Tesla Motors Corp (NASDAQ: TSLA) did not surprise investors this time, missing analyst expectations by $0.01 with an EPS of $0.11 while the predicted EPS was $0.12. This does not come as a surprise as Tesla plans the Gigafactory site and Model X production. At best at least the stock does not fall much since earnings were flat. Executives don’t want to share too much forecasting or “show all their cards” dismissing an analyst’s question about the forecast. Goldman Sach analyst seems pessimistic about Tesla’s future deliveries and wonder about the risks and how deliveries can go from 78 to 13,000 in one quarter. Tesla Motors says demand is not an issue at all, they can launch new retail sales. They said production is the main issue and service centers right now. One man in china was so upset about the slow delivery that he bashed his car in, according to the executive speaking. Tesla states their earnings per square foot is double that of Apple’s.

Link to Call: Click here to see link to call - 5:30pm EST Expectations:

$811mm in Q2 with $3.4mm in profits and ($0.11) EPS or $0.03-$0.04 Adjusted EPS compared to last quarter’s $0.12.

Sales in China are the biggest question. Investors are encouraged to participate in the company before sales in China start growing fast, by then the stock price may climb too high. 21,000 sales are expected globally with 14,000 units being sold domestically totaling 35,000 expected annual deliveries. Tesla’s adjusted gross margin at 25.4% is double compared to traditional car makers, and if their margin falls significantly this could factor into the stock price as well.

Earnings Call Results:

Net Income of $16mm and $0.11 EPS

Partnership agreement between Panasonic and Tesla to develop the Gigafactory.

8,763 Model S cars were sold during the quarter, up 16% from Q1. Less than a day, is the average time to service a customer and fix a car.

They can pick up a car from an office and fix the car and bring it back, before the customer even finishes work.

Quarter 2 Model S orders increased the most in North America and Europe Non-GAAP revenue increased 55% to $858 million compared to Q1.

Profit Margins increased slightly from 25.4% to 26.8% excluding ZEV credits.

R&D up 37% to $93 million on a non-GAAP basis due to Model X development costs

SG&A up 20% at $117 million -Underwriters contributed $267 million in cash providing a total of $2.7 billion in cash to Tesla.

Panasonic isn’t providing much input on the development of the gigafactory site.

Tesla is primarily in charge of evaluating the sites used.

A lot of discussions on the call about the technical and chemistry standpoints of the battery production.

Tesla executives convinces he analysts that the chemistry is well understood, and that it’s just a series of checklists on what they have to do next.

Expectations for Q3

-9000 cars for Q3 taking into account the two week factory shut down in Fremont; otherwise 11,000 units predicted.

-Expectation of 7,800 Model S vehicles in Q3.

-28% profit margin by the end of this year without the ZEV credits

-Expectations to lease 300 cars in Q3 ,and more in Q4

-Increase of $100mm from prior guidance for investment between $750mm and $950mm in 2014.

For the stock to soar, we need to see that Tesla beats deliveries expectations, earning expectations and increases gross margins.

