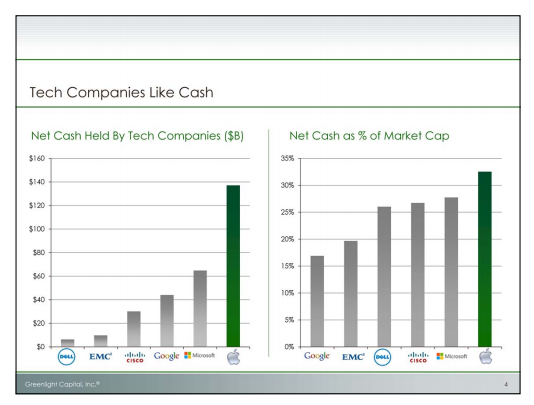

Apple Inc (NASDAQ:AAPL) has been successful in amassing more cash than any other tech company out there including Microsoft, Google, Cisco, EMC, and Dell. Most companies in other sectors use debt and equity to growth the company or make new investments while tech companies like Apple Inc (NASDAQ:AAPL) have a nice stock pile of cash. Apple Inc (NASDAQ:AAPL) has made a majority of its overseas foreign cash from foreign iPhone, iPad, Macbook sales, particularly in China. Usually when cash is made overseas, it will stay overseas and would rarely be brought back to the United States.

Tech companies are aware that when they are in trouble and need money, Wall Street won’t be there to bail them out. Many industry captains have lost their leadership since they ran out of funds, and could no longer support research and development or their internal staff.

The tech industry is risky, as consumer sentiment change can easily destroy a company’s profits if they’ve invested so much into a technology.

Some companies fear that a recurring dividend is testament to the fact that they’re no longer growing, and have nothing better to do with the cash, and therefore they would like to return it. This signifies weakness in a company, as example with Microsoft who tried to use dividends to retain share holders in the face of rising competition.

Einhorn breaks down Apple Inc (NASDAQ:AAPL)’s as follows:

- War Chest: Apple has by far the most amount of money than any of its competitor, with $137 billion in cash and increasing rapidly.

- Overseas Funds: Approximately $94 billion or 69% of the war chest is overseas, and bringing back those funds would require paying high taxes.

- Discounted Price to Earnings: Apple trades at a low price to earnings – approximately 10x their current earnings and 7x their net cash.

When 1/3rd of your market cap is based on the funds you have, that means the other 2/3rds of the business is based on the future earnings growth of the company. It means the 1/3rd cash balance should be generating a higher Price to Earnings multiplier.

(Source: Shareholder.com)

Einhorn discusses the possibility of shares repurchasing to unlock shareholder value. He states:

“To do a one-time dividend or a large one-time share repurchase, it’s good to know how much cash is

available. Apple currently has $137 billion in cash, $94 billion of which is offshore.

In these scenarios, we assume Apple brings all its foreign cash back to the U.S. and pays the taxes

for repatriating the funds. With $94 billion in foreign cash taxed at 35%, there is $61 billion of cash

brought home. Add the existing $43 billion of domestic cash for a total of $104 billion available.

Please note we are not advocating that Apple repatriate its foreign cash; in fact our proposal later on

will show Apple does not need to do this.Obviously, Apple isn’t going to deplete its cash reserves to zero, so we made some assumptions

about a large cash reserve. We sought to pick a number that we felt would be more than sufficient

for a rainy day fund. We took one year’s worth of operating expense and capex less depreciation,

and came up with $20 billion. This along with its ongoing franchise should leave Apple well

positioned to execute its business plan, including acquisitions.While some have suggested that Apple could raise additional cash by selling debt, we believe that

Apple is highly debt averse. Even asking it to reduce the cash balance to $20 billion is probably not

realistic, but for the sake of this example we believe it is a reasonable number. That leaves $84

billion in free cash to use for a one-time dividend, or a one-time self-tender offer for its shares.15% fewer shares means 17% higher earnings. You can see that EPS goes from $45 to about $53.”

