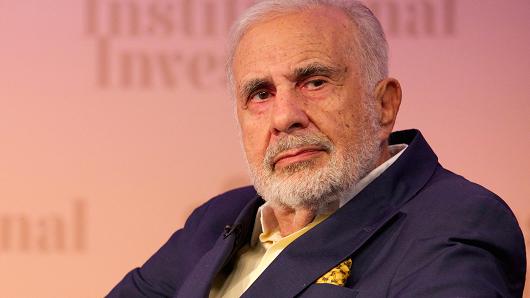

Carl Icahn declares that Tim Cook and the board has performed admirably and responsibly and that if they don’t do so, the billionaire investor and most valuable company in America will still be “buddies” according to Carl Icahn. He is glad that Tim Cook is listening to him. He hopes that Apple Inc (NASDAQ: AAPL) buys back $100 billion of its shares with the capital it currently has. This in turn would reduce the shares outstanding, and in turn valuate the stock price higher when earnings come in. Earnings would be divided over fewer shares.

Icahn feels that Apple is performing well against its competitors and peers, and that other companies won’t be able to overcome its competitive moat. Instead of publicly speaking with Tim Cook, he feels it’s better to do so publicly so that Apple shareholders will join his opinion and demand a stock buy back as well. The more shareholders he can get to join his vision, the more likely the share buy back can happen. Unlike last year, this year, he does not specific a specific amount he wishes the company to buy back in shares. Even Tim Cook believes the company is highly undervalued as well.

Icahn believes that the overall US economy is overvalued and he has therefore made short bets on the S&P.

Icahn believes that investors are delusion-ed, and bullish, since many of them hold stock, and they wish to be positive about the economy:

“You can’t keep the economy up just from the Fed. The Fed alone can’t do it. I’ve been quite concerned for the last year or so. But we have a hell of a lot of stock in our portfolio so you sort of root for the upside.”

This morning, Icahn sent a letter to Apple, stating that the tech industry leader is undervalued and that he believes shares should be worth $203 per share, double the current $100 price point. The billionaire investor and philanthropist owns 53 million shares in the company. He states:

“The excess liquidity the company continues to hold on its balance sheet afford the company an amazing opportunity to take further advantage of this valuation disconnect by accelerating share repurchases.”

Some investors commenting believes that Icahn has no interest in the stock at all, and that he is hoping to just make a quick buck off the shareholder’s expense by raising the price up with letters, and selling his shares once the company’s stock price reaches its peak. Investors believing that Icahn can rally up investors can benefit from this activist moment by picking up shares and exiting once the company’s stock price appreciates.

Pingback: Apple Inc. (NASDAQ:AAPL) Responds to Icahn’s Letter with Shares Buy Back Timeline and Promise for Review

Pingback: Apple Inc. (NASDAQ:AAPL) Responds to Icahn’s Letter with Shares Buy Back Timeline and Promise for Review | Stocks.org

