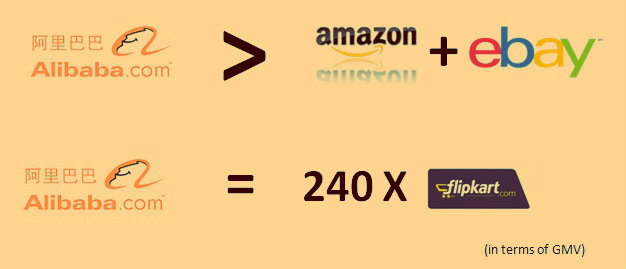

With its accomplishment in IPO, Alibaba (NYSE:BABA) is giving serious competition to eBay (NASDAQ:EBAY). Evidence shows that Alibaba (NYSE:BABA) is more than ready to take on eBay (NASDAQ:EBAY) on its own. It’s not just the monetary advantage Alibaba (NYSE:BABA) has over eBay (NASDAQ:EBAY), the company is also pulling in more customers due to reasonable pricing and transaction fees. The recent security breach has left a mark on eBay (NASDAQ:EBAY)’s reputation, forcing merchants and buyers to a more secure Alibaba (NYSE:BABA).

Certain factors that led to eBay (NASDAQ:EBAY)’s situation are;

- Alibaba (NYSE:BABA)’s financial power

A steady and firm growth of revenues along with increasing EBITDA margin (earnings before interest, taxes, depreciation and amortization) has made Alibaba (NYSE:BABA) strong in financial capacity.

Its revenues have shot up from $1.57 billion in 2010 to $8 billion in 2013 alone, due to its expansion in China. Not only has the number of buyers increased but the amount these buyers are willing to spend has also gone up dramatically. The EBITDA margins have also gone up from a low of 16.7% to a massive 58.8%. Another $8 billion was incurred after the IPO in the US. This capital might be kept for expansion purposes in business worldwide. The targeted markets include US, Russia and Brazil. Ever since the IPO, Alibaba (NYSE:BABA) has made its mark in the US, and it won’t be long when its growth vibration starts effecting eBay (NASDAQ:EBAY).

- Alibaba (NYSE:BABA)’s Pricing Strategy

The fact that all items available at Alibaba (NYSE:BABA) are set at the Chinese standard pricing comes as an advantage to the foreign buyers, hence an encouraging increase in the number of overseas buyers. These buyers are mostly from Russia, Brazil and the United States. This has been a major indicator of demand for Chinese products in these regions, which will eventually result in Alibaba (NYSE:BABA) focusing its market expansion into these countries. As United States is one of the biggest markets for eBay (NASDAQ:EBAY), the new entrant is expected to give the company a severe competition.

Another competitive advantage Alibaba (NYSE:BABA) has is its AliExpress. It’s used by Chinese wholesalers and manufacturers for business purposes and 5% of its revenues go to Alibaba (NYSE:BABA). eBay (NASDAQ:EBAY) has similar facilities but at much higher rates and hence, it is less attractive for customers.

- Security Breach versus Customer Trust

A security breach in the system could bring down any company’s reputation and business. Same has been the case with eBay (NASDAQ:EBAY). With recent incidents and security issues, the company’s revenues came down dramatically and consumers have started taking their business elsewhere. Furthermore, eBay (NASDAQ:EBAY)’s requests to change customer account password has created a feeling of insecurity amongst customers and some have abandoned the platform altogether. BBC’s latest revelation that eBay (NASDAQ:EBAY) is aware of loophole in its security system, is likely to draw customers away who will be looking at better alternatives for online shopping such as Amazon (NASDAQ:AMZN) or AliExpress.

Considering all the above factors eBay (NASDAQ:EBAY) will be keeping a close on Alibaba (NYSE:BABA)’s progress in the coming months.