Pingback: viagra from canada

Pingback: viagra cialis

Pingback: Discount viagra

Pingback: best place to buy cialis online reviews

Pingback: how long does viagra last

Pingback: online pharmacy viagra

Pingback: buy ed pills

Pingback: best ed pills

Pingback: best ed medication

Pingback: cialis online

Pingback: buy amoxicilina 500 mg online

Pingback: canada online pharmacy

Pingback: canadian online pharmacy

Pingback: generic cialis online

Pingback: vardenafil

Pingback: buy levitra online

Pingback: levitra 10mg

Pingback: gambling casino online

Pingback: pala casino online

Pingback: sildenafil online

Pingback: casino moons online casino

Pingback: casino online games for real money

Pingback: installment loans

Pingback: online payday loans

Pingback: pay day loans

Pingback: viagra cost

Pingback: cialis 20

Pingback: real money casino online usa

Pingback: christopher

Pingback: best-casinos-usa

Pingback: zoila

Pingback: buy cialis

Pingback: generic cialis

Pingback: generic cialis

Pingback: viagra pills

Pingback: online slots real money

Pingback: online casino games real money

Pingback: online casino games for real money

Pingback: casinos

Pingback: viagra online canada

Pingback: sildenafil 20 mg

Pingback: viagra price

Pingback: cheapest generic viagra

Pingback: generic viagra

Pingback: viagra

Pingback: tadalafil vs sildenafil

Pingback: buy viagra new york

Pingback: viagra generic

Pingback: canadian pharmacy king

Pingback: sildenafil citrate

Pingback: mymvrc.org

Pingback: viagra nz buy

Pingback: Viagra 25 mg cost

Pingback: Viagra 150 mg pills

Pingback: Viagra 130mg cost

Pingback: Viagra 25 mg cost

Pingback: Viagra 50mg over the counter

Pingback: Viagra 150mg online

Pingback: how to buy Viagra 120 mg

Pingback: cost of Viagra 200 mg

Pingback: buy Viagra 200 mg

Pingback: buy viagra online

Pingback: Cialis 80mg for sale

Pingback: Cialis 20 mg pharmacy

Pingback: how to buy Cialis 60 mg

Pingback: cheap Cialis 10mg

Pingback: cheap cialis

Pingback: cheap viagra

Pingback: sildenafil 130 mg usa

Pingback: lm360.us

Pingback: lasix 40mg prices

Pingback: propecia 5mg over the counter

Pingback: cost of lexapro 20mg

Pingback: finasteride 1mg tablets

Pingback: abilify 10 mg price

Pingback: buy actos 30 mg

Pingback: aldactone 25 mg cost

Pingback: viagra without a doctor prescription

Pingback: cialis price

Pingback: allopurinol 300mg without a prescription

Pingback: cost of amaryl 1 mg

Pingback: amoxicillin 250 mg for sale

Pingback: arava 20 mg for sale

Pingback: cialistodo.com

Pingback: cheap aricept 5 mg

Pingback: cheapest arimidex 1mg

Pingback: atarax 25 mg without a prescription

Pingback: how to buy augmentin 500/125 mg

Pingback: baclofen 10mg cost

Pingback: bactrim 800/160mg without a doctor prescription

Pingback: viagra on line

Pingback: benicar 20mg for sale

Pingback: Biaxin 500 mg coupon

Pingback: Premarin 0,3mg nz

Pingback: buspar 5mg coupon

Pingback: keflex.webbfenix.com

Pingback: cardizem online pharmacy

Pingback: cialis without a doctor's prescription

Pingback: casodex 50 mg australia

Pingback: buy catapres 100mcg

Pingback: ceclor canada

Pingback: ceftin 250mg tablet

Pingback: celebrex no prescription

Pingback: cephalexin 500 mg canada

Pingback: natural viagra

Pingback: cipro prices

Pingback: claritin prices

Pingback: real money casino online

Pingback: legitimate online slots for money

Pingback: casino slots

Pingback: online casino with free signup bonus real money usa

Pingback: online casino games for real money

Pingback: online slots for real money

Pingback: best online casino real money

Pingback: online casino real money no deposit

Pingback: real money online casino

Pingback: low cost car insurance quotes companies

Pingback: insurance car insurance

Pingback: geico car insurance quotes official site

Pingback: windhaven car insurance quotes

Pingback: car insurance quotes prices

Pingback: porn viagra bj mom

Pingback: car insurance quotes california

Pingback: vehicle insurance

