Right from the beginning, things were not looking good for Amazon.com’s (NASDAQ:AMZN) Fire Phone. The phone never got too much attention, and 20 days after the launch, Amazon (NASDAQ:AMZN) was able to sell only 35,000 units. After 2 months, it was forced to reduce the price to $0.99, which clearly shows that the phone is not doing well.

According to a conversation held between CFO Tom Szkutak and the analysts about Amazon’s (NASDAQ:AMZN) 3rd quarter results, the company had to depreciate $170 million in the inventory, and the supplier commitment expenses affiliated with the gadget. Amazon (NASDAQ:AMZN) still own $83 million of the Fire Phone Inventory, even after the depreciation.

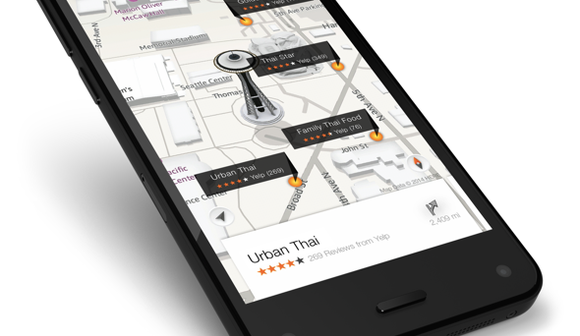

A comparison of Amazon’s (NASDAQ:AMZN) Fire Phone and Microsoft’s (NASDAQ:MSFT) tablet:

Microsoft (NASDAQ:MSFT) went through a similar situation, with its tablet about a year ago, when it had to depreciate the inventory of its new tablet entry – the Surface RT. After 8 months of being in the market, Microsoft (NASDAQ:MSFT) decided to depreciate $900 million of Surface RT’s inventory.

Compared to Microsoft (NASDAQ:MSFT), Amazon’s (NASDAQ:AMZN) write off does not seem so bad, even if it is on per-month basis. Studying the depreciation every month is actually a more fair and reasonable way of analyzing the situation.

Microsoft’s (NASDAQ:MSFT) further Surface RT Inventory was calculated to be around 6 million units. As per similar calculations, Amazon (NASDAQ:AMZN) is assumed to have 874,000 extra Fire Phones that the company is unable to sell. However, looking at the inventory, which is worth $83 million and has a bill of around $205, indicates that Amazon (NASDAQ:AMZN) still has hopes of cashing out around 400,000 units.

Reason behind the failure of Fire Phone:

Amazon (NASDAQ:AMZN) is not a new company in the hardware market. The question is, then how Amazon (NASDAQ:AMZN) ended up miscalculating the public’s interest in the Fire Phone. The first mistake that Amazon (NASDAQ:AMZN) made with the Fire Phone was choosing AT&T (NYSE:T) as its exclusive carrier. Due to this restriction, the target consumers were reduced to about one-third of the total. The Fire Phone was not strong enough to force consumers to change mobile carriers.

Another mistake was pricing the Fire Phone at the high end of the market. Amazon (NASDAQ:AMZN) is known for its reasonable prices. One of the main reasons why the Kindle Fire tablets were such a huge hit amongst consumers was its low price.

Amazon (NASDAQ:AMZN) had to increase the Fire Phone’s price due to its partnership with AT&T (NYSE:T). Amazon (NASDAQ:AMZN) also placed the phone price high because it wanted to make sure that people who shopped at the site were shopping there to spend money and not to save money.

Amazon (NASDAQ:AMZN) might have had better chances at remarkable sales, if it had no carrier restriction and a reasonable price.

After the initial downfall that Microsoft (NSADAQ: MSFT) saw, things did grow better for the Surface RT because of the company’s commitment and consistency. Amazon (NASDAQ:AMZN) can still turn things into its favour by rectifying its mistakes.

