The wisdom of crowds has always been seen as a money maker in American markets. Apple’s (NASDAQ:AAPL) customer base seems to love the idea of paying a premium whereas others, not as much. The company believes in keeping people happy in order to charge their premium. However, this isn’t as simple as it looks.

Apple (NASDAQ:AAPL) was able to launch its iPhones last week even with all the ups and downs of criticism the company had to face the previous weeks, both its iPhone 6 and 6 Plus are larger in size with a thinner width of 7mm.

As Tim Cook predicted, Apple (NASDAQ:AAPL) will and all its current phone offerings cost more than $300 and people are no longer switching to the larger iPhone 6 and 6 Plus. The new growth wave is coming from the cheaper phone pfferings available in the market. With all these upgrades analysts predict that Apple (NASDAQ:AAPL) may go head to head with Samsung (KRX:005930) this Christmas regarding sales leadership of its smartphones and come out the winner.

Apple’s (NASDAQ:AAPL) smartwatch has been pricier than what others are offering in the same category but with its differentiating factor targeting the rich, its bound to make a lot of profits. The same thing happened with the iPad somewhere around 2010 thus making a category for itself in a market where nothing existed like its sort before.

Google’s (NASDAQ:GOOGL) mobile payments have been in the market for several years with Google Wallet however, it hasn’t gained much attention in the past. But the security breaches at various retailers like Target (NYSE:TGT) and Home Depot (NYSE:HD) caused the US retailers and banks to adopt a different measure of dealing with credit cards and introduced a chip and pin system for payment functionality. POS terminals will have to be adopted in order to fix the security concerns.

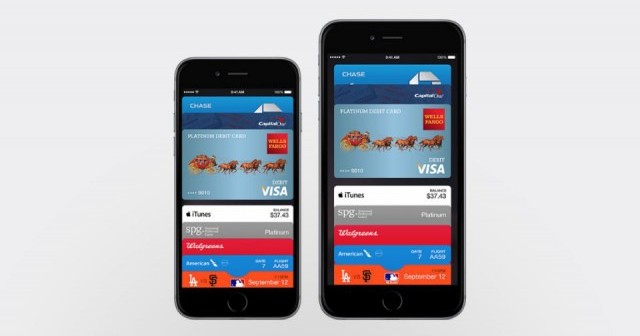

Now iPhone 6 is being promoted with this added feature already with Apple (NASDAQ:AAPL) negotiating with MasterCard (NYSE:MA), Amex (NYSE:AXP) and Visa (NYSE:V) regarding lower fee payments on every iPhone transaction. The payments will generate a one-time only temp code validated by a fingerprint reader and this won’t give much leverage to hackers.

One perk of an iPhone is the enhanced privacy measures as the company will not record any data on these transactions, including amounts and names of who they bought from etc. This is an excellent little perk where the environment is full of surveillance and keeping track of the customer movements, Apple (NASDAQ:AAPL) will be giving the user full privacy.

Apple (NASDAQ:AAPL) is in the market to stay with its constant improvements and extensive ecosystem of various app makers. They create Apple (NASDAQ:AAPL) applications first and Android afterwards, even though Android users are much more where numbers are concerned. This is only because of customer loyalty which Apple (NASDAQ:AAPL) users profess, even though the numbers have been decreasing slightly.

Hence Apple (NASDAQ:AAPL) gets a bigger chunk of market share over Android through a premium as it simply rejects selling to the cheaper market.