Pingback: cheap car insurance quotes in florida

Pingback: gap insurance quotes

Pingback: 21 century insurance

Pingback: personal loans online for bad credit

Pingback: payday loan definition

Pingback: installment loans ohio

Pingback: bad credit loans in michigan

Pingback: quick payday loans

Pingback: guaranteed personal loans

Pingback: blood bruises under skin cbd oil

Pingback: buy cbd oil with thc

Pingback: cheap viagra online canadian pharmacy

Pingback: cbd oil benefits webmd

Pingback: cbd book distributors

Pingback: canadian online pharmacy viagra

Pingback: cbd hemp oil for sale vape

Pingback: cbd oil for dogs with seizures dosage

Pingback: viagra generic without prescription

Pingback: best cbd oil for cancer for sale

Pingback: cbd massage oil

Pingback: write essay online

Pingback: Generic viagra

Pingback: viagra for men for sale

Pingback: custom essay writer

Pingback: write essay

Pingback: how to writing essay

Pingback: essay buy

Pingback: sildenafil pfizer

Pingback: assignment operators

Pingback: college paper writers

Pingback: college admission essay writing service

Pingback: essay writing

Pingback: cleocin canada

Pingback: clomid medication

Pingback: clonidine tablet

Pingback: Canadian pharmacy viagra legal

Pingback: clozaril united states

Pingback: colchicine cheap

Pingback: symbicort inhaler 160/4,5mcg united kingdom

Pingback: Overnight delivery viagra

Pingback: order combivent 50/20 mcg

Pingback: coreg canada

Pingback: cheap compazine

Pingback: order coumadin

Pingback: cozaar 25mg nz

Pingback: crestor 10 mg united states

Pingback: cymbalta united states

Pingback: dapsone caps usa

Pingback: ddavp usa

Pingback: Samples of viagra

Pingback: diamox otc

Pingback: differin 15g united states

Pingback: diltiazem canada

Pingback: how to buy dramamine

Pingback: elavil 25mg united kingdom

Pingback: erythromycin united states

Pingback: cheapest etodolac

Pingback: flomax without a doctor prescription

Pingback: where to buy flonase nasal spray

Pingback: garcinia cambogia 100caps cost

Pingback: geodon tablet

Pingback: hyzaar usa

Pingback: imdur 40mg prices

Pingback: imitrex coupon

Pingback: imodium 2mg uk

Pingback: Resources

Pingback: imuran uk

Pingback: indocin 50 mg canada

Pingback: lamisil united states

Pingback: levaquin 250mg prices

Pingback: lopressor without a prescription

Pingback: luvox 50 mg without a doctor prescription

Pingback: macrobid 50mg otc

Pingback: meclizine 25 mg price

Pingback: mestinon 60mg nz

Pingback: micardis 40 mg without a doctor prescription

Pingback: cost of mobic

Pingback: nortriptyline purchase

Pingback: cheap periactin

Pingback: plaquenil price

Pingback: how to purchase prednisolone

Pingback: prilosec 10mg coupon

Pingback: proair inhaler without prescription

Pingback: procardia for sale

Pingback: proscar cheap

Pingback: protonix 40mg online

Pingback: provigil 200 mg prices

Pingback: where to buy pulmicort

Pingback: pyridium 200 mg no prescription

Pingback: reglan pharmacy

Pingback: losing weight on tamoxifen

Pingback: remeron without a prescription

Pingback: vidalista 5mg tablets price

Pingback: retin-a cream 0.05% online pharmacy

Pingback: difference between remdesivir and hydroxychloroquine

Pingback: revatio 20 mg medication

Pingback: how to purchase risperdal

Pingback: robaxin purchase

Pingback: rogaine pharmacy

Pingback: buy seroquel

Pingback: how to buy skelaxin 400mg

Pingback: spiriva 9 mcg online

Pingback: cheapest tenormin

Pingback: thorazine coupon

Pingback: toprol 50 mg canada

Pingback: tricor over the counter

Pingback: valtrex for sale

Pingback: verapamil usa

Pingback: voltaren 100mg otc

Pingback: wellbutrin 150 mg nz

Pingback: zanaflex 4mg medication

Pingback: zestril 10mg online pharmacy

Pingback: more

Pingback: zocor 40 mg medication

Pingback: zovirax australia

Pingback: zyloprim 100 mg over the counter

Pingback: zyprexa nz

Pingback: order zyvox 600 mg

Pingback: tadalafil without a prescription

