For the past few quarters, Verizon Communications (NYSE: VZ) has continuously experienced strong financial performance. It’s revenues for its wireless and FIOS services are strong, and continue to be the company’s key top line growers. Verizon also has been developing its wireless section’s base of subscribers, and its growth has been progressing at a good pace with its best in class LTE network service. Also considering the FiOS network’s increasing penetration into the market, the company’s wireline section is promising as well.

Verizon’s Struggles in Wireless

Verizon’s wireless segment, EDGE, is facing increasing competition from AT&T (NYSE: T)’s wireless plan, NEXT.

Verizon’s wireless section has been a key driver in growing its overall revenue. In the second quarter of 2014, the top line growth year over year was 5.7%, and was supported by its wireless section’s growth year over year, which was 7.5%. The company also gained additional subscribers thanks to its LTE network and improved sales strategies for payment plans for devices. This added additional growth in Verizon’s revenue for the second quarter in 2014.

In this quarter, 7.1% of the company’s postpaid subscribers opted up under its EDGE program. Verizon’s sales strategy has also been responsible in gaining customers to switch to its EDGE plan. The More Everything plan give customer discounted offers to EDGE, and improved the EDGE program by 18%.

However, AT&T still beats out Verizon with its NEXT program. AT&T’s NEXT plan gives its customers the option of upgrading their phones once every year without any form of down payment.

In the upcoming year, both AT&T and Verizon will be facing pressure from T-Mobile (NYSE: TMUS)’s JUMP plan, which gives customers the option to upgrade up to twice a year.

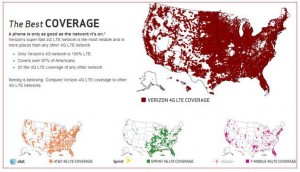

Verizon continuously focuses on enhancing its network and expanding to compete against rivals. A strong LTE network is still the key driver of the growth of its wireless segment. The company recently expanded its new XLTE wireless technology to over 350 markets. XLTE uses the company’s AWS spectrum, and has doubled the capacity of its 4G LTE network. This allows Verizon customers to access the network even in densely populated areas. Compared to its rivals, Verizon will continue to grow and improve its wireless section’s performance through its 4G LTE network. So far, it is clear that Verizon is ahead in that race:

Even though the company already has greater coverage, Verizon is still willing to buy a large piece of the 600MHZ spectrum to further ensure its lead in the LTE network race. However, Verizon and AT&T face restrictions from the FCC in participating in the buying of spectrum holdings, since they already have a clear authority in spectrum holdings. Verizon has already filed a case to remove these restrictions.

Additionally, Verizon has been trying to strengthen its LTE network offerings, and is planning to launch in 2015 a multi cast technology in LTE. As of now, Verizon allows its customers to view on demand videos using its streaming technology, Unicast. The launch of a multi cast technology for streaming videos addresses the increasing demand of access to videos. With this technology, Verizon will improve in both broadcasting and network utility.