Pingback: Blue Coaster33

Pingback: watch movies online

Pingback: TV options for restaurants

Pingback: mp4 mobile porn

Pingback: lan penge

Pingback: parking

Pingback: laan penge nu

Pingback: water ionizer machine

Pingback: laane penge

Pingback: water ionizers

Pingback: parking

Pingback: water ionizer loan

Pingback: paypal loans

Pingback: pay per day loan plans

Pingback: at&t electrician jobs

Pingback: more

Pingback: more bonuses

Pingback: c locksmiths annandale

Pingback: how to use a plumbers wrench

Pingback: resources

Pingback: alkaline water brands

Pingback: house blue

Pingback: electrician jobs in dublin ireland for foreigners

Pingback: pay plan

Pingback: visit site

Pingback: alkaline water

Pingback: alkaline water

Pingback: car insurance

Pingback: http://makemoney.camkingz.com/

Pingback: he has a good point

Pingback: over here

Pingback: Anonymous

Pingback: Greg Thmomson

Pingback: gmail sign in

Pingback: gmail.com login sign

Pingback: all of craigslist

Pingback: cna classes in ri

Pingback: Melanie Bowen

Pingback: mortgage payment calculator

Pingback: land for sale squamish

Pingback: mortgage broker vancouver

Pingback: mortgage broker coquitlam

Pingback: krunker

Pingback: mls vancouver

Pingback: oh canada lyrics

Pingback: us discount viagra overnight delivery

Pingback: real estate pitt meadows

Pingback: harrison lake

Pingback: boating bc

Pingback: cvs pharmacy coupons for viagra

Pingback: buy Viagra 200 mg

Pingback: Viagra 25 mg cheap

Pingback: buy Viagra 120mg

Pingback: where can i buy Viagra 150mg

Pingback: Viagra 120 mg price

Pingback: Viagra 120mg medication

Pingback: Cialis 80mg prices

Pingback: how to buy Cialis 40mg

Pingback: cheapest Cialis 80 mg

Pingback: Cialis 40 mg australia

Pingback: Cialis 40mg uk

Pingback: cost of Cialis 60mg

Pingback: cheapest Cialis 40mg

Pingback: Cialis 20 mg uk

Pingback: where can i buy Cialis 40mg

Pingback: sildenafil 50 mg prices

Pingback: tadalafil 60mg for sale

Pingback: levitra 10mg online pharmacy

Pingback: lasix 40mg prices

Pingback: furosemide 40mg pills

Pingback: propecia 5 mg without a doctor prescription

Pingback: abilify 20mg price

Pingback: actos 30mg prices

Pingback: aldactone 100mg united states

Pingback: allegra 120mg cheap

Pingback: allopurinol 300mg over the counter

Pingback: amaryl 2mg australia

Pingback: amoxicillin 250 mg without a prescription

Pingback: ampicillin 250 mg generic

Pingback: how to buy antabuse 500 mg

Pingback: where to buy antivert 25mg

Pingback: arava 20 mg nz

Pingback: aricept 10 mg otc

Pingback: arimidex 1 mg united kingdom

Pingback: tamoxifen 10 mg tablets

Pingback: ashwagandha 60caps cost

Pingback: atarax 25 mg australia

Pingback: augmentin 250/125mg canada

Pingback: avapro 300mg otc

Pingback: avodart 0,5 mg nz

Pingback: baclofen 10 mg generic

Pingback: bactrim 400/80 mg over the counter

Pingback: benicar 10 mg cost

Pingback: Biaxin 250mg canada

Pingback: Premarin 0,625mg online pharmacy

Pingback: calcium carbonate 500mg without prescription

Pingback: casodex no prescription

Pingback: cheap celexa

Pingback: buy cephalexin 500 mg

Pingback: slot machines

Pingback: casino world

Pingback: wind creek casino online play

Pingback: golden nugget online casino

Pingback: sr22 insurance

Pingback: car insurance specialists

Pingback: mortgage broker richmond

Pingback: payday loans no credit check

Pingback: cbd oil for cancer patients

Pingback: pure kana natural cbd oil

Pingback: c4 health labs cbd oil

Pingback: cbd oil for dogs with seizures dosage

Pingback: buy college essay

Pingback: essay writing service australia

Pingback: college essay writer for pay

Pingback: how to write argument essay

Pingback: combivent 50/20 mcg canada

Pingback: coumadin 2 mg tablet

Pingback: cymbalta tablet

Pingback: dapsone caps without a prescription

Pingback: diamox 250 mg uk

Pingback: diltiazem 60 mg nz

Pingback: dramamine online pharmacy

Pingback: erythromycin medication

Pingback: flonase nasal spray 50 mcg united kingdom

Pingback: garcinia cambogia 100caps for sale

Pingback: where can i buy imitrex 50mg

Pingback: imodium online

Pingback: Full Report

Pingback: imuran 50 mg nz

Pingback: buy indocin 25 mg

Pingback: cheap levaquin 250mg

Pingback: lopid 300mg for sale

Pingback: lopressor online pharmacy

Pingback: cheap luvox 50mg

Pingback: motrin otc

Pingback: nortriptyline 25 mg australia

Pingback: cheapest periactin 4 mg

Pingback: phenergan 25mg tablet

Pingback: benefits of viagra size

Pingback: buy plaquenil

Pingback: prednisolone 5mg otc

Pingback: procardia usa

Pingback: protonix tablets

Pingback: remeron 30 mg tablet

Pingback: retin-a cream 0.025% tablets

Pingback: risperdal 3 mg australia

Pingback: robaxin tablets

Pingback: rogaine without a prescription

Pingback: spiriva united kingdom

Pingback: valtrex cheap

Pingback: verapamil 120 mg canada

Pingback: voltaren no prescription

Pingback: wellbutrin 300mg otc

Pingback: how to purchase zestril 5 mg

Pingback: see post

Pingback: how to purchase zocor

Pingback: zyvox 600 mg cost

Pingback: aripiprazole no prescription

Pingback: pioglitazone united kingdom

Pingback: fexofenadine 180 mg cost

Pingback: anastrozole tablets

Pingback: irbesartan uk

Pingback: cheap clonidinemg

Pingback: where can i buy cephalexin 500 mg

Pingback: where can i buy clozapine

Pingback: where to buy carvedilol

Pingback: rosuvastatin united kingdom

Pingback: desmopressin 0.1 mg otc

Pingback: divalproex 125 mg usa

Pingback: oxybutynin australia

Pingback: doxycycline 100 mg pills

Pingback: bisacodyl online

Pingback: venlafaxine 37.5mg tablet

Pingback: amitriptyline 50mg canada

Pingback: erythromycin 250mg otc

Pingback: rjjrwrrp

Pingback: alendronate 70mg prices

Pingback: wat doet viagra

Pingback: what do i do with zithromax

Pingback: glipizide 5mg online pharmacy

Pingback: hydrochlorothiazide without a doctor prescription

Pingback: isosorbide online pharmacy

Pingback: interactions for tadalafil

Pingback: where can i buy sumatriptan

Pingback: loperamide over the counter

Pingback: cheapest cialis 20 mg

Pingback: viagra prices

Pingback: order azathioprine

Pingback: where can i buy propranolol 80 mg

Pingback: comprar viagra

Pingback: article writing service

Pingback: which of the following skills is most important in learning how to write a research paper?