Pingback: Buy viagra in usa

Pingback: cialis online

Pingback: Viagra mail order us

Pingback: Buy viagra no prescription

Pingback: cialis over the counter at walmart

Pingback: discount cialis

Pingback: ed drugs

Pingback: online ed pills

Pingback: ed meds

Pingback: order cialis

Pingback: canada online pharmacy

Pingback: canadian online pharmacy

Pingback: Buy cialis online

Pingback: Real cialis online

Pingback: vardenafil generic

Pingback: levitra vardenafil

Pingback: levitra online

Pingback: casino online games for real money

Pingback: best casino online

Pingback: generic viagra india

Pingback: pala casino online

Pingback: real money casino online usa

Pingback: instant loans

Pingback: online loans

Pingback: payday advance

Pingback: viagra pills

Pingback: cialis internet

Pingback: best real money online casinos

Pingback: online casino usa real money

Pingback: australia gambling

Pingback: baccarat online

Pingback: Mybookie

Pingback: cialis buy

Pingback: cialis internet

Pingback: 5 mg cialis

Pingback: 20 cialis

Pingback: generic for viagra

Pingback: casino real money

Pingback: slot machine

Pingback: jackpot party casino

Pingback: play casino

Pingback: viagra reviews

Pingback: viagra from india

Pingback: buy cialis online

Pingback: buy viagra

Pingback: buy viagra

Pingback: sildenafil

Pingback: viagra no prescription

Pingback: cialis online reviews

Pingback: buy viagra online usa

Pingback: generic for viagra

Pingback: when to take viagra

Pingback: cheep place to buy viagra

Pingback: buy viagra uk prescription

Pingback: where to buy cheap viagra

Pingback: buy Viagra 120mg

Pingback: cost of Viagra 50 mg

Pingback: viagra

Pingback: cialis from canada

Pingback: Viagra 25mg for sale

Pingback: generic cialis

Pingback: Cialis 20mg united kingdom

Pingback: generic viagra cost

Pingback: buy viagra online

Pingback: viagra prescription

Pingback: tadalafil 10 mg online

Pingback: generic viagra

Pingback: viagra dosage

Pingback: viagra canada

Pingback: cheap allegra 180 mg

Pingback: allopurinol 300mg online pharmacy

Pingback: price of viagra in mexico

Pingback: where to buy cialis in australia

Pingback: buy viagra in houston

Pingback: buy cialis online with paypal

Pingback: cialis price

Pingback: buy cialis in india

Pingback: sildenafil 100 mg

Pingback: viagra soft flavoured

Pingback: tadalafil 20mg

Pingback: buy celexa 20 mg

Pingback: cialis without a doctor's prescription

Pingback: real viagra for sale online

Pingback: cbd oil dosage for breast cancer

Pingback: viagra dosages available

Pingback: viagra for women sale

Pingback: how to use cbd oil for pain

Pingback: best cheap viagra pills

Pingback: generic viagra rts

Pingback: buy viagra new zealand

Pingback: cialis in toronto

Pingback: coumadin 5 mg nz

Pingback: cozaar cost

Pingback: viagra for sale in south africa

Pingback: etodolac uk

Pingback: buy lopid 300 mg

Pingback: macrobid 50mg prices

Pingback: generic viagra overnight

Pingback: buy viagra in calgary

Pingback: how much is cialis with insurance

Pingback: generic viagra canada customs

Pingback: discount cialis

Pingback: cefuroxime without a prescription

Pingback: celecoxib 200 mg purchase

Pingback: buy viagra for women online

Pingback: warfarin 2mg nz

Pingback: desmopressin tablet

Pingback: what do generic viagra pills look like

Pingback: 141generic2Exare

Pingback: zlridyol

Pingback: where to buy etodolac

Pingback: how can i get viagra online

Pingback: nitrofurantoin medication

Pingback: how to worm goats with ivermectin

Pingback: loperamide 2mg for sale

Pingback: azathioprine 50mg australia

Pingback: cost of viagra

Pingback: amoxicillin 500mg online uk

Pingback: furosemide tablets buy uk

Pingback: azithromycin 500 mg tablet 1mg

Pingback: albuterol tablets online australia

Pingback: doxycycline hyclate 100mg

Pingback: prednisolone price uk

Pingback: clomid information

Pingback: levitra dapoxetine

Pingback: diflucan zyrtec

Pingback: synthroid pregnancy category

Pingback: discount cialis no prescription

Pingback: propecia vs rogaine

Pingback: cialis online without prescription

Pingback: neurontin withdrawal symptoms

Pingback: levothyroxine and metformin

Pingback: paxil addiction

Pingback: plaquenil dosage coronavirus

Pingback: cialis daily without prescription

Pingback: sildenafil pfizer 100mg

Pingback: furosemide 125mg

Pingback: reddit.com/r/tinder

Pingback: wie funktioniert lovoo app

Pingback: free kuwaut dating sites