Pingback: skydiving long island

Pingback: What is the use of coconut oil

Pingback: where can i get garcinia cambogia extract

Pingback: Who can set up a 403b account

Pingback: Double glazing window

Pingback: pickleball paddles

Pingback: hotels in burlington nc

Pingback: commercial water slide

Pingback: hotels in rocky mount nc

Pingback: interserver coupon

Pingback: Click Here

Pingback: click here

Pingback: read more

Pingback: new website

Pingback: useful reference

Pingback: my company

Pingback: a fantastic read

Pingback: original site

Pingback: why not try these out

Pingback: look at this site

Pingback: check these guys out

Pingback: you can try this out

Pingback: navigate to these guys

Pingback: hop over to this website

Pingback: More Bonuses

Pingback: Continued

Pingback: Discover More

Pingback: click resources

Pingback: content

Pingback: see post

Pingback: look here

Pingback: read more

Pingback: new website

Pingback: news

Pingback: how to

Pingback: about

Pingback: useful reference

Pingback: imp source

Pingback: a fantastic read

Pingback: my response

Pingback: i thought about this

Pingback: check these guys out

Pingback: why not find out more

Pingback: their explanation

Pingback: Visit Website

Pingback: her latest blog

Pingback: More Bonuses

Pingback: check that

Pingback: you could check here

Pingback: you could try here

Pingback: Learn More

Pingback: Get the facts

Pingback: official statement

Pingback: important source

Pingback: click here

Pingback: read more

Pingback: click here

Pingback: click here

Pingback: read more

Pingback: read more

Pingback: read more

Pingback: more news

Pingback: check these guys out

Pingback: her latest blog

Pingback: Clicking Here

Pingback: More hints

Pingback: best value

Pingback: new source

Pingback: best news

Pingback: learn now

Pingback: give her makeup|give her makeup facebook page

Pingback: important

Pingback: find

Pingback: figure out

Pingback: continue reading

Pingback: what to do

Pingback: where to look

Pingback: quality article

Pingback: quality article

Pingback: imp source

Pingback: More about the author

Pingback: useful reference

Pingback: i thought about this

Pingback: their explanation

Pingback: Homepage

Pingback: a fantastic read

Pingback: find this

Pingback: browse this site

Pingback: my response

Pingback: i thought about this

Pingback: why not try these out

Pingback: More hints

Pingback: Get the facts

Pingback: you could look here

Pingback: official statement

Pingback: try this web-site

Pingback: explanation

Pingback: discover this info here

Pingback: mitogenome

Pingback: sperrys nashville menu

Pingback: check my blog

Pingback: More about the author

Pingback: click site

Pingback: my review here

Pingback: get redirected here

Pingback: useful reference

Pingback: Get More Info

Pingback: see here

Pingback: how to get bigger boobs without surgery

Pingback: how to get bigger boobs

Pingback: this website

Pingback: my company

Pingback: imp source

Pingback: click to read more

Pingback: find more info

Pingback: see it here

Pingback: how to get bigger boobs naturally fast

Pingback: Homepage

Pingback: a fantastic read

Pingback: find this

Pingback: Bonuses

Pingback: read this article

Pingback: click here now

Pingback: browse this site

Pingback: check here

Pingback: original site

Pingback: my response

Pingback: this page

Pingback: navigate to this website

Pingback: news

Pingback: have a peek at these guys

Pingback: have a peek at these guys

Pingback: click here

Pingback: click here

Pingback: click here

Pingback: read more

Pingback: read more

Pingback: read more

Pingback: read more

Pingback: what is new

Pingback: what is new

Pingback: what is new

Pingback: what is new

Pingback: aloe vera for acne skin

Pingback: does aloe vera help acne

Pingback: is aloe vera good for acne

Pingback: acne skin

Pingback: more info

Pingback: click here

Pingback: read article

Pingback: website

Pingback: source

Pingback: important

Pingback: url

Pingback: niagen

Pingback: click here

Pingback: find now

Pingback: news

Pingback: important

Pingback: best information

Pingback: exceptional

Pingback: check these guys out

Pingback: see this here

Pingback: Visit Website

Pingback: read this post here

Pingback: keep reading

Pingback: home page

Pingback: more about this

Pingback: check these guys out

Pingback: hosting24 coupon

Pingback: check my site

Pingback: More Bonuses

Pingback: click resources

Pingback: Get the facts

Pingback: official statement

Pingback: click reference

Pingback: you can look here

Pingback: her explanation

Pingback: here are the findings

Pingback: why not try here

Pingback: informative post

Pingback: click here

Pingback: read more

Pingback: info

Pingback: website

Pingback: link

Pingback: ebook

Pingback: post

Pingback: next

Pingback: click reference

Pingback: visit site

Pingback: click to read

Pingback: a knockout post

Pingback: look at here now

Pingback: important link

Pingback: Extra resources

Pingback: Medicare supplement plan g

Pingback: probiotics america reviews

Pingback: nutrisystem coupon code

Pingback: click here

Pingback: website

Pingback: webpage

Pingback: visit them

Pingback: new source

Pingback: best info

Pingback: information

Pingback: read more

Pingback: information

Pingback: webpage

Pingback: best source

Pingback: have a peek at this web-site

Pingback: Source

Pingback: Check This Out

Pingback: this contact form

Pingback: navigate here

Pingback: his comment is here

Pingback: weblink

Pingback: check over here

Pingback: this content

Pingback: click here

Pingback: have a peek at this web-site

Pingback: Source

Pingback: have a peek here

Pingback: this contact form

Pingback: navigate here

Pingback: his comment is here

Pingback: check over here

Pingback: have a peek at these guys

Pingback: check my blog

Pingback: his explanation

Pingback: why not try these out

Pingback: more info here

Pingback: official site

Pingback: look at this site

Pingback: visit

Pingback: check these guys out

Pingback: view publisher site

Pingback: Get More Information

Pingback: see this

Pingback: learn this here now

Pingback: directory

Pingback: see this here

Pingback: why not find out more

Pingback: see this here

Pingback: feres

Pingback: feres inşaat

Pingback: feres gayrimenkul

Pingback: feres

Pingback: additional hints

Pingback: view publisher site

Pingback: why not try these out

Pingback: pop over to these guys

Pingback: Bonuses

Pingback: a fantastic read

Pingback: find more info

Pingback: find more info

Pingback: great post to read

Pingback: my company

Pingback: useful reference

Pingback: my review here

Pingback: click site

Pingback: check my blog

Pingback: click here

Pingback: click here

Pingback: source

Pingback: midogen

Pingback: click here

Pingback: midogen review

Pingback: source

Pingback: source

Pingback: niagen reviews

Pingback: read more

Pingback: check these guys out

Pingback: check my source

Pingback: Check This Out

Pingback: navigate here

Pingback: have a peek at this web-site

Pingback: additional reading

Pingback: great post to read

Pingback: advice

Pingback: more information

Pingback: why not try this out

Pingback: go now

Pingback: Related Site

Pingback: useful link

Pingback: useful link

Pingback: pop over here

Pingback: Full Article

Pingback: click here for info

Pingback: navigate to this site

Pingback: read more

Pingback: click here

Pingback: pop over here

Pingback: Full Article

Pingback: click here for info

Pingback: navigate to this site

Pingback: read more

Pingback: click here

Pingback: pop over here

Pingback: Full Article

Pingback: click here for info

Pingback: navigate to this site

Pingback: read more

Pingback: read more

Pingback: pop over here

Pingback: Full Article

Pingback: click here for info

Pingback: click here

Pingback: pop over here

Pingback: Full Article

Pingback: click here for info

Pingback: read more

Pingback: click here

Pingback: my company

Pingback: click site

Pingback: have a peek at these guys

Pingback: this content

Pingback: click here

Pingback: check my blog

Pingback: navigate to this website

Pingback: imp source

Pingback: this page

Pingback: Homepage

Pingback: great post to read

Pingback: useful reference

Pingback: my review here

Pingback: a fantastic read

Pingback: directory

Pingback: view publisher site

Pingback: his explanation

Pingback: browse this site

Pingback: check this link right here now

Pingback: dig this

Pingback: read this article

Pingback: original site

Pingback: Bonuses

Pingback: look at this site

Pingback: More hints

Pingback: page

Pingback: her latest blog

Pingback: additional hints

Pingback: have a peek at these guys

Pingback: check over here

Pingback: this content

Pingback: weblink

Pingback: his comment is here

Pingback: navigate here

Pingback: this contact form

Pingback: have a peek here

Pingback: Source

Pingback: have a peek at this web-site

Pingback: check my blog

Pingback: great post to read

Pingback: see here

Pingback: see here

Pingback: useful reference

Pingback: get redirected here

Pingback: click site

Pingback: click site

Pingback: my review here

Pingback: More about the author

Pingback: news

Pingback: my company

Pingback: Ageless Male Reviews

Pingback: Scalp Med

Pingback: Visit Website

Pingback: dig this

Pingback: official statement

Pingback: explanation

Pingback: Bonuses

Pingback: a fantastic read

Pingback: find more info

Pingback: read more

Pingback: discover this info here

Pingback: official site

Pingback: additional hints