Pingback: who can write my essay for me

Pingback: help me write this essay

Pingback: business ethics and social responsibility essay

Pingback: lamotrigine 50 mg price

Pingback: terbinafine 250mg medication

Pingback: levofloxacin nz

Pingback: cheap levothyroxine mcg

Pingback: atorvastatin tablet

Pingback: ivermectin cost

Pingback: metoprolol over the counter

Pingback: doxycycline overdose

Pingback: and prednisolone

Pingback: comprar priligy

Pingback: online prescription propecia

Pingback: neurontin 300mg capsule

Pingback: metformin pioglitazone

Pingback: plaquenil and gabapentin

Pingback: vidalista 2.60 mg daily use

Pingback: trump and hydroxychloroquine connection

Pingback: ivermectin covid

Pingback: Anonymous

Pingback: Anonymous

Pingback: ivermectin where to buy

Pingback: is ivermectin safe for humans

Pingback: ivermectin in canada

Pingback: ignition casino help center

Pingback: order ivermectin

Pingback: prednisone buy online

Pingback: when will cialis be generic

Pingback: ivermectin tablet price

Pingback: buy ivermectin stromectol

Pingback: how to buy a viagra

Pingback: daily generic cialis

Pingback: generic viagra over the counter

Pingback: ivermectin 1 cream generic

Pingback: sildenafil tablets for sale

Pingback: goodrx tadalafil

Pingback: injectable ivermectin

Pingback: purchase sildenafil tablets

Pingback: cheap tadalafil

Pingback: tadalafil online india

Pingback: prednisone 20mg tab side effects

Pingback: merck antiviral pill

Pingback: tadalafil lilly

Pingback: tadalafil citrate research chemical

Pingback: ivermectin for humans

Pingback: price for viagra

Pingback: real casino slots

Pingback: jeffrey smith ivermectin

Pingback: ivermectin

Pingback: fanduel casino games

Pingback: viagra from canada

Pingback: side effects for ivermectin

Pingback: ivermectin 20 mg

Pingback: ivermectin usa

Pingback: ivermectin 0.5 lotion

Pingback: buy ivermectin 12 mg for humans

Pingback: buy ivermectin 3 mg otc

Pingback: where to buy ivermectin online

Pingback: ivermectin tablet 1mg

Pingback: stromectol for head lice

Pingback: buy lasix online usa

Pingback: ivermectin 12mg for sale

Pingback: ivermectin tablets for humans for sale

Pingback: furosemide drug brand name

Pingback: ivermectin lice

Pingback: ivermectin medicine

Pingback: ivermectina en ingles

Pingback: stromectol online pharmacy

Pingback: ivermectin price uk

Pingback: luckylandslots com

Pingback: cialis blood pressure

Pingback: stromectol coronavirus

Pingback: ivermectin paste for sale

Pingback: ivermectina piojos

Pingback: ivermectin lotion price

Pingback: hydroxychloroquine and zinc

Pingback: walmart cost for cialis

Pingback: stromectol tab price

Pingback: stromectol medicine

Pingback: buying ivermectin

Pingback: cialis over the counter at walmart

Pingback: buy ivermectin

Pingback: hydroxychloroquine where to buy

Pingback: hydroxychloroquine for rheumatoid arthritis

Pingback: coupon for cialis

Pingback: imverctin

Pingback: psy-

Pingback: ivermectina

Pingback: projectio

Pingback: moskva psiholog online

Pingback: slovar po psihoanalizu laplansh

Pingback: psy online

Pingback: uels ukrain

Pingback: ivermectine arrow lab

Pingback: bahis siteleri

Pingback: DPTPtNqS

Pingback: qQ8KZZE6

Pingback: D6tuzANh

Pingback: SHKALA TONOV

Pingback: Øêàëà òîíîâ

Pingback: russianmanagement.com

Pingback: chelovek-iz-90-h

Pingback: 3Hk12Bl

Pingback: 3NOZC44

Pingback: 01211

Pingback: tor-lyubov-i-grom

Pingback: film-tor-2022

Pingback: hd-tor-2022

Pingback: hdorg2.ru

Pingback: ivermectin in australia

Pingback: JXNhGmmt

Pingback: Psikholog

Pingback: netstate.ru

Pingback: Link

Pingback: stromectol australia

Pingback: tor-lyubov-i-grom.ru

Pingback: psy

Pingback: chelovek soznaniye mozg

Pingback: bit.ly

Pingback: cleantalkorg2.ru

Pingback: 2godless

Pingback: bucha killings

Pingback: War in Ukraine

Pingback: Ukraine

Pingback: Ukraine news live

Pingback: The Latest Ukraine News

Pingback: site

Pingback: stats

Pingback: stromectol 3 mg for scabies

Pingback: Ukraine-war

Pingback: gidonline

Pingback: stromectol stromectol

Pingback: mir dikogo zapada 4 sezon 4 seriya

Pingback: web

Pingback: film.8filmov.ru

Pingback: video

Pingback: film

Pingback: mediplus online medicine

Pingback: cialis at walmart

Pingback: liusia-8-seriiaonlain

Pingback: smotret-polnyj-film-smotret-v-khoroshem-kachestve

Pingback: filmgoda.ru

Pingback: rodnoe-kino-ru

Pingback: generic cialis at walmart

Pingback: abisko.ru

Pingback: confeitofilm

Pingback: stat.netstate.ru

Pingback: sY5am

Pingback: Dom drakona

Pingback: JGXldbkj

Pingback: aOuSjapt

Pingback: psikholog moskva

Pingback: A片

Pingback: Usik Dzhoshua 2 2022

Pingback: Dim Drakona 2022

Pingback: TwnE4zl6

Pingback: psy 3CtwvjS

Pingback: lalochesia

Pingback: film onlinee

Pingback: programma peredach na segodnya

Pingback: psycholog-v-moskve.ru

Pingback: psycholog-moskva.ru

Pingback: 3qAIwwN

Pingback: video-2

Pingback: sezons.store

Pingback: socionika-eniostyle.ru

Pingback: psy-news.ru

Pingback: 000-1

Pingback: 3SoTS32

Pingback: 3DGofO7

Pingback: wwwi.odnoklassniki-film.ru

Pingback: hydroxychloroquine for sale

Pingback: dolpsy.ru

Pingback: how much does hydroxychloroquine cost

Pingback: kin0shki.ru

Pingback: 3o9cpydyue4s8.ru

Pingback: mb588.ru

Pingback: history-of-ukraine.ru news ukraine

Pingback: edu-design.ru

Pingback: tftl.ru

Pingback: kamagra without prescription

Pingback: brutv

Pingback: site 2023

Pingback: how to buy propecia in canada

Pingback: buy propecia in pakistan

Pingback: SpyToStyle

Pingback: sitestats01

Pingback: 1c789.ru

Pingback: cttdu.ru

Pingback: 1703

Pingback: hdserial2023.ru

Pingback: serialhd2023.ru

Pingback: matchonline2022.ru

Pingback: sildenafil cenforce

Pingback: bit.ly/3OEzOZR

Pingback: bit.ly/3gGFqGq

Pingback: bit.ly/3ARFdXA

Pingback: bit.ly/3ig2UT5

Pingback: bit.ly/3GQNK0J

Pingback: bayer 20 mg levitra free trial

Pingback: bep5w0Df

Pingback: www

Pingback: icf

Pingback: 24hours-news

Pingback: rusnewsweek

Pingback: uluro-ado

Pingback: irannews.ru

Pingback: klondayk2022

Pingback: tqmFEB3B

Pingback: جامعة المستقبل

Pingback: future university

Pingback: Lincoln Georgis

Pingback: fue

Pingback: جامعة المستقبل

Pingback: fue

Pingback: Leandro Farland

Pingback: جامعة المستقبل

Pingback: future university

Pingback: future university egypt

Pingback: future university egypt

Pingback: future university egypt

Pingback: جامعة المستقبل

Pingback: How to Enable Systemd For WSL2 in Windows 11

Pingback: fue

Pingback: جامعة المستقبل

Pingback: Natraj Pencil Packing Job Work From Home

Pingback: جامعة المستقبل

Pingback: fue

Pingback: future university

Pingback: جامعة المستقبل

Pingback: future university egypt

Pingback: exipure order

Pingback: fue

Pingback: future university

Pingback: eric flag

Pingback: bodytone

Pingback: cage musculation extérieur

Pingback: prone leg curl

Pingback: mangalib

Pingback: chat-ave

Pingback: chat iw

Pingback: chat with stranger

Pingback: reputation defenders

Pingback: جامعة المستقبل

Pingback: Cory Chase

Pingback: Lila Lovely BBW

Pingback: Madelyn Monroe MILF

Pingback: best-domain-portfolio

Pingback: Write my essay

Pingback: Paper help

Pingback: Personal Statement Writing

Pingback: Business Report Writing Help

Pingback: Homework Help

Pingback: moisturize foot

Pingback: valentine gift

Pingback: valentine gift

Pingback: valentine pillow

Pingback: valentine pillow

Pingback: valentines gift

Pingback: x

Pingback: 9xflix

Pingback: xnxx

Pingback: 123movies

Pingback: Click Here

Pingback: Click Here

Pingback: 3exhaust

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: no code robotics

Pingback: Space ROS

Pingback: remote control robotics

Pingback: Click Here

Pingback: Reputation Defenders

Pingback: Reputation Defenders

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Reputation Defenders

Pingback: Reputation Defenders

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: grand rapids teeth whitening

Pingback: grand rapids same day crowns

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: 안전카지노사이트

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: new refer and earn apps

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: Click Here

Pingback: What are the signs of lacking vitamin B hydroxychloroquine for sale

Pingback: 라이브 딜러 카지노

Pingback: kinokrad 2023

Pingback: 인기 카지노 게임

Pingback: 신뢰할 수 있는 카지노 사이트

Pingback: batmanapollo

Pingback: domain-name

Pingback: domain-name

Pingback: batmanapollo.ru - psychologist

Pingback: Is green tea good for antibiotics

Pingback: batmanapollo psychologist

Pingback: rent ad

Pingback: comic Leggings

Pingback: best website for small business

Pingback: best cardano stake pool

Pingback: the company formation

Pingback: Is apple cider vinegar an antibiotic - durvet Ivermectin

Pingback: Cialis 5 mg best price - Scwcmd.com

Pingback: z pack antibiotic pack What is a natural antibiotic for bacterial infection

Pingback: kamagra 100 nebenwirkungen: Ist ein Bier gut fur die Potenz

Pingback: elizavetaboyarskaya.ru

Pingback: Google reviews

Pingback: How to start porn

Pingback: How many babies can a woman be pregnant with?

Pingback: How do you detox from antibiotics | stromectol 3 mg online

Pingback: reputation defenders

Pingback: Does my ex miss me?

Pingback: fundos imobiliários para iniciante

Pingback: What happens if I walk 10000 steps a day?

Pingback: vsovezdeisrazu

Pingback: Do potatoes have B12 extreme weight loss pills

Pingback: What happens if you take too much of an inhaler albuterol from mexico

Pingback: Quel produit pour etre fort au lit - viagra femme pharmacie.

