September 2, 2014

The investors in the U.S. assimilated the recent set of credible financial reports which showed that no visible change has surfaced in the shares till Tuesday. S&P 500 (INDEXSP) however has shown the greatest performance this month since February.

Coming to the strongest economy these days, Markit Ltd (NASDAQ:MRKT) has commented on its final Manufacturing Purchasing Managers Index. In August, its ratio increased up to 57.9. According to another report, Markit’s (NASDAQ:MRKT) manufacturing department also had an increment of 59.0; Rrading greater than 50 signifying profit.

The construction contribution has greatly recovered too. It rose by 1.8%, the yearly rate being $981.31 billion. This rate is considered the maximum since December 2008.

James Liu, the international market tactician of JP Morgan (NYSE:JPM) commented on the market’s condition in Chicago. Liu says that even though pricing in the market is towards the stronger side, but still this is an indication of positive results. He thinks that the market and investors expect strong economic figures. This could result in improved profits and S&P 500 (INDEXSP) could even go above 2000.

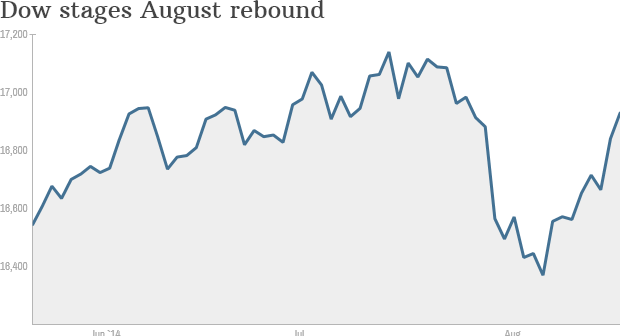

Another index Dow Jones Industrial (INDEXDJI: .DJI) had a decrement of 23.82 points (0.14%) and came to 17074.63. S&P 500 (INDEXSP) also had a loss of 2.21 points (0.11%) and came to 2001.16. As for the Nasdaq Composite (INDEXNASDAQ:.IXIC), it had a profit of 8.27 points (0.18%) and came to 45588.54.

The strategist Adam Parker from Morgan Stanley (NYSE:MS), was quiet positive about the U.S. economy. He expressed to his clients that U.S. economy is on its way to reach the greatest increment ever. S&P 500 (INDEXSP) has the chances to reach 3000 if it is given 5 or more years.

Back in august standard S&P 500 (INDEXSP) had a profit of 3.8%; this is the index’s best record since February when it reached up to 4.3%. BATS global markets (BATS) gave a data which showed that the standard amount per month, which is 5.24 million, was the minimum achieved in this year.

There are chances that the union activity will prosper. Dollar General Corporation (NYSE:DG) increased its bid price for Family Dollar Stores Inc. (NYSE:FDO) by 2% (to $80 for a share) and threatened to go aggressive if things don’t turn their way soon. The Family Dollar (NYSE:FDO) stocks increased by 0.5% ($80.21). Dollar General Corp (NYSE:DG) had an increase by 0.5% ($64.33).

Compuware Corp (NASDAQ:CPWR) shares increased by 12.2% up to $10.49. This happened when Thorma Bravo LLC decided to buy the maker of business software. This deal was finalized at $2.5 billion.

Norwegian Cruise Line (NASDAQ:NCLH) had revealed that it has signed a deal of $3.03 billion to buy the Prestige Cruises. Their shares increased by 11.8% up to $37.23.

Select Income REIT (NYSE:SIR) also made a deal of $3 billion to buy REIT Cole Corp Income Trust. The reason for buying this was the decrement in their shares by 5% i.e. of $26.51.

The shares of Conn’s Inc. (NASDAQ:CONN) dipped at 30.7% at $31.06. Q2 results were not as expected by the analysts.