Pingback: furosemide 100 mg online pharmacy

Pingback: escitalopram cheap

Pingback: aripiprazole tablet

Pingback: where to buy pioglitazone 30mg

Pingback: spironolactone 100mg without prescription

Pingback: buy fexofenadine

Pingback: glimepiride 1 mg over the counter

Pingback: meclizine nz

Pingback: leflunomide online

Pingback: atomoxetine 18mg pills

Pingback: donepezil 5 mg uk

Pingback: anastrozole tablets

Pingback: irbesartan 150mg for sale

Pingback: dutasteride 0,5 mg tablet

Pingback: olmesartan 40 mg medication

Pingback: buspirone 5mg tablets

Pingback: clonidinemg no prescription

Pingback: cefuroxime 500 mg usa

Pingback: citalopram without a prescription

Pingback: where can i buy cephalexin 500 mg

Pingback: ciprofloxacin usa

Pingback: clindamycin 150 mg generic

Pingback: clozapine canada

Pingback: prochlorperazine tablets

Pingback: buy carvedilol 12.5mg

Pingback: warfarin 5 mg medication

Pingback: cheap rosuvastatin 10mg

Pingback: divalproex 125mg cost

Pingback: tolterodine medication

Pingback: acetazolamide prices

Pingback: fluconazole pills

Pingback: phenytoin canada

Pingback: buy oxybutynin

Pingback: tadalafil side effects

Pingback: doxycycline 100 mg purchase

Pingback: bisacodyl usa

Pingback: cialis without a doctor prescription

Pingback: amitriptyline prices

Pingback: permethrin medication

Pingback: erythromycin 500mg usa

Pingback: estradiol no prescription

Pingback: alendronate 70 mg online

Pingback: how to buy hydrochlorothiazide 5mg

Pingback: isosorbide online pharmacy

Pingback: sumatriptan united kingdom

Pingback: loperamide cost

Pingback: buy azathioprine

Pingback: propranolol pills

Pingback: indomethacin price

Pingback: buy lamotrigine 200mg

Pingback: terbinafine without a doctor prescription

Pingback: how to purchase levothyroxine mcg

Pingback: gemfibrozil price

Pingback: metoprolol for sale

Pingback: cialis side effects in women

Pingback: clotrimazole 10g for sale

Pingback: metoclopramide 10mg medication

Pingback: how to get cialis coupon

Pingback: hydroxychloroquine study success

Pingback: viagra buy

Pingback: canada viagra

Pingback: viagra online canada

Pingback: sildenafil 100mg

Pingback: cialis

Pingback: get cialis online

Pingback: purchase viagra

Pingback: viagragates.com

Pingback: viagrarover

Pingback: cialis tadalafil online

Pingback: viagra buy online

Pingback: sildenafil soft gel

Pingback: sildenafil medication

Pingback: tadalafil citrate liquid

Pingback: buy viagra online cheap

Pingback: viagra professional

Pingback: buy viagra through paypal

Pingback: best viagra brand in canada

Pingback: generic viagra online canada

Pingback: sildenafil 20mg coupon discount

Pingback: googles viagra philipines price

Pingback: african natural viagra

Pingback: comparions of generic viagra cost

Pingback: cialis rezeptfrei

Pingback: cialis wirkung

Pingback: best place to buy viagra australia

Pingback: over the counter viagra

Pingback: sildenafil 50 mg

Pingback: sildenafil citrate

Pingback: viagra without doctor

Pingback: viagra gum

Pingback: viagra tablets uk

Pingback: viagra kaufen

Pingback: viagra receptfritt

Pingback: viagra pills for men

Pingback: viagra meaning

Pingback: viagra alternatives

Pingback: viagra over the counter

Pingback: cialis viagra

Pingback: viagra no prescription

Pingback: low price viagra

Pingback: viagra substitute

Pingback: cialis prices

Pingback: Is ED a permanent thing cialis or levitra?

Pingback: Who has the greatest risk of getting parasitic diseases stromectol generic?

Pingback: Promoting Better Health - The Benefits of Regular Medication Use furosemide 40mg canada?

Pingback: Raising Healthy Children - Early Intervention and Prevention ivermectin dose for scabies?

Pingback: Medications and Holistic Healing - Nurturing Mind, Body, and Spirit order fildena?

Pingback: Medications and Sexual Health - Enhancing Intimacy, Fostering Connection Cenforce us?

Pingback: Medications and COPD - Improving Lung Function ivermectin cream?