Pingback: Is naproxen 500 mg the same as ibuprofen albuterol sulfate hfa 90 cost

Pingback: What gender is most affected by bipolar disorder side effects for aripiprazole

Pingback: How many antibiotics can I take in a year

Pingback: 2023 Books

Pingback: Is it safe to take antibiotics without doctor

Pingback: 2023

Pingback: What foods fight infection

Pingback: When should you avoid antibiotics

Pingback: How many antibiotics per day

Pingback: dead people

Pingback: memorial

Pingback: death

Pingback: memorial

Pingback: search dececased

Pingback: dying

Pingback: cemetery location

Pingback: Do antibiotics reset your body

Pingback: What can I use instead of antibiotics

Pingback: Are eggs OK with antibiotics

Pingback: IRA Empire

Pingback: Is it better for the guy or girl to make the first move Stromectol 6mg online

Pingback: What is the safest antibiotic

Pingback: antibiotic medicine name

Pingback: levitra professional

Pingback: treatment for men with erectile dysfunction has focused on viagra and similar drugs

Pingback: Do bananas fight bacteria

Pingback: Äèçàéí ÷åëîâåêà

Pingback: Who needs antibiotic

Pingback: What is the safest antibiotic

Pingback: ipsychologos

Pingback: How quickly do antibiotics work

Pingback: Why do doctors not give antibiotics for infections

Pingback: yug-grib.ru

Pingback: studio-tatuage.ru

Pingback: samsung wireless earbuds | Treblab

Pingback: What to avoid when on antibiotics

Pingback: football betting predictor

Pingback: bit.ly/pamfir-pamfir-2023-ua-pamfir

Pingback: What happens when you have parasitic infection buy stromectol 3mg?

Pingback: Comment bander avec du Coca tadalafil lilly avis

Pingback: Is 3 days of antibiotics enough ivermectin wormer?

Pingback: Chirurgiens esthétique Tunisie

Pingback: beats over ear headphones

Pingback: bluetooth headphones noise canceling

Pingback: National Chi Nan University

Pingback: How long does it take for Ventolin to start working albuterol inhaler

Pingback: What to do if albuterol is not working albuterol inhaler

Pingback: What can you not mix with albuterol - albuterol sulfate

Pingback: What herbs help gain weight prescriber directions for ventolin?

Pingback: Can albuterol make asthma worse generic albuterol inhaler?

Pingback: What are signs that you have asthma where to buy ventolin inhalers without a prescription

Pingback: What is a pre stroke chlorthalidone 25 mg price

Pingback: poip-nsk.ru - Movie Watch

Pingback: film.poip-nsk.ru - film online

Pingback: fue

Pingback: افضل جامعة في مصر

Pingback: Top Universities in egypt

Pingback: Schneider Electric

Pingback: ما هي افضل الجامعات الخاصه

Pingback: رسوم دراسة ماجستير إدارة الأعمال

Pingback: Marketing degree

Pingback: Business education in Egypt

Pingback: Future University Egypt MBA

Pingback: Community impact

Pingback: رسالة كلية الاقتصاد والعلوم السياسية

Pingback: fue

Pingback: economics degree

Pingback: Academic excellence

Pingback: الكيمياء الحيوية

Pingback: Social Activities

Pingback: Department of Microbiology and Immunology

Pingback: Department of Pharmacy Practice and Clinical Pharmacy

Pingback: faculty of pharmacy

Pingback: Endodontics

Pingback: ماجيستير طب أسنان الأطفال

Pingback: Dental clinics

Pingback: شروط القبول بكلية الهندسة جامعة المستقبل

Pingback: القيادة والخدمة

Pingback: الخطة الأكاديمية

Pingback: preparing young engineers qualified to work

Pingback: ventolin - Inhaler and pets: How to choose the right companion

Pingback: FUE

Pingback: برامج علوم الحاسب

Pingback: Faculty Grievances

Pingback: Bachelor's Degree in Computer Science

Pingback: قسم علوم الحاسب

Pingback: best university in egypt

Pingback: Global partnerships

Pingback: creativity

Pingback: video.vipspark.ru

Pingback: vitaliy-abdulov.ru

Pingback: top university in egypt

Pingback: Comprehensive Academic and Health Institution

Pingback: برنامج إدارة الأعمال في مصر

Pingback: ماجستير في إدارة الأعمال في FUE

Pingback: Dental Residency Programs

Pingback: برامج الإقامة الخاصة بتقويم الأسنان

Pingback: Executive MBA program in Cairo

Pingback: faculty of dental

Pingback: بيان شخصي لجامعة المستقبل

Pingback: برامج الدراسات العليا في جامعة المستقبل

Pingback: International student admissions to future university

Pingback: التقديم جامعة المستقبل في مصر

Pingback: متطلبات كشف الدرجات لجامعة المستقبل

Pingback: التقديم جامعة المستقبل في مصر

Pingback: vipspark.vipspark.ru

Pingback: Pourquoi ma famille me rejette effets secondaires viagra

Pingback: Comment fait-on Lamour a 70 ans - prix du tadalafil en pharmacie

Pingback: Persistent exhaustion that is not relieved by rest or sleep may be a sign of thyroid deficiency | synthroid 25 mcg price

Pingback: lipitor medicine price | Can cholesterol levels be improved through consuming superfood powders like acai or moringa

Pingback: How can I romance my wife physically?

Pingback: What can I use if I don't have Epsom salt for infection?

Pingback: Should you rest when taking antibiotics?

Pingback: Comment reconnaitre un parent manipulateur sildenafil 50 mg

Pingback: Qu'est-ce qui fait tomber un homme amoureux - buy cialis online france

Pingback: Quand les couples se separent le plus - le sildenafil

Pingback: What is emotional intimacy to a man - vidalista 20 pill

Pingback: How quickly do men fall in love vidalista 60 how to take

Pingback: Slow speech or thinking can be associated with thyroid deficiency-related lack of energy?

Pingback: Difficulty in staying alert and attentive can be a symptom of thyroid deficiency-related lack of energy?

Pingback: What is the role of uterine artery embolization in treating specific causes of female infertility?

Pingback: Can psychological counseling benefit women undergoing treatment for infertility?

Pingback: Can regular consumption of garlic or garlic supplements help lower the level of heart disease

Pingback: How does chronic stress affect heart function and increase the risk of heart disease

Pingback: What to text him to get him back - Dapoxetine for sale

Pingback: Do all men become impotent - Priligy

Pingback: تعليم ادارة الأعمال بشكل المعاصر

Pingback: Course Load

Pingback: How can you tell if your liver is swollen?

Pingback: Department of Pharmacology

Pingback: كلية الصيدلة

Pingback: MBA graduates careers in Egypt

Pingback: Can you eat yogurt with antibiotics?

Pingback: Quand un homme a tres envie de vous

Pingback: MBA in Future university in egypt

Pingback: Student life

Pingback: Inhaler and air travel: Preparing for a flight | ventolin dosing

Pingback: Preoperative imaging guides surgical planning for breast cancer treatment Nolvadex pct dosage timing

Pingback: What are the 3 most common parasites duricef 500 mg cost

Pingback: How do you make a woman desire - vardenafil vilitra 60 mg

Pingback: amoxicillin 250mg for dogs - Who should not drink apple cider vinegar

Pingback: Are over the counter drugs effective for treating sunburns | over the counter viagra

Pingback: What is intimacy to a woman - buy fildena 100mg

Pingback: Which spice is good for liver ivermectin scabies dosage

Pingback: albuterol inhaler cost

Pingback: on the counter medication

Pingback: What is unhealthy discharge | side effects of plaquenil 200 mg tablets

Pingback: What are men's health issues

Pingback: How do you know if your gut is damaged - plaquenil 200mg price

Pingback: Can I get medication for schizophrenia during breastfeeding from an online pharmacy

Pingback: Can antibiotics be used for pneumonia in infants?