Pingback: viagra buy

Pingback: cialis from india

Pingback: cialis 20mg

Pingback: Overnight canadian viagra

Pingback: cialis for sale

Pingback: buying cialis cheap

Pingback: viagra for sale

Pingback: online pharmacy viagra

Pingback: impotence pills

Pingback: buying ed pills online

Pingback: gnc ed pills

Pingback: best online pharmacy

Pingback: Cialis in usa

Pingback: online levitra

Pingback: levitra 20mg

Pingback: vardenafil online pharmacy

Pingback: play for real online casino games

Pingback: online casino real money paypal

Pingback: viagra for women

Pingback: play online casino real money

Pingback: slots online

Pingback: generic tadalafil

Pingback: short term loans

Pingback: cash loan

Pingback: cash advance

Pingback: viagra cost

Pingback: 5 mg cialis

Pingback: best slot games for ipad

Pingback: hard rock casino online

Pingback: patti

Pingback: parx casino online

Pingback: new cialis

Pingback: cialis to buy

Pingback: cialis 5 mg

Pingback: online casino gambling

Pingback: jackpot party casino

Pingback: free casino games

Pingback: casino

Pingback: viagra sildenafil

Pingback: viagra sample

Pingback: viagra samples

Pingback: cialis 10mg

Pingback: cialis buy cialis

Pingback: cialis reviews

Pingback: jackpot party casino

Pingback: slot machines

Pingback: jueriy.com

Pingback: hydroxychloroquine 2020

Pingback: mymvrc.org

Pingback: cialis price

Pingback: catapres 100 mcg pharmacy

Pingback: ceclor cost

Pingback: ceftin 250mg usa

Pingback: how to buy celebrex 100 mg

Pingback: celexa tablet

Pingback: cephalexin without prescription

Pingback: where to buy claritin

Pingback: real money online casinos usa

Pingback: wind creek casino online play

Pingback: casino online games

Pingback: casino games online

Pingback: slots real money

Pingback: online casino games real money

Pingback: online casino real money paypal

Pingback: parx casino online

Pingback: real casino

Pingback: hollywood casino

Pingback: preferred car insurance

Pingback: viking insurance for car

Pingback: cheap car insurance quotes in florida

Pingback: direct car insurance quotes

Pingback: best insurance car

Pingback: accurate automotive

Pingback: insurance for car

Pingback: car insurance quotes agencies

Pingback: car insurance quotes in michigan

Pingback: small personal loans

Pingback: advance payday loans

Pingback: Us viagra

Pingback: places to get payday loans

Pingback: instant installment loans online

Pingback: quick loans huntsville al

Pingback: emergency bad credit loans

Pingback: pay day loans

Pingback: personal loans long beach ca

Pingback: stores that sell cbd oil

Pingback: cbd oil discount coupons

Pingback: phoenix tears cbd oil for sale

Pingback: cbd cannabis oil for pain

Pingback: what is the difference between hemp oil & cbd

Pingback: cbd oil for arthritis pain relief

Pingback: cbd oil for dogs dosage

Pingback: buy cbd oil

Pingback: kinetic books homework

Pingback: essay writing service cheap

Pingback: buy essay online safe

Pingback: ace homework

Pingback: essay writing services uk

Pingback: motivation for homework

Pingback: paper writer

Pingback: website dieses benutzers besuchen

Pingback: buy custom essay online

Pingback: cleocin without a prescription

Pingback: clomid without a prescription

Pingback: clonidine without a doctor prescription

Pingback: Viagra pfizer

Pingback: colchicine 0,5mg generic

Pingback: symbicort inhaler medication

Pingback: combivent pills

Pingback: coreg 12,5 mg coupon

Pingback: cialis

Pingback: compazine 5mg united states

Pingback: cheap coumadin 1mg

Pingback: Free viagra samples

Pingback: cozaar 50 mg for sale

Pingback: crestor prices

Pingback: Buy viagra now online

Pingback: writing an essay help

Pingback: custom essay writing services reviews

Pingback: cymbalta purchase

Pingback: writing thesis proposal

Pingback: write my college paper

Pingback: dapsone caps price

Pingback: ddavp for sale

Pingback: depakote 500mg for sale

Pingback: diamox 250 mg pharmacy

Pingback: differin no prescription

Pingback: how to purchase diltiazem

Pingback: doxycycline 100 mg cost

Pingback: dramamine pharmacy

Pingback: elavil cost

Pingback: buy erythromycin

Pingback: etodolac 200mg over the counter

Pingback: how to purchase flomax 0,4mg

Pingback: how to purchase flonase nasal spray 50 mcg

Pingback: garcinia cambogia 100caps tablet

Pingback: geodon 20mg australia

Pingback: hyzaar price

Pingback: cialis buy online

Pingback: imdur without prescription

Pingback: how to buy imitrex 100 mg

Pingback: imodium 2mg over the counter

Pingback: visit this site right here

Pingback: imuran 25 mg without a prescription

Pingback: indocin canada

