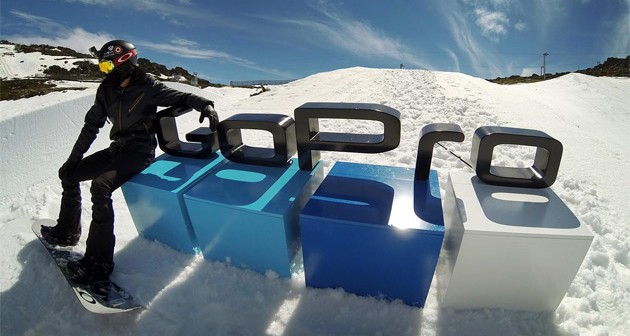

GoPro Inc (NASDAQ: GPRO) is one of the biggest market movers in the tech space right now. The company possesses one thing that the majority of companies in the industry lack: a brand. Many tech companies rely on fads, technology trends, and/or social events to market their products and gain attention. GoPro is unique in that it is one of the few companies that has a base of loyal customers.

For example, we can compare the GoPro camera to the Apple iPod. Back when MP3 players were the latest innovation to hit the market about ten years ago, there were very few companies that stood out in the MP3 making race. Then Apple Inc (NASDAQ: AAPL), whose small handheld devices conquered the market and won the loyalties of consumers even to this day, released the iPod. The company experienced overnight success, dominating the market and rocketing the company to stardom.

The MP3 market has declined since then and proved its impermanence. Similarly, the POV/extreme sports camera market is not infinite either. With some discretion, we can also draw some parallels between the two companies.

iPod vs. GoPro

The GoPro has one advantage over the iPod in that it is regarded as the first of its kind in the market. Any fan of extreme sports or point of view camera user seems to think of GoPro as the go to product when they are looking to buy a camera.

GoPro has established such a name for itself in the market, that for many consumers, it doesn’t matter if the competition has better cameras or if smartphones can do many of the things the GoPro camera can do. The GoPro is the way to go.

GoPro has established such a name for itself in the market, that for many consumers, it doesn’t matter if the competition has better cameras or if smartphones can do many of the things the GoPro camera can do. The GoPro is the way to go.

Once a brand establishes a name and once it gets consumers to associate that brand with a function or necessity, the company has achieved the most sought after goal of any business. GoPro, like Apple, has achieved that status.

However, this doesn’t necessarily mean that GoPro has already achieve the same level of success that Apple has. There is still a considerable amount of work to be done for the camera company. GoPro still needs to expand its client base within the limited potential market. It also needs to keep up with the constant innovation that is characteristic of the tech and hardware space.

For The Year Ahead

For the 2015 year, analysts predict earnings per share to be around $0.95. In contrast, Apple’s shares are priced at sixteen times its earnings.

Analysts are saying that GoPro will likely enter the market at just under $30.

From that point on, it is not unlikely that GoPro will grow to the range of $55 to $60, and yield a profitable investment for patient investors.

Pingback: เครดิตฟรี

Pingback: check this out

Pingback: superkaya88

Pingback: view

Pingback: faw99 สล็อต

Pingback: โรงแรมแมวพัทยา

Pingback: ไฮเบย์

Pingback: dark168

Pingback: ผ้า

Pingback: หวยเด็ด

Pingback: สล็อตเว็บดัง สมัครง่าย

Pingback: หวยหุ้น คืออะไร มีกี่แบบ

Pingback: เกมสล็อตแจ็คพ็อตแตกบ่อย Rich88 Slot

Pingback: linkno789

Pingback: beautiful women

Pingback: essentials

Pingback: คาสิโนออนไลน์ sagame

Pingback: Thai massage Richardson

Pingback: Sandra

Pingback: เกม Y8

Pingback: T-Rex

Pingback: ธุรกิจงานศพ

Pingback: รับผลิตเหรียญรางวัล

Pingback: check this out

Pingback: discover our story

Pingback: พรมรถ

Pingback: ซื้อเหล้าออนไลน์

Pingback: rent Go X scooter

Pingback: read this article

Pingback: raamdecoratie draai kiepramen

Pingback: clothing manufacturer

Pingback: Pin Up Aviator

Pingback: e스포츠베팅

Pingback: แทงบอลออนไลน์ LSM99

Pingback: รับงานเอง