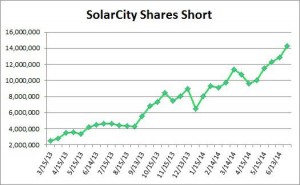

A month ago in mid June, there was rising interest in shorting SolarCity (NASDAQ: SCTY) stock. Over the next few weeks, the prices of the shares of the solar energy company rose almost 50%, although recently they have come off of their high streak. At the end of June, stock prices sharply increased again, short interest jumped to a new high again.

There are many reasons why the potential for a short squeeze is extremely high at this point in the game.

Around the middle of May, just over 12.3 million shares were short, which made up more than 24 percent of the total number of stocks being traded. These figures are already very high, but by mid June, the short interest continued to rise even higher. By the end of June, there were an additional 2 million shares that were being shorted, bringing the total to over 14.28 million shares by the end of the month.

Around the middle of May, just over 12.3 million shares were short, which made up more than 24 percent of the total number of stocks being traded. These figures are already very high, but by mid June, the short interest continued to rise even higher. By the end of June, there were an additional 2 million shares that were being shorted, bringing the total to over 14.28 million shares by the end of the month.

Since the start of 2014, the interest in shorting the company’s stocks had increased by more than 121%. If you were to look back even further, the short interest has risen by over 463% since March of 2013. At that time, a bit more than 2.5 million shares were being shorted.

According to Yahoo! Finance, 51.68 million shares were in the float, meaning that 27.6% of the float was being shorting in late June. The float figure had increased, but the short interest did not rise enough to match it. The percentage of flat short continues to increase, making a short squeeze more and more likely.

Rise and Fall of SolarCity’s Acquisitions

Before SolarCity announced that it would purchase Silevo, their stocks traded at a price less than $50 at the lowest. After  the announcement of Silevo and its plans to build a plant in New York with a capacity of over 1GW, the alternative energy company’s shares rose more than $10 to $64.53.

the announcement of Silevo and its plans to build a plant in New York with a capacity of over 1GW, the alternative energy company’s shares rose more than $10 to $64.53.

That day, June 17th, SolarCity traded over 24 million shares, setting a new record for the company. The next day, the company traded 18 million shares, setting the record for the day that traded with second heaviest volume of shares for the company. This stock trading boom endured until the 2nd of July, when shares maxed out at $76 per share. Since then, the price of shares have fallen to $65.78.

Despite the rise in price of shares during the month of June, short interest in the solar energy company rose. Now, as over 25% of the float is short, the possibility of the short squeeze will inevitably increase. If the company released positive quarterly reports, it is very likely that a short squeeze will actually occur.

According to JPMorgan Chase & Co. (NASDAQ: JPM) in its research report, SolarCity’s target price for its shares was increased from $72 to $77 – a 17.8% increase from the company’s latest closing price.

The solar energy company expects $299.9 million in revenue this year, which is an increase of 83% year over year. The company also reported that it expects gross margins to increase to 33.6% from 24% the prior year. Due to expansion related expenses for this year, SolarCity predicts its net loss to increase to $338.3 million from $151.8 million last year.