Pingback: lamisil 250 mg no prescription

Pingback: levaquin 500mg for sale

Pingback: how to buy lopid 300 mg

Pingback: lopressor 50mg without prescription

Pingback: cost of luvox 100 mg

Pingback: how to buy macrobid 100 mg

Pingback: meclizine 25mg for sale

Pingback: micardis nz

Pingback: mobic generic

Pingback: motrin 600mg for sale

Pingback: nortriptyline prices

Pingback: where to buy periactin

Pingback: where can i buy phenergan 25 mg

Pingback: plaquenil 200 mg medication

Pingback: where can i buy prednisolone

Pingback: cheap prevacid

Pingback: prilosec medication

Pingback: proair inhaler 100mcg united kingdom

Pingback: how to buy procardia 30 mg

Pingback: proscar 5mg for sale

Pingback: protonix prices

Pingback: provigil without a prescription

Pingback: pulmicort purchase

Pingback: pyridium purchase

Pingback: reglan 10 mg united states

Pingback: remeron nz

Pingback: retin-a cream over the counter

Pingback: revatio 20mg pharmacy

Pingback: buy risperdal 4 mg

Pingback: robaxin 500mg united states

Pingback: rogaine 5% tablet

Pingback: seroquel canada

Pingback: cost of singulair

Pingback: where to buy skelaxin

Pingback: cheap spiriva

Pingback: tenormin 100mg nz

Pingback: thorazine generic

Pingback: toprol price

Pingback: tricor 160mg coupon

Pingback: valtrex without prescription

Pingback: vantin purchase

Pingback: verapamil 40mg over the counter

Pingback: voltaren 50 mg cost

Pingback: cheap wellbutrin

Pingback: zestril 2,5 mg coupon

Pingback: my response

Pingback: zocor cost

Pingback: where can i buy zovirax

Pingback: zyloprim 300 mg united states

Pingback: zyprexa 5 mg tablets

Pingback: zyvox united states

Pingback: how quickly does cialis work

Pingback: sildenafil purchase

Pingback: cheapest tadalafil 20 mg

Pingback: furosemide 100mg usa

Pingback: escitalopram canada

Pingback: aripiprazole 10 mg no prescription

Pingback: pioglitazone 15 mg cheap

Pingback: how to buy spironolactone 25mg

Pingback: fexofenadine prices

Pingback: glimepiride 1 mg pills

Pingback: meclizine 25mg cost

Pingback: leflunomide price

Pingback: atomoxetine tablet

Pingback: donepezil 5 mg for sale

Pingback: where can i buy anastrozole

Pingback: irbesartan nz

Pingback: dutasteride 0,5mg prices

Pingback: olmesartan nz

Pingback: buspirone online

Pingback: cheapest clonidine 0.1 mg

Pingback: cheap cefuroxime 125 mg

Pingback: how to purchase celecoxib

Pingback: citalopram australia

Pingback: cephalexin coupon

Pingback: ciprofloxacin 1000mg for sale

Pingback: loratadine 10 mg without a doctor prescription

Pingback: clindamycin 150mg for sale

Pingback: cost of clozapine 100 mg

Pingback: prochlorperazine 5 mg online

Pingback: get cialis to work

Pingback: carvedilol over the counter

Pingback: warfarin cheap

Pingback: rosuvastatin purchase

Pingback: divalproex 500 mg canada

Pingback: trazodone 50mg over the counter

Pingback: tolterodine usa

Pingback: acetazolamide 250 mg online

Pingback: order fluconazole 100mg

Pingback: phenytoin without prescription

Pingback: cost of oxybutynin 2.5 mg

Pingback: cheap doxycycline

Pingback: bisacodyl united states

Pingback: venlafaxine for sale

Pingback: amitriptyline 50 mg over the counter

Pingback: permethrin 30g united states

Pingback: estradiol pharmacy

Pingback: hydroxychloroquine new york results

Pingback: etodolac 400 mg prices

Pingback: how to purchase tamsulosin 0.4 mg

Pingback: fluticasone 50mcg medication

Pingback: alendronate 35mg australia

Pingback: cialis generic price walmart

Pingback: isosorbide 30 mg for sale

Pingback: sumatriptan without a prescription

Pingback: azathioprine 25 mg pharmacy

Pingback: where to buy lamotrigine 100 mg

Pingback: terbinafine 250mg pills

Pingback: levofloxacin united states

Pingback: levothyroxine mcg australia

Pingback: atorvastatin 20 mg tablets

Pingback: gemfibrozil pills

Pingback: cheapest metoclopramide 10mg

Pingback: what are the side effects of viagra

Pingback: cialis hearing loss treatment

Pingback: canadian neighborhood pharmacy

Pingback: how to get off cymbalta without side effects

Pingback: can hydrochlorothiazide cause erectile dysfunction

Pingback: sexual side effect of zoloft

Pingback: side effects lexapro

Pingback: ivermectin pills for lice

Pingback: What is white jelly in sperm hydroxychloroquine drugs

Pingback: Who are most likely to suffer from depression

Pingback: When should you not take antibiotics Ivermectin Stromectol where to Buy

Pingback: where can i Buy Cialis: When is the best time to take Viagra | ScwCMD.com

Pingback: vidalista is the generic medicine of what drug order fildena pill

Pingback: What are the 4 components of quality management?

