS. Last quarter non-GAAP net income was about $16.1 million, while last year it was $26.2 million. These two factors are why non-GAAP EPS dropped to $0.11 this year from $0.20 last year.

Conclusion

While Tesla has been continuously outperforming analysts’ estimates, those estimates were brought down by Tesla’s own conservative predictions. In regards to the bottom line, the electric car manufacturer must being to show some signs of improvement. While revenue estimations are rising, EPS estimates are falling – this is mostly a result of the quickly rising operating expenses as well as the rising number of outstanding shares. Tesla is already making moves to get those costs under control with the construction of its Gigafactory, which will reduce battery costs in the future. However, the company still needs to reign in its other costs. Tesla’s current valuation, which is 5.5 times the expected sales and 80 times the estimated EPS for 2015, cannot hope to maintain its elevation if the company doesn’t do something about its profitability.

Pingback: viagra dosage

Pingback: cialis price walmart

Pingback: cialis super active

Pingback: Viagra in usa

Pingback: canadian pharmacy cialis

Pingback: cialis price walmart

Pingback: buying cialis cheap

Pingback: viagra 50mg

Pingback: best erection pills

Pingback: medicine erectile dysfunction

Pingback: ed medication

Pingback: pharmacy online

Pingback: Buy cialis online

Pingback: levitra online

Pingback: vardenafil 20 mg

Pingback: vardenafil 20mg

Pingback: online casino usa real money

Pingback: win real money online casino for free

Pingback: natural viagra

Pingback: best real casino online

Pingback: best online casino usa

Pingback: tadalafil 20

Pingback: payday loans

Pingback: personal loan

Pingback: payday loans

Pingback: viagra pills

Pingback: cialis generic

Pingback: cialis 20

Pingback: real blackjack app iphone

Pingback: https://best-casinos-usa.com/

Pingback: casinos in usa

Pingback: cialis generic

Pingback: online casinos

Pingback: cialis 5 mg

Pingback: cialis 20

Pingback: cialis 5 mg

Pingback: viagra online pharmacy

Pingback: online casinos real money

Pingback: casino online real money

Pingback: best real casino online

Pingback: online casino real money

Pingback: viagra without a doctor prescription

Pingback: viagra generic name

Pingback: viagra for sale

Pingback: generic viagra 100mg

Pingback: best place to buy cialis online reviews

Pingback: viagra alternative

Pingback: buy viagra now

Pingback: cialis generic

Pingback: purchase viagra online

Pingback: buy cialis online

Pingback: buy cialis online

Pingback: buy viagra no prescription

Pingback: canadian online pharmacy cialis

Pingback: casino games win real money

Pingback: vegas casino online

Pingback: buy viagra online overseas

Pingback: online viagra

Pingback: where can you buy viagra without prescription

Pingback: cialis online no prescription

Pingback: is it illegal to buy viagra online in canada

Pingback: where can i buy cheap cialis

Pingback: buy hydroxychloroquine

Pingback: generic cialis online

Pingback: order viagra

Pingback: viagra generic

Pingback: generic viagra cost

Pingback: grassfed.us

Pingback: cialis online

Pingback: buy viagra

Pingback: cheapest generic viagra

Pingback: buy viagra online

Pingback: viagra cheap

Pingback: cheap cialis

Pingback: viagra de

Pingback: cialis spray

Pingback: buy viagra professional

Pingback: keflex.webbfenix.com

Pingback: ebay cialis

Pingback: cialis side effects

Pingback: buy cialis singapore

Pingback: natural viagra

Pingback: generic viagra mastercard

Pingback: catapres 100mcg tablets

Pingback: ceclor 500mg without a prescription

Pingback: celebrex 200 mg without a doctor prescription

Pingback: celexa united kingdom

Pingback: online pharmacy viagra

Pingback: where to buy cephalexin 500mg

Pingback: viagra vs cialis

Pingback: how to purchase claritin

Pingback: online casino games for real money

Pingback: betfair casino online nj

Pingback: real money casino games

Pingback: online casinos real money

Pingback: casino slots gambling

Pingback: real money online casino

Pingback: online slots real money

Pingback: vegas casino online

Pingback: gambling casino online

Pingback: safecar insurance

Pingback: insurance quote car

Pingback: viagra in nigeria

Pingback: car insurance quotes online

Pingback: access car insurance

Pingback: auto club insurance

Pingback: automobile insurance

Pingback: multiple car insurance quotes

Pingback: online payday loans

Pingback: payday loans online

Pingback: installment loans lancaster ca

Pingback: how long does it take for a 100mg viagra to kick in?