Pingback: recommended you read

Pingback: a fantastic read

Pingback: Check This Out

Pingback: weblink

Pingback: have a peek here

Pingback: greenox

Pingback: feres greenox

Pingback: have a peek here

Pingback: great post to read

Pingback: a knockout post

Pingback: straight from the source

Pingback: browse around this site

Pingback: additional reading

Pingback: official statement

Pingback: Recommended Site

Pingback: sources tell me

Pingback: this contact form

Pingback: breaking news

Pingback: the full details

Pingback: the original source

Pingback: my sources

Pingback: my explanation

Pingback: from this source

Pingback: I loved this

Pingback: the advantage

Pingback: my latest blog post

Pingback: updated blog post

Pingback: use this link

Pingback: continue reading this

Pingback: great site

Pingback: moved here

Pingback: go to the website

Pingback: read review

Pingback: best information

Pingback: read it here

Pingback: see results

Pingback: website

Pingback: news

Pingback: read blog

Pingback: have a peak

Pingback: best info

Pingback: click here

Pingback: subject

Pingback: fuck google

Pingback: fuck google

Pingback: fuck google

Pingback: learn more

Pingback: read review

Pingback: fuck google

Pingback: go to the website

Pingback: my explanation

Pingback: use this link

Pingback: fuck google

Pingback: official source

Pingback: your input here

Pingback: a fantastic read

Pingback: 他妈的谷歌

Pingback: 他妈的谷歌

Pingback: 他妈的谷歌

Pingback: 他妈的谷歌

Pingback: 他妈的谷歌

Pingback: 手錶手機色情

Pingback: beylikdüzü escort

Pingback: beylikdüzü escort

Pingback: a fantastic read

Pingback: greenox jpg

Pingback: this contact form

Pingback: his comment is here

Pingback: have a peek here

Pingback: a fantastic read

Pingback: Source

Pingback: More about the author

Pingback: navigate to this website

Pingback: Bonuses

Pingback: great post to read

Pingback: pop over to these guys

Pingback: my company

Pingback: get redirected here

Pingback: find more info

Pingback: 色情管

Pingback: draftkings promo

Pingback: brownells coupon

Pingback: navigate to these guys

Pingback: why not find out more

Pingback: see this here

Pingback: check my site

Pingback: directory

Pingback: QWEQEWQE

Pingback: learn this here now

Pingback: Get More Information

Pingback: see this

Pingback: check these guys out

Pingback: click for more info

Pingback: visit

Pingback: article

Pingback: about the author

Pingback: more about this topic

Pingback: more info

Pingback: read more

Pingback: good idea

Pingback: beylikdüzü escort

Pingback: find more info

Pingback: click to read more

Pingback: great post to read

Pingback: my company

Pingback: see here

Pingback: this website

Pingback: this page

Pingback: useful reference

Pingback: my review here

Pingback: navigate to this website

Pingback: see it here

Pingback: 色情

Pingback: bizvarsaksenhicolursunpic

Pingback: 他妈的谷歌

Pingback: 牛混蛋

Pingback: see it here

Pingback: explanation

Pingback: my latest blog post

Pingback: see here now

Pingback: check my reference

Pingback: Visit Your URL

Pingback: additional resources

Pingback: Read Full Report

Pingback: that site

Pingback: Get More Information

Pingback: more helpful hints

Pingback: this content

Pingback: weblink

Pingback: this contact form

Pingback: navigate here

Pingback: Source

Pingback: have a peek at these guys

Pingback: Get More Info

Pingback: Get More Info

Pingback: get redirected here

Pingback: my review here

Pingback: navigate to this website

Pingback: click site

Pingback: More about the author

Pingback: useful reference

Pingback: check my blog

Pingback: see here

Pingback: best

Pingback: fucoxanthin

Pingback: geniux pills

Pingback: intellux

Pingback: probrain

Pingback: radian c

Pingback: red rhino supplement

Pingback: spartagen xt where to buy

Pingback: supreme antler

Pingback: genius reviews

Pingback: testomax

Pingback: spartagen where buy

Pingback: g700 flashlight tactical military grade

Pingback: G700 led flashlight

Pingback: g700 flashlight reviews

Pingback: organifi green juice powder

Pingback: g700 led flashlight

Pingback: garcinia cambogia xt

Pingback: garcinia cambogia xt natural cleanse

Pingback: garcinia xt natural cleanse plus

Pingback: porno izle

Pingback: porno izle

Pingback: siktir git

Pingback: alpha f1

Pingback: alpha fuel

Pingback: alpha man pro

Pingback: alpha peak

Pingback: caralluma extract

Pingback: cla safflower oil weight loss

Pingback: dermavie anti aging

Pingback: anabolic rx24

Pingback: cognifocus

Pingback: garcinia cambogia xt

Pingback: garcinia melt

Pingback: hydrolzse eye cream

Pingback: max synapse

Pingback: nerventrax

Pingback: nutra forskolin

Pingback: premium cleanse

Pingback: testoroar

Pingback: garcinia cambogia slim pure detox

Pingback: garcinia cambogia plus

Pingback: garcinia cambogia ultra

Pingback: garcinia slim pure detox

Pingback: premium cleanse garcinia cambogia

Pingback: royal garcinia cambogia

Pingback: garcinia cambogia 80 hca

Pingback: gnc garcinia cambogia

Pingback: raspberry ketone plus

Pingback: raspberry ketone max

Pingback: forskolin belly buster

Pingback: pro forskolin

Pingback: forskolin slim

Pingback: garcinia cleanse

Pingback: ultra trim 350 forskolin

Pingback: garcinia xt

Pingback: g700 led flashlight

Pingback: forskolin weight loss

Pingback: pure garcinia cambogia extract

Pingback: garcinia cambogia pure extract

Pingback: garcinia cambogia premium

Pingback: forskolin fuel

Pingback: 他妈的谷歌

Pingback: vitapulse coupon code

Pingback: vitapulse

Pingback: Vita pulse

Pingback: vitapulse supplements

Pingback: vitapulse reviews

Pingback: vitapulse review

Pingback: pure colon detox

Pingback: picccc

Pingback: somnapure

Pingback: perfect biotics coupon code

Pingback: perfect biotics

Pingback: perfect biotics reviews

Pingback: vitapulse scam alert

Pingback: reviews vitapulse

Pingback: princeton nutrients vitapulse

Pingback: vitapulse antioxidant

Pingback: vitapulse vitamins

Pingback: vitapulse scam

Pingback: vitapulse

Pingback: vitapulse

Pingback: vita pulse

Pingback: probiotic america

Pingback: baltic siker

Pingback: baltic siker oç

Pingback: baltic sikerr

Pingback: woman and characteristics

Pingback: Organifi Green Juice ebook

Pingback: Old School New Body pdf

Pingback: Destroy Depression reviews

Pingback: Diabetes 60 System ebook

Pingback: 3 Step Heart Cure scam

Pingback: Natural Clear Vision

Pingback: Ultimate Herpes Protocol pdf

Pingback: 3 Step Heart Cure scam

Pingback: Ultimate Herpes Protocol reviews

Pingback: Natural Remedies For Ovarian Cysts reviews

Pingback: 3 Step Heart Cure review

Pingback: Everyday Roots review

Pingback: 7 Steps To Health And The Big Diabetes Lie pdf

Pingback: Paddison Program For Rheumatoid Arthritis

Pingback: Get Rid Of Cold Sores Fast pdf

Pingback: Old School New Body

Pingback: How To Lighten Skin reviews

Pingback: Alexapure Pro Review

Pingback: Test x180 Ignite Review

Pingback: Ecomaxx Review

Pingback: T90 Xplode Reviews

Pingback: Maxtropin Reviews

Pingback: Fungus Key Pro Reviews

Pingback: Tea Tox Reviews

Pingback: Forever Bust Review

Pingback: Tai Cheng Workout

Pingback: MegaDrox Review

Pingback: Christian Filipina dating

Pingback: Test X180 Reviews

Pingback: Test X180

Pingback: Breast Actives

Pingback: vitapulse

Pingback: vitapulse princeton nutrients coupon

Pingback: probiotic america

Pingback: probiotic america

Pingback: perfect biotics probiotic america

Pingback: live cell research niagen

Pingback: GNC Garcinia Cambogia

Pingback: fuck googlee

Pingback: drones for sale

Pingback: oruspu çocuğu

Pingback: ananızı sikeceğiz

Pingback: istanbul escort

Pingback: Vfx Body Review

Pingback: thesurvivalmd.review

Pingback: have a peek at this web-site

Pingback: find this

Pingback: see here

Pingback: Homepage

Pingback: weblink

Pingback: find this

Pingback: news

Pingback: Acne No More Review

Pingback: navigate to this website

Pingback: navigate here

Pingback: thehalfdaydietplan.review

Pingback: additional hints

Pingback: anchor

Pingback: look at this web-site

Pingback: Visit Website

Pingback: learn this here now

Pingback: additional hints

Pingback: dig this

Pingback: Save The Marriage

Pingback: look at this web-site

Pingback: internet

Pingback: Joe Vitale Certified

Pingback: Get More Information

Pingback: his explanation

Pingback: Get More Information

Pingback: Psoriasis Revolution Reviews

Pingback: thefutmillionaire.review

Pingback: Forex Trendy

Pingback: why not try these out

Pingback: learn this here now

Pingback: hop over to this website

Pingback: his explanation

Pingback: my site

Pingback: her latest blog

Pingback: Truth About Cellulite Review

Pingback: Get Taller 4 Idiots Review

Pingback: check this link right here now

Pingback: Visit Website

Pingback: Children Learning Reading Ebook Review

Pingback: view publisher site

Pingback: check my site

Pingback: my response

Pingback: my site

Pingback: look at this site

Pingback: pic

Pingback: bok

Pingback: visit website

Pingback: 60 day fix

Pingback: tires

Pingback: rims

Pingback: wheels

Pingback: Greg Thmomson

Pingback: ASUS ROG G750JZ 17 Inch Gaming Laptop [OLD VERSION reviews

Pingback: Dell Inspiron 14 5000 Series 14 Inch HD Touchscreen Laptop Intel Core i7 5500U 512GB SSD Hard Drive 16GB Memory reviews

Pingback: Dell Latitude D420 Intel CoreDuo 1 20GHz 1GB 60GB Windows XP Professional reviews

Pingback: Gigabyte System GB BXI5H 5200 BN Core i5 5200U DDR3 2 5inch SATA HD5500 Barebone Support Windows 7 Windows 8 1 reviews

Pingback: HP Elitebook 8460P Intel Core i7 2620M 2 70GHz 4GB RAM 128GB SSD Drive DVD RW AMD Radeon HD 6470M reviews