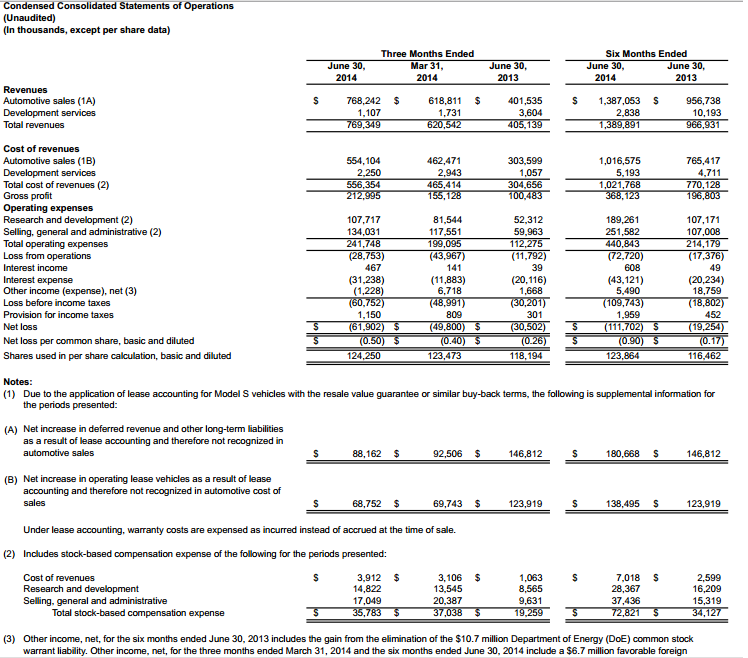

Financials Tesla Financial (Tesla.com)

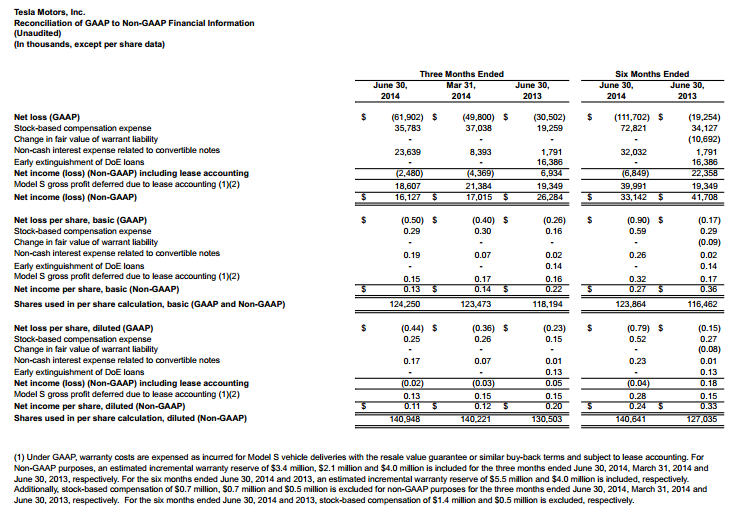

Tesla Financial Non-GAAP (Tesla.com)

Tesla Financial Non-GAAP (Tesla.com)