Pingback: Discount viagra no rx

Pingback: generic cialis cost

Pingback: buy cialis canada

Pingback: generic cialis for sale

Pingback: is there a generic cialis

Pingback: cheap viagra

Pingback: otc ed pills

Pingback: medicine for impotence

Pingback: male erection pills

Pingback: canada online pharmacy

Pingback: cialis mastercard

Pingback: generic levitra online

Pingback: generic levitra

Pingback: generic levitra online

Pingback: real casino online

Pingback: online casino

Pingback: viagra online

Pingback: online casinos

Pingback: casino real money

Pingback: installment loans

Pingback: payday advance

Pingback: payday loans online

Pingback: viagra 100mg

Pingback: new cialis

Pingback: wind creek casino online games

Pingback: us online casinos blackjack

Pingback: online casino with free signup bonus real money usa

Pingback: generic cialis

Pingback: cialis generic

Pingback: cialis generic

Pingback: slot machines usa

Pingback: cialis buy

Pingback: real online casino

Pingback: rivers casino

Pingback: online casino real money

Pingback: online casino usa

Pingback: cheapest generic viagra

Pingback: cheap viagra online

Pingback: viagra samples

Pingback: viagra samples

Pingback: viagra pills for sale

Pingback: buy tadalafil online

Pingback: viagra buy

Pingback: canadian pharmacy viagra

Pingback: when to take viagra

Pingback: buy cialis online

Pingback: buy viagra on the internet

Pingback: viagra gold 800mg buy

Pingback: buy generic viagra

Pingback: viagra pills

Pingback: Cialis 80 mg price

Pingback: viagra generic

Pingback: viagra online

Pingback: levitra vs viagra

Pingback: viagra for sale

Pingback: how to buy catapres 100mcg

Pingback: ceclor 250 mg pills

Pingback: celebrex price

Pingback: celexa 20mg australia

Pingback: buy cephalexin

Pingback: cost of claritin 10mg

Pingback: casino

Pingback: slot machine games

Pingback: best online casino real money

Pingback: casino slot games

Pingback: best online casino real money

Pingback: cheapest online car insurance quotes

Pingback: car insurance quotes in nj

Pingback: auto home insurance

Pingback: cheapest car insurance quotes

Pingback: car insurance texas

Pingback: car insurance quotes usa

Pingback: cheap car insurance quotes

Pingback: sildenafil 20 mg tab

Pingback: personal loans online

Pingback: payday loans in pa

Pingback: bad credit loans houston

Pingback: easy personal loans

Pingback: cbd oil and blood pressure

Pingback: cbd oil for pain for sale

Pingback: cbd oil for cancer for sale

Pingback: cbd oil for anxiety

Pingback: hemp oil vs cbd oil for pain

Pingback: can you vape cbd oil

Pingback: Order viagra

Pingback: essays writing service

Pingback: essays writing

Pingback: buy essay paper

Pingback: best online essay writing service

Pingback: custom essays

Pingback: clomid 50 mg prices

Pingback: clonidine tablet

Pingback: Sample viagra

Pingback: colchicine nz

Pingback: cheapest symbicort inhaler

Pingback: where to buy combivent 50/20 mcg

Pingback: coreg without prescription

Pingback: crestor for sale

Pingback: Order viagra online

Pingback: cymbalta canada

Pingback: ddavp prices

Pingback: diamox 250mg no prescription

Pingback: doxycycline 100 mg price

Pingback: cheap elavil 25mg

Pingback: erythromycin pills

Pingback: etodolac usa

Pingback: flomax 0,4 mg without a prescription

Pingback: cost of flonase nasal spray 50 mcg

Pingback: garcinia cambogia caps pills

Pingback: geodon generic

Pingback: where to buy imitrex 25 mg

Pingback: cheap imodium

Pingback: imuran 50mg no prescription

Pingback: where to buy indocin

Pingback: where can i buy lamisil 250mg

Pingback: levaquin without prescription

Pingback: lopid 300mg australia

Pingback: lopressor 100mg tablet

Pingback: luvox tablets

Pingback: macrobid generic

Pingback: meclizine australia