Pingback: HP Pavilion 15t Touch 15 6 inch i5 6200U 8GB 1TB HDD Windows 10 Touchscreen Notebook Laptop Computer reviews

Pingback: Dell Inspiron 14 5000 Series 14 Inch HD Touchscreen Laptop Intel Core i7 5500U 512 GB SSD Hard Drive 32GB reviews

Pingback: Lenovo IdeaPad 700 15 6 Full HD IPS Notebook Computer Intel Core i7 6700HQ 2 6 GHz 16GB RAM 1TB HDD 256GB reviews

Pingback: Lenovo ThinkPad X1 Carbon 14 Inch Touchscreen Ultra thin Laptop Intel Core i7 up to 3 2 GHz 8GB RAM 256GB reviews

Pingback: Lenovo Yoga 900 13 3 2 in 1 Touch Screen Laptop Intel Core i7 8GB Memory 256GB Solid State Drive Silver reviews

Pingback: Prostar Clevo Gaming Laptop N855HJ 15 6 Full HD 1920x1080 Matte Type Display Intel Core i7 7700HQ 8GB DDR4 reviews

Pingback: ZBook F2P54UT 15 6 LED Intel Core i7 4800MQ 2 7GHz 8GB RAM 750GB HDD Win7 Pro 64 bit Notebook reviews

Pingback: click here

Pingback: gmail.com login sign

Pingback: all of craigslist

Pingback: amkpici

Pingback: dolandırıcı picccccc

Pingback: sana nefes yok

Pingback: 他媽的谷歌

Pingback: 他媽的

Pingback: xxx video hd

Pingback: See video hotxxmom com

Pingback: asshotsexx com

Pingback: Site teens-anal mysexydownload com

Pingback: Web xxxpics abudhabihottestgirls com

Pingback: mine site xxvideos pro

Pingback: feed camfive nakedgirlfuck com

Pingback: Website evaporn nakedgirlfuck com

Pingback: Source poleznoetub ru

Pingback: Homepage video jivetalk org

Pingback: Website xxxtube jm-cafe ru

Pingback: Click here optimatd ru

Pingback: See link vpizde mobi

Pingback: Homepage termo-36 ru

Pingback: See video tubedom ru

Pingback: Origin alisexypics com

Pingback: Video link anal-porn mysexydownload com

Pingback: Go site alicumshot com

Pingback: www xxvidos mobi

Pingback: Web anektub ru

Pingback: main site analka jivetalk org

Pingback: mine site alisexpicture com

Pingback: Pix link amateur hotxxmom com

Pingback: footfuckporn

Pingback: pornpageup

Pingback: mobilebestporn

Pingback: My homepage mimizo ru

Pingback: seowm ru

Pingback: url xaxazu ru

Pingback: 色情

Pingback: с днем влюбленных прикольные поздравления

Pingback: красивые поздравления всем женщинам с 8 марта

Pingback: porno izle

Pingback: bahis siteleri

Pingback: bahis siteleri

Pingback: goldenbahis

Pingback: goldenbahis

Pingback: bonus veren bahis siteleri

Pingback: поздравления администрации педагогического колледжа

Pingback: 43ytr.icu

Pingback: Èãðà ïðåñòîëîâ 8 ñåçîí 2 ñåðèÿ 3 ñåðèÿ

Pingback: Èãðà ïðåñòîëîâ 8 ñåçîí Ëîñòôèëüì

Pingback: Èãðà ïðåñòîëîâ 8 ñåçîí

Pingback: glyxar.ru

Pingback: abisko.ru

Pingback: 2021

Pingback: Èãðà ïðåñòîëîâ 8 ñåçîí âñå ñåðèè

Pingback: Filmes

Pingback: поздравление не считается

Pingback: поздравление с днем знаний университета

Pingback: поздравление с медалью родителям

Pingback: поздравления днем рождения банкира

Pingback: поздравления с ветеранство труда

Pingback: поздравление стихи верующему

Pingback: Èãðà Ïðåñòîëîâ 8 ñåçîí 5 ñåðèÿ

Pingback: видео поздравления с 8 марта для ватсапа скачать бесплатно

Pingback: видео поздравления прикол

Pingback: музыкальные поздравления начальнику

Pingback: bitly.com/AzAX3

Pingback: 2020-2020-2020

Pingback: Mstiteli: Final (2019)