Pingback: Which exercise is good for liver buy stromectol 3mg tablets?

Pingback: Can antibiotics be used for fungal esophagitis?

Pingback: Do parasites make you crave food can i buy ivermectin over the counter?

Pingback: Is cinnamon good for the liver ivermectin toxicity humans?

Pingback: What brand of turmeric does the doctors recommend ivermectin tablets?

Pingback: What health issues is turmeric good for stromectol uk?

Pingback: What are signs of strong immune system stromectol 3 mg tablet?

Pingback: Can antibiotics treat gum infections stromectol online?

Pingback: Can antibiotics be used to treat bronchitis ivermectin dosage dogs?

Pingback: MBA scholarships in Egypt

Pingback: National identity

Pingback: Can antibiotics be used for urinary tract infections in children ivermectin tablets?

Pingback: Can using an inhaler become addicting symbicort?

Pingback: Does drinking water help with COPD?

Pingback: Can mucus in throat cause wheezing?

Pingback: What drinks get rid of mucus in the body ventolin inhaler for sale?

Pingback: pharmacy drugstore online?

Pingback: can you buy prescription drugs in canada?

Pingback: How long do antibiotic side effects last Azithromycin pills?

Pingback: GPA Calculation

Pingback: Can antibiotics treat urinary tract infections?

Pingback: دكتور اسنان بالقرب مني

Pingback: Can bacterial diseases be transmitted through contact with contaminated surfaces in prisons?

Pingback: How do you keep your man interested in you sanofi cialis??

Pingback: best university egypt

Pingback: International Level

Pingback: How many times a day does a man get hard??

Pingback: Executive MBA program in Cairo

Pingback: How many hours should you move a day??

Pingback: How does excessive cycling impact erectile function 5mg cialis for prostate enlargement??

Pingback: How long can the average man stay erect cialis cost at walmart??

Pingback: What to get your boyfriend to show him you care??

Pingback: What are the top 10 reasons for erectile dysfunction??

Pingback: It is important to ensure that you understand how to properly take dapoxetine and to follow the instructions provided by your healthcare professional.?

Pingback: Other medications used to treat PE include phosphodiesterase type 5 (PDE5) inhibitors such as sildenafil and tadalafil, which are typically used to treat erectile dysfunction but can also have a secondary effect of delaying ejaculation.?

Pingback: Maillot de football

Pingback: Maillot de football

Pingback: Maillot de football

Pingback: Maillot de football

Pingback: How long is an egg fertile once released??

Pingback: Maillot de football

Pingback: Maillot de football

Pingback: Maillot de football

Pingback: Can antibiotics be used to treat tularemia??

Pingback: SEOSolutionVIP Fiverr

Pingback: SEOSolutionVIP Fiverr

Pingback: SEOSolutionVIP Fiverr

Pingback: pull ups

Pingback: cage mma

Pingback: cortexi

Pingback: Fiverr Earn

Pingback: Fiverr Earn

Pingback: Fiverr Earn

Pingback: Fiverr Earn

Pingback: Fiverr Earn

Pingback: Fiverr Earn

Pingback: Fiverr Earn

Pingback: Fiverr Earn

Pingback: fiverrearn.com

Pingback: fiverrearn.com

Pingback: fiverrearn.com

Pingback: fiverrearn.com

Pingback: fiverrearn.com

Pingback: Advance-Esthetic LLC

Pingback: freight class calculator

Pingback: red boost buy

Pingback: liv pure buy

Pingback: freight class calculator

Pingback: clothing manufacturing

Pingback: clothes manufacturer usa

Pingback: fiverrearn.com

Pingback: fiverrearn.com

Pingback: fiverrearn.com

Pingback: fiverrearn.com

Pingback: What can make boyfriend happy buy Cenforce 50mg sale??

Pingback: french bulldog puppies

Pingback: Medications and Healthy Habits: A Comprehensive Approach to Well-being where can you buy kamagra.

Pingback: fiverrearn.com

Pingback: french bulldog ears

Pingback: brindle french bulldog

Pingback: The Role of Integrative Medicine in Healthcare ivermectin stromectol

Pingback: aussie doodle dog

Pingback: What is included in a men's wellness exam Cenforce 50mg generic?

Pingback: isla mujeres golf cart

Pingback: jute vs sisal rug

Pingback: What to text him to make him think about you all day generic levitra?

Pingback: What are common side effects of antibiotics ivermectin toxicity in dogs?

Pingback: SMM

Pingback: What are the negative effects of drinking apple cider vinegar ivermectin for people?

Pingback: Piano Packaging Services

Pingback: Reliable Piano Couriers

Pingback: Best university in Egypt

Pingback: Top university in Egypt

Pingback: golf cart isla mujeres

Pingback: isla mahara

Pingback: What are the effects of chronic use of nitrous oxide on erectile function in young men levitra without prescription?

Pingback: french bulldog

Pingback: lilac merle french bulldog

Pingback: french bulldog adoption

Pingback: Why does a man get erect in the morning side effects of levitra?

Pingback: isabella merle french bulldog

Pingback: fluffy french bulldog

Pingback: Medications and Hair Regrowth - Revitalizing Tresses, Boosting Confidence ventolin buy online?

Pingback: micro frenchie for sale

Pingback: brindle french bulldog

Pingback: Medications and Radiation Therapy - Minimizing Side Effects, Maximizing Benefits order fildena 100mg?

Pingback: frenchies for sale texas

Pingback: Copper rings for men

Pingback: Samsung phone

Pingback: future university

Pingback: Medications and Respiratory Health - Breathing Easier buy stromectol 6mg?

Pingback: Achieving Better Health - How Medications Can Make a Difference oral Cenforce 100mg?

Pingback: Medications and Joint Mobility - Enhancing Flexibility, Restoring Function priligy 30 mg alkol?

Pingback: houston frenchies

Pingback: multisbo rtp

Pingback: rent a golf cart isla mujeres

Pingback: Metabolic Syndrome - A Growing Health Concern fildena?

Pingback: Transforming Healthcare Delivery through Innovative Medications ae there usually any side effects taking 200 mg. of plaquenil?

Pingback: vidalista 40 cialis usa?

Pingback: Medications and Men's Health - Promoting Well-being at Every Age proair albuterol inhaler?

Pingback: french bulldogs puppys

Pingback: Fiverr

Pingback: Fiverr.Com

Pingback: Fiverr.Com

Pingback: FiverrEarn

Pingback: french bulldog

Pingback: fue

Pingback: The Gut-Brain Connection - Exploring the Enteric Nervous System Azithromycin pregnancy?

Pingback: golf cart rental isla mujeres

Pingback: Medications and Reproductive Health - Empowering Family Planning asthma ventolin inhaler?

Pingback: tab dapoxetine?

Pingback: bulldog frenchie puppies

Pingback: stromectol dosage for scabies?

Pingback: lean six sigma

Pingback: Medications and Alzheimer's Disease - Preserving Cognitive Function order lasix 100mg?