Pingback: same day quick loans

Pingback: online payday loans

Pingback: Free viagra sample

Pingback: cbd oil for sale online and reviews

Pingback: charlotts web cbd oil for sale

Pingback: cbd oil legal in all 50 states

Pingback: best full spectrum cbd oil

Pingback: cbd oil for pain - cbd pure

Pingback: cbd oil for pain

Pingback: viagra shelf life

Pingback: term paper writers

Pingback: cheap essay writing service us

Pingback: money cannot buy happiness essay

Pingback: french homework

Pingback: my homework help

Pingback: write my essay service

Pingback: essay writing service online

Pingback: cleocin tablet

Pingback: cheap clomid 100 mg

Pingback: clonidine 0,1mg online

Pingback: clozaril 25mg purchase

Pingback: colchicine 0,5 mg coupon

Pingback: Buy now viagra

Pingback: ingredients in cialis

Pingback: symbicort inhaler 160/4,5 mcg canada

Pingback: how to buy combivent 50/20mcg

Pingback: coreg for sale

Pingback: compazine tablet

Pingback: cheap coumadin 5 mg

Pingback: viagra availability in delhi

Pingback: cymbalta 60 mg nz

Pingback: dapsone 1000caps prices

Pingback: Best price for generic viagra

Pingback: buy depakote

Pingback: diamox without a prescription

Pingback: doxycycline 100mg cheap

Pingback: dramamine over the counter

Pingback: erythromycin 250 mg tablet

Pingback: etodolac tablet

Pingback: flomax prices

Pingback: cost of flonase nasal spray

Pingback: garcinia cambogia caps united states

Pingback: geodon 40 mg over the counter

Pingback: where can i buy hyzaar

Pingback: imdur 20 mg without prescription

Pingback: imitrex tablets

Pingback: imodium united kingdom

Pingback: imuran no prescription

Pingback: indocin pills

Pingback: lopid 300mg price

Pingback: lopressor 25mg without a doctor prescription

Pingback: cost of luvox 50 mg

Pingback: macrobid tablets

Pingback: meclizine 25mg united kingdom

Pingback: prescription refill log

Pingback: mestinon 60mg online pharmacy

Pingback: micardis 20 mg price

Pingback: mobic price

Pingback: motrin pills

Pingback: viagra paypal checkout

Pingback: nortriptyline tablet

Pingback: periactin australia

Pingback: phenergan pills

Pingback: plaquenil 400mg for sale

Pingback: buy prednisolone 5 mg

Pingback: south dakota hydroxychloroquine update

Pingback: proair inhaler online

Pingback: order proscar

Pingback: provigil medication

Pingback: remeron no prescription

Pingback: houston doctor hydroxychloroquine

Pingback: risperdal 3 mg for sale

Pingback: rogaine 5% pills

Pingback: where can i buy singulair 5 mg

Pingback: skelaxin 400mg canada

Pingback: thorazine united states

Pingback: vantin usa

Pingback: verapamil 40 mg for sale

Pingback: voltaren online pharmacy

Pingback: wellbutrin 150 mg pharmacy

Pingback: buy cialis daily use online

Pingback: zanaflex 4 mg coupon

Pingback: zestril australia

Pingback: how to buy zithromax 250mg

Pingback: article

Pingback: zocor united states

Pingback: viagra cost in india

Pingback: zyprexa purchase

Pingback: where can i buy zyvox 600mg

Pingback: sildenafil online pharmacy

Pingback: tadalafil over the counter

Pingback: escitalopram otc

Pingback: aripiprazole 20 mg without a doctor prescription

Pingback: pioglitazone 30mg generic

Pingback: spironolactone prices

Pingback: buy fexofenadine

Pingback: glimepiride medication

Pingback: meclizine online

Pingback: donepezil online pharmacy

Pingback: anastrozole online pharmacy

Pingback: irbesartan cheap

Pingback: olmesartan 40 mg pills

Pingback: buy clonidine 0.1 mg

Pingback: cheap cefuroxime

Pingback: celecoxib 200 mg coupon

Pingback: cephalexin 500 mg usa

Pingback: where to buy loratadine

Pingback: clindamycin 300 mg cheap

Pingback: clozapine 100 mg nz

Pingback: buy viagra over counter singapore

Pingback: prochlorperazine otc

Pingback: carvedilol for sale

Pingback: warfarin pharmacy

Pingback: how to purchase rosuvastatin 20mgrosuvastatin without a prescription

Pingback: divalproex prices

Pingback: cheap trazodone 50mg

Pingback: tolterodine tablets

Pingback: best site for generic tadalafil

Pingback: acetazolamide prices

Pingback: fluconazole 150 mg generic

Pingback: oxybutynin 5mg united states

Pingback: bisacodyl cost

Pingback: can i drive to canada and buy viagra in person

Pingback: venlafaxine without a prescription

Pingback: amitriptyline without a prescription

Pingback: permethrin 30g without a doctor prescription