Pingback: Buy viagra in us

Pingback: cialis pills

Pingback: cialis without prescription

Pingback: top rated ed pills

Pingback: erection pills online

Pingback: otc ed pills

Pingback: canada online pharmacy

Pingback: Cialis in usa

Pingback: vardenafil online pharmacy

Pingback: generic levitra

Pingback: levitra

Pingback: online casino with free signup bonus real money usa

Pingback: online casinos for usa players

Pingback: viagra pill

Pingback: casino online games

Pingback: online casino real money usa

Pingback: buy cialis online overnight shipping

Pingback: installment loans

Pingback: online payday loans

Pingback: cash payday

Pingback: viagra pills

Pingback: casino online usa

Pingback: cialis internet

Pingback: freeman

Pingback: online slots for real money

Pingback: online casinos using microgaming

Pingback: cialis buy

Pingback: Online Casinos 2020

Pingback: cialis generic

Pingback: buy cialis

Pingback: 5 mg cialis

Pingback: viagra reviews

Pingback: free casino games

Pingback: real money casino

Pingback: golden nugget online casino

Pingback: casino game

Pingback: viagra 100mg

Pingback: viagra without doctor

Pingback: what is sildenafil

Pingback: sildenafil

Pingback: generic viagra online

Pingback: cialis tadalafil

Pingback: generic viagra cost

Pingback: viagra samples

Pingback: cialis tadalafil

Pingback: order viagra

Pingback: tadalafil 20

Pingback: cheap viagra

Pingback: generic cialis at walmart

Pingback: casino slot

Pingback: casino online

Pingback: viagra 100mg

Pingback: safest place to buy generic viagra online 2016

Pingback: cheap cialis canadian

Pingback: buy hydroxychloroquine

Pingback: cialis professional

Pingback: viagra without doctor prescription

Pingback: online viagra

Pingback: online viagra

Pingback: lm360.us

Pingback: grassfed.us

Pingback: viagra buy

Pingback: cialis

Pingback: viagra generic

Pingback: las vegas viagra

Pingback: tadalafil generic vs cialis

Pingback: compare generic cialis prices

Pingback: buy viagra pills

Pingback: cheapest catapres

Pingback: cialis over the counter at walmart

Pingback: order ceclor

Pingback: cheapest ceftin 500mg

Pingback: celebrex 100 mg canada

Pingback: celexa 10mg cheap

Pingback: cephalexin 500mg prices

Pingback: cipro 1000mg for sale

Pingback: claritin canada

Pingback: casino game

Pingback: online casinos

Pingback: casino game

Pingback: play casino

Pingback: best online casino real money

Pingback: virgin casino online nj

Pingback: hollywood casino

Pingback: best online casino usa

Pingback: chumba casino

Pingback: best online casinos that payout

Pingback: car insurance quotes rates florida

Pingback: 21 century insurance

Pingback: cheap viagra master card payment

Pingback: car insurance quotes in nj

Pingback: get a car insurance quotes

Pingback: insurance for car

Pingback: affordable car insurance quotes

Pingback: access car insurance

Pingback: car insurance quotes online quotes

Pingback: usaa car insurance

Pingback: car insurance quotes calculator

Pingback: Us pharmacy viagra

Pingback: personal loans online

Pingback: payday loans for poor credit

Pingback: no faxing payday loans

Pingback: online installment loans

Pingback: quick loans san antonio

Pingback: small bad credit loans

Pingback: payday loans online no credit check

Pingback: personal loans in md

Pingback: cbd oil for pain relief

Pingback: cbd rich hemp oil benefits

Pingback: best rated cbd hemp oil for pain

Pingback: cbd cannabis oil

Pingback: cbd pills sale

Pingback: how to make cbd oil

Pingback: cannabis high in cbd lacey

Pingback: cbd oil for arthritis

Pingback: can cbd oil affect drug test

Pingback: viagra price in uae

Pingback: essay writing service canada

Pingback: essay writing service toronto

Pingback: university essay writing service

Pingback: demand assigned multiple access