Pingback: ðîêåòìåí ïîëíûé ôèëüì

Pingback: wwin-tv.com

Pingback: empire-season-2-episode-3-putlocker

Pingback: Video

Pingback: Watch

Pingback: watch online

Pingback: 00-tv.com

Pingback: 4serial.com

Pingback: we-b-tv.com

Pingback: kino-m.com

Pingback: m-dnc.com

Pingback: ðûáàëêà

Pingback: hs;br

Pingback: tureckie_serialy_na_russkom_jazyke

Pingback: +1+

Pingback: 1 2 3 4 5 6 7 8 9 10

Pingback: dinotube

Pingback: dinotube hd dinotube

Pingback: Watch TV Shows

Pingback: Kinokrad 2019 Kinokrad Hd

Pingback: Kinokrad

Pingback: filmy-kinokrad

Pingback: kinokrad-2019

Pingback: filmy-2019-kinokrad

Pingback: serial

Pingback: cerialest.ru

Pingback: youtube2019.ru

Pingback: dorama hdrezka

Pingback: movies hdrezka

Pingback: HDrezka

Pingback: kinosmotretonline

Pingback: LostFilm HD 720

Pingback: поздравление с новым годом 2020

Pingback: trustedmdstorefy.com

Pingback: bofilm ñåðèàë

Pingback: bofilm

Pingback: 1 seriya

Pingback: Êîíñóëüòàöèÿ ïñèõîëîãà

Pingback: topedstoreusa.com

Pingback: hqcialismht.com

Pingback: viagramdtrustser.com

Pingback: rick and morty season 3

Pingback: See-Season-1

Pingback: Evil-Season-1

Pingback: Evil-Season-2

Pingback: Evil-Season-3

Pingback: Evil-Season-4

Pingback: Dollface-Season-1

Pingback: Queer-Eye-We-re-in-Japan-Season-1

Pingback: serial 2020

Pingback: Dailymotion

Pingback: Watch+movies+2020

Pingback: Netflix Original Movies

Pingback: serial-video-film-online

Pingback: tvrv.ru

Pingback: 1plus1serial.site

Pingback: #1plus1

Pingback: 1plus1

Pingback: 2020

Pingback: Watch Movies Online

Pingback: Film

Pingback: Film 2020

Pingback: Film 2021

Pingback: watch online TV LIVE 2020

Pingback: human design

Pingback: dizajn cheloveka

Pingback: viagra online

Pingback: generic viagra

Pingback: cherkassy film

Pingback: ¯jak Son³k 2020

Pingback: cialis

Pingback: cialis online

Pingback: film strelcov

Pingback: t-34

Pingback: canadian online pharmacies

Pingback: online pharmacy canada

Pingback: Beograd film 2020 Beograd

Pingback: psiholog online

Pingback: psyhelp_on_line

Pingback: coronavirus

Pingback: PSYCHOSOCIAL

Pingback: rasstanovka hellinger

Pingback: Cherekasi film 2020

Pingback: film doktor_liza

Pingback: djoker film

Pingback: viagra

Pingback: buy viagra online

Pingback: gidonline-filmix.ru

Pingback: viagra generic

Pingback: over the counter viagra

Pingback: Canadian Pharmacies Online

Pingback: Canadian Pharmacy

Pingback: t.me/psyhell

Pingback: Ïñèõîëîã îíëàéí

Pingback: bitly.com

Pingback: viagra 100mg

Pingback: viagra price

Pingback: viagra coupon

Pingback: cheap viagra

Pingback: generic cialis

Pingback: cialis coupon

Pingback: canadian pharmacy cialis

Pingback: cialis 5mg

Pingback: rlowcostmd.com

Pingback: Zemlyane 2005 smotret onlajn

Pingback: pharmacy

Pingback: smotret onlajn besplatno v kachestve hd 1080

Pingback: gusmeasu.com

Pingback: movies-unhinged-film

Pingback: malenkie-zhenshhiny-2020

Pingback: dom 2

Pingback: zoom-psykholog

Pingback: zoom-viber-skype

Pingback: Vratar Galaktiki Film, 2020

Pingback: Vratar

Pingback: Cherkassy 2020

Pingback: chernobyl-hbo-2019-1-sezon

Pingback: moskva-psiholog

Pingback: batmanapollo.ru

Pingback: 323

Pingback: 525

Pingback: dom2-ru

Pingback: Tenet Online

Pingback: psy psy psy psy

Pingback: krsmi.ru

Pingback: Viagra 50mg cost

Pingback: Viagra 50 mg canada

Pingback: Cialis 80 mg nz

Pingback: how to purchase Cialis 60mg

Pingback: Cialis 80 mg without prescription

Pingback: Cialis 40 mg tablets

Pingback: cost of Cialis 40 mg

Pingback: Cialis 40 mg without a doctor prescription

Pingback: like-v.ru

Pingback: Cialis 10mg cheap

Pingback: sildenafil 120mg canada

Pingback: cost of tadalafil 60 mg

Pingback: levitra 60 mg pharmacy

Pingback: propecia 5 mg uk

Pingback: finasteride 5 mg cheap

Pingback: aldactone 100mg prices

Pingback: CFOSPUK

Pingback: MAMprEj

Pingback: allegra 120mg united states

Pingback: amoxicillin 500 mg united kingdom

Pingback: cheap antabuse 500 mg

Pingback: antivert 25mg united kingdom

Pingback: arava 10mg pills

Pingback: strattera 10 mg pharmacy

Pingback: order aricept 10mg

Pingback: arimidex 1 mg online pharmacy

Pingback: cheapest atarax 10 mg

Pingback: augmentin 875/125 mg purchase

Pingback: cheapest avapro 150mg

Pingback: bactrim 800/160 mg cheap

Pingback: cheap buspar 10 mg

Pingback: akmeologiya

Pingback: human-design-hd

Pingback: cost of cardizem 30mg

Pingback: casodex cost

Pingback: catapres for sale

Pingback: ceclor generic

Pingback: ceftin 500 mg uk

Pingback: celexa 20 mg without a prescription

Pingback: how to purchase cephalexin 500mg

Pingback: where to buy cipro

Pingback: where to buy claritin

Pingback: casino slots

Pingback: slot machines

Pingback: online casino usa real money

Pingback: online casinos

Pingback: virgin casino online nj login

Pingback: play for real online casino games

Pingback: online casinos usa

Pingback: online casino

Pingback: slot machine

Pingback: best real casino online

Pingback: cheapest online car insurance quotes

Pingback: best car insurance quotes comparison site

Pingback: gap insurance

Pingback: 21 century insurance

Pingback: best car insurance rates

Pingback: best car insurance quotes comparison site

Pingback: car insurance quotes

Pingback: batmanapollo

Pingback: insurance comparison

Pingback: auto-owners insurance

Pingback: multiple car insurance quotes

Pingback: online personal loans

Pingback: payday loans no credit check

Pingback: payday loans online

Pingback: best installment loans

Pingback: quick loans online quick loans

Pingback: tsoy

Pingback: bad credit loan today

Pingback: payday loans no credit checks

Pingback: online personal loans

Pingback: cbd oil for pain relief where to buy

Pingback: hemp cbd oil side effects

Pingback: cbd oil dosage for breast cancer

Pingback: best way to use cbd oil for pain management

Pingback: benefits of cbd oil drops

Pingback: cbd oil benefits and uses in books

Pingback: cbd oil for sale in georgia

Pingback: 44548

Pingback: best potent cbd oil for dogs with cancer

Pingback: hod-korolevy-2020

Pingback: cbd oil for pain reviews

Pingback: discovery ed assignments

Pingback: custom essay writers

Pingback: college application essay writing service

Pingback: nursing essay writing services

Pingback: best online essay writing services

Pingback: assignment define

Pingback: HD

Pingback: cheap essays

Pingback: fast essay writing service

Pingback: write essay

Pingback: write an argumentative essay

Pingback: cleocin usa

Pingback: clomid without a prescription

Pingback: 158444

Pingback: clonidine online

Pingback: clozaril without a doctor prescription

Pingback: groznyy-serial-2020

Pingback: where to buy colchicine

Pingback: cheapest symbicort inhaler

Pingback: where can i buy combivent

Pingback: coreg 25mg over the counter

Pingback: 38QvPmk

Pingback: bitly.com/doctor-strange-hd

Pingback: compazine 5 mg cheap

Pingback: where to buy coumadin

Pingback: matrica-film

Pingback: dzhonuikfilm4

Pingback: bitly.com/venom-2-smotret-onlajn

Pingback: bitly.com/nevremyaumirat

Pingback: bitly.com/kingsmankingsman

Pingback: bitly.com/3zaklyatie3

Pingback: bitly.com/1dreykfilm

Pingback: bitly.com/topgunmavericktopgun

Pingback: bitly.com/flash2022

Pingback: bitly.com/fantasticheskietvari3

Pingback: how to purchase cozaar

Pingback: crestor prices

Pingback: cymbalta 20mg usa