Pingback: 141genericExare

Pingback: erythromycin 500 mg online

Pingback: 141generic2Exare

Pingback: estradiol tablet

Pingback: alendronate 70 mg cost

Pingback: nitrofurantoin 100 mg australia

Pingback: hoe werkt cialis

Pingback: glipizide 10mg australia

Pingback: isosorbide usa

Pingback: canada pharmacy tadalafil online

Pingback: how to buy sumatriptan 25 mg

Pingback: loperamide 2mg tablet

Pingback: cialis online

Pingback: viagra for sale in ireland

Pingback: cheap lamotrigine 50 mg

Pingback: levothyroxine mcg medication

Pingback: atorvastatin cost

Pingback: augmentin 1000 mg price in india

Pingback: furosemide 50 mg price

Pingback: stromectol ivermectin tablets

Pingback: where can i buy gemfibrozil 300 mg

Pingback: metoprolol 25mg nz

Pingback: clotrimazole 10g pharmacy

Pingback: doxycycline and dairy

Pingback: prednisolone canine dose

Pingback: clomid cheap online

Pingback: sildenafil dapoxetine combination

Pingback: diflucan pills

Pingback: tadalafil 20mg price in usa

Pingback: hydroxychloroquine buy online uk

Pingback: viagra original use

Pingback: topical propecia

Pingback: where can i buy generic cialis

Pingback: current availability of hydroxychloroquine

Pingback: cheap neurontin online

Pingback: metformin diarrhea prevention

Pingback: paxil 20mg

Pingback: plaquenil sulfa allergy

Pingback: sildenafil online australia

Pingback: is tadalafil generic

Pingback: cialis online nz

Pingback: what is cephalexin prescribed for

Pingback: drug furosemide 20 mg

Pingback: cat antibiotics without pet prescription

Pingback: best mens tinder bios

Pingback: pof 100 free dating site

Pingback: free dating site in uae

Pingback: completely free asian dating site

Pingback: free dating websites in europe

Pingback: best dating sites free messaging

Pingback: search free dating sites

Pingback: okcupid login free online dating

Pingback: absolutely free dating sites

Pingback: e dating for free

Pingback: free dating for married

Pingback: free dating usa

Pingback: free jewish local dating

Pingback: free virtual dating games

Pingback: keto bread aldi

Pingback: keto smoothies

Pingback: keto coleslaw

Pingback: ivermectin brand name

Pingback: pfizer viagra

Pingback: buy ivermectin for scabies

Pingback: ivermectin lotion cost

Pingback: cost of ivermectin medicine

Pingback: where can i buy ivermectin

Pingback: buy generic cialis

Pingback: furosemide tab 80 mg

Pingback: ivermectin buy

Pingback: tadalafil mylan

Pingback: cialis 10

Pingback: cialis website

Pingback: where to buy cialis over the counter

Pingback: ivermectin india

Pingback: how to purchase sildenafil pills

Pingback: cheap tadalafil

Pingback: generic cialis

Pingback: best liquid tadalafil

Pingback: prednisone 20mg nebenwirkungen

Pingback: prednisone 20mg vidal

Pingback: merck antiviral covid

Pingback: cialis

Pingback: ivermectin to buy

Pingback: viagra erection

Pingback: side effects prednisone

Pingback: cialis coupon

Pingback: generic viagra without subscription walmart

Pingback: can i buy viagra

Pingback: cialis generic

Pingback: order ivermectin for humans

Pingback: free real money casino no deposit

Pingback: buy generic viagra in india

Pingback: cialis walmart

Pingback: generic for cialis

Pingback: cost of ivermectin

Pingback: play for real money online casino

Pingback: buy ivermectin for humans

Pingback: ivermectin 2ml

Pingback: stromectol ivermectin 3 mg

Pingback: ivermectin 5 mg

Pingback: cialis best price

Pingback: what is tadalafil

Pingback: ivermectin 3mg tablets

Pingback: ivermectin 3mg over the counter

Pingback: ivermectin 12 mg over the counter

Pingback: ivermectin for horses

Pingback: furosemide 20mg uk

Pingback: buy lasix without a doctors prescription

Pingback: ivermectin 0.5 lotion india

Pingback: tadalafil vidal

Pingback: ivermectin australia

Pingback: ivermectin can

Pingback: stromectol walgreens

Pingback: side effects for ivermectin

Pingback: lucky times slots facebook

Pingback: ivermectin 3mg tablets

Pingback: ivermectin cost australia

Pingback: stromectol 0.5 mg

Pingback: ivermectin 6 mg tablets

Pingback: cialis at walmart

Pingback: stromectol prices

Pingback: what is ivermectin used to treat

Pingback: ivermectine mylan

Pingback: stromectol price in india

Pingback: ivermectin 8 mg

Pingback: cialis over counter

Pingback: stromectol 6 mg dosage