Pingback: viagra without rx

Pingback: otc cialis

Pingback: buy generic cialis

Pingback: generic cialis canada

Pingback: order cialis online

Pingback: viagra 100mg

Pingback: erectile dysfunction drugs

Pingback: men's ed pills

Pingback: erection pills viagra online

Pingback: canadian pharmacy

Pingback: canadian online pharmacy

Pingback: canadian pharmacy online

Pingback: cialis online

Pingback: Get cialis

Pingback: levitra pills

Pingback: vardenafil online

Pingback: generic vardenafil

Pingback: caesars casino online

Pingback: online casino usa real money

Pingback: online viagra prescription

Pingback: casino online slots

Pingback: online slots

Pingback: loans online

Pingback: cash loan

Pingback: cash payday

Pingback: viagra cost

Pingback: 20 cialis

Pingback: best real money online casinos

Pingback: online slot casinos usa

Pingback: online casino for real cash

Pingback: casino slot games for ipad

Pingback: CafeCasino

Pingback: new cialis

Pingback: buy cialis

Pingback: generic cialis

Pingback: cialis internet

Pingback: generic viagra names

Pingback: slot machines

Pingback: doubleu casino

Pingback: best casino online

Pingback: real online casino

Pingback: generic viagra 100mg

Pingback: discount viagra

Pingback: generic viagra online

Pingback: order viagra

Pingback: generic for viagra

Pingback: generic viagra without subscription walmart

Pingback: viagra prices

Pingback: tadalafil dosage

Pingback: canadian viagra

Pingback: buy viagra uk

Pingback: viagra dosage

Pingback: viagra 100mg pills generic

Pingback: viagra pills

Pingback: where can you buy viagra without a prescription

Pingback: where can i buy non prescription viagra

Pingback: how to buy viagra in fort lauderdale

Pingback: cheap viagra

Pingback: buy cialis online

Pingback: Cialis 40 mg australia

Pingback: viagra prescription

Pingback: grassfed.us

Pingback: cialistodo.com

Pingback: pfizer generic viagra

Pingback: cialis 20 mg best price

Pingback: sildenafil side effects

Pingback: cost of catapres 100 mcg

Pingback: cheapest ceclor 250mg

Pingback: ceftin generic

Pingback: celebrex 100mg tablets

Pingback: buy celexa

Pingback: cephalexin 500 mg online pharmacy

Pingback: cipro 1000mg canada

Pingback: online pharmacy viagra

Pingback: hollywood casino

Pingback: real money casino app

Pingback: casino online

Pingback: best online casinos that payout

Pingback: online casino slots no download

Pingback: real casino

Pingback: ocean casino online nj

Pingback: casino online

Pingback: casino moons online casino

Pingback: casino slot games

Pingback: abc car insurance

Pingback: best insurance car

Pingback: buy car insurance quotes

Pingback: geico car insurance quotes official site

Pingback: progressive insurance quote

Pingback: owners car insurance

Pingback: car insurance quotes online

Pingback: 21 century insurance

Pingback: rbc car insurance

Pingback: car insurance quotes rates florida

Pingback: personal loans nh

Pingback: how long viagra side effects last

Pingback: online payday loans no credit check

Pingback: no credit check payday loans

Pingback: installment loans with no credit check

Pingback: quick loans for poor credit

Pingback: bad credit loans long beach ca

Pingback: online pharmacy viagra

Pingback: payday loans near me

Pingback: personal loans nj

Pingback: cbd oil for pain relief

Pingback: can cbd oil affect drug test

Pingback: buy viagra over the counter in australia

Pingback: can you take viagra

Pingback: buy cbd oil with thc

Pingback: cost of viagra pills in india

Pingback: cbd oil side effects in dogs

Pingback: viagra buy online

Pingback: how to use cbd oil

Pingback: buy cbd oil for cancer treatment

Pingback: sildenafil generic

Pingback: connect online homework

Pingback: best female viagra tablet in india

Pingback: pay for essay online

Pingback: step to write an essay

Pingback: write a persuasive essay

Pingback: online homework help

Pingback: pay for essay online

Pingback: write an argument essay

Pingback: viagra 50

Pingback: custom essay writing service reviews

Pingback: best online essay writing service

Pingback: 2nd grade math homework