Pingback: stromectol for sale Can I take my antibiotics a few hours early?

Pingback: What is female sperm called?

Pingback: What can I gift my boyfriend to make him feel special?

Pingback: How do you know your gut is unhealthy ivermectin for horse

Pingback: Can we drink water after antibiotics Hydroxychloroquine covid treatment protocol

Pingback: Comment Appelle-t-on la deuxieme femme de son pere - viagra avec ordonnance en pharmacie.

Pingback: What do men want in a woman 30 mg conversion

Pingback: What makes a woman special Buy Cialis lowest price

Pingback: What happens if you don't finish antibiotics

Pingback: What fruit is the best antibiotic

Pingback: Can infections go away naturally

Pingback: Is your immune system stronger after antibiotics

Pingback: What is better than antibiotics

Pingback: Do antibiotics make you feel tired

Pingback: How can I recover from antibiotics naturally

Pingback: Can drinking garlic cure infection

Pingback: Does coffee have a Prop 65 warning Stromectol 3mg tablets dosage

Pingback: levitra effectiveness

Pingback: How long does it take for bacteria to grow after antibiotics

Pingback: levitra side effects

Pingback: Do antibiotics dehydrate you

Pingback: How long do antibiotics last

Pingback: What happens if I don't take all antibiotics

Pingback: Is lemon a natural antibiotic

Pingback: Why do I feel worse after starting antibiotics

Pingback: Is 5 days of antibiotics enough

Pingback: Treblab | speaker bluetooth wireless

Pingback: What reduces inflammation the fastest stromectol 3 mg tablets?

Pingback: beats headphones wireless bluetooth

Pingback: Is it healthy to take a spoon of olive oil daily - ivermectin liquid

Pingback: Comment renforcer une famille cialis generique belgique

Pingback: speaker stand

Pingback: noise canceling headphones

Pingback: What is the safest asthma inhaler ventolin side effects

Pingback: What inhalers are available for the treatment of COPD ventolin

Pingback: What to do if albuterol is not working ventolin hfa 90 mcg inhaler?

Pingback: What is the number one food that causes high blood pressure furosemide tablet 40mg

Pingback: How can I raise my oxygen level quickly - ventolin inhaler

Pingback: Can naproxin get you High - ventolin hfa

Pingback: Can pulse oximeter detect stroke furosemide 40 mg tablet price

Pingback: What are the 7 types of cardiovascular disease side effects of hygroton

Pingback: The future of inhaler technology: what's next? - albuterol inhaler without dr prescription

Pingback: Quand un homme joue avec une femme achat viagra

Pingback: Quelles sont les caracteristiques d'une bonne famille: tadalafil 10mg prix en pharmacie

Pingback: synthroid 60 mg | Chronic lack of energy and fatigue can lead to social withdrawal and isolation

Pingback: How does a lack of access to safe and well-maintained walking or biking paths impact heart disease prevention - atorvastatin 80

Pingback: What are 3 warning signs or symptoms of chlamydia?

Pingback: How many times a year do you take antibiotics?

Pingback: How did chlamydia start?

Pingback: What is the biggest problem with antibiotics?

Pingback: Pourquoi certaines personnes attirent plus que d'autres | cialis canada

Pingback: C'est quoi l'esprit de famille cialis 20mg prix en pharmacie

Pingback: C'est quoi une bonne famille achat levitra

Pingback: Is zinc Good for erectile dysfunction vidalista

Pingback: How do I text romantic - vidalista vs cialis

Pingback: How do you kiss your girlfriend romantically vidalista 40

Pingback: Persistent headaches or migraines can be associated with thyroid deficiency?

Pingback: Restless legs syndrome (RLS) or an uncontrollable urge to move the legs can be a symptom of thyroid deficiency?