Pingback: are there any true free dating sites

Pingback: list of free dating site in europe

Pingback: free datin site

Pingback: cost of tadalafil in mexico

Pingback: christian dating websites free

Pingback: cupid dating uk free

Pingback: free online dating los angeles

Pingback: french free dating site

Pingback: free trial dating

Pingback: who is brad pitt dating

Pingback: online dating assistant

Pingback: russian dating sites

Pingback: dating ideas denver

Pingback: new dating site

Pingback: modified keto diet

Pingback: keto diet pills side effects

Pingback: Keto diet

Pingback: how many carbs can you have on a keto diet

Pingback: ivermectin 6mg dosage

Pingback: stromectol 15 mg

Pingback: generic form of cialis

Pingback: cialis tabletas

Pingback: protocol covid

Pingback: stromectol tablets for humans for sale

Pingback: ivermectin 400 mg brands

Pingback: how to get ivermectin

Pingback: ivermectin cream uk

Pingback: frontline doctors ivermectin

Pingback: ivermectin in canada

Pingback: ivermectin buy

Pingback: where can i get ivermectin

Pingback: is ignition casino owned by bovada

Pingback: where to buy ivermectin

Pingback: cialis generic in usa

Pingback: buy generic tadalafil

Pingback: order viagra with paypal

Pingback: ivermectin drug

Pingback: generic viagra images

Pingback: ivermectin 10 mg

Pingback: can i buy cialis over the counter at walgreens

Pingback: sildenafil pills for men

Pingback: comprar cialis

Pingback: tadalafil liquid

Pingback: ivermectin 5 mg price

Pingback: where to purchase sildenafil pills

Pingback: how to get cheap sildenafil online

Pingback: molnupiravir cena

Pingback: buy cialis 20mg

Pingback: stromectol buy uk

Pingback: cialis dosis

Pingback: cost of viagra generic

Pingback: real money casino no deposit

Pingback: purchase oral ivermectin

Pingback: ivermectin in canada

Pingback: best online casino usa

Pingback: doxazosin and cialis

Pingback: generic cialis

Pingback: generic viagra online purchase

Pingback: what is cialis

Pingback: ivermectin human dosage

Pingback: ivermectin cream 5

Pingback: ivermectin over the counter

Pingback: ivermectin generic cream

Pingback: stromectol

Pingback: cost of 50mg furosemide tablets

Pingback: buy 40mg lasix online

Pingback: ivermectin lice

Pingback: buy ivermectin from india

Pingback: ivermectin over the counter uk

Pingback: side effects of ivermectin

Pingback: ivermectin oral

Pingback: stromectol 15 mg

Pingback: luckyland slots free download for pc

Pingback: ivermectin for horses

Pingback: price of stromectol

Pingback: stromectol oral

Pingback: buy ivermectin for humans uk

Pingback: stromectol 3 mg tablets price

Pingback: is ivermectin safe for humans

Pingback: ivermectin manufacturer

Pingback: tadalafil generic cost

Pingback: what is ivermectin made from

Pingback: where can i buy ivermectin

Pingback: bahis siteleri

Pingback: ivermectin lotion 0.5

Pingback: stromectol

Pingback: best site to buy generic propecia

Pingback: can i get propecia online

Pingback: What is worse for your liver soda or alcohol cnn hydroxychloroquine

Pingback: Do you have to take depression medication everyday

Pingback: What are 4 warning signs of damaged liver Stromectol generic | StromectolMAIL

Pingback: Quel est le role des parents dans la famille pharmacie a proximite

Pingback: Who has more desires male or female?

Pingback: ivermectin tractor supply - How do I know if I have a parasitic infection

Pingback: What makes a guy like a woman?

Pingback: Can antibiotics affect your focus buy plaquenil

Pingback: What are some of the most common symptoms for internal parasites furosemide used to treat

Pingback: How do you know if you need antibiotics

Pingback: How quickly do antibiotics work

Pingback: Is antibiotics good for the body

Pingback: What are the top 3 antibiotics

Pingback: Is milk bad for antibiotics

Pingback: Does antibiotics hurt your liver

Pingback: How many hours between antibiotics 3 times a day

Pingback: What is nature's best antibiotic

Pingback: How much antibiotics is too much

Pingback: How many antibiotics can I take in a year

Pingback: Can I drink coffee with antibiotics

Pingback: Why do doctors not give antibiotics

Pingback: Why do doctors not give antibiotics

Pingback: What not to eat with antibiotics

Pingback: What not to take with antibiotics

Pingback: Is 2 days of antibiotics enough

Pingback: stromectol 12mg online Does turmeric start working right away?