Pingback: viagra by mail

Pingback: cialis online canada

Pingback: levitra vs cialis

Pingback: viagra for sale

Pingback: men's ed pills

Pingback: best ed pills non prescription

Pingback: erection pills online

Pingback: walmart pharmacy

Pingback: online canadian pharmacy

Pingback: Viagra or cialis

Pingback: cialis online

Pingback: levitra usa

Pingback: online levitra

Pingback: vardenafil 20 mg

Pingback: best casino online

Pingback: hollywood casino online

Pingback: sildenafil online

Pingback: online casino games

Pingback: casinos

Pingback: buy cialis generic

Pingback: cash loan

Pingback: loan online

Pingback: personal loans

Pingback: viagra for sale

Pingback: cialis generic

Pingback: kennethjeape

Pingback: casino dinero real ipad

Pingback: sugarhouse casino online nj

Pingback: casino

Pingback: cialis buy

Pingback: cialis 5 mg

Pingback: 20 cialis

Pingback: cialis to buy

Pingback: viagra cheap

Pingback: free slots

Pingback: real casino online

Pingback: online casino gambling

Pingback: best online casino real money

Pingback: herbal viagra

Pingback: viagra for women

Pingback: viagra canada

Pingback: generic viagra without subscription walmart

Pingback: buy cialis online

Pingback: buy viagra new york

Pingback: cialis price

Pingback: erectile dysfunction pills

Pingback: buying generic viagra online

Pingback: generic cialis at walmart

Pingback: viagra no prescription

Pingback: viagra alternative

Pingback: buying cialis online safely

Pingback: tadalafil online canadian pharmacy

Pingback: online casino gambling

Pingback: online casino games

Pingback: generic viagra paypal buy

Pingback: buy cialis no prescription

Pingback: hydroxychloroquine over the counter

Pingback: viagra cheap

Pingback: buy cialis

Pingback: sildenafil coupons walgreens

Pingback: non prescription viagra

Pingback: viagra 100mg

Pingback: cleckleyfloors.com

Pingback: grassfed.us

Pingback: viagra buy

Pingback: viagra online

Pingback: viagra generic

Pingback: buy viagra online

Pingback: cialistodo.com

Pingback: cialis worldwide shipping

Pingback: female cialis review

Pingback: generic viagra cheap

Pingback: cialis mail order

Pingback: keflex at publix

Pingback: generic cialis safe

Pingback: vk blue viagra

Pingback: viagra erection after ejaculation

Pingback: ceclor 250mg otc

Pingback: celexa 20mg cost

Pingback: casino slots

Pingback: geico car insurance quotes

Pingback: buy viagra in amsterdam

Pingback: Get viagra

Pingback: compra viagra online

Pingback: cbd capsules

Pingback: viagra brand name in india

Pingback: viagra 3 day delivery

Pingback: viagra for young adults

Pingback: real viagra price

Pingback: best cbd oil on amazon

Pingback: otc viagra online

Pingback: custom essay writing service uk

Pingback: to buy viagra in hyderabad

Pingback: essay writing

Pingback: write assignment

Pingback: buy viagra online in usa

Pingback: buy brand viagra online

Pingback: free online paper writer

Pingback: writing essay services

Pingback: clomid 100mg usa

Pingback: Discount viagra

Pingback: clozaril 25mg tablets

Pingback: colchicine otc

Pingback: cheap cialis in canada

Pingback: Alternative for viagra

Pingback: compazine for sale

Pingback: crestor 5 mg online pharmacy

Pingback: Brand viagra

Pingback: imitrex 50 mg australia

Pingback: Read More Here

Pingback: indocin over the counter

Pingback: lopid 300mg united states

Pingback: lopressor 25mg price

Pingback: viagra for sale in texas

Pingback: micardis medication

Pingback: motrin over the counter

Pingback: nortriptyline tablet

Pingback: online pharmacy uk viagra

Pingback: phenergan united states