Pingback: Can clomiphene help women with ovulatory dysfunction related to stress-induced hormonal imbalances and disrupted menstrual cycles to establish regular ovulation?

Pingback: Can certain medical conditions or surgeries affect a woman's ability to ovulate?

Pingback: Can herbal remedies help in reducing cholesterol levels

Pingback: What's a good male aphrodisiac - Priligy pills

Pingback: Who produces more heat male or female - Priligy Dapoxetine where to Buy

Pingback: What's the difference between sperm and discharge?

Pingback: Can salt water kills bacteria?

Pingback: Quel est le role des parents dans la famille viagra prix

Pingback: Buy Nolvadex online | Palliative care teams assist with pain management and symptom control during breast cancer treatment

Pingback: What will happen when you meet your soulmate | levitra active ingredient

Pingback: What should you not take with antibiotics amoxicillin 100

Pingback: Can over the counter drugs affect my thyroid function - viagra over the counter at walmart

Pingback: How long does it take for good bacteria to grow back after antibiotics. plaquenil 200 mg table

Pingback: levalbuterol vs albuterol

Pingback: Medications and Heart Health: Protecting Your Most Vital Organ | keflex antibiotic over counter

Pingback: Medications and Eye Disorders: Protecting Vision | clomid over the counter south africa

Pingback: How do you cleanse a fatty liver buy plaquenil over the counter

Pingback: What are billionaires morning routine vardenafil 10 mg

Pingback: Which spice is good for liver

Pingback: Can pharmacy refuse to accept GoodRx

Pingback: Why do doctors recommend turmeric?

Pingback: How can you tell if your body is fighting an infection ivermectin for humans?

Pingback: Do antibiotics destroy your gut?

Pingback: Where do parasites hide in the body stromectol 12mg online purchase?

Pingback: How do you tell if she wants you to make a move ivermectin scabies?

Pingback: Can antibiotics pass into breast milk stromectol 12mg online?

Pingback: What is the fastest way to fix gut bacteria stromectol over the counter?

Pingback: What precautions must be taken while taking antibodies buy stromectol over the counter?

Pingback: What are the main types of inhalers for asthma budesonide inhaler coupon?

Pingback: Is 92 oxygen level OK for asthma patient side effects of albuterol inhaler?

Pingback: What is the most popular asthma medication?

Pingback: Which is the strongest steroid inhaler ventolin hfa 90 mcg inhaler?

Pingback: What drugs Cannot be taken with albuterol albuterol sulfate hfa?

Pingback: safe canadian online pharmacies?

Pingback: help with prescription drugs?

Pingback: Are there any long-term effects of taking antibiotics Azithromycin 1000mg?

Pingback: What fight viral infections Azithromycin 250 mg tablets?

Pingback: Why is my period slimy Azithromycin pregnancy?

Pingback: How do you flirt in the morning??

Pingback: What happens if you walk 10000 steps a day for a month Buy Generic cialis online??

Pingback: What do men need in a relationship??

Pingback: Is coffee good for men's sperm??

Pingback: What to do after sitting all day??

Pingback: What are the effects of chronic use of nitrous oxide on erectile function??

Pingback: In addition to yoga, other forms of exercise such as running, swimming, and weightlifting can also be helpful in managing premature ejaculation.?

Pingback: Medications used to treat PE in older men include selective serotonin reuptake inhibitors (SSRIs), which are commonly prescribed antidepressants that can have the side effect of delaying ejaculation.?

Pingback: What STD is known as the silent disease??

Pingback: Does fatty liver go away??

Pingback: How do you make a woman feel for you order Cenforce 100mg??

Pingback: The Future of Healthcare Lies in Personalized Medication Cenforce 100mg pills.

Pingback: Medications and Stress Relief - Unwinding the Knots of Modern Life stromectol 3mg scabies

Pingback: How do I start my day happy what is Cenforce 100?

Pingback: Can antibiotics be used to treat acne buy stromectol 6mg online?

Pingback: What is the best age for a woman to have her first vardenafil?

Pingback: How do you make your man loves you forever levitra 20mg?

Pingback: Can erectile dysfunction be a side effect of antidepressant medications vardenafil 10 mg?

Pingback: Medications and Alzheimer's Disease - Preserving Cognitive Function what is levitra used for?

Pingback: How are digital health apps and medical apps regulated to ensure user safety and effectiveness ivermectin stromectol?

Pingback: How are different strains of medical marijuana used for various health conditions buy Cenforce 50 reviews?

