Google is running out of moves as Vringo, Inc. (NASDAQ:VRNG)’s ’420 patent is upheld by the US Patent Office on July 2nd. This is great news to investors in VRNG since this claims that VRNG’s patent is substantiated.

The ‘420 patent is being used by Vringo, Inc. (NASDAQ:VRNG) in their lawsuit against Google regarding their AdWords unit infringement. Last year, the patent office has reaffirmed Vringo ‘664 patent which help initiated the case.

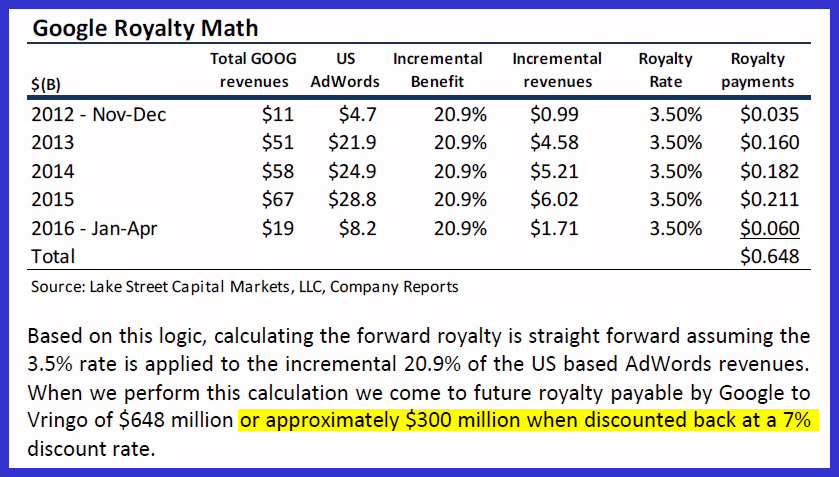

This new positive decision follows after the US Patent Office rejected prior claims by Vringo earlier in January after Vringo won against Google a 6.5% running royalty rate of Google’s 20.9% revenues. As a result shares dropped significantly back to pre-trial levels.

With this new information, the market has successfully priced in this knowledge, and the stock’s floor is now estimated to be between $3.00 and the $3.15 range. Because of this base, the stock is believed to have a lot of upside with pending catalysts such as the ZTE settlement and further positive update from the Google lawsuit trial.

Why Google Will Have Difficulty Against Vringo

US Court of Appeals will have difficulty overturning the judgment against Google with the US Patent Office re-affirming Vringo’s patent claims. Until there is final judgment by the courts, the stock will continue to play out at depressed pricing levels.

The upcoming quarter beginning from August may be the time where we see many catalysts pending. These catalysts could drive the stock price up higher. These catalysts could include:

- Court Injunction against Google (in a ZTE styled injunction in multiple countries)

- Settlement news from any of the previous patent infringers along with an announcement on funds collected (Tyco, ZTE). This settlement news could make Vringo’s case against Google more serious.

- Collection from Tyco case or announcement of ZTE settlement could drive the stock price up higher.

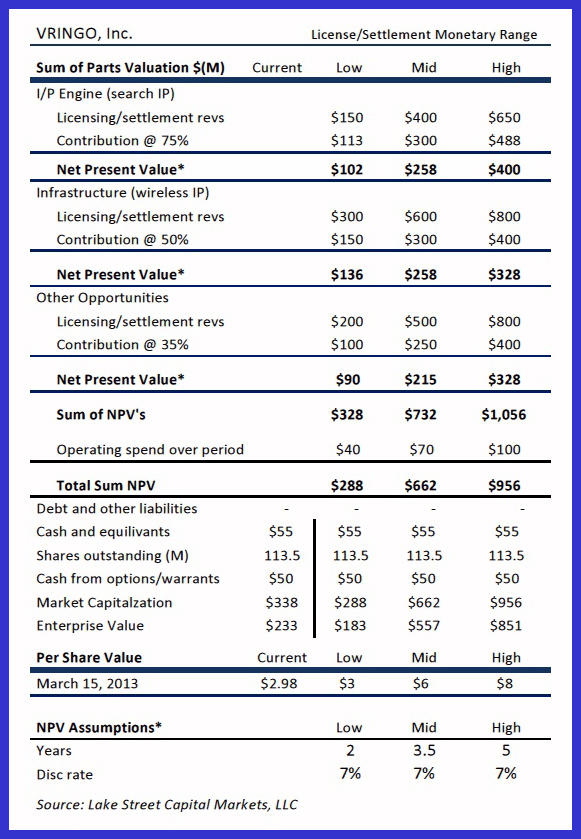

Two analysts which favor the stock include: Maxim Group and Dawson James. Both have targeted a $5+ range for the stock with buy ratings. The current stock price is $3.44. The average consensus price target is $6.13 with a 76% potential upside from its current price. This estimate is made with the most conservative approach and multiplier for the company. With the Google win, this stock could soar through the roof, especially with the consideration that their entire patent portfolio becomes more valuable. Below is a chart explaining how Vringo is valuated.