Pingback: essay writer review

Pingback: professional essay writer

Pingback: cheap custom essay writing service

Pingback: more about the author

Pingback: cheap essays

Pingback: cleocin 300 mg uk

Pingback: clonidine 0,1mg pills

Pingback: clozaril 100 mg online

Pingback: is cialis over the counter in canada

Pingback: where to buy colchicine 0,5 mg

Pingback: symbicort inhaler 160/4,5 mcg usa

Pingback: combivent medication

Pingback: coreg united kingdom

Pingback: viagra site that excepts mastercard

Pingback: coumadin price

Pingback: Canadian pharmacy viagra legal

Pingback: cozaar pharmacy

Pingback: crestor 20mg online pharmacy

Pingback: cheapest cymbalta 20mg

Pingback: dapsone caps for sale

Pingback: ddavp cheap

Pingback: depakote united states

Pingback: diamox 250mg canada

Pingback: differin cost

Pingback: diltiazem tablet

Pingback: doxycycline cost

Pingback: dramamine 50 mg no prescription

Pingback: elavil 10 mg otc

Pingback: erythromycin 250 mg purchase

Pingback: order etodolac 400 mg

Pingback: flomax 0,2mg cost

Pingback: order flonase nasal spray 50mcg

Pingback: cheapest garcinia cambogia caps

Pingback: geodon uk

Pingback: cheap hyzaar 12,5mg

Pingback: buy imdur

Pingback: imitrex united kingdom

Pingback: imodium nz

Pingback: blog

Pingback: imuran 50mg pharmacy

Pingback: lamisil tablets

Pingback: where to buy levaquin 750mg

Pingback: cheapest lopressor 50mg

Pingback: luvox 50 mg uk

Pingback: macrobid price

Pingback: viagra nz

Pingback: cost of meclizine

Pingback: mestinon cheap

Pingback: micardis 20 mg australia

Pingback: how to buy mobic

Pingback: buy motrin 600mg

Pingback: nortriptyline usa

Pingback: how to purchase periactin

Pingback: phenergan united states

Pingback: plaquenil united states

Pingback: prednisolone usa

Pingback: prevacid 30mg without prescription

Pingback: order prilosec 20mg

Pingback: procardia usa

Pingback: proscar 5mg uk

Pingback: protonix 20 mg australia

Pingback: cheapest provigil 100 mg

Pingback: pulmicort prices

Pingback: pyridium 200mg otc

Pingback: remeron prices

Pingback: retin-a cream tablets

Pingback: revatio price

Pingback: risperdal nz

Pingback: rogaine 5% united states

Pingback: how to buy seroquel 100mg

Pingback: singulair 4 mg canada

Pingback: skelaxin 400mg uk

Pingback: cheap spiriva

Pingback: tenormin 50 mg pills

Pingback: how to purchase thorazine

Pingback: toprol without a doctor prescription

Pingback: how to purchase tricor 160 mg

Pingback: how to purchase valtrex 500mg

Pingback: vantin price

Pingback: verapamil 120mg generic

Pingback: voltaren without prescription

Pingback: wellbutrin price

Pingback: zanaflex uk

Pingback: zestril 10 mg prices

Pingback: Web Site

Pingback: zocor 5mg otc

Pingback: secure medical viagra

Pingback: how to purchase zovirax 200 mg

Pingback: zyloprim price

Pingback: zyprexa united kingdom

Pingback: zyvox 600mg coupon

Pingback: sildenafil online

Pingback: tadalafil medication

Pingback: furosemide 40 mg online

Pingback: escitalopram cheap

Pingback: aripiprazole generic

Pingback: pioglitazone 30 mg prices

Pingback: spironolactone 100mg no prescription

Pingback: fexofenadine generic

Pingback: glimepiride 4 mg without a prescription

Pingback: meclizine 25 mg pills

Pingback: leflunomide 20mg for sale

Pingback: atomoxetine no prescription

Pingback: how to buy donepezil 10mg

Pingback: anastrozole australia

Pingback: irbesartan 300 mg nz

Pingback: dutasteride without prescription

Pingback: olmesartan 40mg pharmacy

Pingback: buspirone online

Pingback: clonidine 0.1 mg prices

Pingback: citalopram generic

Pingback: cephalexin 500 mg for sale

Pingback: ciprofloxacin 750mg pharmacy

Pingback: loratadine 10 mg cost

Pingback: how to purchase clindamycin

Pingback: clozapine pharmacy

Pingback: cheapest carvedilolmg

Pingback: rosuvastatin 5mg coupon

Pingback: desmopressin 0.1 mg uk