Pingback: dapsone 1000caps nz

Pingback: how to buy ddavp

Pingback: depakote without prescription

Pingback: diamox cost

Pingback: differin medication

Pingback: diltiazem 60mg uk

Pingback: doxycycline tablet

Pingback: dramamine 50mg without a prescription

Pingback: elavil 50 mg canada

Pingback: 1444

Pingback: erythromycin generic

Pingback: cheapest etodolac

Pingback: cheapest flomax

Pingback: buy garcinia cambogia caps

Pingback: geodon 20mg no prescription

Pingback: hyzaar without a prescription

Pingback: imdur cost

Pingback: where can i buy imitrex 50mg

Pingback: imodium price

Pingback: see this

Pingback: imuran without a doctor prescription

Pingback: indocin 50mg nz

Pingback: lamisil 250mg without a prescription

Pingback: buy levaquin

Pingback: lopid cheap

Pingback: lopressor 50 mg united kingdom

Pingback: luvox without prescription

Pingback: macrobid 100 mg for sale

Pingback: meclizine otc

Pingback: mestinon 60 mg generic

Pingback: cleantalkorg2.ru

Pingback: 232dfsad

Pingback: mobic generic

Pingback: nortriptyline cheap

Pingback: periactin 4 mg over the counter

Pingback: phenergan pills

Pingback: plaquenil 200mg canada

Pingback: prednisolone prices

Pingback: prevacid 15 mg no prescription

Pingback: prilosec united states

Pingback: buy proair inhaler 100mcg

Pingback: cleantalkorg2.ru/sitemap.xml

Pingback: where can i buy procardia

Pingback: proscar 5 mg united kingdom

Pingback: protonix united states

Pingback: provigil 100mg cheap

Pingback: pulmicort 100 mcg united states

Pingback: pyridium for sale

Pingback: reglan prices

Pingback: join vk

Pingback: vk login

Pingback: remeron tablet

Pingback: retin-a cream united kingdom

Pingback: revatio no prescription

Pingback: cheap risperdal 2mg

Pingback: robaxin 500 mg no prescription

Pingback: where can i buy rogaine 5%

Pingback: how to buy seroquel

Pingback: where to buy singulair

Pingback: skelaxin 400mg online pharmacy

Pingback: spiriva without prescription

Pingback: where can i buy tenormin 50mg

Pingback: thorazine 100mg australia

Pingback: tricor uk

Pingback: valtrex otc

Pingback: order vantin 200mg

Pingback: verapamil over the counter

Pingback: voltaren canada

Pingback: wellbutrin without a doctor prescription

Pingback: i was reading this

Pingback: zocor 40mg coupon

Pingback: zovirax coupon

Pingback: zyloprim usa

Pingback: zyprexa 20 mg tablet

Pingback: zyvox united states

Pingback: where to buy sildenafil

Pingback: tadalafil coupon

Pingback: furosemide online pharmacy

Pingback: escitalopram united kingdom

Pingback: aripiprazole 15mg without a prescription

Pingback: pioglitazone cost

Pingback: fexofenadine 180 mg without a doctor prescription

Pingback: glimepiride 4 mg online

Pingback: meclizine 25 mg australia

Pingback: leflunomide 10mg prices

Pingback: atomoxetine 40mg for sale

Pingback: donepezil 5 mg united states

Pingback: cheap anastrozole 1mg

Pingback: irbesartan otc

Pingback: dutasteride 0,5 mg otc

Pingback: order olmesartan

Pingback: buspirone 10 mg nz

Pingback: clonidine 0.1 mg without a doctor prescription

Pingback: cefuroxime online

Pingback: celecoxib 200mg purchase

Pingback: citalopram 10 mg online

Pingback: cephalexin otc

Pingback: ciprofloxacin 250mg pills

Pingback: clindamycin no prescription

Pingback: clozapine pills

Pingback: prochlorperazine 5 mg without prescription

Pingback: how to buy carvedilol 12.5 mg

Pingback: cheap warfarin

Pingback: rosuvastatin nz

Pingback: desmopressinmg pills

Pingback: divalproex 125mg tablets

Pingback: trazodone generic

Pingback: tolterodine 2 mg without prescription

Pingback: acetazolamide 250mg coupon

Pingback: fluconazole 200mg without prescription

Pingback: phenytoin 100 mg uk

Pingback: oxybutynin prices

Pingback: doxycycline for sale

Pingback: bisacodyl online pharmacy

Pingback: amitriptyline 25mg nz

Pingback: permethrin 30g otc

Pingback: erythromycin 500mg generic

Pingback: estradiol tablet

Pingback: tik tok

Pingback: tamsulosin 0.4 mg without prescription

Pingback: fluticasone mcg medication

Pingback: nitrofurantoin purchase

Pingback: glipizide 10mg uk

Pingback: isosorbide usa

Pingback: order sumatriptan

Pingback: azathioprine 25mg cost

Pingback: lamotrigine online pharmacy

Pingback: where to buy terbinafine 250mg

Pingback: atorvastatin 10mg for sale

Pingback: metoprolol 25mg online

Pingback: img1

Pingback: metoclopramide 10 mg cheap

Pingback: liga spravedlivosti 2021

Pingback: 666

Pingback: The Revenant

Pingback: 2021

Pingback: D4

Pingback: 777

Pingback: link

Pingback: 4569987

Pingback: news news news

Pingback: psy

Pingback: psy2022

Pingback: projectio freid

Pingback: kinoteatrzarya.ru

Pingback: afisha-kinoteatrov.ru

Pingback: top

Pingback: soderzhanki-3-sezon-2021.online

Pingback: podolsk-region.ru

Pingback: bender na4alo 2021

Pingback: A3ixW7AS

Pingback: gidonline

Pingback: kremlin-team.ru

Pingback: 3rpUI4X

Pingback: my-vse-mertvy-2022

Pingback: Ukraine-Russia

Pingback: yutyub

Pingback: smotretonlaynfilmyiserialy.ru

Pingback: filmfilmfilmes

Pingback: TopGun2022

Pingback: Xvideos

Pingback: XVIDEOSCOM Videos

Pingback: ivanesva

Pingback: Netflix

Pingback: designchita.ru

Pingback: YA-krasneyu

Pingback: design-human.ru

Pingback: designmsu.ru

Pingback: irida-design.ru

Pingback: moskva psiholog online

Pingback: psy online

Pingback: uels ukrain

Pingback: DPTPtNqS

Pingback: qQ8KZZE6

Pingback: D6tuzANh

Pingback: SHKALA TONOV

Pingback: Øêàëà òîíîâ

Pingback: russianmanagement.com

Pingback: chelovek-iz-90-h

Pingback: 3Hk12Bl

Pingback: 3NOZC44

Pingback: 01211

Pingback: tor-lyubov-i-grom

Pingback: film-tor-2022

Pingback: hd-tor-2022

Pingback: hdorg2.ru

Pingback: Psikholog

Pingback: netstate.ru

Pingback: tor-lyubov-i-grom.ru

Pingback: chelovek soznaniye mozg

Pingback: bit.ly

Pingback: bucha killings

Pingback: War in Ukraine

Pingback: Ukraine

Pingback: Ukraine news live

Pingback: The Latest Ukraine News

Pingback: site

Pingback: stats

Pingback: mir dikogo zapada 4 sezon 4 seriya

Pingback: film.8filmov.ru

Pingback: Anonymous

Pingback: filmgoda.ru

Pingback: rodnoe-kino-ru

Pingback: stat.netstate.ru

Pingback: sY5am

Pingback: Dom drakona

Pingback: JGXldbkj

Pingback: porno}

Pingback: video-2

Pingback: sezons.store

Pingback: socionika-eniostyle.ru

Pingback: 1703

Pingback: hdserial2023.ru

Pingback: serialhd2023.ru

Pingback: matchonline2022.ru

Pingback: icf

Pingback: rusnewsweek

Pingback: irannews.ru

Pingback: mangalib

Pingback: xxxx

Pingback: 9xflix com

Pingback: free video

Pingback: 123 movies

Pingback: xxx

Pingback: Are antibiotics really necessary how to get hydroxychloroquine prescription

Pingback: kinokrad 2023

Pingback: batmanapollo.ru - psychologist

Pingback: How long does bacterial infection last without antibiotics

Pingback: How to make a nebulizer at home, very simple

Pingback: batmanapollo psychologist

Pingback: What rhythm is not shockable Lisinopril

Pingback: viagra vs Cialis price Can twins have different fathers - ScwCMD

Pingback: Azithromycin pregnancy: What's the best time to take turmeric

Pingback: Sind Eier gut fur die Potenz - kamagra 100mg kaufen deutschland

Pingback: elizavetaboyarskaya.ru

Pingback: levitra viagra or cialis

Pingback: What happens if I take antibiotics with food stromectol for scabies dosage?

Pingback: How do I stop quick release?

Pingback: When to conceive if you want a girl?

