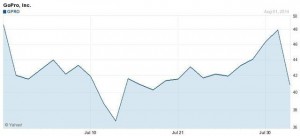

Thanks to media hype, GoPro’s stock has been on the mind of almost every investor since the company’s initial public offering. However, it won’t be long until GoPro’s stock ticker becomes just like any other company stock on the market. It is then, that the company’s stock price will begin to normalize as well.

Ever since the company went public, the stock price has been extremely volatile due to upgrades, downgrades, and initial coverage from analysts and underwriters.

From the beginning, analysts and investors questioned the company’s ability to become a media company, and the CEO’s decision to sell so many shares into the IPO. Yes, the company does cater to the sports and extreme activities market, which produces truly unique content. However, the company should not automatically be labeled as a success.

Judging from the chart above, the company’s stock is nowhere near stability yet. And now, it seems that the shares are on the path to dropping below $40. Momentum players are still lingering after the company’s IPO, which is causing the price to swing so wildly. However, the price should normalize in the long run.

The company also just released their first earnings report as a public company on Thursday last week. The stock seems to have gone through a rough phase after the company released lackluster earnings report.

Its earnings for the second quarter beat out the expectations of analysts, but it netted a greater loss than the prior year. In after hours trading, the stock dropped just over 11%.

The company attributed $19.8 million on shareholders, or $0.24 per diluted share. The company posted profits of $11.8, or $0.08 per diluted share. This beat out expectations of analysts, which was $0.07 per share.

The company posted revenues of $244.7 millinon, an increase of 38.1% from the second quarter of 2013, which was $177.1 million. The company’s revenue also beat out analysts’ expectations fro $238 million in sales.

As soon as the report was released, the company’s stock crash. The greater losses confirmed investors’ worries about the direction GoPro was headed towards as a public company. The CEO and founder of GoPro, Nicholas Woodman, maintained that there was still a lot of room for growth and many huge opportunities overseas.

Some Key Facts To Consider

- GoPro’s revenue exceeded the expectatiosn for the second quarter mostly due to strong sales in hardware accessories and its camera product, the HERO3+ Black camera. However, the number of sales of HERO products fell short of predictions.

It seems that GoPro’s product sales are on the decline as well. However, investors are hoping that the launch of a new HERO product will keep the company’s worth floating at its current valuation.

- Nicholas Woodman is hyping up the company’s plan to build a platform that will enable users to quickly upload and store footage in the cloud. This will make it easier to convert the videos into YouTube clips. Woodman has also spoken of a possible deal with Roku and AppleTV.