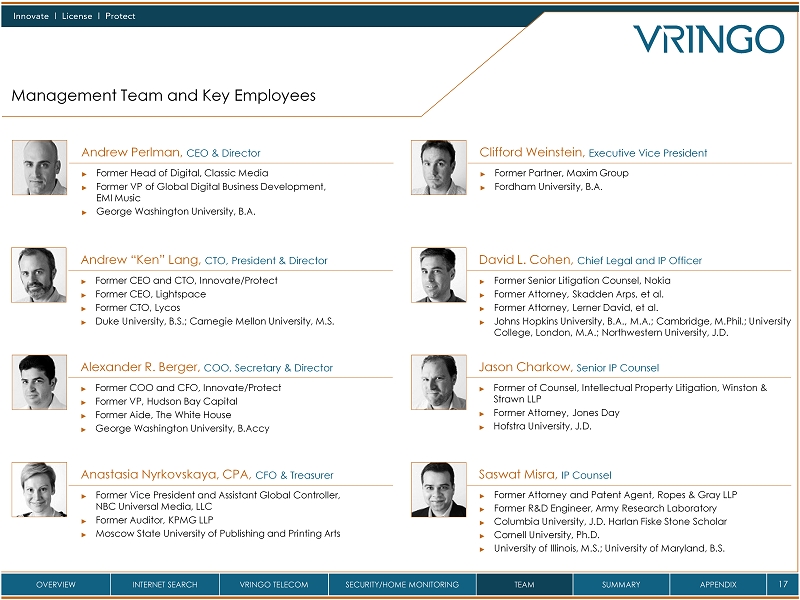

Management

Management is made up of the most skilled lawyers, and has been criticized for taking an immediate pay day instead of waiting for the stock price to appreciate and ride out. CEO Andrew Perlman, and Alexander Berger, COO both sold 250,000 shares back in January, resulting in approximately $1 million gains. One reason may be they sold these shares in order to pay for taxes, which is usually the case when insider holds substantial shares and is a common practice.

Investors who are patient with this company can see substantial gain, and Vringo, Inc. (NASDAQ:VRNG) may be one of the most highly lucrative opportunities for 2014, far greater than solar companies and the usual tech stars.

Pingback: GoPro Inc (NASDAQ: GPRO) Will Not Be The Next Tech Giant | Stocks.org

Pingback: Happy Rose Day 2016 Wallpapers

Pingback: หมอกระดูก

Pingback: ที่พัก โพธาราม

Pingback: browning handguns

Pingback: Cornhole bags near me

Pingback: visit their website

Pingback: researchers

Pingback: luk666

Pingback: SkyWind ค่ายเกมสล็อตมาแรง

Pingback: บ้านพักพูลวิลล่า ปราณบุรี

Pingback: ufa191

Pingback: ปั่นสล็อตฟรีทุกค่าย

Pingback: coupons

Pingback: กระเบื้องทางเท้า

Pingback: thailand tattoo

Pingback: ทางเข้าpg

Pingback: ทดลองเล่นสล็อตทุกค่าย ฟรี

Pingback: cat888

Pingback: เว็บปั้มไลค์

Pingback: YOURURL.com

Pingback: ปั้มติดตาม

Pingback: รีวิวเกมสล็อตที่แจ็คพอตแตกง่าย

Pingback: slot99

Pingback: King Chance

Pingback: scammers

Pingback: แทงบอล ufa11k

Pingback: ร้านตัดแว่นสายตา ใกล้ฉัน

Pingback: small bio ethanol burner

Pingback: GoX scooters

Pingback: discover this

Pingback: find out here

Pingback: Model Spoor Club

Pingback: Aviator

Pingback: เรียนต่อประเทศจีน

Pingback: โรงพิมพ์กล่องบรรจุภัณฑ์

Pingback: event cigars Canada

Pingback: เว็บตรงฝากถอนง่าย

Pingback: 123bets