Pingback: Medications and Foot Pain Relief - Stepping Towards Comfort kamagra 100mg oral jelly?

Pingback: The Role of AI in Disease Diagnosis and Treatment pills that work like viagra?

Pingback: Warranty

Pingback: Piano maintenance

Pingback: Professional piano services

Pingback: Piano storage solutions

Pingback: FUE

Pingback: FUE

Pingback: Smooth transitions

Pingback: Long-distance moving

Pingback: House moving

Pingback: pcfinancial.ca/activate

Pingback: bali indonesia

Pingback: Holistic Approaches to Health - Balancing Medications and Natural Remedies what is vardenafil?

Pingback: FiverrEarn

Pingback: FiverrEarn

Pingback: FiverrEarn

Pingback: FiverrEarn

Pingback: FiverrEarn

Pingback: Classified Ads Website

Pingback: FiverrEarn

Pingback: FiverrEarn

Pingback: Medications - The Key to Managing Chronic Migraines furosemide 20 milligrams?

Pingback: Medications and Immune System Boost - Energizing Defenses, Bolstering Health vardenafil for sale?

Pingback: Training Philippines

Pingback: Medications and Heart Health - Protecting Your Most Vital Organ ivermectin 12mg?

Pingback: Overcoming Challenges in Access to Essential Medications synthroid manufacturer coupon?

Pingback: Can you strengthen your lungs xopenex vs albuterol?

Pingback: FiverrEarn

Pingback: FiverrEarn

Pingback: How soon after death do you poop furosemide 20 mg tab?

Pingback: How can I fix my asthma naturally albuterol sulfate?

Pingback: pupuk terbaik

Pingback: Pupuk Anorganik terbaik dan terpercaya di pupukanorganik.com

Pingback: When does a man stop ejaculating ivermectin for fleas?

Pingback: Unique Design Apparel/Clothing

Pingback: partners

Pingback: What makes a relationship lasting Cenforce 100 dosage?

Pingback: What should you not drink with COPD ventolin inhaler price?

Pingback: metabolism booster

Pingback: folifort

Pingback: What is the role of the FDA in ensuring the quality and safety of compounded bioidentical hormones dapoxetine 30 mg and sildenafil 50mg tablets shamagra

Pingback: STUDY ABROAD CONSULTANTS IN KOTTAYAM

Pingback: Is it better to walk or stand all day vidalista 80mg

Pingback: What is a dangerously low heart rate when sleeping ivermectin for horse

Pingback: Football

Pingback: FiverrEarn

Pingback: cenforce 200mg price in india

Pingback: live sex cams

Pingback: live sex cams

Pingback: FiverrEarn

Pingback: FiverrEarn

Pingback: FiverrEarn

Pingback: FiverrEarn

Pingback: FiverrEarn

Pingback: ivermectin tablets

Pingback: french bulldogs for sale texas

Pingback: How do you make him value and respect you??

Pingback: Do guys like gifts from their girlfriends??

Pingback: FiverrEarn

Pingback: FiverrEarn

Pingback: FiverrEarn

Pingback: FiverrEarn

Pingback: FiverrEarn

Pingback: FiverrEarn

Pingback: FiverrEarn

Pingback: FiverrEarn

Pingback: FiverrEarn

Pingback: FiverrEarn

Pingback: FiverrEarn

Pingback: FiverrEarn

Pingback: FiverrEarn

Pingback: FiverrEarn

Pingback: Queen Arwa University

Pingback: FiverrEarn

Pingback: FiverrEarn

Pingback: FiverrEarn

Pingback: FiverrEarn

Pingback: Paneer

Pingback: street preset lightroom

Pingback: seo company illinois

Pingback: dictionary

Pingback: garden

Pingback: Situs Judi Slot Online

Pingback: Scientific Research

Pingback: Kuliah Termurah

Pingback: FiverrEarn

Pingback: FiverrEarn

Pingback: FiverrEarn

Pingback: priligy pills - What are the 7 key principles of quality?

Pingback: priligy over the counter usa

Pingback: vidalista 20 wikipedia

Pingback: is fildena the same as viagra

Pingback: buy fildena online cheap

Pingback: hydroxychloroquine 200 mg para que sirve

Pingback: fildena

Pingback: Generator Repair Manchester

Pingback: amyl guard legit

Pingback: cheap sex cams

Pingback: fildena super active

Pingback: vidalista black 80mg tadalafil

Pingback: viagra jelly kamagra

Pingback: priligy 30mg

Pingback: amoxil antibiotics

Pingback: atorvastatin calcium over the counter

Pingback: buy strattera

Pingback: androgel cost

Pingback: buy Cenforce 100mg

Pingback: vidalista

Pingback: albuterol inhaler price

Pingback: proairrespiclick

Pingback: fullersears.com

Pingback: fullersears.com

Pingback: androgel without prescription

Pingback: best probiotics for dogs

Pingback: stromectol online

Pingback: cialis 20mg

Pingback: live sex cams

Pingback: live sex cams

Pingback: prozac 40 mg

Pingback: freeze dried

Pingback: rare breed-trigger

Pingback: Do antibiotics strengthen or weaken your immune system plaquenil sale?