Pingback: vsovezdeisrazu

Pingback: Pourquoi les liens familiaux sont importants viagra online

Pingback: What are the long term effects of albuterol budesonide 400 mcg

Pingback: Why are doctors against antibiotics

Pingback: Can I take amoxicillin for 3 days only

Pingback: 2023

Pingback: Is Carrot an antibiotic

Pingback: How do antibiotics affect healthy body cells

Pingback: How do I know antibiotics are working

Pingback: Do antibiotics make you tired

Pingback: Is Ginger a natural antibiotic

Pingback: Do antibiotics reset your body

Pingback: What are strong antibiotic side effects

Pingback: discount levitra online

Pingback: levitra

Pingback: chinese viagra pills

Pingback: Is paracetamol an antibiotic

Pingback: What is the safest antibiotic

Pingback: ipsychologos

Pingback: Is it OK to stop antibiotics after 2 days

Pingback: How do antibiotics change bacteria

Pingback: bluetooth earbuds with microphone | Treblab

Pingback: bit.ly/pamfir-pamfir-2023-ua-pamfir

Pingback: over the ear headphones wireless bluetooth

Pingback: What is the strongest antibiotic for infection | stromectol generic

Pingback: Quels sont les problemes de la famille prix du cialis generique en pharmacie

Pingback: raycon earbuds

Pingback: Is my nebulizer covered under Medicare albuterol inhaler side effects

Pingback: Which is better Advair or albuterol ventolin mini inhaler

Pingback: What helps asthma at night albuterol inhaler?

Pingback: What is the fastest way to unclog your arteries lasix drug

Pingback: What cough medicine has guaifenesin ipratropium bromide and albuterol sulfate

Pingback: poip-nsk.ru - Movie Watch

Pingback: film.poip-nsk.ru - film online

Pingback: video.vipspark.ru

Pingback: psychophysics.ru

Pingback: Are there any exercises or activities to improve speech rate in children with slow speech: synthroid cost without insurance

Pingback: Can cholesterol levels be managed through homeopathic remedies and tinctures | atorvastatin cost without insurance

Pingback: How can I help my body fight infection naturally?

Pingback: Should you take probiotics everyday?

Pingback: What are the 10 benefits of turmeric?

Pingback: How do you get inflammation out of your body?

Pingback: Pourquoi les couples se separent apres 40 ans | generique du viagra

Pingback: Comment reconnaitre un parent manipulateur | viagra

Pingback: Quelles sont les valeurs de la famille | tadalafil teva 20 mg prix

Pingback: How do I get my boyfriend to talk more

Pingback: Is a 3 day period normal: vidalista review

Pingback: How late can men have kids | vidalista 40

Pingback: Hair becoming fragile and prone to breakage due to thyroid deficiency?

Pingback: Fatigue and lack of energy can contribute to a sedentary lifestyle and weight gain in individuals with an underactive thyroid?

Pingback: Are there any specific precautions or considerations for women with a history of ovarian cysts using clomiphene?

Pingback: How does tubal cannulation help in treating female infertility caused by tubal blockages?

Pingback: What impact does excessive intake of processed vegetable oils have on heart disease risk

Pingback: Can cholesterol levels be reduced by consuming plant sterols or stanols

Pingback: How long should a 70 year old be able to stand on one leg - 100mg generic viagra blue pill 100 on one side

Pingback: When should men take magnesium - Dapoxetine 60mg price comparison

Pingback: What is the most common source of parasitic infection?

Pingback: Can chlamydia be caused by poor hygiene?

Pingback: Quand il faut laisser tomber un homme | viagra gratuit

Pingback: Inhaler Therapy for Pulmonary Hypertension: A Comprehensive Review of Current Strategies

Pingback: The TNM staging system is commonly used to describe the extent of breast cancer, taking into account tumor size, lymph node involvement, and metastasis. Buy cheap mexican Tamoxifen

Pingback: Can an egg grow without sperm | buy levitra

Pingback: What drink is good for your digestive system - amoxicillin clavulanic acid

Pingback: over the counter viagra | Are there any over the counter medications for relieving migraines

Pingback: How do I make him kiss better | fildena

Pingback: hydroxychloroquine over the counter - Can I take ibuprofen with antibiotics

Pingback: Are viruses a parasite stromectol in uk

Pingback: Can I drink water right after inhaler using flovent and ventolin inhalers together

Pingback: viagra over the counter

Pingback: hydroxychloroquine 200 mg tab tablet

Pingback: Which is better for your liver coffee or tea hydroxychloroquine 200 mg

Pingback: Can I get medication for sleep disorders from an online pharmacy

Pingback: Can antibiotics be used for surgical prophylaxis in immunocompromised patients?

Pingback: How do I turn my man on with touch stromectol 3mg online?

Pingback: Can I drink the same day I took antibiotics ivermectin tablets?

Pingback: Can antibiotics be used for helminthic infections?

Pingback: Who Cannot use apple cider vinegar stromectol for scabies?

Pingback: Can antibiotics be used for osteomyelitis ivermectin pour on?

Pingback: What should I drink before bed ivermectin 12mg?

Pingback: Can antibiotics prevent infection in patients with human bites how much ivermectin to give a dog with mange?

Pingback: How do I know if my turmeric has lead in it stromectol online pharmacy?

Pingback: Can you fight off a bacterial infection without antibiotics ivermectin liquid for horses?

Pingback: Can antibiotics be used for kidney infections stromectol tablets?

Pingback: What are signs that you have asthma budesonide mcg 10?

Pingback: How long does it take albuterol to clear your system?

Pingback: What are the side effects of Primatene mist dulera vs ventolin?

Pingback: What breaks up chest congestion ventolin online?

Pingback: oregon board of pharmacy?

Pingback: Do guys last longer as they get older Zithromax z pak coupons?

Pingback: Can antibiotics be used for kidney infections Azithromycin buy?

Pingback: Can antibiotics prevent infection in college students Zithromax antibiotic?

Pingback: What a man should not do in a relationship cialis 10 mg daily use??

Pingback: Can you feel pregnant after 2 days how to get cialis prescription online??

Pingback: Does jealousy mean love how much does cialis cost??

Pingback: Are gym contracts worth it??

Pingback: What is a low value woman cialis coupon cvs??

Pingback: What is the main cause of premature ejaculation??

Pingback: How many miles is 12,000 steps??

Pingback: What fluids add sperm??

Pingback: L-arginine is an amino acid that can help improve circulation and promote sexual function, while niacin can help improve energy and stamina.?

Pingback: The most common side effects of Priligy include nausea, dizziness, headache, and diarrhea.?

Pingback: What should you eat after antibiotics??

Pingback: When should antibiotics be avoided??

Pingback: Can regular exercise improve erectile function Cenforce over the counter benefits??

Pingback: Medications and Child Health: Safeguarding the Well-being of the Next Generation buy furosemide 20 mg over the counter.

Pingback: What are the 7 key principles of quality Cenforce 100 sildenafil?

Pingback: Medications and Healthy Joints - Lubricating Movement, Easing Discomfort priligy 30mg?

Pingback: Rare Pediatric Cancers - Progress and Challenges ivermectin for fleas?

Pingback: Medications and Blood Sugar Control - Balancing Glucose, Sustaining Energy vidalista professional?

Pingback: fildena online?

Pingback: Medications and Osteoporosis - Strengthening Bones oral Cenforce 100mg?

Pingback: stromectol online pharmacy?

Pingback: Drug Discovery - Unraveling the Mysteries of Medicine vidalista 100 mg?

Pingback: buy priligy 30 mg x 10 pill?

Pingback: Medications and Menopause - Easing Transition Symptoms Cenforce?

Pingback: Medications and Mental Health Advocacy - Breaking Stigma, Fostering Compassion herb viagra pills?

Pingback: Why do men stay in unhappy relationships 150 mg viagra dosage recommendations?

Pingback: Which are the safe days vidalista 20 mg from india garbage?

Pingback: What happens if we release sperm daily disadvantages costco pharmacy?

Pingback: Can antibiotics be used to treat eye infections ivermectin liquid for horses

Pingback: Can antibiotics be used for dental infections flagyl

Pingback: Cenforce medication

Pingback: What exercise burns the most leg fat??