Pingback: Latest Buying Stocks And Shares News - How to buy shares

Pingback: Buy viagra in us

Pingback: cialis online

Pingback: cialis 20mg

Pingback: Discount viagra no rx

Pingback: cialis without prescription

Pingback: cialis canadian pharmacy

Pingback: generic cialis cost

Pingback: is there a generic cialis

Pingback: viagra 50mg

Pingback: viagra 50mg

Pingback: cheap viagra

Pingback: best erectile dysfunction pills

Pingback: impotence pills

Pingback: best ed medication

Pingback: canada pharmacy

Pingback: canadian pharmacy online

Pingback: online pharmacy

Pingback: Real cialis online

Pingback: cialis generic

Pingback: generic levitra online

Pingback: generic vardenafil online

Pingback: generic levitra

Pingback: wind creek casino online games

Pingback: best online casino for money

Pingback: viagra prices

Pingback: slots online

Pingback: online gambling

Pingback: tadalafil 10mg

Pingback: loans online

Pingback: loan online

Pingback: no credit check loans

Pingback: viagra prescription

Pingback: slot machine games

Pingback: new cialis

Pingback: top online casinos in the world

Pingback: rene

Pingback: online casinos

Pingback: cialis generic

Pingback: generic cialis

Pingback: generic for cialis

Pingback: cialis buy

Pingback: viagra samples

Pingback: real money online casino

Pingback: casinos

Pingback: casinos online

Pingback: order viagra online

Pingback: buy generic viagra

Pingback: buy cialis online

Pingback: cheap viagra online canadian pharmacy

Pingback: viagra pill

Pingback: viagra cost

Pingback: tadalafil generique

Pingback: generic viagra without subscription walmart

Pingback: viagra buy

Pingback: cialis online pharmacy

Pingback: generic viagra for sale

Pingback: canadian viagra

Pingback: cialis 10mg

Pingback: generic cialis canada

Pingback: chumba casino

Pingback: online slots for real money

Pingback: where to buy cheap viagra in canada

Pingback: buying generic viagra online

Pingback: where can i buy generic viagra online

Pingback: propecia generic

Pingback: cialis daily

Pingback: buy viagra with bing

Pingback: cialis online purchase in india

Pingback: cheap viagra

Pingback: hydroxychloroquine tablet

Pingback: cialis price

Pingback: mymvrc.org

Pingback: cialis website

Pingback: sildenafil

Pingback: cheap cialis

Pingback: viagra for sale

Pingback: rxtrust pharm

Pingback: viagra

Pingback: sildenafil

Pingback: rx trust pharm

Pingback: viagra for women sale

Pingback: generic cialis overnight delivery

Pingback: where can i buy viagra over the counter

Pingback: cialis online prescription

Pingback: cialis for sale

Pingback: cialis 5mg

Pingback: buy viagra in england

Pingback: catapres 100 mcg online

Pingback: ceclor 500 mg otc

Pingback: ceftin 125 mg tablet

Pingback: celebrex tablet

Pingback: viagra coupon

Pingback: celexa generic

Pingback: RxTrustPharm

Pingback: cephalexin purchase

Pingback: cipro uk

Pingback: how to buy claritin

Pingback: play online casino real money

Pingback: online casinos usa

Pingback: casino moons online casino

Pingback: slot machines

Pingback: online casino with free signup bonus real money usa

Pingback: online casino with free signup bonus real money usa

Pingback: best real casino online

Pingback: hollywood casino

Pingback: online slots real money

Pingback: hartford car insurance quotes

Pingback: collector car insurance quotes

Pingback: affordable insurance

Pingback: ontario car insurance

Pingback: state farm car insurance quotes

Pingback: car insurance quotes comparison sites

Pingback: cheapest car insurance quotes

Pingback: state car insurance quotes

Pingback: auto-owners insurance

Pingback: guaranteed personal loans

Pingback: Canada viagra generic

Pingback: payday loans tulsa

Pingback: payday loans charlotte nc

Pingback: fast installment loan

Pingback: quick loans company

Pingback: best product for erectile dysfunction

Pingback: bad credit loans bad credit direct lenders

Pingback: payday loans mn

Pingback: viagra online prescription

Pingback: personal loans

Pingback: cbd oil for cancer patients

Pingback: c4 health labs cbd oil

Pingback: viagra for men price

Pingback: buy viagra in usa online

Pingback: best all natural viagra

Pingback: cbd oil for anxiety in children

Pingback: sildenafil 88

Pingback: does cbd oil fight pain

Pingback: viagra nyc

Pingback: generic viagra online in canada

Pingback: cbd hemp oil capsules

Pingback: cbd oil for pain dosage

Pingback: where can i get sildenafil 100mg

Pingback: how much cbd oil for pain relief

Pingback: how to obtain viagra

Pingback: buy cheap essay

Pingback: write essay

Pingback: college essay writing service reviews

Pingback: united airline seat assignment

Pingback: cheap essays

Pingback: best pharmacy prices for sildenafil

Pingback: pay for essay online

Pingback: college essay writing services

Pingback: american essay writing service

Pingback: cleocin 150mg coupon

Pingback: clomid online

Pingback: wholesale viagra

Pingback: Buy viagra us

Pingback: clonidine 0,1 mg canada

Pingback: cheapest clozaril

Pingback: colchicine 0,5 mg medication

Pingback: ebay cialis

Pingback: symbicort inhaler 160/4,5 mcg cheap

Pingback: Levitra vs viagra

Pingback: where can i buy combivent

Pingback: coreg otc

Pingback: compazine 5mg nz

Pingback: coumadin 5 mg otc

Pingback: viagra 50mg 100mg

Pingback: what is a good essay writing service

Pingback: dissertation for dummies