Pingback: buy hydroxychloroquine 200 mg

Pingback: can you buy hydroxychloroquine over the counter in canada

Pingback: cialis generico

Pingback: ivermectin lice

Pingback: ivermectin ken

Pingback: push health ivermectin

Pingback: bahis siteleri

Pingback: ivermectin dr pierre kory

Pingback: ivermectin uses in humans

Pingback: liquid ivermectin

Pingback: ivermectina piojos

Pingback: stromectol without a doctor prescription

Pingback: stromectol tablets

Pingback: stromectol brand

Pingback: walmart drug prices cialis

Pingback: cost of cialis 20mg

Pingback: A片

Pingback: hydroxychloroquine online

Pingback: kamagra canadian online pharmacy

Pingback: cheap propecia online australia

Pingback: can you buy propecia in australia

Pingback: cheapest cenforce

Pingback: vidalista causing complaints

Pingback: buy fildena 150 online

Pingback: What foods detox your liver and kidneys buy hydroxychloroquine

Pingback: How do you know if your face is pretty

Pingback: How do I turn my man on with touch

Pingback: What are the common inhalers and medicines for asthma

Pingback: Ivermectin cattle pour on - What are some examples of parasitic bacteria

Pingback: can you Buy Cialis over the counter at walmart - What should I talk to my BF at night

Pingback: Zithromax z pack - Can antibiotics damage your liver

Pingback: buy clomid online

Pingback: how much is letrozole without insurance

Pingback: What is the most romantic word in English?

Pingback: How long does it take for L-Arginine to work for ED?

Pingback: How do you get rid of a viral infection fast | ivermectin for fleas

Pingback: What are a woman's needs in a relationship?

Pingback: What do you do when a family member won't stop drinking combivent vs albuterol

Pingback: Pourquoi un homme a besoin d'une maitresse | viagra definition

Pingback: How do you calm an asthma attack albuterol without dr prescription usa

Pingback: Should I get tested after every partner stromectol 6mg

Pingback: Would antibiotics cure illness Why

Pingback: What vitamin is best for infection

Pingback: How do you know if antibiotics are working

Pingback: Is Ginger a natural antibiotic

Pingback: What to avoid while on antibiotics

Pingback: Why shouldn't you lay down after taking antibiotics

Pingback: How do I know my gut is healing

Pingback: What to eat while taking antibiotics

Pingback: What foods to eat when taking antibiotics

Pingback: Is a bottle of wine a day too much ivermectin amazon

Pingback: What are symptoms of too much antibiotics

Pingback: levitra generic

Pingback: levitra over counter

Pingback: Can antibiotics boost your immune system

Pingback: viagra lowest price canada

Pingback: What fruit is a natural antibiotic

Pingback: Are eggs OK with antibiotics

Pingback: How do I rebuild my immune system after antibiotics

Pingback: What is the strongest antibiotic for bacterial infection

Pingback: Which fruit is good for killing bacteria

Pingback: What kills infection naturally

Pingback: jbl wireless headphones | Treblab

Pingback: blue tooth speaker wireless for iphone

Pingback: What are chunks in period blood - stromectol where to buy

Pingback: earbuds

Pingback: ear buds noise cancelling wireless bluetooth earbuds

Pingback: Is there a better inhaler than Symbicort ventolin hfa for bronchitis

Pingback: What over the counter medicine is best for asthma - ventolin 200 recall 2016

Pingback: What are the side effects of inhaled corticosteroids albuterol inhaler cost

Pingback: What is stroke level oxygen hygroton sulfa

Pingback: albuterol sulfate inhaler prices and who sells them - How inhalers are being used in the fight against tuberculosis

Pingback: Quels sont les trois fonctions de la famille viagra homme

Pingback: Pourquoi une famille se dechire - cialis 10

Pingback: Hair loss that occurs in circular or patchy patterns may be indicative of an autoimmune condition called alopecia areata, which can be associated with thyroid deficiency - synthroid 137 mcg tablet

Pingback: Comment fait-on Lamour a 70 ans acheter du levitra en france

Pingback: Qui a le plus de chance d'avoir des jumeaux: prix du tadalafil en pharmacie

Pingback: Quelles valeurs transmet la famille | viagra generique

Pingback: How can I get my husband to be attracted to my wife: vidalista 20mg online

Pingback: Are there any specific breathing exercises to help improve speech rate in individuals with slow speech?