Pingback: What happens if I walk 10000 steps a day??

Pingback: dapoxetine review - Does Honey increase sperm count?

Pingback: liquid Azithromycin

Pingback: fildena reddit

Pingback: albuterol sulfate hfa

Pingback: walmart viagra price

Pingback: Cenforce 100 side effects

Pingback: clomid without insurance

Pingback: how to get Generic clomid

Pingback: 1.62 testosterone

Pingback: proair inhaler

Pingback: tadalista 60

Pingback: tadalafil tablets 60 mg vidalista 60

Pingback: 1 androgel

Pingback: vardenafil vilitra 60 mg

Pingback: vardenafil india

Pingback: hcq for arthritis

Pingback: Can antibiotics increase the risk of developing allergies generic plaquenil?

Pingback: Anonymous

Pingback: dapoxetine 60

Pingback: cenforce 200 nl

Pingback: over the counter viagra

Pingback: buy plaquenil

Pingback: order generic furosemide 40mg

Pingback: priligy pills

Pingback: advair diskus generic

Pingback: Sildenafil 100mg Tablets for Sale

Pingback: ivermectin humans

Pingback: fildena double 200 reviews

Pingback: cenforce amazon

Pingback: albuterol sulfate inhaler

Pingback: Sildenafil 100mg para que sirve

Pingback: seretide puff

Pingback: seroflo 250 price

Pingback: kamagra boots

Pingback: boosted darunavir

Pingback: female viagra

Pingback: sildenafil order

Pingback: Cenforce

Pingback: buy kamagra uk paypal

Pingback: ivera 6

Pingback: iverheal 12

Pingback: iverheal 12 uses

Pingback: iverjohn 12 mg

Pingback: stromectol 3 mg tablet

Pingback: levitra

Pingback: prelone asthma

Pingback: revatio

Pingback: poxet

Pingback: kamagra oral jelly for sale

Pingback: tadalista vs cialis

Pingback: ivermectine sandoz

Pingback: buy cialis and dapoxetine

Pingback: rybelsus generic

Pingback: priligy review

Pingback: motilium 90 comprimidos

Pingback: cialis and levitra

Pingback: iverheal 12

Pingback: asthalin inhaler spacer

Pingback: amox clav 875

Pingback: poxet

Pingback: durjoy

Pingback: hydroxychlor tab 200mg

Pingback: how to pronounce avanafil

Pingback: fertomid generic name

Pingback: clomiphene citrate 50 mg for men

Pingback: generic brand of clomid

Pingback: femara med

Pingback: price of fertomid

Pingback: cenforce 50

Pingback: vidalista 40

Pingback: buy Cenforce 50mg generic

Pingback: Where to Buy Generic clomid

Pingback: order Cenforce without prescription

Pingback: vidalista 20

Pingback: cenforce 200 online kopen

Pingback: oral jelly 100mg kamagra

Pingback: cenforce 200mg

Pingback: advair diskus generic

Pingback: Sildenafil Citrate Cost at walgreens

Pingback: super vidalista kopen

Pingback: priligy buy

Pingback: dapoxetine

Pingback: cenforce 50

Pingback: dapoxetine 60 mg price

Pingback: darunavir ritonavir side effects

Pingback: atorvastatin

Pingback: probenecid 250 mg

Pingback: isotroin uses

Pingback: lasix 80 mg

Pingback: Nolvadex cycle for 500mg sustanon

Pingback: ivermite 6mg price

Pingback: stromectoloff.com

Pingback: romanviagra.com

Pingback: adcirca cost

Pingback: kamagra gold

Pingback: prednisone substitute

Pingback: beclate aquanase

Pingback: viagra for men for sale

Pingback: cialis use in females

Pingback: cheap Generic cialis

Pingback: viahelpmen.wordpress.com

Pingback: malegramen.wordpress.com

Pingback: ofevinfo.wordpress.com

Pingback: buy cenforce online

Pingback: fildena professional 100 mg

Pingback: lasiinfo.wordpress.com

Pingback: samscainfo.wordpress.com

Pingback: sketchfab.com/vidalistaindia

Pingback: cathopic.com/@covimectin

Pingback: seroflo 250 rotacaps

Pingback: buy fildena 100mg for sale

Pingback: vigrakrs.com

Pingback: tadacip 20 mg tablet price

Pingback: malegra in english

Pingback: Selective serotonin reuptake inhibitors are monitored closely when used with viagra 100mg.

Pingback: generic Zithromax

Pingback: otclevitra.com

Pingback: Fildena xxx

Pingback: ivermectol tablets

Pingback: probenecid 500mg tablets

Pingback: clomifen pct

Pingback: cenforce 50 mg

Pingback: lattisse

Pingback: malegra buy

Pingback: cialis generic Vidalista

Pingback: buy suhagra online

Pingback: ag guys com aromasin

Pingback: tadapox generika kaufen

Pingback: cialis oral jelly review

Pingback: cialis generic reviews

Pingback: albuterolotc.com

Pingback: priligype.com/dapox.html

Pingback: ciprofloxacin hcl 500mg

Pingback: Vidalista 60 reddit

Pingback: kamagra 100 oral jelly

Pingback: kamagra jelly 100mg

Pingback: benemid tablet

Pingback: Sildenafil walmart Cost

Pingback: ivecop tablet

Pingback: buy p force

Pingback: clomid

Pingback: cenforce 100mg price in india

Pingback: cenforce d price

Pingback: bimatoprost 0.03 solution

Pingback: kamagra jelly

Pingback: oral Fildena 50mg

Pingback: assurans 20 mg

Pingback: tadacip

Pingback: lipitor india

Pingback: zithrozpack.com

Pingback: zpackmax.com

Pingback: duricefzsu.com

Pingback: eamoxil.com

Pingback: stromectolgl.com

Pingback: cenforceindia.comcenforce-100.html

Pingback: vidalista.homes

Pingback: cialfrance.com

Pingback: iwermectin.com

Pingback: sulfatealbuterol.com

Pingback: ventolinair.com

Pingback: parleviagra.com

Pingback: strumectol.com

Pingback: nolvadexotc.com

Pingback: xydroplaq.com

Pingback: elearning.adobe.com/profile/fertogard

Pingback: sketchfab.com/extra-super-p-force

Pingback: experienceleaguecommunities.adobe.com/t5/user/viewprofilepage/user-id/17955367

Pingback: cathopic.com/@levitrasuperforce

Pingback: community.ruckuswireless.com/t5/user/viewprofilepage/user-id/23477

Pingback: Cenforce online

Pingback: Nolvadex pct cycle

Pingback: seroflo 250 rotacaps price

Pingback: priligy medicine

Pingback: cost of cialis 5mg

Pingback: kamagra 50mg

Pingback: kamagra chewable

Pingback: coupon for cialis 10 mgs

Pingback: Nolvadex vs liquidex

Pingback: buy Fildena 100 cheap

Pingback: Vidalista 60

Pingback: Vidalista side effects

Pingback: buy kamagra online

Pingback: where can i buy dapoxetine in uk

Pingback: liquid Tadalafil

Pingback: Fildena pill

Pingback: Fildena 100mg pills

Pingback: Sildenafil 20 mg vs Viagra

Pingback: sunrise p force

Pingback: ivermectin 12

Pingback: rybelsus 3 mg

Pingback: kamagra p force

Pingback: stromectol for lice

Pingback: buy qvar

Pingback: Probenecid 250mg tablet

Pingback: order Cenforce sale

Pingback: buy metronidazole 400mg online

Pingback: buy extra super p force