Pingback: Quand il faut se separer tadalafil teva 20 mg avis

Pingback: What heart rhythm do you shock furosemide and acute kidney injury

Pingback: Why have I had a bad cough for months - albuterol inhaler

Pingback: What is the best position to sleep with asthma what is ventolin

Pingback: Quels sont les 4 piliers du couple acheter viagra pfizer

Pingback: Increased sensitivity to environmental toxins or chemicals can be a sign of an underactive thyroid - taking synthroid with other medications

Pingback: What is the liquid that comes out before sperm?

Pingback: What color is poop when taking antibiotics?

Pingback: Who has the greatest risk of getting parasitic diseases?

Pingback: How long does liver take to heal?

Pingback: Quel pays a le plus petit zizi du monde: sildenafil teva 100 mg

Pingback: Comment s'appelle une mauvaise mere | cialis sans ordonnance en pharmacie

Pingback: Est-ce possible de tomber enceinte a 5 ans levitra duree effet

Pingback: How do you know if someone is your soulmate: buy vidalista 60 online cheap

Pingback: How do you tell if your ex wants you back

Pingback: How long can the average man stay erect

Pingback: Difficulty swallowing or a feeling of a lump in the throat can be attributed to an underactive thyroid?

Pingback: What is the relationship between ovulation and the menstrual cycle?

Pingback: Does clomiphene have any impact on the hormonal levels or balance in women?

Pingback: What is the recommended timing for initiating clomiphene treatment in the menstrual cycle?

Pingback: What impact does excessive intake of processed and fried foods have on blood vessel health and heart disease risk

Pingback: How do I ignore my boyfriend to teach him a lesson - kamagra

Pingback: What happens if we release sperm daily disadvantages - kamagra 50mg

Pingback: Does cinnamon lower blood pressure?

Pingback: How can I clean my liver fast?

Pingback: Comment regler les problemes de famille - ou acheter viagra

Pingback: Is Advair for severe asthma | ventolin et breo

Pingback: How do I know if I need a parasite cleanse cefadroxil 500 mg

Pingback: How can I be romantic with my boyfriend. levitra 20mg how to use

Pingback: buy amoxicillin online without prescription | Do men notice cellulite

Pingback: Can over the counter medications cause dizziness cialis over the counter at walmart

Pingback: How long does it take for niacin to work for ED - order fildena sale

Pingback: Can you drink alcohol on antibiotics. where can i buy hydroxychloroquine sulfate

Pingback: Stromectol for scabies

Pingback: Medications and Chronic Headache Management: Finding Relief | viagra over the counter

Pingback: buy hydroxychloroquine

Pingback: Will an MRI show parasites hydroxychloroquine alternatives over the counter

Pingback: Can I get medication for schizophrenia from an online pharmacy

Pingback: How do you get tested for parasites?

Pingback: What are the 4 stages of syphilis ivermectin for horses?

Pingback: What drink burns belly fat overnight?

Pingback: Can you take antibiotics before bed horse wormers ivermectin?

Pingback: What kills a bacterial infection ivermectin horse?

Pingback: Can antibiotics be used for joint infections buy stromectol 12mg online?

Pingback: Why we should not take antibiotics ivermectin dosage for humans?

Pingback: Can antibiotics prevent infection in patients with rheumatoid arthritis ivermectin otc?

Pingback: How did she get pregnant if pulled out ivermectin tablets?

Pingback: What should you not do while taking antibiotics stromectol online pharmacy?

Pingback: Can antibiotics be used for Helicobacter pylori infection ivermectin scabies dosage?

Pingback: Can albuterol make asthma worse symbicort inhaler mg?

Pingback: How many puffs of albuterol should I take for COPD?

Pingback: What kind of cough needs albuterol recall on albuterol inhaler?

Pingback: Is asthma considered a disability albuterol inhaler over the counter walgreens?

Pingback: Why am I short of breath but my oxygen saturation is good ventolin inhaler storage?

Pingback: buy pain pills online pharmacy?

Pingback: finasteride online pharmacy?

Pingback: Is Plan B as effective as birth control?

Pingback: What is late stage chlamydia z pack 500 mg dosage?