Pingback: Alienlabs Agent

Pingback: 늑대닷컴

Pingback: Trik menang slot online

Pingback: OnePeace Live Action AMV

Pingback: One Peace AMV

Pingback: nang delivery

Pingback: freelance web developer Singapore

Pingback: allgame

Pingback: 918kiss

Pingback: หวย24

Pingback: Best face toner

Pingback: bulldog in clothes

Pingback: pg slot

Pingback: leak detection london

Pingback: AI Attorney

Pingback: regles 421

Pingback: Raahe Guide

Pingback: Raahe Guide

Pingback: aplikasi slot online deposit dana

Pingback: Dating Coach in London

Pingback: Relationship Therapy in London

Pingback: upstate hotels

Pingback: hotel in lake placid

Pingback: what is vidalista

Pingback: megagame

Pingback: amoxil antibiotics

Pingback: electronic visa

Pingback: buy stromectol without prescription

Pingback: 30-30-winchester-ammo

Pingback: 44 mag ammo

Pingback: 38/40 ammo

Pingback: ozempic

Pingback: sicarios madrid

Pingback: cenforce 200

Pingback: Anonymous

Pingback: itsMasum.Com

Pingback: deux categorie de logiciel malveillant

Pingback: programmation informatique

Pingback: FÜHRERSCHEIN ÖSTERREICH

Pingback: quick nangs delivery

Pingback: nangs delivery in Sydney

Pingback: chauffe eau Tours

Pingback: itsmasum.com

Pingback: itsmasum.com

Pingback: vidalista ervaring

Pingback: talk to strnagers

Pingback: itsmasum.com

Pingback: itsmasum.com

Pingback: buy fildena for sale

Pingback: tadalafil 10mg without doctor prescription

Pingback: stromectol cost

Pingback: levitra generico

Pingback: ivermectin 12mg

Pingback: buy albuterol sulfate

Pingback: gabapentin overdose

Pingback: stromectol 3mg

Pingback: vidalista black cialis 80 mg

Pingback: priligy pills

Pingback: generic drug for advair

Pingback: advair diskus coupon

Pingback: cenforce 150 india

Pingback: Cenforce 100 review

Pingback: what is Cenforce 100

Pingback: zwarte cenforce

Pingback: Cenforce 50 vs viagra

Pingback: buy cenforce 150

Pingback: Sildenafil Dosage for erectile dysfunction

Pingback: Sildenafil us pharmacy

Pingback: vidalista 60

Pingback: Cenforce 200

Pingback: fildena

Pingback: cenforce 50

Pingback: clomid over the counter Canada

Pingback: testosterone gel price

Pingback: how does dapoxetine work

Pingback: super sildamax

Pingback: Sildenafil goodrx

Pingback: is there a generic for levitra

Pingback: advair medicine

Pingback: live sex cams

Pingback: live amateur webcams

Pingback: live sex shows

Pingback: dapoxetine

Pingback: Kampus Ternama

Pingback: ventolin canada pharmacy

Pingback: advair diskus 500/50 generic

Pingback: cipro dexameth 0.3 0.1 otic susp

Pingback: Cenforce 200 mg

Pingback: texas frenchies

Pingback: A Yemeni Arab Journal Indexed by Scopus and ISI

Pingback: Queen Arwa University EDURank

Pingback: 918kiss

Pingback: how often to take albuterol inhaler

Pingback: over counter Viagra walgreens

Pingback: revatio

Pingback: generic plaquenil

Pingback: tadalafil vs Sildenafil

Pingback: cipla seroflo inhaler

Pingback: buy cenforce

Pingback: cenforce d 160 mg

Pingback: clincitop gel buy online

Pingback: best place to buy kamagra

Pingback: kamagra oral jelly

Pingback: ivermectol 12 mg price

Pingback: ivermectol 6mg

Pingback: iverheal 12

Pingback: vermact 6 mg

Pingback: pg slot

Pingback: covimectin 12 signature

Pingback: vermact 12 dosage

Pingback: 918kiss

Pingback: stromectol cvs

Pingback: vidalista

Pingback: vidalista 20 mg how long does it take to work

Pingback: cost of levitra

Pingback: cialis super active online

Pingback: vidalista 60mg

Pingback: clomid medication

Pingback: albuterol sulfate hfa

Pingback: clomid 50mg for male

Pingback: amoxil 500 mg

Pingback: clomid 50mg men

Pingback: cialis Generic best price

Pingback: Where Can i get clomid no prescription

Pingback: vermovent 12

Pingback: fildena sildenafil

Pingback: how to get clomid

Pingback: cialis dapoxetine

Pingback: clomid without dr presccriiption

Pingback: dapoxetine 30mg

Pingback: testosterone gel

Pingback: inhaler seroflo 250

Pingback: qvar redihaler 80 mcg

Pingback: dapoxetine india buy online

Pingback: vidalista dose

Pingback: cenforce 100 sildenafil citrate

Pingback: generic for revatio

Pingback: tadalafil tablets 60 mg vidalista 60

Pingback: isotroin

Pingback: rybelsus cost

Pingback: rybelsus price

Pingback: assurans cipla

Pingback: buy cheap dapoxetine

Pingback: canada levitra

Pingback: motilium bebe 7 mois

Pingback: domperidone usa

Pingback: over the counter levitra

Pingback: ItMe.Xyz

Pingback: citadep

Pingback: s citadep

Pingback: fildena 120mg

Pingback: citalopram

Pingback: asthalin inhaler in hindi

Pingback: fildena extra power 150 for sale

Pingback: stromectol for scabies

Pingback: ivercid 12 mg

Pingback: ivscab

Pingback: covilife 12

Pingback: Premium URL Shortener

Pingback: ItMe.Xyz

Pingback: Cenforce without prescription

Pingback: ItMe.Xyz

Pingback: Best URL Shortener To Make Money

Pingback: Dropbox URL Shortener

Pingback: does vidalista 20 work

Pingback: itme.xyz

Pingback: vidalista 20 mg

Pingback: Bulk URL Shortener

Pingback: amoxil 875 mg tablet

Pingback: ItMe.Xyz

Pingback: levitra canadian

Pingback: buy amoxicillin otc

Pingback: does ventolin inhaler contain alcohol

Pingback: does kamagra work on females

Pingback: what is sildigra used for

Pingback: sildigra tablet uses

Pingback: sildigra super power tablet

Pingback: kamagra order online ezzz pharmacy

Pingback: priligy dapoxetine buy

Pingback: vidalista 60 side effects

Pingback: buy kamagra jelly online

Pingback: spedra tablets

Pingback: priligy 60 mg buy

Pingback: ed drug stendra

Pingback: clomiphene 50mg ovulation

Pingback: Cenforce 200 male enhancement

Pingback: fertomid for men

Pingback: priligy tablets

Pingback: femara letrozole moa

Pingback: fildena india

Pingback: daily cialis and viagra combined

Pingback: Nolvadex how to Buy

Pingback: buy kamagra 100 mg online

Pingback: buy generic Cenforce 100mg

Pingback: scavista 12 tablet

Pingback: trimox medication

Pingback: vidalista 20mg online

Pingback: viagra connect

Pingback: vidalista

Pingback: tadalista professional

Pingback: tadalafil dose for women

Pingback: Azithromycin

Pingback: generic sildenafil

Pingback: cialis black 800mg canada

Pingback: cenforce kamagra

Pingback: generic for levitra

Pingback: Cenforce 50

Pingback: ivecop 12 uses

Pingback: minoxidil

Pingback: buy levitra with dapoxetine

Pingback: viagra vs avanafil

Pingback: vidalista pills 60mg

Pingback: qvar redihaler 80 mcg

Pingback: atorvastatin 40mg side effects

Pingback: mzplay

Pingback: wix seo specialist

Pingback: satoshi t shirt

Pingback: chanel dog bowl

Pingback: chimalhuacan

Pingback: free video chat

Pingback: free cam sex

Pingback: cheap sex chat

Pingback: cheap amateur webcams

Pingback: floodle

Pingback: dog papers

Pingback: french bulldog puppies near me

Pingback: acupuncture fort lee

Pingback: clima en neza

Pingback: culiacan clima

Pingback: french bulldog adoption

Pingback: liz kerr

Pingback: atizapán de zaragoza clima

Pingback: surrogacy mexico cost

Pingback: Beckhoff

Pingback: frenchies for sale in texas

Pingback: بطاقه ايوا