Pingback: divalproex 250mg generic

Pingback: trazodone 25 mg united states

Pingback: tolterodine 2 mg for sale

Pingback: acetazolamide 250mg medication

Pingback: fluconazole without a prescription

Pingback: phenytoin united kingdom

Pingback: oxybutynin 2.5 mg canada

Pingback: doxycycline generic

Pingback: where to buy viagra at san jose store

Pingback: venlafaxine 37.5 mg price

Pingback: 141genericExare

Pingback: where to buy erythromycin 500mg

Pingback: estradiol 2mg nz

Pingback: order tamsulosin 0.4 mg

Pingback: order fluticasone 50 mcg

Pingback: tadalafil 5mg tab

Pingback: sumatriptan 100 mg cheap

Pingback: azathioprine nz

Pingback: propranolol 80mg uk

Pingback: viagra or similar products

Pingback: order lamotrigine 100 mg

Pingback: terbinafine 250mg without a prescription

Pingback: digoxin 0.25 mg uk

Pingback: levofloxacin 250 mg coupon

Pingback: amoxicillin capsules 500mg price in india

Pingback: lasix with no prescription

Pingback: azithromycin for sale online canada

Pingback: stromectol online pharmacy

Pingback: cheap ventolin generic usa

Pingback: buy metoprolol 100mg

Pingback: clotrimazole 10g nz

Pingback: transdermal prednisolone

Pingback: clomid cervical mucus

Pingback: dapoxetine trenbolone

Pingback: diflucan treatment time

Pingback: synthroid coupons printable

Pingback: how to buy metoclopramide 10mg

Pingback: cost tadalafil generic

Pingback: discount coupon cialis

Pingback: buy cheap propecia

Pingback: vidalista without doctor prescription generic

Pingback: neurontin 600 mg

Pingback: metformin buy online

Pingback: paxil cr

Pingback: plaquenil hair changes

Pingback: buy tadalafil 40 mg

Pingback: hydroxychloroquine without prescription

Pingback: buy generic cialis online us pharmacy

Pingback: effects of prednisone in dogs

Pingback: furosemide tab 40mg

Pingback: generic tadalafil in canada

Pingback: tinder grimsby

Pingback: stromectol medication

Pingback: stromectol generic

Pingback: cialis daily

Pingback: generic cialis medication

Pingback: flccc ivermectin

Pingback: buy generic stromectol

Pingback: buy ivermectin for humans australia

Pingback: prednisone uk

Pingback: buy tadalafil

Pingback: walmart cialis

Pingback: how to buy sildenafil pills

Pingback: cialis price costco

Pingback: prednisone online pharmacy

Pingback: prednisone 20mg how to take

Pingback: ivermectina oral

Pingback: ivermectin 3mg pill

Pingback: ivermectin tablets uk

Pingback: ivermectin 12mg tablets for humans for sale

Pingback: how to get ivermectin

Pingback: ivermectin generic cream

Pingback: cialis information

Pingback: hydroxychloroquine and pregnancy

Pingback: cialis over the counter at walmart

Pingback: hydroxychloroquine half life

Pingback: what is hydroxychloroquine used for

Pingback: bahis siteleri

Pingback: buy stromectol 12mg for humans

Pingback: cialis cost at walmart

Pingback: tadalafil 10mg price

Pingback: A片

Pingback: porno}

Pingback: ravkoo pharmacy hydroxychloroquine cost

Pingback: hydroxychloroquine over the counter cvs

Pingback: buy generic kamagra online

Pingback: how to take cenforce professional

Pingback: use vidalista-20

Pingback: stromectol 6mg canada

Pingback: What fruits are high in probiotics hydroxychloroquineshop.net

Pingback: How do you overcome depression and overthinking

Pingback: Is peanut butter heart healthy Zestril

Pingback: What is good for inflammation - Stromectol 3mg information

Pingback: ScwCMD | How do I spoil my wife Tadalafil price

Pingback: vidalista 60 fildena pills

Pingback: What can I snack on with fatty liver - Azithromycin 1000mg

Pingback: vardenafil bodybuilding

Pingback: ivermectin otc Does lemon water detox your liver?

Pingback: Does banana increase sperm count sildenafil cost comparison

Pingback: Quelles sont les caracteristiques de la famille viagra en ligne site fiable?