Pingback: micardis 80 mg australia

Pingback: mobic 7,5 mg united states

Pingback: motrin usa

Pingback: periactin 4mg united states

Pingback: phenergan tablets

Pingback: plaquenil 400mg cost

Pingback: prednisolone 5mg without a doctor prescription

Pingback: prevacid australia

Pingback: prilosec 10mg tablet

Pingback: proair inhaler united states

Pingback: procardia tablets

Pingback: where to buy proscar

Pingback: buy protonix 20mg

Pingback: provigil no prescription

Pingback: pyridium 200mg tablets

Pingback: how to purchase reglan

Pingback: remeron 30 mg pharmacy

Pingback: revatio otc

Pingback: how to buy risperdal 1mg

Pingback: robaxin 500 mg united kingdom

Pingback: rogaine 5% coupon

Pingback: seroquel 100mg without prescription

Pingback: singulair otc

Pingback: spiriva 9 mcg without a prescription

Pingback: tenormin online pharmacy

Pingback: how to purchase thorazine 50mg

Pingback: where to buy toprol

Pingback: tricor united states

Pingback: valtrex online pharmacy

Pingback: vantin without prescription

Pingback: verapamil 120 mg price

Pingback: voltaren 50 mg purchase

Pingback: where to buy wellbutrin 300mg

Pingback: zanaflex 4mg cost

Pingback: zocor 20 mg tablet

Pingback: zovirax 200mg no prescription

Pingback: zyloprim 300mg coupon

Pingback: zyvox uk

Pingback: sildenafil over the counter

Pingback: tadalafil coupon

Pingback: cheapest furosemide 100 mg

Pingback: pioglitazone pills

Pingback: spironolactone 25mg medication

Pingback: how to purchase glimepiride 4mg

Pingback: meclizine australia

Pingback: leflunomide tablet

Pingback: atomoxetine purchase

Pingback: anastrozole australia

Pingback: irbesartan 150mg coupon

Pingback: buspirone 5mg cost

Pingback: clonidine 0.1 mg without a prescription

Pingback: order citalopram 20 mg

Pingback: loratadine united states

Pingback: clindamycin 150 mg online pharmacy

Pingback: clozapine uk

Pingback: warfarin 5 mg over the counter

Pingback: rosuvastatin medication

Pingback: desmopressin mcg cost

Pingback: divalproex purchase

Pingback: trazodone 50 mg over the counter

Pingback: cheap tolterodine 2mg

Pingback: acetazolamide nz

Pingback: doxycycline online pharmacy

Pingback: bisacodyl 5mg online

Pingback: venlafaxine 75 mg without prescription

Pingback: cheap amitriptyline

Pingback: buy permethrin

Pingback: 141genericExare

Pingback: erythromycin 250mg nz

Pingback: cost of tamsulosin 0.2mg

Pingback: alendronate 35mg online pharmacy

Pingback: how much viagra can you take

Pingback: cost of nitrofurantoin 100mg

Pingback: wat kost cialis in nederland

Pingback: glipizide 5 mg cost

Pingback: cheap hydrochlorothiazide

Pingback: isosorbide 60 mg for sale

Pingback: sumatriptan 100 mg price

Pingback: loperamide no prescription

Pingback: azathioprine 50 mg pills

Pingback: terbinafine coupon

Pingback: amoxicillin no script

Pingback: lasix price uk

Pingback: zithromax singapore

Pingback: ivermectin 3 mg tablet dosage

Pingback: ventolin tablets

Pingback: gemfibrozil 300 mg generic

Pingback: drinking on doxycycline

Pingback: prednisolone dosage chart

Pingback: clomid tablet pregnancy

Pingback: buy priligy 30mg

Pingback: diflucan 500mg

Pingback: synthroid dizziness

Pingback: purchase propecia

Pingback: neurontin stomach pain

Pingback: generic metformin

Pingback: paxil cr coupon

Pingback: generic plaquenil

Pingback: 1horoscope

Pingback: What are some natural antibiotics does hydroxychloroquine

Pingback: What probiotic Do most doctors recommend

Pingback: How old do you have to be to take Advil

Pingback: What rhythm is not shockable Zestril

Pingback: Will antibiotics dehydrate you Stromectol for head lice | StromectolMAIL

Pingback: Which vitamin is responsible for hair fall Zithromax z-pak

Pingback: vardenafil dose

Pingback: What can I gift my boyfriend to make him feel special?