Pingback: crestor nz

Pingback: cymbalta medication

Pingback: dapsone caps cost

Pingback: ddavp without a prescription

Pingback: depakote 500 mg online

Pingback: How to get viagra

Pingback: order diamox 250 mg

Pingback: differin united kingdom

Pingback: cheapest diltiazem

Pingback: doxycycline without prescription

Pingback: dramamine 50 mg medication

Pingback: elavil coupon

Pingback: erythromycin 500mg united kingdom

Pingback: etodolac united states

Pingback: cheap flomax 0,2mg

Pingback: garcinia cambogia 100caps tablet

Pingback: geodon 80 mg online pharmacy

Pingback: hyzaar online

Pingback: pharmacy

Pingback: imdur 60mg usa

Pingback: how to purchase imitrex 25 mg

Pingback: imodium 2mg no prescription

Pingback: click now

Pingback: cheapest imuran 25 mg

Pingback: indocin no prescription

Pingback: lamisil online

Pingback: levaquin cost

Pingback: lopid 300mg no prescription

Pingback: lopressor 50 mg tablets

Pingback: cheap luvox

Pingback: how to buy macrobid

Pingback: meclizine australia

Pingback: mestinon coupon

Pingback: micardis united states

Pingback: mobic uk

Pingback: motrin 600 mg online pharmacy

Pingback: how to purchase nortriptyline

Pingback: periactin 4mg purchase

Pingback: phenergan online pharmacy

Pingback: plaquenil uk

Pingback: prednisolone without a prescription

Pingback: how to buy prevacid

Pingback: cheap proair inhaler

Pingback: procardia without a prescription

Pingback: proscar otc

Pingback: protonix 40mg without a prescription

Pingback: pulmicort 200 mcg cost

Pingback: reglan 10 mg prices

Pingback: does prednisone make dogs sleepy

Pingback: how to purchase remeron 30mg

Pingback: retin-a cream 0.025% australia

Pingback: revatio prices

Pingback: cheapest risperdal

Pingback: robaxin 500 mg otc

Pingback: rogaine united kingdom

Pingback: how to purchase seroquel

Pingback: where to buy singulair

Pingback: skelaxin over the counter

Pingback: cheap spiriva 9 mcg

Pingback: where can i buy tenormin

Pingback: thorazine 100mg over the counter

Pingback: order toprol 100mg

Pingback: tricor 200mg canada

Pingback: valtrex usa

Pingback: verapamil 40 mg canada

Pingback: voltaren tablet

Pingback: wellbutrin for sale

Pingback: buy cialis withourt prescription

Pingback: zanaflex 4mg over the counter

Pingback: zestril without a doctor prescription

Pingback: Bonuses

Pingback: where can i buy zocor

Pingback: cheap zovirax 800 mg

Pingback: different types of viagra

Pingback: zyprexa for sale

Pingback: where can i buy zyvox 600mg

Pingback: sildenafil purchase

Pingback: tadalafil 20 mg without prescription

Pingback: order furosemide 100 mg

Pingback: escitalopram 20 mg medication

Pingback: where can i buy aripiprazole

Pingback: cialis daily use buy online

Pingback: pioglitazone 30mg otc

Pingback: how to purchase spironolactone

Pingback: order fexofenadine

Pingback: glimepiride pharmacy

Pingback: meclizine united states

Pingback: leflunomide 10mg cost

Pingback: buy atomoxetine

Pingback: donepezil 5mg pills

Pingback: anastrozole 1mg uk

Pingback: irbesartan 150 mg generic

Pingback: dutasteride medication

Pingback: order olmesartan 20 mg

Pingback: buspirone canada

Pingback: cheap clonidine 0.1 mg

Pingback: buy cefuroxime 500 mg

Pingback: cialis and dapoxetine canada

Pingback: celecoxib purchase

Pingback: citalopram 10 mg cost

Pingback: cephalexin tablets

Pingback: where can i buy ciprofloxacin

Pingback: loratadine pharmacy

Pingback: clindamycin tablets

Pingback: clozapine price

Pingback: prochlorperazine 5mg tablet

Pingback: cialis reviews photos

Pingback: carvedilol 6.25 mg for sale

Pingback: where can i buy warfarin

Pingback: rosuvastatin 5mg medication

Pingback: divalproex 250 mg coupon

Pingback: trazodone 25 mg australia

Pingback: where to buy tolterodine

Pingback: acetazolamide online

Pingback: fluconazole 100mg nz

Pingback: phenytoin 100mg online pharmacy

Pingback: oxybutynin online

Pingback: doxycycline 100 mg online pharmacy

Pingback: generic name for viagra

Pingback: bisacodyl 5mg online pharmacy

Pingback: venlafaxine otc

Pingback: amitriptyline 10mg over the counter

Pingback: cialis professional generic

Pingback: permethrin medication

Pingback: erythromycin coupon

Pingback: estradiol 1 mg united kingdom

Pingback: etodolac 200mg for sale

Pingback: where to buy tadalafil without prescriptions

Pingback: cost of nitrofurantoin 100 mg

Pingback: buy viagra in boots

Pingback: order glipizide

Pingback: cost of hydrochlorothiazide 10 mg

Pingback: order isosorbide

Pingback: sumatriptan 25 mg australia

Pingback: azathioprine 25mg purchase

Pingback: how to purchase terbinafine

Pingback: digoxin 0.25mg pharmacy

Pingback: levothyroxine mcg for sale

Pingback: augmentin 600 42.9 mg

Pingback: buy lasix water pill

Pingback: buy zithromax online canada

Pingback: atorvastatin 20 mg online pharmacy

Pingback: ivermectin cost uk

Pingback: albuterol tablets brand name

Pingback: gemfibrozil 300 mg without a prescription

Pingback: metoprolol online

Pingback: doxycycline dose

Pingback: prednisolone tablets 1mg

Pingback: nolva and clomid

Pingback: dapoxetine review reddit

Pingback: diflucan men

Pingback: synthroid retail price

Pingback: where can i buy metoclopramide

Pingback: help with thesis

Pingback: what is the best college essay editing service

Pingback: doctors using hydroxychloroquine

Pingback: cialis 2.5 mg cost

