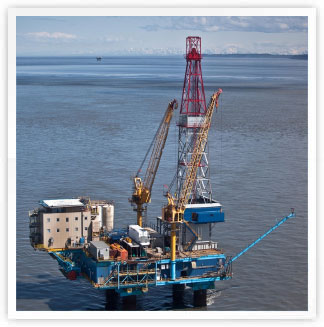

According to a report submitted on Monday by TheStreet, when the Sun Trust Bank updated MILL’s shares from neutral to buy, the share price of the company was recorded to be $6.33 with an escalation rate of 15.7%. Such a high escalation rate forced Sun Trust to raise the target price of MILL from $8 to $10. According to Neal Dingmann, a senior analyst at Sun Trust, MILL’s production for the current year was predicted to go up by 180% whereas for the next year, keeping in view company’s wells and acquisitions in the areas of Cook Inlet and North Slope, the production was predicted to go up by 60%.

The ratings team at TheStreet gave MILLER ENERGY RESOURCES INC (NYSE: MILL) a D+ score with a rating as Sell. TheStreet analysts were of the view that the ratings were given keeping in view several of the company’s weaknesses: for instance, the very low returns on investments and a meager growth in per share earnings. According to the team, the weak points of the company were taken into account since the investors were not getting any positive results on their investments.

The analysis report released by TheStreet showed that the company’s performance was not an improvement if compared with the past year, rather it was a disappointment. Per share earnings of the company, for the recent quarter of the year, were reduced by 7.1% when compared with the same time frame a year ago. The report stated that this decline in the earnings will even increase in the coming year. For the past year, the earnings dropped to -$0.60 from -$0.47, and chances are that in the coming year, earnings will be -$0.61.

Coming to the cash flows of MILLER ENERGY RESOURCES INC (NYSE: MILL), the company has been successful in surpassing the average cash flow rate of the industry: the industry rate is 17.57% whereas the company’s is 19%. Furthermore, if the current gross profit margin of the company is compared with that of the last year’s margin, a significant increase will be recorded. The current margin is 63.45% which is good. However, the net profits of the company have been recorded at -18.65%.

However, the company has been successful in lowering its debt to equity ratio; the ratio has been recorded at 0.20, which is lower than the average. Such a decline implies that the management is trying to improve the company’s situation by improving the equity ratio. Nonetheless, the quick ratio of the company is 0.63 and chances are that the company will face difficulties with its cash coverings, at least in the short-term.

Moreover, the company’s returns on investments have also decreased, if compared with the same time period of last year. This decline clearly suggests that the organization has some kind of weakness integrated in either its structure or the management of the company. If the equity returns are compared with other companies’- companies that are also in the Fuel industry business- a significantly different Standard & Poor’s 500 and industry average indexes will be seen.

Pingback: แคล้มรัดท่อ

Pingback: สล็อต ฝากถอน true wallet เว็บตรง 888pg

Pingback: เว็บพนันออนไลน์

Pingback: LinkedIn

Pingback: แอปลดน้ำหนัก

Pingback: nagaway สล็อต

Pingback: magic mushies sydney

Pingback: auto detailing

Pingback: ลวดสลิง

Pingback: Buy Remington UMC Ammunition 223 Remington 55 Grain Full Metal Jacket Online

Pingback: Buy REAR RECEIVER QD SWIVEL ATTACHMENT POINT (W/SWIVEL) Online

Pingback: uwinipay เว็บหวยออนไลน์ เล่นได้ครบทุกหวย

Pingback: บับเบิ้ล

Pingback: รับจัดงานอีเว้นท์

Pingback: ทางเข้าpg

Pingback: profibus connector

Pingback: ไพ่เสือมังกร

Pingback: fear of god essentials

Pingback: hit789

Pingback: fox888

Pingback: Ricky Casino

Pingback: แทงบอลออนไลน์เกาหลี

Pingback: Winspark Italia

Pingback: Aviator Game Official

Pingback: เช่ารถเครน

Pingback: casino

Pingback: av

Pingback: 1xbet chile

Pingback: ศัลยกรรมตาสองชั้น

Pingback: พลาสติกปูพื้นก่อนเทคอนกรีต

Pingback: url

Pingback: Scopri come funziona Winnita

Pingback: นำเข้าสินค้าจากจีน

Pingback: ยอยคัปปลิ้ง

Pingback: ddiyyala

Pingback: ช่างภาพเชียงใหม่

Pingback: เน็ต บ้าน ais