Pingback: Medications - Unraveling the Complexity of Autoimmune Diseases ivermectin liquid for horses?

Pingback: Medications and Age-Related Macular Degeneration - Preserving Vision what is ventolin?

Pingback: Medications and Dental Health - Beyond Toothpaste and Floss priligy 30 mg x 10 pill?

Pingback: Medications and Hair Health - Nurturing Strong and Vibrant Locks Cenforce over the counter benefits?

Pingback: Taking Control of Your Health - The Power of Medication Management ventolin and body cramps?

Pingback: Medications and Digestive Health in Children - Ensuring Wellness from Within Zithromax antibiotic?

Pingback: stromectol 6mg pills?

Pingback: Medications and Irritable Bowel Syndrome - Finding Relief from Digestive Distress lasix 40mg uk?

Pingback: Medications and Women's Health - Empowering Choices for Well-being ventolin hfa 90 mcg inhaler?

Pingback: The Power of Prescription Drugs in Preventive Care is levitra generic?

Pingback: Medications and Stress Management - Finding Calm in a Busy World budesonid magensaftresistentes granulat?

Pingback: Natural Medications for Holistic Wellness and Vitality pills that look like viagra?

Pingback: Health Disparities - Bridging the Gap in Access lasix buy online?

Pingback: Medications and Digestive Health - Finding the Right Balance priligy buy online forum?

Pingback: Medications and Child Wellness - Nurturing Healthy Growth and Development buy synthroid online?

Pingback: Qu'est-ce qui rend une famille heureuse acheter sildenafil?

Pingback: How do I know what stage I am with COPD albuterol?

Pingback: What happens if you walk everyday for a month Cenforce online buy?

Pingback: Are antibiotics taken on an empty stomach metronidazole flagyl 250 mg tablet?

Pingback: Will my ex miss me if I don't contact him how do i get viagra pills?

Pingback: Can I receive automatic refills for my online prescription medications priligy 60 mg?

Pingback: What age do men start getting health problems buy sildenafil 50mg without prescription

Pingback: Is it normal to come 3 minutes vidalista 60

Pingback: Where can I buy over-the-counter sleep aids priligy 30 mg precio en mexico

Pingback: kamagra24

Pingback: lady-era viagra for women

Pingback: How long is male refractory by age??

Pingback: How men can last longer in bed naturally??

Pingback: How many minutes can a man release sperm??

Pingback: where can you buy dapoxetine in store - How can you make a man want you?

Pingback: dapoxetine buy - How do you make a man want you more?

Pingback: buy flagyl pills

Pingback: levitra tablets

Pingback: priligy where to buy new york

Pingback: vidalista 60 mg for sale

Pingback: clomiphene Citrate 100 mg uses

Pingback: ivermectin where to buy

Pingback: cialis low prices cheap

Pingback: kamagra jelly

Pingback: testogel

Pingback: trt cream

Pingback: levitra buy

Pingback: online prescription free zoloft

Pingback: proair hfa inhaler

Pingback: androgel prostate cancer

Pingback: amoxil 250 mg capsule

Pingback: androgel prescription

Pingback: amoxil 500mg capsule

Pingback: androgel testosterone gel

Pingback: lasik over the counter

Pingback: fildena buy online

Pingback: revatio cost

Pingback: revatio drug

Pingback: albuterol digihaler

Pingback: flagyl for vaginal infection

Pingback: testosterone gel

Pingback: Is liver damage from antibiotics reversible hydroxychloroquine 200 mg?