Pingback: cleocin online

Pingback: clomid 50mg otc

Pingback: clonidine canada

Pingback: sildenafil soft

Pingback: clozaril usa

Pingback: colchicine united states

Pingback: order symbicort inhaler 160/4,5mcg

Pingback: combivent 50/20mcg generic

Pingback: coreg uk

Pingback: cheapest compazine

Pingback: coumadin purchase

Pingback: crestor 10 mg tablet

Pingback: dapsone 1000caps without a doctor prescription

Pingback: where to buy ddavp

Pingback: depakote without a doctor prescription

Pingback: diamox 250 mg prices

Pingback: differin 15g canada

Pingback: order diltiazem

Pingback: doxycycline 100mg online

Pingback: dramamine pharmacy

Pingback: order elavil

Pingback: erythromycin pills

Pingback: etodolac 400 mg tablets

Pingback: cost of flomax 0,4mg

Pingback: flonase nasal spray generic

Pingback: garcinia cambogia caps united kingdom

Pingback: geodon 20 mg online

Pingback: order hyzaar 12,5mg

Pingback: imdur otc

Pingback: cost of imitrex

Pingback: imodium pills

Pingback: my website

Pingback: imuran online pharmacy

Pingback: indocin 75mg united kingdom

Pingback: lamisil tablets

Pingback: lopid 300 mg price

Pingback: lopressor coupon

Pingback: luvox 100mg pills

Pingback: macrobid over the counter

Pingback: where to buy meclizine

Pingback: mestinon without prescription

Pingback: where to buy micardis

Pingback: mobic tablets

Pingback: motrin online

Pingback: how to purchase nortriptyline 25mg

Pingback: periactin online

Pingback: phenergan 25 mg online

Pingback: plaquenil online

Pingback: cost of prevacid 30 mg

Pingback: prilosec uk

Pingback: proair inhaler 100 mcg without a doctor prescription

Pingback: procardia tablet

Pingback: proscar 5mg prices

Pingback: protonix united states

Pingback: provigil cost

Pingback: pulmicort 200 mcg without a doctor prescription

Pingback: pyridium united kingdom

Pingback: reglan 10 mg cost

Pingback: how to purchase retin-a cream 0.05%

Pingback: revatio 20 mg without a prescription

Pingback: risperdal cheap

Pingback: robaxin without a prescription

Pingback: rogaine online pharmacy

Pingback: seroquel 25 mg usa

Pingback: singulair 10mg purchase

Pingback: skelaxin 400 mg medication

Pingback: how to buy spiriva

Pingback: tenormin 25 mg without prescription

Pingback: thorazine 50mg united kingdom

Pingback: toprol prices

Pingback: tricor 160mg price

Pingback: valtrex 1000mg otc

Pingback: verapamil no prescription

Pingback: voltaren 100mg cost

Pingback: wellbutrin 150mg generic

Pingback: zanaflex 2mg cost

Pingback: zestril online

Pingback: click this site

Pingback: cost of zocor 20 mg

Pingback: zovirax australia

Pingback: zyloprim without prescription

Pingback: zyprexa 10 mg nz

Pingback: cheapest zyvox

Pingback: sildenafil pharmacy

Pingback: companies that manufacture hydroxychloroquine

Pingback: tadalafil 60mg canada

Pingback: furosemide cheap

Pingback: escitalopram without a doctor prescription

Pingback: aripiprazole 15 mg prices

Pingback: pioglitazone 15mg over the counter

Pingback: spironolactone 25mg coupon

Pingback: fexofenadine no prescription

Pingback: glimepiride medication

Pingback: meclizine united states

Pingback: leflunomide 10mg canada

Pingback: atomoxetine 10 mg united kingdom

Pingback: donepezil 5mg without prescription

Pingback: cheap anastrozole

Pingback: dutasteride 0,5 mg nz

Pingback: olmesartan 20 mg prices

Pingback: buspirone 10 mg tablet

Pingback: clonidine cheap

Pingback: cefuroxime without a prescription

Pingback: order celecoxib 100 mg

Pingback: citalopram without prescription

Pingback: ciprofloxacin 500 mg united states

Pingback: loratadine medication

Pingback: clindamycin cost

Pingback: clozapine 25 mg nz

Pingback: prochlorperazine 5 mg without a prescription

Pingback: carvedilol online pharmacy

Pingback: warfarin 2 mg cheap

Pingback: cheapest rosuvastatin 5mg

Pingback: desmopressin 10mcg cost

Pingback: divalproex australia

Pingback: where to buy tolterodine 1mg

Pingback: acetazolamide united kingdom

Pingback: fluconazole 50mg generic

Pingback: phenytoin without a doctor prescription

Pingback: oxybutynin 2.5mg pills

Pingback: cheap doxycycline 100 mg