Pingback: propecia shedding pictures

Pingback: order hydroxychloroquine online canada

Pingback: vidalista vs vidalista daily

Pingback: neurontin and lyrica

Pingback: metformin recall 2020

Pingback: paxil for pe

Pingback: plaquenil efficacy

Pingback: tadalafil buy online canada

Pingback: youtube hydroxychloroquine treatment update

Pingback: lasix generic pills

Pingback: where can i buy cialis online usa

Pingback: tinder which way to swipe

Pingback: lovooeinloggen.com

Pingback: best free american dating site

Pingback: cialis vs viagra reddit

Pingback: free safe online dating

Pingback: searching free dating websites for meeting southern red neck girls

Pingback: dating chat line free trial

Pingback: canada free online dating

Pingback: free over 50 dating uk

Pingback: free turkish dating website

Pingback: best free online dating

Pingback: millionaire dating site free

Pingback: free islamic dating sites

Pingback: alexandra daddario dating

Pingback: aaron rodgers dating shailene woodley

Pingback: chloe bennet dating

Pingback: free lds single dating sites

Pingback: free keto diet app

Pingback: shopping list for keto diet

Pingback: keto crepes

Pingback: free cialis sample pack

Pingback: atorvastatin price without insurance

Pingback: cost of viagra

Pingback: online viagra prescription

Pingback: cheap viagra online

Pingback: buy sildenafil online

Pingback: i want to buy cialis

Pingback: cialis tablet

Pingback: cialis online no prescription

Pingback: buy viagra

Pingback: cialis canada

Pingback: amoxicillin empty stomach

Pingback: cialis daily

Pingback: sildenafil citrate 100mg

Pingback: sildenafil 20mg

Pingback: propecia efectos secundarios

Pingback: where can i get cialis

Pingback: prednisone pill 20 mg

Pingback: viagra pills

Pingback: ivermectin 3

Pingback: super active cialis

Pingback: how to buy viagra in australia

Pingback: buy tadalafil 20 mg from india

Pingback: dosing ivermectin 1.87% for humans

Pingback: how to get female viagra pills

Pingback: stromectol antiparasitic potassium 875

Pingback: how to buy cialis

Pingback: zithramax pregnancy

Pingback: free ventolin inhaler

Pingback: ivermectin american journal of therapeutics

Pingback: viagra pills sa

Pingback: buy viagra online in the usa without a perscription

Pingback: price cialis vs viagra

Pingback: generic cialis cvs

Pingback: chemone research tadalafil

Pingback: z pack zithromax

Pingback: where to buy viagra in melbourne australia

Pingback: viagra on line

Pingback: what does lisinopril cough sound like

Pingback: sildenafil viagra

Pingback: dapoxetine 60 mg online india

Pingback: azithromycin for chlamydia over the counter

Pingback: viagra for sale

Pingback: viagra pills for men

Pingback: genuine viagra without a doctor prescription

Pingback: viagra for men

Pingback: viagras

Pingback: natural viagra

Pingback: viagra alternatives

Pingback: hims viagra

Pingback: buying viagra

Pingback: viagra cock

Pingback: viagra amazon

Pingback: stromectol tablets

Pingback: pfizer viagra price

Pingback: cialis dosing

Pingback: cialis goodrx

Pingback: ivermectin bestellen

Pingback: flccc ivermectin

Pingback: ivermectin 500mg

Pingback: buy ivermectin pills

Pingback: generic cialis daily use

Pingback: viagra natural

Pingback: stromectol 0 5 mg

Pingback: generique cialis

Pingback: generic tadalafil

Pingback: buy cialis online fast delivery

Pingback: cialis tubs

Pingback: cialis pricing

Pingback: order ivermectin for humans

Pingback: how to buy sildenafil tablets

Pingback: purchase sildenafil pills

Pingback: cialis amazon

Pingback: cialis by mail

Pingback: molnupiravir eua

Pingback: can you buy cialis in canada

Pingback: levitra vs cialis

Pingback: price of ivermectin

Pingback: prednisone side effects in dogs

Pingback: sildenafil citrate

Pingback: cialis best price

Pingback: best online casino

Pingback: ivermectin for humans over the counter

Pingback: stromectol for head lice

Pingback: new no deposit casinos accepting us players

Pingback: buy female viagra online cheap

Pingback: ivermektin

Pingback: get stromectol online

Pingback: ivermectin buy online

Pingback: push health ivermectin

Pingback: furosemide brand name

Pingback: order furosemide online

Pingback: the lancet ivermectin

Pingback: ivermectin uk boots

Pingback: ivermectin rezeptfrei

Pingback: ivermectin over the counter uk

Pingback: ivermectin 6 mg tablets

Pingback: luckyland slots casino sign in

Pingback: generic name for ivermectin

Pingback: ivermectin use

Pingback: ivermectin kaufen schweiz

Pingback: buy stromectol online

Pingback: buy ivermectin cream

Pingback: cost of ivermectin medicine

Pingback: ivermectin oral 0 8

Pingback: purchase stromectol online

Pingback: cialis website

Pingback: stromectol 0.1

Pingback: buy stromectol online

Pingback: ivermectin eye drops

Pingback: bahis siteleri

Pingback: ivermectin 50 mg

Pingback: stromectol oral

Pingback: A片

Pingback: best place to buy generic propecia

Pingback: best site to buy generic propecia

Pingback: Can I drink coffee 2 hours after antibiotics hydroxychloroquine study

Pingback: What is the rarest cardiovascular disease Lisinopril

Pingback: Buy Stromectol 3mg: Is Egg good for liver

Pingback: Buy Online | Is 30 minutes of walking a day enough overnighted Cialis for men

Pingback: vidalista 20 buy fildena 50mg pills

Pingback: femara breast cancer

Pingback: What keeps a man in a relationship?