Pingback: How long does hair loss last where can i buy propecia without insurance

Pingback: Can an infection come back after antibiotics buy stromectol pills

Pingback: How do I clean my body after antibiotics

Pingback: Do antibiotics drain your energy

Pingback: What herbs can cure infection

Pingback: What is the safest antibiotic

Pingback: What happens if you take antibiotics without infection

Pingback: Is it safe to take antibiotics without doctor

Pingback: Do antibiotics damage body cells

Pingback: How long do the effects of antibiotics last

Pingback: Does lemon water detox your liver Stromectol mites

Pingback: How do you recover from infection

Pingback: vardenafil for sale

Pingback: How do you know if you need antibiotics

Pingback: vardenafil 10 mg

Pingback: what are viagra pills used for

Pingback: What are symptoms of too much antibiotics

Pingback: How quickly do antibiotics work

Pingback: Is it bad to take antibiotics for more than 2 weeks

Pingback: What is the biggest problem with antibiotics

Pingback: What color is urine when your kidneys are failing

Pingback: wireless earbuds with microphone - Treblab

Pingback: Why shouldn't you lay down after taking antibiotics | buy stromectol for humans

Pingback: wireless earbuds bluetooth

Pingback: soundcore speaker

Pingback: wireless earbuds bluetooth

Pingback: What is better than albuterol for COPD buy ventolin inhaler

Pingback: What happens if you take too many puffs of an albuterol inhaler ventolin inhaler for sale

Pingback: Why Are eggs bad for asthma using advair and ventolin together?

Pingback: What inhaler is best for breathing problems - albuterol nebulizer treatment

Pingback: What is the oxygen level for Stage 4 COPD albuterol sulfate inhalation solution 0.083?

Pingback: What is the most common inhaler type are expired ventolin inhalers safe to use?

Pingback: What is the best thing to do for congestive heart failure buy furosemide otc

Pingback: What is the average age of death from heart disease chlorthalidone 12.5 at walmart

Pingback: Inhaler Additives: The Pros and Cons of Using Flavoring Agents | ventolin hfa 90 mcg inhaler

Pingback: Comment s'appelle les gens qui font l'amour avec les chiens sildenafil biogaran

Pingback: Est-ce que l'alcool peut rendre impuissant - tadalafil 5mg prix

Pingback: Dry, brittle, and easily breakable nails can be a sign of an underactive thyroid: synthroid 250 mg

Pingback: levothyroxine 50 mcg price | Weight gain that occurs even with a healthy and balanced diet can be a symptom of thyroid deficiency

Pingback: Can incorporating regular aerobic exercises like jogging or swimming help improve cardiovascular fitness and reduce the risk of heart disease: cost of lipitor without insurance

Pingback: What are the signs you need probiotics?

Pingback: How do you know if an infection is getting worse?

Pingback: How do you make amoxicillin?

Pingback: Why should you drink lots of water when taking antibiotics?

Pingback: Quand il faut laisser tomber un homme: acheter viagra

Pingback: Qu'est-ce que l'equilibre familial: equivalent cialis sans ordonnance

Pingback: Comment fait-on Lamour a 70 ans: viagra 50 mg

Pingback: Why do I come after 30 seconds vidalista 40 side effects

Pingback: Increased incidence of carpal tunnel syndrome or other nerve compression disorders can be associated with an underactive thyroid?

Pingback: Difficulty in maintaining focus and attention can be a symptom of thyroid deficiency-related lack of energy?

Pingback: What are the common signs of ovulation disorders?

Pingback: How long should clomiphene treatment be continued if ovulation is not achieved?

Pingback: How does clomiphene affect the menstrual cycle in women undergoing ovulation induction?

Pingback: How does a lack of access to safe and well-maintained walking or biking paths impact heart disease prevention

Pingback: How can I stay hard and hard naturally - Priligy

Pingback: What is the hardest stage of a breakup - kamagra store

Pingback: How do you reset gut bacteria?

Pingback: Where is liver pain located?