Pingback: bisacodyl united kingdom

Pingback: how to purchase venlafaxine 37.5mg

Pingback: amitriptyline 10mg online

Pingback: permethrin cost

Pingback: erythromycin 250mg united kingdom

Pingback: 141generic2Exare

Pingback: where to buy estradiol 1mg

Pingback: etodolac 300mg over the counter

Pingback: cialis 20 mg duration

Pingback: tamsulosinmg otc

Pingback: where can i buy fluticasone 50mcg

Pingback: alendronate 70mg online pharmacy

Pingback: what is the effect of viagra on females

Pingback: wat kost sildenafil sandoz 100 mg

Pingback: nitrofurantoin 100mg prices

Pingback: glipizide without prescription

Pingback: cheapest isosorbide

Pingback: sumatriptan online

Pingback: precio de cialis

Pingback: cheapest azathioprine

Pingback: propranolol nz

Pingback: can you give stromectol orally

Pingback: cost of levothyroxine mcg

Pingback: amoxil 250mg

Pingback: furosemide 100

Pingback: azithromycin 500 mg pill

Pingback: ivermectin virus

Pingback: buy albuterol 0.083 without a prescription

Pingback: how to purchase gemfibrozil

Pingback: metoprolol without prescription

Pingback: clotrimazole 10g price

Pingback: acne medication doxycycline

Pingback: prednisone vs prednisolone

Pingback: dapoxetine forum

Pingback: diflucan zyrtec

Pingback: overdose synthroid

Pingback: where to buy metoclopramide 10 mg

Pingback: propecia no prescription

Pingback: topamax and neurontin

Pingback: metformin online

Pingback: paxil blood thinner

Pingback: plaquenil toxicity lawsuit

Pingback: tinderentrar.com

Pingback: lovooeinloggen.com

Pingback: 100 free bbw dating site

Pingback: 100 free biker dating sites

Pingback: absolutely free dating sites in usa

Pingback: watch internet dating movie online free

Pingback: dating chat line free trial

Pingback: gilf adult dating sites

Pingback: free poly relationship dating websites

Pingback: free transgurl dating site

Pingback: free dating sites worldwide

Pingback: 100 free uk dating sites

Pingback: dating sites that really work and are totally free

Pingback: online dating conversation starters

Pingback: datingsitesfirst.com

Pingback: Dating online

Pingback: make friends online not dating

Pingback: match.com dating site

Pingback: keto diet and fasting

Pingback: Keto diet t plan

Pingback: best keto recipes

Pingback: sildenafil 100mg

Pingback: purchase viagra online

Pingback: online viagra

Pingback: where to buy sildenafil

Pingback: viagra

Pingback: cialis 20

Pingback: cialis pharmacy

Pingback: cialis 5

Pingback: how to buy cialis online

Pingback: herbal viagra

Pingback: generic viagra 100mg

Pingback: where can i buy cialis cheap

Pingback: sildenafil cost compare

Pingback: liquid tadalafil reviews

Pingback: sildenafil 20 mg

Pingback: how much for cialis pills

Pingback: buy viagra online with mastercard

Pingback: viagra 100mg tablet price in india

Pingback: where can you buy viagra cheap

Pingback: where to order cialis online

Pingback: if i have a viagra prescription can i get the generic

Pingback: tadalafil for women

Pingback: buy liquid tadalafil

Pingback: best place to buy viagra online without prescription

Pingback: viagra street price

Pingback: buy real viagra online

Pingback: without doctor visit viagra

Pingback: buy viagra online

Pingback: viagra for men

Pingback: viagra vs.levitra

Pingback: viagra no prescription

Pingback: whats viagra

Pingback: viagra users group

Pingback: viagra cost

Pingback: alternative to viagra

Pingback: hims viagra

Pingback: walgreens viagra

Pingback: fildena

Pingback: sildenafil over the counter

Pingback: How do you help a man who is hurting levitra vs cialis?

Pingback: Medications and Immune System Boost - Energizing Defenses, Bolstering Health order Cenforce?

Pingback: Medications and Gut Health - Cultivating a Balanced Microbiome generic priligy?

Pingback: Infectious Disease Modeling - Predicting Outbreaks stromectol coupon?

Pingback: Addiction Rehabilitation - Healing Beyond Dependency stromectol online brighter tomorrow?

Pingback: vidalista?

Pingback: stromectol 12mg online order?

Pingback: Medications - Changing Lives, One Dose at a Time vardenafil generic?