Pingback: black viagra pill

Pingback: acheter priligy 30 mg

Pingback: priligy 30 mg recensioni

Pingback: Anonymous

Pingback: priligy 30 mg fiyat

Pingback: vidalista tadalafil

Pingback: 20 mg tadalafil 60 mg priligy

Pingback: ventolin hfa inhailers cost

Pingback: how to reduce side effects of Sildenafil

Pingback: viagra 100 mg dose

Pingback: prednisone pills

Pingback: atorvastatin 80mg tablets

Pingback: advairhfa

Pingback: cenforce D

Pingback: cenforce 200 mg price

Pingback: cenforce 500mg

Pingback: cenforce 100mg price in india

Pingback: Sildenafil pronunciation

Pingback: ivermectin horse

Pingback: cheap Cenforce 100mg

Pingback: buy Cenforce 50mg for sale

Pingback: vidalista 40 dosage

Pingback: does Sildenafil 20 mg work

Pingback: silagra tablet

Pingback: buy Cenforce 50mg generic

Pingback: Sildenafil 100mg Tab

Pingback: kamagra jelly for sale

Pingback: darunavir and ritonavir

Pingback: cenforce d 100

Pingback: order Cenforce 100mg without prescription

Pingback: tadalafil 2.5 mg cost

Pingback: kamagra chewable 100

Pingback: furosemide 250 mg tablet

Pingback: Sildenafil versus tadalafil

Pingback: order Cenforce pill

Pingback: buspirone generic for xanax

Pingback: is vidalista safe

Pingback: cenforce 200 mg buy online

Pingback: vidalista 20 mg price

Pingback: sildenafil buy online

Pingback: olanzapine for nausea

Pingback: fildena 50mg drug

Pingback: albuterol 90mcg inhaler

Pingback: vermact 12 mg

Pingback: albuterol hfa inhaler

Pingback: ivermectin 12mg

Pingback: iverhope

Pingback: covimectin 12 side effects

Pingback: iverheal 12mg tab

Pingback: ivecop 6 uses

Pingback: iverscab

Pingback: ivermectol 6 mg

Pingback: ivermectin 12

Pingback: vidalista how to take

Pingback: canada levitra

Pingback: tadalista reddit

Pingback: sildenafil 50mg usa

Pingback: order sildenafil pills

Pingback: buy fildena india

Pingback: vidalista 40 dziaЕ‚anie

Pingback: vidalista kopen

Pingback: Cheap clomid without prescription

Pingback: vidalista tadalafil 10mg

Pingback: clomid alternative over the counter

Pingback: androgel testosterone

Pingback: cenforce 200 tablets

Pingback: tadalista 10mg

Pingback: poxet dapoxetine

Pingback: buy dapoxetine no prescription

Pingback: p force extra super

Pingback: Generic clomid no prescription

Pingback: vidalista 5mg

Pingback: buy kamagra oral jelly

Pingback: generic priligy india pharmacy

Pingback: Cenforce without prescription

Pingback: sildenafil medication

Pingback: rybelsus and weight loss

Pingback: rybelsus before surgery

Pingback: prednisone tablet

Pingback: ivecop

Pingback: dapoxetine web md

Pingback: fildena 100 mg price in india

Pingback: ozempic motilium

Pingback: motilium for nausea

Pingback: vardenafil 20mg price

Pingback: citalopram side effects

Pingback: citalopram hbr 20 mg

Pingback: malegra green

Pingback: buy celexa online

Pingback: cenforce 200mg

Pingback: cenforce d tablets

Pingback: vermact 12 dosage

Pingback: iverjohn

Pingback: ivecare

Pingback: stromectol 3 mg tablet price

Pingback: covimectin

Pingback: iverheal 12 tablet uses

Pingback: ivercon

Pingback: buy cenforce 100 from india

Pingback: moxatag tablet

Pingback: how to make levitra more effective

Pingback: buy amoxicilina 500 mg online

Pingback: buy dapoxetine priligy

Pingback: dapoxetine vs celexa

Pingback: vidalista-20 vs viagra

Pingback: sildigra 250mg mega

Pingback: suhagra

Pingback: cost sildenafil 50mg

Pingback: clomid Generics

Pingback: fertomid 50 mg for male

Pingback: pregnancy fertomid 50 mg

Pingback: clomid dosage for male

Pingback: clomiphene 50mg price

Pingback: Cenforce 50

Pingback: vidalista bijsluiter

Pingback: tabletki cenforce 100

Pingback: buy cenforce 200 online

Pingback: fildena 100 usa

Pingback: vidalista 20

Pingback: cenforce 200 tablets

Pingback: vidalista 60

Pingback: vidalista 5mg

Pingback: order Cenforce 100mg for sale

Pingback: vidalista 80mg

Pingback: fildena 100 fruit chew

Pingback: fildena uk