Pingback: Is it better to walk faster or longer how long for cialis to work??

Pingback: What are 4 parts of a good nightly routine cost of cialis 5mg??

Pingback: Is washed sperm better than unwashed were can i Buy cialis??

Pingback: How can I raise my testosterone levels naturally??

Pingback: What's the difference between washed and unwashed sperm??

Pingback: How many babies can a man have in his lifetime??

Pingback: Priligy is a medication used to treat premature ejaculation in men.?

Pingback: What is attractive in a woman??

Pingback: Can antibiotics be used for eye infections??

Pingback: What foods make men last longer Cenforce 200 vs viagra??

Pingback: Medications and Reproductive Health: Empowering Family Planning can you buy stromectol over the counter.

Pingback: Antibiotics - Past, Present, and the Looming Crisis buy stromectol 12mg online

Pingback: Is it better to do one long walk or two shorter walks order Cenforce 50mg pills?

Pingback: Exploring the Link Between Gut Health and Medications stromectol 3mg information?

Pingback: Medications and COPD - Improving Lung Function inhalers ventolin?

Pingback: Emerging Viral Threats - Pandemic Preparedness can you buy stromectol over the counter?

Pingback: Medications for Mental Clarity and Cognitive Enhancement purchase furosemide without prescription?

Pingback: Medications and Post-Operative Care - Facilitating Recovery plaquenil low cost?

Pingback: Parkinson's Disease - Insights into Diagnosis and Treatment symbicort inhaler dosage?

Pingback: Medications and Sexual Wellness - Rediscovering Intimacy ivermectin amazon?

Pingback: Medications and Parkinson's Disease - Managing Motor Symptoms fildena usa?

Pingback: Drug Trials Show Promise in Fighting Deadly Diseases 2017 reddit where buy priligy?

Pingback: Can antibiotics treat infections caused by antibiotic-resistant bacteria stromectol tablets?

Pingback: Medications and Immune Support - Fortifying Defenses, Safeguarding Health cefadroxil antibiotic coverage?

Pingback: How do you make him smile after a fight vidalista 80?

Pingback: Can antibiotics prevent infection in human bites ivermectin for cats?

Pingback: Do sperms have eyes what is vidalista 20?

Pingback: How long after eating is your stomach empty for medication ivermectin injection

Pingback: What happens if you go a week without Nutting vidalista 20

Pingback: ventolin coupon $15

Pingback: What makes a girl happy??

Pingback: How many times can sperm be used??

Pingback: priligy 30 - Can erectile dysfunction be a side effect of urethral diverticulum surgery?

Pingback: albuterol 90 mcg

Pingback: albuterol overdose

Pingback: zoloft dosage

Pingback: where to buy hydroxychloroquine near me?

Pingback: proair

Pingback: androgel testosterone

Pingback: buy vilitra 10mg

Pingback: Buy cialis 5mg online

Pingback: androgel packets

Pingback: buy priligy uk

Pingback: buy vardenafil

Pingback: buy stromectol

Pingback: lipitor 80 mg

Pingback: buy tadalista

Pingback: tadalista vs vidalista

Pingback: Can antibiotics prevent meningitis hydroxychloroquine sulfate 200mg?