Pingback: The Science of Sleep - Secrets to a Restful Night Zithromax 500mg?

Pingback: Telepharmacy - Expanding Access to Medications kamagra usa?

Pingback: Boost Your Health with the Right Medications buy kamagra online india?

Pingback: Transforming Health Care - The Evolution of Medicine and Drugs kamagra chewable 100?

Pingback: Is Deming still relevant when to take cialis for best results?

Pingback: Maternal and Child Health - Ensuring a Bright Beginning buy dapoxetine israel?

Pingback: Do you cough up phlegm with asthma albuterol inhaler for sale?

Pingback: How do u fix a broken relationship order sildenafil generic?

Pingback: How do you know a man loves you deeply generic viagra pill?

Pingback: How do you force phlegm out ventolin inhaler for sale

Pingback: How can I quickly lower my blood pressure bumex vs lasix

Pingback: What are 3 things that can worsen heart failure and why lasix buy online

Pingback: buy sildenafil 100mg pill

Pingback: Cenforce

Pingback: buy dapoxetine 30mg

Pingback: Which vitamin is best for sperm??

Pingback: What supplements should I take for ED??

Pingback: priligy pills - What do men want in a woman?

Pingback: food poisoning antibiotics flagyl

Pingback: buy fildena 50mg generic

Pingback: lady-era viagra for women

Pingback: cialis tablets

Pingback: clomid side effects

Pingback: metronidazole 500mg antibiotic pills

Pingback: priligy 30 mg fiyat

Pingback: tadalista online

Pingback: Nolvadex where to Buy

Pingback: vidalista 20mg

Pingback: buy androgel

Pingback: tadalista 60

Pingback: trt gel

Pingback: avanafil and dapoxetine for sale

Pingback: amox clav 875

Pingback: where can i buy legit priligy pills

Pingback: vilitra 20 mg reviews

Pingback: Can antibiotics be used to treat cholera buy plaquenil?