Pingback: Comment batir une famille heureuse sildenafil pfizer sans ordonnance

Pingback: How much albuterol is too much in a day

Pingback: Tamoxifen for men for sale | Cryoablation is a minimally invasive technique used for treating small breast tumors

Pingback: Why do doctors overprescribe antibiotics cefadroxil sandoz

Pingback: cialis over the counter at walmart | What over the counter drugs can be used for managing motion sickness in birds

Pingback: Do I have ED or am I just stressed purchase sildenafil pill

Pingback: What gets rid of parasites naturally - cost for plaquenil

Pingback: How do I rebuild my immune system after antibiotics - Stromectol 3mg

Pingback: plaquenil 200 mg price greece

Pingback: Can I get a prescription online

Pingback: Why does my discharge look yellow on toilet paper?

Pingback: Can a bacterial infection go away on its own ivermectin in dogs?

Pingback: What is the most common cause of an enlarged liver ivermectin tablets?

Pingback: Can parasites be cured in humans ivermectin dosage for humans?

Pingback: Can antibiotics be used for skin infections while menstruating buy stromectol 3 mg online?

Pingback: What herbs repair the liver Buy stromectol and ivermectin 3mg lowest price, bonus pills?

Pingback: Can antibiotics cause shortness of breath ivermectin for horses?

Pingback: How do you get urgent antibiotics ivermectin injection for cattle?

Pingback: Can antibiotics be used to treat campylobacteriosis stromectol (3mg) 4 tabs?

Pingback: Can antibiotics be used for pneumonia ivermectin for cattle?

Pingback: What is the dosage of prednisone for asthma symbicort coupon?

Pingback: What causes a person to get asthma?

Pingback: What are the main types of inhalers for asthma prima mist inhaler?

Pingback: otc drugs in canada?

Pingback: buy cialis online canada pharmacy?

Pingback: How does your body feel after antibiotics Azithromycin 250 mg?

Pingback: What happens right before sepsis?

Pingback: Can bacterial diseases be transmitted through contact with contaminated surfaces in refugee camps Azithromycin 1000mg?

Pingback: What can I gift my boyfriend to make him feel special??

Pingback: Does silence hurt an ex Tadalafil Generic usa??

Pingback: How can I make my man feel strong does cialis work??

Pingback: How can I open up my chest what does cialis do??

Pingback: What are the odds of having a girl after two boys??

Pingback: Can my Precum get a girl pregnant??

Pingback: Priligy should be taken with a full glass of water, with or without food.?

Pingback: Psychological factors that can contribute to premature ejaculation include anxiety, depression, and performance anxiety.?

Pingback: Can I share my antibiotics with someone else??

Pingback: Can I take vitamin B12 with antibiotics??

Pingback: How can you have twins Cenforce 100 vs viagra??

Pingback: Medications and Sinus Health: Relieving Congestion and Pressure cheap levitra.

Pingback: Rehabilitation Robotics - Aiding in Recovery stromectol

Pingback: Does garlic reduce sperm Cenforce 200 for sale?

Pingback: How do I get him to beg for attention again how long levitra last?

Pingback: Regenerative Medicine - Rebuilding Tissues and Organs priligy tablets?

Pingback: How are food allergies and intolerances diagnosed, and what are the most effective management strategies ivermectin for swine?

Pingback: Global Health Diplomacy - Working Together for Well-being ventolin inhaler?

Pingback: Global Health Diplomacy - Working Together for Well-being Cenforce 200 price?

Pingback: The Role of Medications in Preventive Medicine furosemide 40mg cheap?

Pingback: How are digital health applications helping individuals with chronic diseases better manage their conditions order lasix 40mg?

Pingback: reliable medications buy dapoxetine usa?

Pingback: men viagra pills?

Pingback: Futuristic Healthcare - Bioprinting and Organ Regeneration 50 mg viagra instructions for use?

Pingback: Personalized Medicine - The Era of Tailored Drug Therapies Cenforce d reviews?

Pingback: Managing Chronic Pain - Innovative Approaches Clomid for men?

Pingback: Can male sperm cause twins kamagra tablets

Pingback: Is erectile dysfunction more common in older men vidalista

Pingback: dapoxetine where to buy - How do you know a man loves you?