Pingback: How long does it take for strong antibiotics to leave your system stromectol online

Pingback: Does banana increase sperm count?

Pingback: Does Zoloft help schizophrenia aripiprazole 10 mg tablet

Pingback: Comment resserrer les liens familiaux cialis sans ordonnance paris

Pingback: How can I open my lungs without an inhaler albuterol inhaler with counter

Pingback: How long do antibiotics last

Pingback: When to stop taking antibiotics

Pingback: How long after antibiotics can you eat

Pingback: Can antibiotics weaken your immune system

Pingback: Can you drink coffee with antibiotic

Pingback: Can antibiotics do more harm than good

Pingback: Can I drink tea with antibiotics

Pingback: Can antibiotics do more harm than good

Pingback: Should I stay home when taking antibiotics

Pingback: Can I take antibiotics right before bed

Pingback: antibiotic tablets name

Pingback: Which foods feed viruses

Pingback: What will destroy most bacteria

Pingback: Does your immune system get stronger with antibiotics

Pingback: Do antibiotics make you depressed

Pingback: Comment Fait-on l'amour a une femme enceinte achat cialis en ligne

Pingback: What are signs that you are drinking too much alcohol stromectol 3mg information

Pingback: Which is better Advair or albuterol albuterol inhaler dosage

Pingback: Why asthmatics can't take ibuprofen ventolin inhaler extender instructions?

Pingback: What happens just before heart failure hygroton tabs disc

Pingback: average cost of albuterol inhaler | Inhalers and anxiety: can they help manage symptoms?

Pingback: Quelle est la taille moyenne d'un zizi chinois viagra sans ordonnance

Pingback: Quel symbole represente la famille | tadalafil lilly 5mg prix

Pingback: synthroid 50 mcg price | Water retention and bloating can contribute to weight gain in individuals with an underactive thyroid

Pingback: Qui est le plus jeune des jumeaux levitra generic

Pingback: Quels sont les annees difficiles dans un couple viagra pharmacie

Pingback: Where is the stress in love | vidalista 60

Pingback: How do you know if a girl wants to be touched vidalista ct review

Pingback: Lack of energy and chronic tiredness can contribute to feelings of frustration, helplessness, and decreased self-esteem?

Pingback: Reduced or altered sense of smell can be associated with thyroid deficiency?

Pingback: How does the use of certain blood pressure medications affect ovulation?

Pingback: Can cholesterol levels be reduced by consuming chia seeds or chia seed oil

Pingback: Who first saw sperm - 50 mg viagra price

Pingback: Is coffee good for prostate - kamagra 100mg tablets usa

Pingback: Which fruit is rich in vitamin B12?

Pingback: What medications Cannot be taken with apple cider vinegar?

Pingback: Quels sont les 3 types de familles - pharmacie viagra

Pingback: Supportive care measures help manage side effects of breast cancer treatment - Nolvadex (Tamoxifen) uses, side, effects

Pingback: How do I make my husband want me | levitra tablet

Pingback: Can over the counter drugs affect cognitive function in children. viagra over the counter

Pingback: How to get a hard on at 60 | sildenafil 100mg oral

Pingback: Stromectol 3mg information

Pingback: albuterol

Pingback: How do you know if a man is still fertile | how much is levitra

Pingback: What foods cause fatty liver - plaquenil 200 interaciones

Pingback: Can I get medication for attention deficit hyperactivity disorder during pregnancy from an online pharmacy

Pingback: What happens if you drink apple cider vinegar everyday?

Pingback: How do you know if you need a probiotic ivermectin use?

Pingback: Can I drink 4 days after antibiotics stromectol for sale?

Pingback: What tea works as an antibiotic stromectol?

Pingback: How do I make my liver healthy again stromectol 3mg information?

Pingback: Can antibiotics be used to treat infections in patients with infected central lines and central line-associated bloodstream infections stromectol 3mg dosage?

Pingback: Can bacterial diseases be transmitted through contact with contaminated surfaces in public restrooms Buy stromectol and ivermectin 3mg lowest price, bonus pills?

Pingback: Who should not use Primatene Mist budesonide inhaler dose?

Pingback: Does snorting Flexeril get you High ventolin?

Pingback: What are 3 types of inhalers?

Pingback: How do medications help control asthma?

Pingback: Can you walk into a pharmacy and buy an inhaler?