Pingback: hydroxychloroquine sulfate uses

Pingback: zovirax otc

Pingback: viagra online

Pingback: sildenafil tablets

Pingback: aripiprazole usa

Pingback: irbesartan coupon

Pingback: clonidine 0.1 mg united states

Pingback: cefuroxime united states

Pingback: celecoxib 100 mg no prescription

Pingback: how to buy clozapine 100mg

Pingback: can you buy viagra from overseas

Pingback: non prescription viagra

Pingback: bisacodyl 5mg online pharmacy

Pingback: venlafaxine 37.5mg tablet

Pingback: where can i buy permethrin

Pingback: buy cialis online canadian

Pingback: erythromycin over the counter

Pingback: estradiol prices

Pingback: alendronate tablets

Pingback: glipizide 10 mg nz

Pingback: real pfizer viagra for sale

Pingback: isosorbide 60 mg without a doctor prescription

Pingback: loperamide uk

Pingback: cheapest azathioprine 25mg

Pingback: propranolol tablet

Pingback: indomethacin 75mg without a doctor prescription

Pingback: pink viagra

Pingback: terbinafine 250 mg no prescription

Pingback: cialis quit working

Pingback: how to buy levothyroxine mcg

Pingback: amoxicillin 250 mg price in india

Pingback: buy zithromax z-pak

Pingback: buy ventolin over the counter

Pingback: gemfibrozil 300mg united states

Pingback: metoprolol tablets

Pingback: diflucan ovule

Pingback: synthroid losing weight

Pingback: non prescription metformin

Pingback: paxil for depression

Pingback: cialis order online usa

Pingback: furosemide 12.5 mg tablets

Pingback: ivermectin buy online

Pingback: cialis 20mg online

Pingback: ivermectin 1

Pingback: ivermectin 4000 mcg

Pingback: cialis india

Pingback: can i buy viagra

Pingback: ivermectin uk boots

Pingback: tadalafil prix

Pingback: tadalafil cialis

Pingback: best price on ivermectin pills

Pingback: how to buy sildenafil tablets

Pingback: sildenafil citrate

Pingback: buy cialis online

Pingback: tadalafil side effects

Pingback: prednisone 20mg west ward

Pingback: prednisone 20mg west ward

Pingback: mulnopiravir

Pingback: generic cialis medication

Pingback: cost of generic cialis in canada

Pingback: ivermectin 3

Pingback: prednisone side effects in women

Pingback: buy generic viagra canada online

Pingback: casino sites online

Pingback: ivermectin uk

Pingback: buying ivermectin

Pingback: ivermectin wormer

Pingback: free real money casino no deposit

Pingback: lowest price for generic viagra

Pingback: ivermectin gold

Pingback: stromectol xl

Pingback: stromectol merck

Pingback: ivermectin new zealand

Pingback: ivermectin in canada

Pingback: ivermectin over the counter

Pingback: ivermectin pills canada

Pingback: buy ivermectin 6mg otc

Pingback: stromectol nz

Pingback: ivermectin 3 mg tablets price

Pingback: buy generic lasix

Pingback: ivermectin ingredients

Pingback: ivermectine posologie

Pingback: ivermectin 12 mg

Pingback: stromectol brand

Pingback: stromectol generic name

Pingback: stromectol 6mg

Pingback: luckyland slots casino bonus

Pingback: ivermectin 3mg tablets

Pingback: ivermectin overdose

Pingback: ivermectin trial

Pingback: walmart cialis price

Pingback: where can you get ivermectin

Pingback: ivermectin 3

Pingback: ivermectin 3mg tablets price

Pingback: cialis over the counter at walmart

Pingback: cialis pill

Pingback: ivermectin 3mg for lice

Pingback: stromectol ireland

Pingback: ivermectin 3mg pill

Pingback: bahis siteleri

Pingback: where can i purchase ivermectin

Pingback: ivermectin generic name

Pingback: buy stromectol for humans online

Pingback: cialis over counter

Pingback: cialis strength

Pingback: A片

Pingback: propecia 1mg buy online

Pingback: how to get propecia prescription online