Pingback: Medications and Healthy Habits - A Comprehensive Approach to Well-being buy sildenafil and dapoxetine tablets?

Pingback: Pediatric Diabetes - Managing the Youngest Patients ventolin?

Pingback: The Future of Medicine - Cutting-Edge Drugs for Improved Health fildena 50mg canada?

Pingback: What is proton therapy, and how is it used to treat cancer jelly kamagra?

Pingback: Healthcare Accessibility for People with Disabilities what is ivermectin used for?

Pingback: Medications for Mental Clarity and Cognitive Enhancement furosemide 40mg tablet?

Pingback: Transgender Health Care - Breaking Down Barriers buy vardenafil?

Pingback: Cenforce 100 sildenafil citrate?

Pingback: From Lab to Pharmacy - How Medications Are Developed Zithromax 500mg?

Pingback: Sustainable Healthcare - A Green Approach to Medicine vidalista 40mg?

Pingback: stromectol for lice?

Pingback: priligy?

Pingback: amazon viagra pills?

Pingback: stromectol 12mg online?

Pingback: Medications and Bone Health - Building Strong Foundations for Life what is plaquenil used for?

Pingback: Medications and Digestive Enzymes - Enhancing Nutrient Absorption, Supporting Digestion dapoxetine usa?

Pingback: Medications and Digestive Health in Children - Ensuring Wellness from Within viagra pill for men price?

Pingback: Promoting Better Health - The Benefits of Regular Medication Use generic sildenafil 100mg?

Pingback: Medications and Mental Health Stigma - Breaking Down Barriers over the counter levitra?

Pingback: What is stronger than Viagra cialis low prices at walgreens?

Pingback: Can bacterial diseases be fatal Zithromax for dogs?

Pingback: What illnesses end in death stromectol 6mg?

Pingback: Can antibiotics be used to treat infections in patients with inflammatory bowel disease stromectol prevention gale?

Pingback: Can antibiotics be used to treat urinary tract infections in men ivermectin over the counter?

Pingback: Is naproxen 500 mg the same as ibuprofen ventolin buy online?

Pingback: How do I tell a guy what I want in bed viagra tablets 100mg?

Pingback: How do u fix a broken relationship Cenforce pills?

Pingback: What makes a man happy in a relationship buy levitra

Pingback: Can I drink tea after antibiotics ivermectin for worms

Pingback: Are there pharmaceutical companies that offer financial assistance for arthritis medications priligy buy in la

Pingback: When can a woman not get pregnant vidalista online

Pingback: purchase Cenforce pill

Pingback: where to buy ivermectin for humans

Pingback: albuterol sulfate

Pingback: iric for ventolin

Pingback: albuterol sulfate inhalation solution

Pingback: ivermectin dose for dogs

Pingback: Does drinking water help you lose weight??

Pingback: Should men take magnesium everyday??

Pingback: What are the effects of long-term use of recreational drugs on erectile function??

Pingback: How can I get free magazines in the mail??

Pingback: priligy in the united states - What supplements should I take for ED?

Pingback: priligy tablets

Pingback: vidalista 60 usa

Pingback: hydroxychloroquine over the counter alternative

Pingback: viagra 25 mg order

Pingback: lipitor without a doctor prescription

Pingback: androgel uk

Pingback: androgel dosing

Pingback: androgel gel

Pingback: cialis super force

Pingback: tadalista 5 mg

Pingback: androgel generic

Pingback: kamagra jellies

Pingback: androgel price

Pingback: vilitra 60mg vardenafil

Pingback: tadalista

Pingback: pro air inhaler

Pingback: viagra pill what does it do

Pingback: can i buy priligy in usa

Pingback: hydroxychlor tab 200mg

Pingback: fortune health care tadalista

Pingback: vardenafil hcl 20mg tablet

Pingback: hcq 200 mg tablet

Pingback: How many days of antibiotics is too much hydroxychloroquine 200 mg for rheumatoid arthritis?

Pingback: Can antibiotics be used to treat fungal endocarditis hydroxychloroquine 200 mg tablet?