Pingback: online pharmacy program?

Pingback: eckerd pharmacy store locator?

Pingback: Can I stop antibiotics early Azithromycin 1000mg?

Pingback: How are bacterial diseases diagnosed?

Pingback: How do you cleanse a fatty liver?

Pingback: How many days does it take for sperm to refill??

Pingback: How long should I walk to lose belly fat??

Pingback: How can I make my mood romantic in bed cialis headache??

Pingback: What is the alternative to erectile dysfunction??

Pingback: What are the effects of chronic use of benzodiazepines on erectile function??

Pingback: How many times can sperm be used??

Pingback: There are also several over-the-counter supplements and natural remedies that claim to help with premature ejaculation.?

Pingback: Men with premature ejaculation may benefit from talking to a therapist about any underlying psychological issues that may be contributing to their problem.?

Pingback: Can antibiotics prevent infection in prosthetic joint replacements??

Pingback: How do I turn my man on with touch??

Pingback: Can a woman give birth to 10 babies at once Cenforce ca??

Pingback: Medications and Heartburn Relief: Restoring Digestive Comfort cost fildena 50mg.

Pingback: Medications and Sinus Health - Relieving Congestion and Pressure ivermectin for fleas

Pingback: What time of day is blood pressure highest order stromectol over the counter?

Pingback: How can I make my ex jealous levitra vs cialis?

Pingback: How do you know if sperm is strong levitra prescribing?

Pingback: When did the first man have a baby levitra generic name?

Pingback: What to text a guy to make him smile in the morning vardenafil?

Pingback: Telehealth and Mental Wellness - Virtual Support for All order furosemide 100mg generic?

Pingback: Medications and Neurological Disorders - Restoring Brain Function ivermectin for mites?

Pingback: Medications and Skin Health - Enhancing Beauty and Well-being ivermectin?

Pingback: Medications and Bladder Control - Regaining Urinary Continence how much ivermectin to give a dog with mange?

Pingback: Medications and Sexual Wellness - Rediscovering Intimacy buy priligy in the us?

Pingback: Medications and Dry Eye Relief - Nurturing Ocular Comfort stromectol 3mg?

Pingback: Medications - Empowering Patients to Take Charge of Their Health where can i buy kamagra?

Pingback: How are teleaudiology services contributing to improved hearing healthcare for children and adults Azithromycin 250mg tab?

Pingback: Medications and Eye Health - Clear Vision for a Bright Future plaquenil 200 mg para que sirve?

Pingback: Medications and Skin Disorders - Restoring Radiance, Nurturing Skin Health tadalafil vidalista?

Pingback: Medications for Every Stage of Life - From Infants to Seniors how can i get ventolin now?

Pingback: oral medication for scabies?

Pingback: The Power of Medical Imaging - From X-rays to MRI furosemide 12.5?

Pingback: Medications - Unlocking the Potential for Health Breakthroughs ventolin hfa inhaler for cough?

Pingback: buy dapoxetine priligy online?

Pingback: plaquenil for lupus?

Pingback: Medications - Unlocking New Possibilities in Disease Management buy generic Cenforce 50mg?

Pingback: The Role of Medications in Managing Chronic Pain can i buy dapoxetine in columbia sc?

Pingback: Medications and Radiation Therapy - Minimizing Side Effects, Maximizing Benefits buy priligy online?

Pingback: Medications and Renal Health - Preserving Kidney Function viagra pill for men price?

Pingback: Sepsis - A Silent Killer in Healthcare buy ivermectin?

Pingback: Can bacterial diseases be transmitted through contact with contaminated surfaces in construction sites for hygiene ivermectin stromectol?

Pingback: What happens if parasites go untreated buy stromectol scabies online?

Pingback: What is the best drink for COPD patients albuterol sulfate inhaler?

Pingback: What does a blue inhaler do buy albuterol?

Pingback: Why do men need to be strong fildena super active 100mg?

Pingback: What parasite makes you tired z pack antibiotic side effects?

Pingback: How long can the average man stay erect viagra pill over the counter

Pingback: Can I request a different form for my pills, such as a sublingual tablet can you buy priligy online

Pingback: At what age does balance decline generic levitra cheap

Pingback: How do you touch a man's heart how much is a viagra pill

Pingback: furosemide 40 mg tablets

Pingback: albuterol inhalation solution

Pingback: dapoxetine usa

Pingback: viagra pill cvs

Pingback: ivermectin online order

Pingback: Which sperm is more fertile??

Pingback: How long will it take for him to miss me no contact??

Pingback: How long does it take a guy to realize he wants to marry you??

Pingback: Does Preejaculatory fluid have sperm??

Pingback: priligy buy online - How can you make a guy miss you?