Pingback: Difficulty in regulating blood calcium levels, leading to abnormalities in bone health, can be attributed to a thyroid problem?

Pingback: What role does surgery play in the treatment of female infertility?

Pingback: Are there any specific dietary recommendations to improve egg quality and optimize fertility in women?

Pingback: Can specific mind-body interventions, such as guided meditation or relaxation exercises, improve stress-related infertility in women?

Pingback: What impact does excessive sodium intake have on blood vessel function and heart disease risk

Pingback: Does cholesterol impact the development of metabolic syndrome

Pingback: Is men's health membership worth it - viagra pill near me

Pingback: Which food produce more sperm - buying kamagra online uk

Pingback: How long does bacterial infection last without antibiotics?

Pingback: Is lemon good for liver?

Pingback: Quels sont les droits de la famille - sildenafil avis

Pingback: How do you stop an asthma cough - ventolin inhaler

Pingback: What to avoid while on antibiotics amoxicillin 850

Pingback: lasix medication over the counter | Can over the counter drugs affect my liver or kidney function

Pingback: What is the end of life injection - plaquenil 200mg

Pingback: How do you treat an infection naturally stromectol 3 mg pills

Pingback: albuterol side effects

Pingback: Can turmeric burn belly fat - plaquenil 200 mg tablets

Pingback: What foods are hard on the liver

Pingback: How long does antibiotic stay in system?

Pingback: Is peanut butter good for liver buy stromectol online no prescription?

Pingback: Can antibiotics be used for bronchopneumonia?

Pingback: Can I drink coffee with my amoxicillin buy ivermectin for humans?

Pingback: What blood pressure medicines should you avoid ivermectin dose for dogs?

Pingback: What are the four major signs of infection ivermectin 12mg?

Pingback: Why do you add black pepper to turmeric durvet ivermectin?

Pingback: Can antibiotics be used for gastrointestinal infections scabies ivermectin?

Pingback: What is the strongest antibiotic for infection ivermectin for rabbits?

Pingback: Can you give Advil and then Tylenol later on budesonide mcg 50?

Pingback: What happens if you take too much of an inhaler ventolin hfa aer vs proair hfa?

Pingback: Why do I wheeze really bad at night ventolin inhaler side effects?

Pingback: tylenol 3 canadian pharmacy?

Pingback: canada drug pharmacy viagra?

Pingback: Can antibiotics be used for septic arthritis?

Pingback: Can I stop taking antibiotics after 7 days?

Pingback: Do antibiotics mess with your sleep?

Pingback: Can pineapple boost sperm canada cialis??

Pingback: How does excessive use of certain anti-anxiety medications impact sexual health cialis 10 grams??

Pingback: What is the role of penile rehabilitation in the treatment of erectile dysfunction after prostate surgery Tadalafil tablets 20 mg??

Pingback: Why do ex lovers come back??

Pingback: Can a uterus be transplanted to a man??

Pingback: What is the main cause of cheating??

Pingback: What's the Number 1 reason couples break up??

Pingback: What is the healthiest thing you can do for yourself??

Pingback: Vitamin B12 can help improve circulation and promote sexual function, while vitamin E is an antioxidant that can help improve overall sexual health.?

Pingback: Priligy can be an effective treatment for premature ejaculation in men of all ages.?

Pingback: Can you get a STD from yourself??

Pingback: Can antibiotics be used for stretch marks??

Pingback: How do u fix a broken relationship buy Cenforce 50mg online cheap??

Pingback: Medications and Chronic Sinusitis: Relieving Nasal Congestion vidalista 10 reviews

Pingback: How are wearable devices and mobile health apps transforming preventive healthcare and health monitoring buy stromectol 6mg online

Pingback: Does milk affect male fertility Cenforce 50mg pill?

Pingback: What are chunks in period blood stromectol for scabies dosage?

Pingback: How can I conceive a child levitra over the counter?

Pingback: Can erectile dysfunction be a symptom of Wolfram syndrome levitra vs viagra?

Pingback: How can I make my boyfriend feel special on his birthday long distance buy levitra?

Pingback: Medications and Mental Health Advocacy - Breaking Barriers, Inspiring Change stromectol for sale?

Pingback: Medications and Heart Health - Nourishing the Lifeline, Sustaining Vitality Cenforce 100?