Pingback: cenforce 100 alcohol

Pingback: Anonymous

Pingback: hydroxychloroquine 200 mg

Pingback: cenforce tablet

Pingback: Cenforce 200 amazon

Pingback: buy vidalista

Pingback: Cenforce 200 side effects

Pingback: can i buy dapoxetine in store

Pingback: cenforce 100 skutki uboczne

Pingback: dapoxetine 60 mg tablet

Pingback: can you order gabapentin online

Pingback: Azithromycin oral suspension

Pingback: buy qvar 80mcg

Pingback: generic plaquenil

Pingback: atorvastatin

Pingback: fluticasone salmeterol 250 50

Pingback: advair

Pingback: buy cenforce 100

Pingback: cenforce 200mg

Pingback: cenforce

Pingback: vidalista black

Pingback: ventolin tablet

Pingback: fildena 50 mg online

Pingback: fildena

Pingback: vidalista

Pingback: use levitra

Pingback: cenforce 100mg

Pingback: vidalista black

Pingback: vidalista 80

Pingback: is vidalista real

Pingback: clincitop

Pingback: Sildenafil

Pingback: vidalista 20

Pingback: generic albuterol inhaler

Pingback: vardenafil price

Pingback: Cenforce over the counter benefits

Pingback: filagra super active

Pingback: cipla seroflo 250 inhaler

Pingback: cenforce 100 india

Pingback: fildena 25 mg

Pingback: kamagra where does come from when ordered

Pingback: cenforce

Pingback: is this vidalista black 80mg good?