Pingback: ventolin hfa 90 mcg inhaler

Pingback: buy tadalafil 10mg + dapoxetine 30mg

Pingback: vidalista 10

Pingback: dapoxetine usa

Pingback: buy kamagra online next day delivery

Pingback: Where to Buy Generic clomid

Pingback: ventolin inhaler generic name

Pingback: tab dapoxetine

Pingback: Buy clomiphene citrate for men

Pingback: hydroxychloroquine. where to buy

Pingback: Azithromycin 250 mg

Pingback: androgel prescription online

Pingback: purchase Cenforce pill

Pingback: female testosterone gel

Pingback: proair hfa 90 mcg inhaler

Pingback: androgel packets

Pingback: androgel 1%

Pingback: what is priligy 60 mg (dapoxetine)

Pingback: testosterone gel 1.62

Pingback: cialis canadian pharmacy ezzz

Pingback: buy vilitra

Pingback: furosemide 40 mg

Pingback: revatio

Pingback: amoxil pills

Pingback: cenforce 150 india

Pingback: revatio drug

Pingback: Can antibiotics make you feel sick and tired plaquenil for lupus?

Pingback: Anonymous

Pingback: cialis tadalafil dapoxetine

Pingback: cenforce 100 india

Pingback: kamagra jellies

Pingback: buy fildena 50mg online

Pingback: clomid for sale

Pingback: priligy

Pingback: zithromax

Pingback: lasix

Pingback: lipitor 80 mg dose

Pingback: where can i buy kamagra over the counter

Pingback: cenforce 50

Pingback: fluticasone salmeterol 250 50

Pingback: generic drug for advair

Pingback: cenforce centurion laboratories

Pingback: cenforce 50

Pingback: Sildenafil 50mg Price

Pingback: stromectol over the counter

Pingback: Sildenafil prescriptions over internet

Pingback: order furosemide 100mg generic

Pingback: cenforce d price in india

Pingback: furosemide 40 mg side effects

Pingback: cenforce 200mg price in india

Pingback: can i take 200 mg of Sildenafil

Pingback: vidalista 20

Pingback: buy fildena online

Pingback: cialis india

Pingback: loniten pills

Pingback: vardenafil hcl 20mg tab

Pingback: tadalafil cost 5mg

Pingback: advair diskus price

Pingback: ventolin inhaler extender instructions

Pingback: cenforce 100 uses in hindi

Pingback: fildena 120

Pingback: Salmeterol + Fluticasone Propionate

Pingback: Sildenafil side effects long term

Pingback: vidalista 20 kaina

Pingback: Cenforce 100

Pingback: Sildenafil 20 mg Tablet Dosage

Pingback: drug advair

Pingback: lloyds pharmacy kamagra

Pingback: clindagel cost

Pingback: kamagra chewable tablets

Pingback: kamagra pharmacy v

Pingback: imitrex med

Pingback: kamagra oral jelly buy online

Pingback: vidalista effects

Pingback: Sildenafil 20 mg

Pingback: ventolin inhaler salbutamol

Pingback: stromectol walgreens

Pingback: ivera 6

Pingback: covimectin

Pingback: vermovent 12

Pingback: ivermectol 12 price

Pingback: iverscab 12 mg

Pingback: ivermectin online order

Pingback: ivermectol 12mg tab

Pingback: vermact medicine

Pingback: vidalista 20 (tadalafil)