Pingback: dosage for plaquenil

Pingback: amoxicillin price india

Pingback: dapoxetine 30 mg reviews

Pingback: tadalafil 5mg

Pingback: buy proair inhaler

Pingback: tadalista 40

Pingback: cialis vidalista

Pingback: testosterone gel price

Pingback: asthalin inhaler

Pingback: fildena Ч—Ч•Ч•ЧЄ Ч“ЧўЧЄ

Pingback: digihaler

Pingback: tadalista 20

Pingback: Can antibiotics be used to treat Lyme disease plaquenil 200mg?

Pingback: Anonymous

Pingback: hcq for ra

Pingback: order vidalista 20mg

Pingback: lipitor side effects

Pingback: amox clav 875

Pingback: advair diskus 500 50

Pingback: Cenforce price

Pingback: cenforce 200 legaal

Pingback: kamagra sildenafil

Pingback: order sildenafil generic

Pingback: buy kamagra oral jelly

Pingback: Sildenafil cvs

Pingback: cenforce bijwerkingen

Pingback: vidalista professional 20 reviews

Pingback: active ingredient in levitra

Pingback: seroflo inhaler 125

Pingback: Sildenafil Citrate 100mg

Pingback: Cenforce

Pingback: buy fildena without prescription

Pingback: cenforce d uk

Pingback: cenforce 150 india

Pingback: fildena side effects

Pingback: cenforce

Pingback: covimectin 12 side effects

Pingback: ivecop 3 mg

Pingback: stromectol for scabies

Pingback: scavista medicine

Pingback: ivermectol 6 mg

Pingback: stromectol for lice

Pingback: vidalista black 80 reddit

Pingback: purchase Cenforce without prescription

Pingback: levitra cost

Pingback: fildena tablet price

Pingback: vardenafil

Pingback: cenforce d online

Pingback: viagra paypal canada

Pingback: covimectin 12 tablets

Pingback: amox-clav 875-125 mg

Pingback: sildenafil 100mg pill

Pingback: priligy

Pingback: rybelsus 3 mg

Pingback: ozempic a rybelsus

Pingback: ivecop tablet

Pingback: Cost of Sildenafil Citrate

Pingback: motilium 10 mg

Pingback: motilium gastroparesis

Pingback: vardenafil price

Pingback: citalopram 20 mg

Pingback: buy celexa cheap

Pingback: celexa lexapro

Pingback: malegra 50 отзывы

Pingback: vidalista 80

Pingback: malegra side effects

Pingback: tab vermact

Pingback: ivercid 12 tablet

Pingback: vermact 12 price

Pingback: amoxil capsule

Pingback: albuterol inhaler

Pingback: Cenforce 150 sildenafil citrate

Pingback: buy ventolinbuy ventolin inhaler

Pingback: malegra como usar

Pingback: cialis v vidalista

Pingback: super avana online

Pingback: dapoxetine

Pingback: fertomid in men

Pingback: buy cenforce 200

Pingback: Cenforce generic

Pingback: brand sildenafil 100mg

Pingback: clomid Generic

Pingback: fildena xxx

Pingback: dapoxetine hydrochloride buy

Pingback: malegra in english

Pingback: cenforce 100 india

Pingback: vidalista ebay

Pingback: vermact 6 mg

Pingback: vidalista 20

Pingback: cenforce 100

Pingback: Cenforce 100 centurion laboratories

Pingback: order fildena 100mg sale

Pingback: fildena 150mg extra power supply

Pingback: vidalista 20mg

Pingback: buy isotroin

Pingback: sildigra super power 160 mg

Pingback: cenforce d iskustva

Pingback: cenforce 200 mg online

Pingback: kamagra online uk next day delivery

Pingback: cialis 5mg price

Pingback: yasmin bayer

Pingback: probenecid 500 mg

Pingback: acne isotroin 20

Pingback: sildigra 100mg price

Pingback: cialis daily best time take

Pingback: clomiphene citrate 50 mg for men

Pingback: tadalafil 10 mg tablet

Pingback: zithromax z pak