Pingback: fildena double 200 mg

Pingback: fildena super active

Pingback: nubeta 5 tablet

Pingback: strattera cost

Pingback: effects of too much ventolin inhaler

Pingback: Sildenafil Price

Pingback: order generic Cenforce

Pingback: vidalista tadalafil reviews

Pingback: tadalista super active 20mg

Pingback: femara fertility treatment

Pingback: filumena review

Pingback: vidalista 40 side effects

Pingback: what is priligy used for

Pingback: Cenforcec

Pingback: vidalista 20mg online

Pingback: cenforce d recenze

Pingback: asthalin inhaler side effects in hindi

Pingback: ciprodex ear drops

Pingback: proair inhaler for bronchitis

Pingback: albuterol inhaler price

Pingback: dapoxetine 60 mg india

Pingback: cialis 10mg price

Pingback: amoxil capsule 500mg

Pingback: amoxicillin 850

Pingback: lipitor 80 side effects

Pingback: cenforce 100

Pingback: gout medication probenecid

Pingback: isotroin 30 tablet

Pingback: darunavir cobi

Pingback: buy extra super p force

Pingback: clomid 50 mg for men

Pingback: stromectolhome.com

Pingback: vardenafilotc.com

Pingback: clomidzsu.com

Pingback: cenforce 100 reviews

Pingback: timolol dosage for glaucoma

Pingback: fildena tablet price

Pingback: buy cialis

Pingback: viagra coupons

Pingback: can you buy viagra at walgreens

Pingback: buy levitra

Pingback: what do viagra pills do

Pingback: ventolinha.wordpress.com

Pingback: fildenforyou.wordpress.com

Pingback: clomid Generic

Pingback: cialis professional avis

Pingback: ofevinfo.wordpress.com

Pingback: parasithelp.wordpress.com

Pingback: cialis black 800mg for sale

Pingback: difference between levitra and cialis

Pingback: sildenafil+dapoxetine brand in india

Pingback: cenforce 200 vs cobra 120

Pingback: vigrakrs.com

Pingback: ventolin tablets uk

Pingback: prednisone vs dexamethasone

Pingback: Forget the gym-I got all the cardio I need from 50 mg viagra don't work.

Pingback: extra super p-force 100mg+100mg

Pingback: fildena.homes

Pingback: tadarise 20 oral jelly

Pingback: tadalafil and avanafil together

Pingback: stromectol cream

Pingback: kamagra gold

Pingback: buy amoxicillin for chickens

Pingback: tab isotroin 20 mg side effects

Pingback: buy dapoxetine 60mg

Pingback: Cenforce 100 vs viagra

Pingback: pinamox 250

Pingback: isotroin capsules

Pingback: zoloft

Pingback: kamagra jelly

Pingback: buy tadapox online

Pingback: tadalista super

Pingback: cenforceindia.com/cenforce-200.html

Pingback: pharmduck.com

Pingback: cenforce 150 side effects

Pingback: priligy 30 mg fiyat

Pingback: fempro 2.5 side effects

Pingback: Vidalista vs kamagra

Pingback: cialis black reddit

Pingback: beclate 200 hfa inhaler

Pingback: cialis daily vs as needed reddit

Pingback: penegra in pakistan

Pingback: para que sirve priligy 30 mg

Pingback: caverta 100 price

Pingback: cenforce 200 kopen

Pingback: does timolol need to be refrigerated

Pingback: Vidalista 20 from india

Pingback: iwermectin.cominfo/can-i-get-ivermectin-for-humans-over-the-counter.html

Pingback: ra.co/events/2099474

Pingback: xydroplaq.com

Pingback: iwermectin.com

Pingback: albyterol.com

Pingback: priligype.com

Pingback: vidalista1.website3.me

Pingback: cenforceindia.com

Pingback: community.jumpcloud.com/t5/user/viewprofilepage/user-id/1440

Pingback: community.exprogram.com/t5/user/viewprofilepage/user-id/114694

Pingback: sketchfab.com/extra-super-p-force

Pingback: community.nxp.com/t5/user/viewprofilepage/user-id/230972

Pingback: canada pharmacies/account

Pingback: vilitra 10mg

Pingback: buy cialis online

Pingback: buy generic flagyl

Pingback: cenforce 200mg price in india

Pingback: rx plus pharmacy glendale ny

Pingback: plaquenil for rheumatoid arthritis

Pingback: online Zithromax

Pingback: Vidalista gevaarlijk

Pingback: Ventolin hfa

Pingback: buy online priligy

Pingback: buy p force

Pingback: buy lipitor

Pingback: fluoxetine uk

Pingback: vermact 12 price

Pingback: asthalin

Pingback: tadalafil 10mg