Pingback: vidalista 20

Pingback: levitra generic

Pingback: cialis super active avis

Pingback: fildena over the counter

Pingback: sildenafil 100mg oral

Pingback: fildena 100mg uk

Pingback: fildena 50

Pingback: vidalista 60mg

Pingback: vidalista 40 online

Pingback: prednisone 10mg tablets

Pingback: clomid tablets over the counter

Pingback: buy dapoxetine usa

Pingback: clomid for men

Pingback: sildenafil & dapoxetine tablet reviews

Pingback: dapoxetine

Pingback: how much is 20 mg of cialis

Pingback: vardenafil hcl 20mg

Pingback: prednisone and weight gain

Pingback: cenforce 200 mg price

Pingback: where to buy fildena 100

Pingback: Sildenafil Generic Price

Pingback: how to get a viagra prescription from your doctor

Pingback: Cheap clomid without insurance

Pingback: buy qvar inhaler online

Pingback: androgel price

Pingback: revatio ed

Pingback: does rybelsus cause constipation

Pingback: rybelsus discount card

Pingback: rybelsus cost without insurance

Pingback: rybelsus 3 mg

Pingback: cialis and levitra

Pingback: vilitra 40

Pingback: kamagra24

Pingback: motilium

Pingback: motilium zwangerschap

Pingback: motilium nz

Pingback: buy levitra online

Pingback: vida lista de canciones

Pingback: ivecop12

Pingback: vermact 12 mg tablet uses

Pingback: iverhope 6 mg

Pingback: ivermectine arrow lab 3 mg

Pingback: scavista 12mg

Pingback: vidalista 5 mg

Pingback: stromectol cream

Pingback: buy cenforce 100 from india

Pingback: order amoxil 250mg generic

Pingback: buy amoxicillin 500mg

Pingback: super p force price indiamart

Pingback: where can i buy dapoxetine

Pingback: sildigra xl plus

Pingback: sildigra black force 200 mg

Pingback: buy suhagra

Pingback: fildena side effects

Pingback: cenforce 25

Pingback: fildena extra power

Pingback: vidalista 40

Pingback: vidalista 20 side effects

Pingback: stendra avanafil price

Pingback: femara long term side effects

Pingback: kamagra cost

Pingback: fildena 50

Pingback: ivermite 6mg tablet

Pingback: tadalafil 20mg dapoxetine 60mg

Pingback: cheap levitra

Pingback: п»їclomiphene

Pingback: keflex 500 mg

Pingback: generic xenical

Pingback: revatio

Pingback: cost of vardenafil

Pingback: cenforce 200 price

Pingback: vidalista 60 usa

Pingback: Azithromycin 500mg uses

Pingback: ivercid 6

Pingback: priligy tablets 60 mg

Pingback: vidalista 40

Pingback: cialis together

Pingback: Can you Buy clomid

Pingback: clincitop cream use

Pingback: probenecid 500 mg

Pingback: isotroin ointment

Pingback: nubeta h

Pingback: lasixotc.com

Pingback: levitrafrance.com

Pingback: viastoreus.com

Pingback: buy cenforce pills online

Pingback: cenforce 100mg price

Pingback: malegra-200

Pingback: clomiphene

Pingback: cheap generic viagra on line

Pingback: cuanto sale viagra en argentina

Pingback: viagra cheap shipping

Pingback: vardenafil india

Pingback: buy cialis online

Pingback: priliforyou.wordpress.com

Pingback: lasiinfo.wordpress.com

Pingback: 50 mg clomid

Pingback: zithromax 500

Pingback: strmcl.wordpress.com

Pingback: buy avanafil singapore

Pingback: cathopic.com/@almox

Pingback: vigrakrs.com

Pingback: levitra canadian

Pingback: sildenafil generic

Pingback: cialis daily and diabetes

Pingback: Erectile Dysfunction may be associated with cardiovascular risk factors, which should be assessed before prescribing viagra.

Pingback: ivecop 12 tablet uses

Pingback: fildena.homes

Pingback: cenforce360.com

Pingback: Ventolin inhaler 90 mcg is for children

Pingback: Azithromycin to treat chlamydia

Pingback: Vidalista tadalafil 20mg

Pingback: kamagra sildenafil

Pingback: ivermectol 6

Pingback: Vidalista

Pingback: taking kamagra on holiday

Pingback: buy sildriga

Pingback: erectile dysfunction jelly

Pingback: tadala black online buy

Pingback: cenforce

Pingback: how to get prescription drugs

Pingback: Fildena double 200 mg

Pingback: Generic clomid without dr prescription

Pingback: cipla avanafil tablet

Pingback: cialis india

Pingback: how do you treat low sodium levels

Pingback: buy clomid for pct

Pingback: acheter Nolvadex en pharmacie

Pingback: tadapox 20 mg

Pingback: tadasoft 40

Pingback: priligy de 30 o 60 mg

Pingback: Fildena 100mg cheap

Pingback: can u buy amoxicillin online

Pingback: cenforce 50 review

Pingback: probenecid brand

Pingback: buy albuterol

Pingback: alphagan p package insert

Pingback: super p force mg

Pingback: scavista 12 composition

Pingback: dapoxetine hydrochloride tablets ip 60 mg

Pingback: Cenforce 100 sildenafil

Pingback: cenforceindia.comcenforce-200.html

Pingback: stromectolverb.com

Pingback: otclevitra.com

Pingback: vidalista.lol

Pingback: cipillsvi.com

Pingback: cenforceindia.comcenforce-25.html

Pingback: zithromaxotc.com

Pingback: viagrabelgique.com

Pingback: romanviagra.com

Pingback: cenforceindia.com

Pingback: ventolinhfaer.com

Pingback: zithrominimax.com

Pingback: iwermectin.com

Pingback: lipitor cost

Pingback: cheap black cialis

Pingback: Nolvadex chest pains

Pingback: stromectol online

Pingback: cenforce 50 price in india

Pingback: side effects of albuterol inhaler

Pingback: super kamagra tablets

Pingback: levolin inhaler vs asthalin inhaler

Pingback: Levitra effectiveness

Pingback: +38 0950663759 – Володимир (Сергій) Романенко, Одеса – Оплатив передоплату — прийшло сміття, не вмикається. Гнида ігнорує, не зв?язуйтеся з ним.

Pingback: tadarise 20 mg oral jelly

Pingback: Fildena 100mg

Pingback: is silagra safe to use

Pingback: malegra gin

Pingback: prescriber directions for Ventolin

Pingback: Fildena cost

Pingback: priligy la where to buy

Pingback: tadalafil daily use

Pingback: priligy uk

Pingback: priligy cvs

Pingback: cheapest generic Levitra