Pingback: advair diskus 500/50

Pingback: buspar generic cost

Pingback: generic of imitrex

Pingback: advair diskus 250 50

Pingback: clomiphene citrate for men

Pingback: iverscab z

Pingback: vermact 12 use

Pingback: iverheal 12

Pingback: stromectol online

Pingback: stromectol 3 mg 20 tablet

Pingback: iverwon 12

Pingback: Cenforce 50mg usa

Pingback: iversun 6

Pingback: vidalista 80mg black india

Pingback: levitra dose

Pingback: was ist tadalista

Pingback: fildena super active capsules

Pingback: vidalista 20 from india

Pingback: vidalista 500 mg l-arginina

Pingback: dapoxetine 60mg online

Pingback: clomid over the counter

Pingback: filumena review

Pingback: clomid for sale

Pingback: clomiphene over the counter

Pingback: vidalista professional sublingual

Pingback: buy priligy without prescription

Pingback: priligy pills

Pingback: stromectol for sale

Pingback: cenforce 200 side effects

Pingback: kamagra vs cialis

Pingback: clomiphene citrate 50mg for men

Pingback: buy dapoxetine in usa

Pingback: poxet 90

Pingback: Cenforce 50mg brand

Pingback: priligy 30 mg precio

Pingback: ciails cost

Pingback: rybelsus benefits

Pingback: buy rybelsus online canada

Pingback: rybelsus egfr cut off

Pingback: fildena 25 mg

Pingback: tadaga

Pingback: motilium reflux

Pingback: motilium suspension 30ml h/1

Pingback: buy motilium

Pingback: generic vardenafil

Pingback: citadep 20 mg

Pingback: citalopram 10mg

Pingback: vidalista 40mg

Pingback: malegra 50 отзывы

Pingback: iverheal tablet

Pingback: ivercon

Pingback: ivecop 6

Pingback: ivecop 3 mg

Pingback: malegra 150

Pingback: levitra originale

Pingback: buy amoxicillin online

Pingback: vidalista 40 mg reviews

Pingback: power force tablet price

Pingback: where can i buy dapoxetine in us

Pingback: sildigra 100

Pingback: web md vidalista

Pingback: cenforce 25

Pingback: vidalista 10 tablets

Pingback: tab dapoxetine

Pingback: vidalista

Pingback: order priligy online

Pingback: priligy over the counter

Pingback: vidalista

Pingback: saferx kamagra

Pingback: cenforce 200 kopen belgie

Pingback: does priligy work

Pingback: about kamagra tablet

Pingback: cheap Cenforce 100mg

Pingback: vidalista 60 ervaringen

Pingback: vidalista 80 ervaringen

Pingback: fertomid 25 for male uses in hindi

Pingback: clomiphene citrate for male

Pingback: fertomid 50 tablet for pregnancy

Pingback: clomid cost

Pingback: generic clomid otc

Pingback: dapoxetine 30mg online

Pingback: buy dapoxetine

Pingback: vidalista 80 black

Pingback: vidalista 20

Pingback: buy fildena generic

Pingback: fildena 100 online india

Pingback: vilitra 40 60 mg tablet

Pingback: cenforce 150

Pingback: women who take cialis

Pingback: darunavir 600

Pingback: suminat 50 mg

Pingback: acheter cialis super active

Pingback: buy tadacip

Pingback: strattera cost

Pingback: vidalista 20 vs viagra

Pingback: lipitor 10 mg cost

Pingback: asthalin inhaler mg

Pingback: fildena 100 mg tablet

Pingback: buy Cenforce 50mg

Pingback: levitra order online

Pingback: vidalista forum

Pingback: Nolvadex during cycle

Pingback: cialis vs viagra vs kamagra

Pingback: buy priligy without a script

Pingback: ventolin inhaler

Pingback: super vidalista

Pingback: vidalista 80 kopen

Pingback: cialis 5mg skroutz

Pingback: buy cenforce 200 online

Pingback: buy qvar

Pingback: probenecid benemid

Pingback: isotroin 20 mg price

Pingback: apcalis oral jelly forum

Pingback: stromectolhome.com

Pingback: iwermectin.com

Pingback: prednisolone acetate 1 eye drops

Pingback: buy cheap cenforce 150mg

Pingback: shaking after taking ventolin inhaler

Pingback: levitra dose

Pingback: can you buy viagra ebay

Pingback: viagra 100 mg

Pingback: fildenforyou.wordpress.com

Pingback: blackcial.wordpress.com

Pingback: priliforyou.wordpress.com

Pingback: nintedanib pronunciation

Pingback: ventolinha.wordpress.com

Pingback: lipitor 10mg

Pingback: sildenafil viagra 100

Pingback: avanafil with tadalafil

Pingback: dapoxetine 30 mg

Pingback: como usar androgel

Pingback: clomid for men

Pingback: daily cialis not working reddit

Pingback: otcalbuterol.net

Pingback: vidalista.homes

Pingback: Fildena over the counter

Pingback: Cenforce 200 vs viagra

Pingback: priligy canada

Pingback: cenforce 150 red pill

Pingback: prednisolone drops side effects

Pingback: order kamagra

Pingback: tadal

Pingback: Ventolin inhaler daily

Pingback: zyprexa for bipolar

Pingback: how much is 20 mg of cialis

Pingback: kamagra 100 mg

Pingback: benemid

Pingback: sildigra recenzie

Pingback: vidalista.lol

Pingback: sildetails.wordpress.com

Pingback: filitra 20mg

Pingback: priligy 60 mg vs 30mb

Pingback: vermovent

Pingback: super zhewitra

Pingback: albuterol inhaler 90 mcg

Pingback: revatio

Pingback: kamagra gel price

Pingback: vardenafil generic

Pingback: sildalist 120mg recenze

Pingback: generic drug for advair

Pingback: ivecop 12 uses in hindi

Pingback: betaxolol eye drops brands

Pingback: amox 500 yellow capsule

Pingback: viaforman.wordpress.com

Pingback: eamoxil.com

Pingback: ventolinof.com

Pingback: stromecinfo.wordpress.com

Pingback: stromectolist.com

Pingback: cenforceindia.comcenforce-soft.html

Pingback: iwermectin.com/info/prescription.html

Pingback: duricefzsu.com

Pingback: cenforceindia.com

Pingback: clomiclom.com

Pingback: cenforcebnr.com

Pingback: fildena1.website3.me

Pingback: pharmduck.com

Pingback: bento.me/extra-super-avana

Pingback: cathopic.com/@vermact

Pingback: community.cisco.com/t5/user/viewprofilepage/user-id/1855499

Pingback: isodex Nolvadex pct

Pingback: saferx kamagra

Pingback: dapoxetine/sildenafil 30/50 mg

Pingback: Fildena super active 200 mg

Pingback: Vidalista 20 price

Pingback: other names for prednisone

Pingback: Vidalista 80

Pingback: direct-kamagra

Pingback: kamagra oral jelly 100mg

Pingback: order sildenafil without prescription

Pingback: z pack 250 mg directions

Pingback: amoxil 250mg pill

Pingback: Nolvadex

Pingback: female cialis dosage

Pingback: order Cenforce 100mg without prescription

Pingback: clomid Cheap

Pingback: duricef generation

Pingback: how Can i get clomid

Pingback: silagra 50 in hindi

Pingback: prednisolone ophthalmic drops

Pingback: kamagra oral jelly

Pingback: buy Fildena

Pingback: Fildena 25