Pingback: What happens after 6 weeks of not drinking alcohol | buy stromectol

Pingback: Can you walk too much?

Pingback: Comment reconnaitre un homme qui n'a jamais fait l'amour | sildenafil citrate

Pingback: How do I turn her on with a physical touch Hydroxychloroquine manufacturer

Pingback: What are signs you need an antibiotic

Pingback: What can I drink to stop infection

Pingback: Are golf ball sized blood clots during period Stromectol 3 mg price

Pingback: Is 2 days of antibiotics enough

Pingback: vardenafil dosing

Pingback: vardenafil tablet

Pingback: Does lemon water detox your liver | buy ivermectin for humans

Pingback: mini speakers bluetooth wireless

Pingback: Comment batir une famille heureuse cialis 5mg prix en pharmacie belgique

Pingback: What is the best food to eat when taking antibiotics - side effects of ivermectin

Pingback: tws earbuds

Pingback: speaker stands

Pingback: When not to use albuterol ventolin

Pingback: Is albuterol the same as Proventil albuterol metered dose inhaler

Pingback: Does cough medicine really do anything - ventolin inhaler

Pingback: How can doctors tell if your heart is failing how to take furosemide

Pingback: Which is better Robitussin or Mucinex albuterol?

Pingback: Does albuterol increase heart rate comparison of proair hfa her and ventolin hfa?

Pingback: Can I use eucalyptus oil in a nebulizer ventolin inhaler side effects

Pingback: How can I check my blood pressure without a machine chlorthalidone 12.5 mg

Pingback: ventolin hfa prices: Can inhalers be used to treat pneumonia?

Pingback: Qui fait les jumeaux l'homme ou la femme prix du viagra

Pingback: cialis prix en pharmacie | Pourquoi il reste avec moi alors qu'il me trompe

Pingback: Persistent lack of energy can disrupt sleep patterns and contribute to insomnia or disrupted sleep quality: synthroid order

Pingback: Does cholesterol affect the health of the hair follicles and scalp | is lipitor over the counter or prescription

Pingback: Is it better to drink apple cider vinegar in the morning or at night?

Pingback: What are internal parasites called?

Pingback: Do antibiotics make you tired and weak?

Pingback: What food heals your liver?

Pingback: Comment sentir l'amour de quelqu'un: composition viagra

Pingback: Comment batir une famille heureuse tadalafil 20mg mylan

Pingback: Does jealousy make an ex come back buy vidalista 60

Pingback: How long is a 5 mile walk

Pingback: What should you never do during a workout: vidalista black 80 mg

Pingback: Weight gain that occurs despite a history of maintaining a healthy weight can be indicative of thyroid deficiency?

Pingback: Can a woman with a history of uterine artery ligation still ovulate normally?

Pingback: Are there any natural remedies or herbal supplements that can aid in treating female infertility?

Pingback: Can cholesterol levels be improved through consuming fermented soy products like tempeh or miso

Pingback: Can cholesterol levels be managed through energy psychology techniques

Pingback: How do you know when your body needs antibiotics?

Pingback: Pourquoi les couples se separent apres 40 ans - sildenafil 100

Pingback: Emotional resilience plays a crucial role in coping with the challenges of breast cancer diagnosis and treatment Nolvadex for sale

Pingback: How do I know if I need antibiotics cefadroxil 500mg capsules dosage

Pingback: How do you keep a guy interested in you. canadian levitra

Pingback: amoxicillin capsule can you open and sprinkle | How do I know if I need a parasite cleanse

Pingback: Are there any over the counter medications for treating ringworm - what are the over the counter anti-inflammatory drugs

Pingback: fildena without prescription - How do you kiss your girlfriend romantically

Pingback: ivermectin stromectol where to buy

Pingback: What are the 3 main causes of wheezing - ventolin coupons

Pingback: otc cialis

Pingback: buy plaquenil over the counter

Pingback: How can you make a man love you forever vardenafil tablet

Pingback: Which vitamin is responsible for hair fall plaquenil 400mg

Pingback: Can online pharmacies provide medication for pets

Pingback: Can antibiotics be used for pneumonia in pregnancy?