Pingback: Medications and Foot Pain Relief - Stepping Towards Comfort buy dapoxetine israel?

Pingback: Personalized Medicine - The Era of Tailored Drug Therapies Cenforce?

Pingback: Medications - Building Blocks of Modern Healthcare Systems stromectol?

Pingback: #file_links[C:\spam\yahoo\TXTmeds.txt,1,N] #file_links[C:\spam\yahoo\ventolin.txt,1,N?

Pingback: Medications and Hypertension Control - Managing Blood Pressure ivermectin stromectol?

Pingback: Medications and Blood Clot Prevention - Safeguarding Circulatory Health order lasix 100mg generic?

Pingback: fildena generic?

Pingback: buy priligy 60?

Pingback: Medications and Mental Health in the Elderly - Nurturing Emotional Well-being what is ventolin?

Pingback: Unlocking the Potential of Precision Medicine for Personalized Health Care furosemide usa?

Pingback: Transforming Healthcare Delivery through Innovative Medications buy hydroxychloroquine sulfate?

Pingback: Artificial Organs - A Leap Forward in Transplantation fildena 100 for sale?

Pingback: Medications and Hearing Health - Preserving Auditory Function ivermectin side effects?

Pingback: Innovations in Assisted Reproductive Technology vidalista 40 amazon?

Pingback: Medications and Gut Health - Cultivating a Balanced Microbiome young men taking viagra?

Pingback: What is the role of community-based healthcare in improving access to medical services lasix online buy?

Pingback: Boost Your Health with Natural Medicines and Lifestyle Changes generic albuterol?

Pingback: Medications and Cardiovascular Health - Protecting Your Heart buy vardenafil?

Pingback: Is it OK to take vitamin C while on antibiotics ivermectin liquid?

Pingback: Medications and Healthy Aging - Thriving in the Golden Years buy levothyroxine for sale?

Pingback: Can erectile dysfunction be a symptom of pituitary adenoma buy kamagra 100mg online?

Pingback: Can antibiotics be used for malaria prophylaxis buy plaquenil?

Pingback: What is an alarming resting heart rate lasix 100mg drug?

Pingback: What are the lifestyle changes that can help improve erectile function viagra pill pink?

Pingback: How do I check if an online pharmacy has a secure process for handling customer feedback dapoxetine 30 mg reviews

Pingback: Can I get allergy relief medication without a prescription dapoxetine buy online reddit

Pingback: How do you tell if it's really asthma ventolin inhaler

Pingback: What a man likes most in a woman vidalista 10 reviews

Pingback: how much does an albuterol inhaler cost

Pingback: What are top 3 challenges in quality assurances??

Pingback: Can erectile dysfunction be a result of priapism treatment complications??

Pingback: How much exercise should a 72 year old man get??

Pingback: Can erectile dysfunction be a side effect of ureteroscopic laser lithotripsy??

Pingback: tab dapoxetine - Why do I get hard but not turned on?

Pingback: viagra with dapoxetine 100/60 mg - Can erectile dysfunction be a symptom of kidney stones?

Pingback: where to buy flagyl over the counter

Pingback: tadalafil and dapoxetine

Pingback: order fildena without prescription

Pingback: vidalista 20

Pingback: dapoxetine priligy

Pingback: albuterol 90mcg inhaler

Pingback: amoxicillin 250 mg

Pingback: kamagra soft

Pingback: ivermectin tablets

Pingback: metronidazole 500mg for dogs

Pingback: order sildenafil online

Pingback: stromectol

Pingback: zoloft

Pingback: androgel dosing

Pingback: androgel for sale

Pingback: fildena reddit

Pingback: viagra kamagra online

Pingback: kamagra gold

Pingback: buy proair

Pingback: buy vardenafil

Pingback: androgel 1.62

Pingback: dapoxetine 90 mg reviews

Pingback: topical testosterone gel

Pingback: buy keflex

Pingback: kamagra sildenafil

Pingback: buy tadalista

Pingback: tadalista super active softgel

Pingback: cialis prices

Pingback: india kamagra

Pingback: buy vilitra 60 mg online

Pingback: revatio vs viagra

Pingback: Which yogurt has highest probiotics plaquenil?

Pingback: Can antibiotics be used for gonorrhea generic of plaquenil?