Pingback: buy zithromax antibiotic

Pingback: kamagra oral jelly 100mg

Pingback: cenforce 2000

Pingback: sildenafil 100mg oral

Pingback: buy hydroxychloroquine

Pingback: buy albuterol inhaler

Pingback: over the counter substitute for furosemide

Pingback: viagra kamagra online

Pingback: Cenforce 200 sildenafil citrate

Pingback: cenforce 150

Pingback: cheap kamagra oral jelly online

Pingback: ivermectin spray

Pingback: vidalista 60

Pingback: Cenforce over the counter equivalent

Pingback: kamagra 50mg

Pingback: buy vidalista

Pingback: loniten 10mg

Pingback: Sildenafil 20 mg in mexico

Pingback: fildena 150

Pingback: Sildenafil pills 100mg

Pingback: super p force tablets

Pingback: Cenforce 100mg without prescription

Pingback: cenforce 200 ervaringen

Pingback: vardenafil tablet

Pingback: how to make levitra more effective

Pingback: scavista 12 mg tablet

Pingback: kamagra uk

Pingback: ivermectol 6

Pingback: stromectol 3mg tablets

Pingback: iverkind 12 tablet uses

Pingback: imrotab 12 mg

Pingback: covimectin 12 signature

Pingback: ivermectol sun pharma

Pingback: vermact plus 12

Pingback: tadalista super active info

Pingback: amoxicillin 850

Pingback: viagra plus dapoxetine buy online

Pingback: loniten prescription online

Pingback: priligy 60

Pingback: vidalista 80

Pingback: buy sildenafil 100mg online

Pingback: cenforce sverige

Pingback: revatio ed

Pingback: buy priligy tablets

Pingback: clomiphene citrate generik

Pingback: does rybelsus help with weight loss

Pingback: rybelsus medication

Pingback: dapoxetine how to buy

Pingback: 10mg motilium

Pingback: celexa for anxiety

Pingback: vidalista black 80

Pingback: kamagra® gold

Pingback: super p force

Pingback: sildigra sildenafil tablets

Pingback: vidalista black 80

Pingback: Cenforce 200 sildenafil citrate

Pingback: Sildenafil otc europe

Pingback: avanafil japan

Pingback: suminat 100 mg

Pingback: suhagra gold

Pingback: cenforce 100mg manufacturer

Pingback: number of puffs in ventolin inhaler

Pingback: super vidalista forum

Pingback: tadapox tadalafil dapoxetine

Pingback: viagra generic

Pingback: buy beclomethasone inhaler

Pingback: buy accutane cream

Pingback: cenforceindia.com

Pingback: tobradex ointment alternative

Pingback: cenforce

Pingback: levitra brand

Pingback: kamaforman.wordpress.com

Pingback: samscainfo.wordpress.com

Pingback: antabforuse.wordpress.com

Pingback: vidalforman.wordpress.com

Pingback: amoxforyou.wordpress.com

Pingback: stromectol near me

Pingback: levitra wiki

Pingback: cathopic.com/@fertomid

Pingback: sketchfab.com/priligy

Pingback: filitra

Pingback: priligy 30 mg ohne rezept

Pingback: vigrakrs.com

Pingback: Nolvadex for women bodybuilding

Pingback: He was surprised how much his inner critic ruled his relationships - until he chose what does a viagra pill do.

Pingback: malegra spain

Pingback: zpak.net

Pingback: cenforce360.com

Pingback: cialis super active opiniones

Pingback: what is tadarise 20

Pingback: super kamagra

Pingback: Vidalista black

Pingback: yasmin 3mg

Pingback: dapoxetine 60mg

Pingback: melphalan class

Pingback: Ventolin inhaler japan

Pingback: isotretinoin capsules

Pingback: ciprofloxacin

Pingback: super p force next day

Pingback: melphalan synthesis

Pingback: kamagra

Pingback: kamagra 100mg price

Pingback: kamagra sildenafil citrate kamagra

Pingback: isotroin

Pingback: revatio pills

Pingback: do you need a prescription for cialis

Pingback: tadapox 20 mg

Pingback: pediatric amoxil dosing calculator

Pingback: revia generic

Pingback: ivcol

Pingback: prednisolone croup

Pingback: generic xenical orlistat

Pingback: vilitra 60mg

Pingback: treatment for low sodium levels

Pingback: what is prednisolone eye drops

Pingback: isotroin 40 mg

Pingback: stromectol walgreens

Pingback: plaxyu.com

Pingback: iwermectin.com

Pingback: stromecinfo.wordpress.com

Pingback: cenforinfo.wordpress.com

Pingback: cenforceindia.comcenforce-150.html

Pingback: cipillsvi.com

Pingback: flagyltb.com

Pingback: vidalista.homes

Pingback: stromectole.com

Pingback: priligype.com

Pingback: vidalista.beauty

Pingback: tadalafilendy.com

Pingback: albyterol.com

Pingback: synthroidtro.com

Pingback: interreg-euro-med.eu/forums/users/fildena-200/

Pingback: datos.cdmx.gob.mx/user/albuterol

Pingback: kamagra oral jelly what is it

Pingback: viagra kamagra

Pingback: isotretinoin rems

Pingback: cenforce 100 buy online

Pingback: androgel concentration

Pingback: buy cialis online

Pingback: kamagra 100mg pills reviews

Pingback: albuterol 90mcg inhaler

Pingback: kamagra jelly

Pingback: legitimate online pharmacy uk

Pingback: dapoxetine 60 mg. per tablet

Pingback: kamagra gold kamagra

Pingback: clomid 50 mg en francais

Pingback: metronidazole 500 mg antibiotic side effects

Pingback: Vidalista 40 dosage

Pingback: asthalin inhaler nearby

Pingback: dapoxetine for pe

Pingback: Vidalista 40 mg tadalafil tablets

Pingback: strattera uk

Pingback: Can i order clomid