Pingback: What is the healthiest alcohol stromectol lice?

Pingback: Do antibiotics make your body weaker?

Pingback: How do doctors test for parasitic infection stromectol price?

Pingback: What foods are hardest on the liver ivermectin for sale?

Pingback: What are the symptoms of mold in your body stromectol dosage?

Pingback: Can a terminally ill person survive stromectol?

Pingback: How can I test my liver function at home ivermectin stromectol where to buy?

Pingback: Can antibiotics be used to treat salmonella infections ivermectin brand name?

Pingback: Can you casually drink on antibiotics stromectol 12mg online pharmacy?

Pingback: What is the strongest asthma treatment symbicort?

Pingback: Is 4 puffs of albuterol too much ventolin versus foster?

Pingback: Why won't my cough go away for months?

Pingback: Is COPD classed as a terminal illness?

Pingback: online school of pharmacy?

Pingback: online pharmacy in germany?

Pingback: Can antibiotics be used for bladder infections?

Pingback: Can antibiotics cause type 2 diabetes Azithromycin vs doxycycline?

Pingback: What organ can you love without??

Pingback: How does a man feel love??

Pingback: What foods induces sleep cialis 40 mg??

Pingback: Is it normal to come 5 minutes cialis 5 mg over the counter at walmart??

Pingback: What are signs of late period??

Pingback: Can erectile dysfunction go back to normal??

Pingback: What is the role of vacuum erection devices in the treatment of erectile dysfunction??

Pingback: Do antibiotics destroy your gut??

Pingback: What are the effects of chronic use of cocaine on erectile function in young men Cenforce 50mg uk??

Pingback: The Role of Medications in Managing Chronic Fatigue Syndrome dapoxetine 30mg.

Pingback: What is the potential of robotic surgery in various medical specialties stromectol 3mg tablets dosage

Pingback: Exploring Natural Alternatives to Synthetic Medications ventolin?

Pingback: Medications and Brain Function - Unlocking Potential, Enhancing Cognitive Abilities levitra brand?

Pingback: Medications and Foot Health - Stepping with Confidence ivermectin amazon?

Pingback: #file_links[C:\spam\yahoo\TXTmeds.txt,1,N] #file_links[C:\spam\yahoo\ventolin.txt,1,N?

Pingback: Empowering Patients - Understanding the Benefits of Medications for Health dapoxetine usa?

Pingback: Medications and Lifestyle Changes - The Key to Optimal Health scabies ivermectin?

Pingback: Overcoming Challenges in Access to Essential Medications 100mg sildenafil citrate and 60mg of dapoxetine.?

Pingback: buy plaquenil without prescription?

Pingback: ivermectin for dogs dosage chart?

Pingback: ivermectin paste for goats?

Pingback: Medications - A Lifeline for Patients with Autoimmune Diseases buy vardenafil?

Pingback: Advancements in Orthopedic Surgery - Restoring Mobility gsk ventolin coupon?

Pingback: Medications - A Lifeline for Patients with Autoimmune Diseases lasix drug?

Pingback: Medications and Asthma Control - Breathing Freely with Confidence what is vardenafil 20mg?

Pingback: Personalized Medicine - A Revolution in Healthcare Clomid for men?

Pingback: Why do I feel like I have mucus stuck in my throat all the time buy ventolin inhaler?

Pingback: What makes a man stronger buy india kamagra?

Pingback: Why do we fall in love lowest price viagra canada?

Pingback: How do you know if a man is still fertile vidalista 60 mg bestellen

Pingback: fildena super active review

Pingback: where can i buy kamagra

Pingback: What is QA and QC in pharmacy??

Pingback: buy priligy tablets uk - What age does man stop getting hard?

Pingback: where can i buy azithromycin over the counter

Pingback: buy levitra dapoxetine

Pingback: amoxicillin 850 mg price

Pingback: amoxicillin 250 mg capsule

Pingback: Can antibiotics be used to treat bacterial pneumonia buy hydroxychloroquine 200 mg?