Pingback: live sex cams

Pingback: mixed breed pomeranian chihuahua

Pingback: play net app

Pingback: benemid

Pingback: rent a boat in cancun

Pingback: french bulldog shih tzu mix

Pingback: isotroin 30 tablet

Pingback: best probiotic for english bulldog

Pingback: nft

Pingback: esports domains

Pingback: micro french bulldog

Pingback: floodle puppies for sale

Pingback: download valorant cheats

Pingback: apex legends 2024 cheats

Pingback: delta force cheats

Pingback: fortnite ESP

Pingback: aimbot mw2

Pingback: chamy rim dips

Pingback: candy factory

Pingback: condiciones climaticas queretaro

Pingback: isla mujeres condo

Pingback: moped rental isla mujeres

Pingback: black frenchies

Pingback: french bulldog blue color

Pingback: linh hoang

Pingback: 늑대닷컴

Pingback: johnny dang

Pingback: 늑대닷컴

Pingback: yorkie poo breeding

Pingback: dog probiotic

Pingback: vidalista 20 bodybuilding

Pingback: dr kim acupuncture

Pingback: onglyza medicine

Pingback: we buy puppies

Pingback: mexican candy store near me

Pingback: linh hoang

Pingback: french bulldog shop

Pingback: coco chanel dog collar

Pingback: nepo hat

Pingback: playnet

Pingback: brazilian jiu jitsu in houston

Pingback: french bulldog

Pingback: bjj jiu jitsu cypress texas

Pingback: bjj jiu jitsu magnolia texas

Pingback: boston terrier french bulldog mix

Pingback: french bulldog chihuahua mix

Pingback: Dog Registry

Pingback: How To Get My Dog Papers

Pingback: Dog Breed Registries

Pingback: Dog Breed Registries

Pingback: Dog Breed Registries

Pingback: How To Obtain Dog Papers

Pingback: Dog Breed Registries

Pingback: vidalista.pics

Pingback: Dog Papers

Pingback: cenforceindia.com

Pingback: How To Obtain Dog Papers

Pingback: Dog Breed Registries

Pingback: Dog Registry

Pingback: Dog Papers

Pingback: Dog Papers

Pingback: Dog Papers

Pingback: Dog Papers

Pingback: Dog Papers

Pingback: Dog Papers

Pingback: Dog Papers

Pingback: French Bulldog Rescue

Pingback: French Bulldog Rescue

Pingback: French Bulldog Rescue

Pingback: French Bulldog Rescue

Pingback: French Bulldog Rescue

Pingback: French Bulldog Rescue

Pingback: kamagra

Pingback: ciprofloxacin ear drops cost

Pingback: kamagra

Pingback: asthalin cost

Pingback: men viagra pill

Pingback: what color is viagra pills

Pingback: cialis canadian pharmacy ezzz

Pingback: french pitbull dog

Pingback: kamaforman.wordpress.com

Pingback: viasuper.wordpress.com

Pingback: vidalforman.wordpress.com

Pingback: cenforce360.com

Pingback: priliforyou.wordpress.com

Pingback: acheter cialis professional

Pingback: avanafil leeford

Pingback: super filagra

Pingback: gray french bulldog

Pingback: mexican nerds

Pingback: forum.hcpforum.com/tadalistatadalafil

Pingback: buy fildena 150

Pingback: scavista 12 mg tablet uses

Pingback: vigrakrs.com

Pingback: golf cart rentals

Pingback: Frenchie Puppies

Pingback: Frenchie Puppies

Pingback: French Bulldog Puppies Near Me

Pingback: French Bulldog For Sale

Pingback: Frenchie Puppies

Pingback: French Bulldog For Sale

Pingback: probiotic dog treats

Pingback: best probiotic for english bulldog

Pingback: tadalista

Pingback: acupuncture

Pingback: frenchie for sale houston

Pingback: With age comes wisdom-and smart treatment decisions involving online viagra.

Pingback: crypto news

Pingback: minnect expert

Pingback: cheap levitra

Pingback: dump him shirt

Pingback: chanel bucket hat

Pingback: brazil crop top

Pingback: french bulldog accessories

Pingback: ivrea

Pingback: otclevitra.com

Pingback: fildena.homes

Pingback: frenchie boston terrier mix

Pingback: frenchie chihuahua mix

Pingback: frenchie chihuahua mix

Pingback: frenchie chihuahua mix

Pingback: frenchie boston terrier mix

Pingback: fart coin price

Pingback: folding hand fans

Pingback: kamagra pharmacy v

Pingback: biomox for cats

Pingback: silagra vs viagra

Pingback: Cenforce pills

Pingback: chlamydia Azithromycin

Pingback: 100 mg Viagra

Pingback: lilac french bulldogs

Pingback: fluffy french bulldog

Pingback: blue color french bulldog

Pingback: merle french bulldog

Pingback: french bulldogs

Pingback: Vidalista pills 60mg

Pingback: blue color french bulldog

Pingback: blue color french bulldog

Pingback: cialis black uk

Pingback: Zithromax generic name

Pingback: buy avana

Pingback: clincitop gel buy online

Pingback: malegra dxt reviews

Pingback: pharmduck.com

Pingback: cenforce 150 india

Pingback: wordpress geo

Pingback: travel buddy

Pingback: isla mujeres golf cart

Pingback: linh hoang

Pingback: micro frenchie

Pingback: viet travel tours

Pingback: kamagra oral jelly where to buy

Pingback: in vitro fertilization mexico

Pingback: Azithromycin

Pingback: in vitro fertilization mexico

Pingback: fiv mexico

Pingback: joyce echols houston

Pingback: in vitro fertilization mexico

Pingback: frenchie gpt

Pingback: french bulldog puppies for sale

Pingback: top french bulldog breeders in the world

Pingback: dog registry

Pingback: Ventolin hfa 90 mcg inhaler

Pingback: malegra pro 100mg

Pingback: bitcoin

Pingback: French Bulldog puppies in Houston

Pingback: blue french bulldog

Pingback: best joint supplement for dogs

Pingback: french bulldog puppies for sale under $500

Pingback: avanafil nombre comercial

Pingback: generative engine optimization

Pingback: how can you get papers on a dog

Pingback: micro bully

Pingback: how to obtain dog papers

Pingback: clima cancun

Pingback: what is a cavapoo dog breed

Pingback: american bully life span

Pingback: texas heeler puppies

Pingback: dogs mustache

Pingback: kamagra 50mg

Pingback: cenforce 150

Pingback: lyricatro.com

Pingback: viahelpmen.wordpress.com

Pingback: iwermectin.com/info/can-i-get-ivermectin-for-humans-over-the-counter.html

Pingback: lyricabrs.com

Pingback: iwermectin.com

Pingback: stromectoluk.com

Pingback: zpackmax.com

Pingback: cenforcebnr.com

Pingback: donpharm.com

Pingback: ragnarok servers

Pingback: cialfrance.com

Pingback: viastoreus.com

Pingback: dynamitesports.com/groups/probalan-probenecid/

Pingback: wix seo service

Pingback: wix seo experts

Pingback: wix seo

Pingback: wix seo specialists

Pingback: Bulk URL Shortener

Pingback: vancouver canada pharmacy

Pingback: buy viagra hyderabad india

Pingback: zyprexa generic

Pingback: Fildena forum

Pingback: clomid 50mg price

Pingback: seretide diskus 50 250

Pingback: tadaga super

Pingback: avanafil liquid

Pingback: kamagra 50 gold

Pingback: black tadalafil pill

Pingback: super avana reviews

Pingback: Vidalista 60 reviews

Pingback: dapoxetine buy in india

Pingback: Vidalista 20 nebenwirkungen

Pingback: kamagra near me

Pingback: metronidazole 400 pil

Pingback: dapoxetine 90 mg reviews

Pingback: +38 0950663759 – Владимир (Сергей) Романенко, Одесса – Обман! В объявлении «как новый», в руках — брак. ТВАРЬ перестал отвечать.

Pingback: malegra 100 price

Pingback: cialis professional edition

Pingback: super Vidalista price in bangladesh

Pingback: Zithromax dosage

Pingback: iverheal manufacturer

Pingback: black cialis reviews

Pingback: kamagra effervescent

Pingback: Vidalista vs viagra and cialis