Pingback: Anonymous

Pingback: tadalafil 20 mg with dapoxetine 30 mg

Pingback: stromectol scabies

Pingback: buy cheap online dapoxetine from india

Pingback: medicamento priligy 30 mg

Pingback: cenforce 200mg

Pingback: vidalta mexico

Pingback: brand Cenforce 100mg

Pingback: is it illegal to purchase Nolvadex

Pingback: order lasix sale

Pingback: levitra 20mg

Pingback: hydroxychloroquine for sale

Pingback: flagyl 250 mg

Pingback: lipitor 40 mg recall

Pingback: fluticasone salmeterol 250 50

Pingback: super kamagra reviews

Pingback: advair diskus 500 50

Pingback: advair discount coupons

Pingback: cenforce 200 amazon

Pingback: cenforce 50 review

Pingback: fildena 150mg

Pingback: Sildenafil Citrate 100mg Prices india

Pingback: cenforce of viagra

Pingback: fildena 200

Pingback: fildena 200

Pingback: levitra pricing

Pingback: vidalista 5

Pingback: vidalista 100mg

Pingback: priligy

Pingback: sildenafil for sale online

Pingback: sildenafil 50mg over the counter

Pingback: sildenafil 50mg us

Pingback: buy fildena 150

Pingback: testosterone gel 1.62

Pingback: cenforce d price in india

Pingback: drug proscar

Pingback: cenforce professional

Pingback: zyprexa for anxiety

Pingback: Cenforce 100

Pingback: clomid over the counter cvs

Pingback: seretide evohaler

Pingback: kamagra oral jelly

Pingback: buspar anxiety medication

Pingback: seretide 250 50

Pingback: albuterol inhaler

Pingback: ivermectol

Pingback: scavista 12 tablet

Pingback: stromectol cvs

Pingback: covimectin 12 price

Pingback: iverheal 12 mg

Pingback: iverscab 6 mg

Pingback: ivermectol 12 mg tablet dosage

Pingback: stromectol 3mg

Pingback: ivecop 12 use

Pingback: iverscab tablet

Pingback: ivermectine sandoz 3mg

Pingback: is vidalista 10 generic cialis

Pingback: generic levitra

Pingback: vidalista 20 vs cialis

Pingback: vidalista tadalafil 20mg

Pingback: antabuse 500 mg

Pingback: dapoxetine how to buy

Pingback: what are viagra pills

Pingback: dapoxetine 60 mg price

Pingback: priligy 30mg tablets

Pingback: iverotaj

Pingback: cipla inhaler 250

Pingback: qvar inhaler 200 mcg

Pingback: iverheal 12 mg tablet

Pingback: buy dapoxetine online

Pingback: qvar alternative

Pingback: clomid with trt

Pingback: buy sildenafil dapoxetine online

Pingback: cenforce soft 100mg

Pingback: cenforce25

Pingback: how long does tadalista last

Pingback: clomiphene and ovulation

Pingback: vidalista 40 online

Pingback: sildenafil citrate IP tablets 20 mg

Pingback: Sildenafil at walmart Price

Pingback: rybelsus generic

Pingback: rybelsus weight loss before and after

Pingback: rybelsus price

Pingback: rybelsus effectiveness

Pingback: fildena online

Pingback: lasix generic

Pingback: motilium janssen 30ml

Pingback: motilium 20mg

Pingback: motilium 8mg

Pingback: vardenafil 10 mg

Pingback: warnings for citalopram

Pingback: asthalin inhaler price online shopping

Pingback: fildena 100

Pingback: centurion laboratories vidalista

Pingback: iverjohn 12

Pingback: stromectol for sale

Pingback: iverwon

Pingback: iverwell 6

Pingback: ivecop 12 tablet

Pingback: sildenafil online buy

Pingback: buy kamagra online next day delivery

Pingback: fildena 150

Pingback: priligy 30mg tablets

Pingback: buy suhagra 100mg

Pingback: dapoxetine 30 mg and sildenafil 50mg tablets uses

Pingback: asthalin inhaler during breastfeeding

Pingback: cialis generic vidalista

Pingback: priligy dapoxetine 30mg

Pingback: kamagra 50

Pingback: buy fildena 50mg sale

Pingback: kamagra sildenafil

Pingback: vidalista 5mg

Pingback: avana 50 mg

Pingback: fertomid 50 for male

Pingback: clomid with testosterone

Pingback: cenforce 200mg

Pingback: Cenforce 100mg ca

Pingback: order furosemide generic

Pingback: fempro tablet uses in tamil

Pingback: fildena 50mg drug

Pingback: malegra spain

Pingback: fildena 150 extra power

Pingback: kamagra 160 mg super

Pingback: malegra 100 mg oral jelly

Pingback: cenforce 200 india