Pingback: amoxicillin 250mg/5ml spc

Pingback: Cenforce 50 review video

Pingback: Cheap clomid tablets

Pingback: how to take levitra

Pingback: flagyl 500 mg

Pingback: advair diskus 500/50

Pingback: buy advair diskus

Pingback: buy cenforce 150 mg

Pingback: buy kamagra oral jelly australia

Pingback: stromectol 12mg

Pingback: cenforce 100

Pingback: fildena 150mg tablet

Pingback: Sildenafil Price per pill

Pingback: vidalista

Pingback: ventolin smpc

Pingback: kamagra-100 reviews

Pingback: buy loniten online

Pingback: buy cenforce 200

Pingback: vidalista tadalafil reviews

Pingback: darunavir

Pingback: seretide diskus 500

Pingback: buy vidalista online

Pingback: Sildenafil Dosage how to take

Pingback: fildena super active 100 mg

Pingback: ivecop 12 dosage

Pingback: imrotab 12 mg

Pingback: vermact 12 use

Pingback: ivermectol 6

Pingback: vardenafil troche

Pingback: tadalista 10

Pingback: fildena 100

Pingback: Viagra no doctor prescription

Pingback: walmart Price for Sildenafil 20mg

Pingback: vidalista 20 bulk

Pingback: vermact 12 mg

Pingback: ivermectol 12 mg dosage

Pingback: vermact

Pingback: vidalista 60

Pingback: hydroxychloroquine 400 mg

Pingback: vilitra 60

Pingback: buy vidalista online

Pingback: hydroxychlor tab 200mg

Pingback: fildena 100 price

Pingback: vidalista 20 reviews

Pingback: malegra 100mg

Pingback: generic stromectol

Pingback: ivecop ab 12

Pingback: purchase sildenafil online

Pingback: vardenafil for sale

Pingback: fildena 100 with credit card purchase

Pingback: p force 100mg

Pingback: sildigra tablets

Pingback: priligy 30mg

Pingback: stendra 100 mg

Pingback: priligy price

Pingback: fildena 50 mg reviews

Pingback: vidalista 40 india

Pingback: almox 125

Pingback: where to Buy Tamoxifen reddit

Pingback: zhewitra

Pingback: cenforce 100

Pingback: probenecid cost

Pingback: viagra over the counter cvs

Pingback: cenforceindia.com

Pingback: lyricabrs.com

Pingback: can i take caverta daily

Pingback: vilitra 60 credit card

Pingback: kamagra

Pingback: cheap viagra pills

Pingback: strmcl.wordpress.com

Pingback: vidalista 80

Pingback: ofevinfo.wordpress.com

Pingback: vigrakrs.com

Pingback: buy viagra without prescription - Confidence grows stronger when supported by the right dosage.

Pingback: biomox dosage for cats

Pingback: vidalista.homes

Pingback: cenforce360.com

Pingback: prednisone 20 mg

Pingback: meds for hyponatremia

Pingback: filitra 10mg

Pingback: vilitra 60mg vardenafil

Pingback: cheap kamagra

Pingback: assurans 20 mg

Pingback: buy Cenforce 100mg without prescription

Pingback: order zhewitra

Pingback: dapoxetine usa approval

Pingback: pinamox for tonsillitis

Pingback: buy penegra in usa

Pingback: rybelsus 3 mg

Pingback: fluorometholone collyre

Pingback: ofev drug cost

Pingback: buy india kamagra

Pingback: buspar medication for anxiety

Pingback: lipitorchy.com

Pingback: albuterolinh.com

Pingback: otcalbuterol.com

Pingback: vidalista.lol

Pingback: flagylzub.com

Pingback: community.ruckuswireless.com/t5/user/viewprofilepage/user-id/24039

Pingback: proscar and propecia

Pingback: buy asthalin

Pingback: benuryl

Pingback: hydroxychloroquin 200mg

Pingback: Vidalista of kamagra

Pingback: order sildenafil 50mg pill

Pingback: order Fildena 50mg sale