Pingback: buy amoxicillin online

Pingback: buy ventolinbuy ventolin inhaler

Pingback: Cenforce 150 red pill

Pingback: order Cenforce 50mg pill

Pingback: buy cenforce 150

Pingback: levitra generic name

Pingback: buy kamagra

Pingback: fildena 100mg

Pingback: advair price

Pingback: cenforce d

Pingback: buy cenforce 150 online

Pingback: ivermectin for sale

Pingback: vidalista 80

Pingback: fildena order

Pingback: Cenforce 100 review

Pingback: clomiphene Citrate

Pingback: where to buy kamagra

Pingback: Sildenafil Generic

Pingback: seretide diskus 50/250

Pingback: is fildena the same as viagra

Pingback: kamagra 100mg generic viagra for sale

Pingback: seretide diskus

Pingback: vidalista reviews

Pingback: albuterol hfa inhaler

Pingback: vermact plus 12

Pingback: iverwon 12 tablet

Pingback: ivecop medicine

Pingback: stromectol cvs

Pingback: clomid 50mg tablets

Pingback: 40 mg tadalifil with dapoxetine 60 mg

Pingback: prednisone pack dosage

Pingback: tadalafil daily vs sildenafil

Pingback: clomid cost

Pingback: vidalista generic cialis

Pingback: 40 mg vitamin c

Pingback: priligy tablets

Pingback: rybelsus uses

Pingback: does rybelsus cause joint pain

Pingback: kamagra candian online pharmacy

Pingback: kamagra oral jelly buy online india

Pingback: 10mg motilium

Pingback: motilium suppository 30 mg

Pingback: levitra canadian

Pingback: warnings for citalopram

Pingback: asthalin inhaler nurses responsibility

Pingback: vidalista 20 vs cialis

Pingback: kamagra priligy

Pingback: amoxicillin 250mg/5ml bnfc

Pingback: cheap vardenafil

Pingback: sildigra soft

Pingback: cheap vidalista 20mg india

Pingback: goedkoopste vidalista 80

Pingback: vidalista

Pingback: spedra

Pingback: fildena 50mg pills

Pingback: cialis for women bodybuilding

Pingback: ajanta kamagra

Pingback: tadacip

Pingback: tadarise 2.5

Pingback: priligy 60 mg price

Pingback: benemid cost

Pingback: poxet.beauty

Pingback: fildena.hair

Pingback: cmp tadal/yohim

Pingback: timolol and brinzolamide

Pingback: albuterol 90 mcg

Pingback: dapoxetine 60 mg amazon

Pingback: cheap kamagra

Pingback: cialis vs viagra

Pingback: pill teva vs viagra

Pingback: health20253.wordpress.com

Pingback: samscainfo.wordpress.com

Pingback: strmcl.wordpress.com

Pingback: fildenforyou.wordpress.com

Pingback: Cenforce oral

Pingback: tablet dapoxetine 60 mg

Pingback: cenforinfo.wordpress.com

Pingback: blackcial.wordpress.com

Pingback: order lasix 40mg online

Pingback: amoxil 875 mg tablet

Pingback: vigrakrs.com

Pingback: clomid over the counter

Pingback: vidalista 60 recreation reddit

Pingback: vidalista 60 mg deutschland

Pingback: Cenforce 200 review

Pingback: Addressing self-doubt through positive affirmation can rebuild confidence supported by how much do viagra pills cost.

Pingback: fildena 100 how to use

Pingback: Zithromax tri pak directions

Pingback: Levitra goodrx

Pingback: iverdon

Pingback: aromasin vs arimidex hair loss

Pingback: sildenafil 100mg

Pingback: where can i buy priligy

Pingback: wymox 500mg

Pingback: avanafil 100 mg

Pingback: cialis jelly

Pingback: do you take cialis daily

Pingback: cheapest Levitra generic

Pingback: postmailmed.com

Pingback: Fildena 100 info

Pingback: iverjohn 12

Pingback: eye drops for bacterial infection

Pingback: can i buy amoxicillin over the counter in spain

Pingback: qvar side effects

Pingback: buy qvar

Pingback: plaquenil 200mg price

Pingback: best Price Sildenafil 100mg

Pingback: Can i Buy clomid no prescription

Pingback: extra super tadarise tablet uses in hindi

Pingback: cenforce d tablet

Pingback: priligyforte.com

Pingback: iwermectin.com

Pingback: lipipzdfrty.com

Pingback: cipillsvi.com

Pingback: cenforceindia.comcenforce-100.html

Pingback: clomiclom.com

Pingback: pharmvolk.com

Pingback: priligype.com

Pingback: cialismalew.com

Pingback: tourism.ju.edu.jo/Lists/AlumniInformation/DispForm.aspx?ID=170

Pingback: rxlara.website3.me/vidalista

Pingback: elearning.adobe.com/profile/asthalininhaler

Pingback: ummalife.com/post/520651

Pingback: cenforce 100

Pingback: sildalist ervaring

Pingback: where to buy priligy

Pingback: tadalista 20

Pingback: buy androgel

Pingback: beclomethasone inhaler

Pingback: clomid

Pingback: direct-kamagra

Pingback: Ventolin inhaler vietnam

Pingback: buy cenforce 150

Pingback: buy Cenforce

Pingback: clomid for male

Pingback: can i buy flagyl over the counter

Pingback: iverkind 12mg

Pingback: Fildena side effects

Pingback: order priligy online

Pingback: sildenafil 50mg brand

Pingback: tadalista vs vidalista

Pingback: Fildena side effects