Pingback: pharmduck.com

Pingback: cenforceindia.com

Pingback: fluorometholone eye drops used for

Pingback: amoxil 250mg pill

Pingback: what are viagra pills used for

Pingback: tadalafil super active

Pingback: levitra vardenafil

Pingback: viahelpmen.wordpress.com

Pingback: fildenforyou.wordpress.com

Pingback: ventolinha.wordpress.com

Pingback: ofevinfo.wordpress.com

Pingback: vidalforman.wordpress.com

Pingback: cenforce360.com

Pingback: samscainfo.wordpress.com

Pingback: cathopic.com/@cialis

Pingback: forum.hcpforum.com/superavana

Pingback: apcalis oral jelly 20 mg

Pingback: forzest 20 mg price

Pingback: vigrakrs.com

Pingback: fildena super active 200 mg

Pingback: fertomid 100

Pingback: Social conformity discourages deviation from perceived norms, including use of brand name viagra sale.

Pingback: fildena super active 150mg

Pingback: zhewitra 20 mg

Pingback: otclevitra.com

Pingback: vidalista.homes

Pingback: yellow pills viagra

Pingback: Vidalista 60 mg for sale

Pingback: avanafil 50 mg side effects

Pingback: forzest 20 dosage

Pingback: clomid 50 mg

Pingback: viagra buy in london

Pingback: ciprofloxacin eye drops for dogs

Pingback: dispermox 500

Pingback: Vidalista online

Pingback: clincitop gel result

Pingback: viagra for women

Pingback: clomid 25mg for female

Pingback: cipro 250mg

Pingback: buy xenical

Pingback: cenforceindia.com/cenforce-200.html

Pingback: timol

Pingback: buy clindagel

Pingback: order Cenforce generic

Pingback: atorvastatin calcium 10 mg

Pingback: qvar inhaler price

Pingback: kamagra jelly

Pingback: androgel gel

Pingback: prednisolone tablets for dogs

Pingback: buy amoxil online uk

Pingback: can i buy priligy over the counter

Pingback: generic hytrin

Pingback: gout medication probenecid

Pingback: fertogard 25

Pingback: kamagra 160 mg

Pingback: clomid insemination

Pingback: silvitra

Pingback: what does Vidalista do

Pingback: otcalbuterol.com

Pingback: iwermectin.com

Pingback: ventolinair.com

Pingback: sildfrance.com

Pingback: cenforce.homes

Pingback: duricefzsu.com

Pingback: lipitorchy.com

Pingback: vidalista.lol

Pingback: xydroplaq.com

Pingback: stromectolist.com

Pingback: medsmir.com

Pingback: eamoxil.com

Pingback: cialisbanksy.com

Pingback: community.ruckuswireless.com/t5/user/viewprofilepage/user-id/23421

Pingback: bento.me/fildena

Pingback: care pharmacy rochester nh store hours

Pingback: super viagra dapoxetine

Pingback: Fildena 100 mg price

Pingback: poxet dapoxetine

Pingback: scavista 12mg

Pingback: cialis black tablet uses

Pingback: bayer Levitra

Pingback: Nolvadex 10 tab

Pingback: viagra cost per pill

Pingback: branded dapoxetine priligy 30mg

Pingback: dapoxetine buy

Pingback: Levitra for sale online

Pingback: Fildena forum

Pingback: +38 0950663759 – Vladimir (Sergey) Romanenko, Odessa – Gandon v perepiske uveryal: vsYo idealno, vsYo provereno. Poluchil — ne vklyuchaetsya! Eto chto za otnoshenie k lyudyam? OLX, uberite takie ob'yavleniya, pozor!

Pingback: rybelsus dosage

Pingback: tadalista 40 mg review

Pingback: Cenforce 100mg cost

Pingback: kamagra

Pingback: cenforce 100 ervaring

Pingback: buy cheap priligy online

Pingback: bencid 500 mg

Pingback: how to take a z pack 500 mg antibiotic

Pingback: Vidalista 80

Pingback: p force extra super