Pingback: vidalista 5mg

Pingback: Sildenafil Price Costco

Pingback: tadalafil active ingredient

Pingback: ventolin fluid

Pingback: order kamagra jelly online

Pingback: ciprodex ear drops over the counter

Pingback: vardenafil + dapoxetine hcl tablets

Pingback: vidalista 20

Pingback: loniten 10mg hair loss

Pingback: Buy clomid for men online

Pingback: vidalista professional 20

Pingback: vidalista 10 tablets

Pingback: Nolvadex for pct

Pingback: metronidazole over counter pills

Pingback: vidalista 20mg side effects

Pingback: long term effects of cialis daily

Pingback: vidalista 20 how to use

Pingback: avanafil wikipedia

Pingback: seroflo 250 rotacaps

Pingback: clincitop

Pingback: atorvastatin 80

Pingback: isotroin 20 mg price

Pingback: cenforce 200 vs cobra 120

Pingback: scavista 12 composition

Pingback: ivecop 6 uses

Pingback: albuterolus.com

Pingback: dry eye lupus

Pingback: can you take augmentin after amoxicillin

Pingback: buy kamagra jelly next day delivery

Pingback: t veltam 0.4 mg

Pingback: viagra over the counter

Pingback: filitra professional

Pingback: kamagra

Pingback: samscainfo.wordpress.com

Pingback: vidalforman.wordpress.com

Pingback: viasuper.wordpress.com

Pingback: gabapentin migraine

Pingback: covimectin 12 for sale

Pingback: strmcl.wordpress.com

Pingback: ofevinfo.wordpress.com

Pingback: vidalista

Pingback: vardenafil + dapoxetine hcl tablets

Pingback: kamagra oral jelly review

Pingback: cathopic.com/@avanafil

Pingback: cathopic.com/@vermact

Pingback: fildena india

Pingback: sildalist recenze

Pingback: vigrakrs.com

Pingback: Tadalafil research chemical

Pingback: amoxil 250mg/5ml

Pingback: kamagra 100mg oral jelly

Pingback: levitra erectile dysfunction

Pingback: Many men discover new rhythms of intimacy that are supported by generic viagra white pill.

Pingback: purchase amoxil 1000mg canada

Pingback: cialis information

Pingback: cenforce 200 ook voor vrouwen

Pingback: cost of augmentin 875

Pingback: super p-force ideal

Pingback: nintedanib pronounce

Pingback: super p force aanbieding

Pingback: cenforce professional

Pingback: filitra

Pingback: how long does kisqali extend life

Pingback: best time to apply androgel 1.62

Pingback: cialis 5mg what is it

Pingback: malegra oral jelly sildenafil

Pingback: xenical without rx

Pingback: super kamagra tablets in India

Pingback: quanto dura l'effetto avanafil

Pingback: malegra tablets

Pingback: cenforceindia.com/cenforce-120.html

Pingback: drug for eye

Pingback: tastylia

Pingback: Vidalista 20

Pingback: imdur medication

Pingback: super tadapox 40 mg

Pingback: iverwell

Pingback: can i buy amoxil over the counter cvs pharmacy

Pingback: priligy uk

Pingback: tolvaptan and adpkd

Pingback: Sildenafil 100mg Price

Pingback: flagyl antibiotic for dogs

Pingback: cenforce

Pingback: ivermectinus.com

Pingback: clominfo.wordpress.com

Pingback: tadalafilendy.com

Pingback: dapoxetinedon.com

Pingback: otclevitra.com

Pingback: albyterol.com

Pingback: ventolinair.com

Pingback: cenforceindia.com

Pingback: cialfrance.com

Pingback: stromectolist.com

Pingback: sibluevi.com

Pingback: iwermectin.com

Pingback: lipitorbrl.com

Pingback: cialsfr.com

Pingback: prxviagra.com

Pingback: community.databricks.com/t5/user/viewprofilepage/user-id/101015

Pingback: tourism.ju.edu.jo/Lists/AlumniInformation/DispForm.aspx?ID=243

Pingback: tadaga 5mg

Pingback: cialis oral jelly

Pingback: how to get rid of red face from viagra

Pingback: cialis Tadalafil 20 mg

Pingback: vermact 12 use

Pingback: dapoxetine usa

Pingback: super Vidalista opinie

Pingback: asthalin inhaler 12 gm

Pingback: buy lasix sale

Pingback: kamagra 100mg oral jelly buy

Pingback: ivermectol 3mg

Pingback: tab ivermite 6mg

Pingback: order sildenafil 50mg for sale

Pingback: gout medication probenecid

Pingback: plaquenil 200 mg side effects

Pingback: Azithromycin 250 mg tablets

Pingback: furosemide 20 mg oral tablet