International tax rules have tweaked up a bit and the result is that it has taken a toll on the big money makers like Google Inc. (NASDAQ:GOOGL), Apple Inc. (NASDAQ:AAPL) etc. These companies will now put some of its revenue into government budgets- as agreed by the G20 countries.

The draft rules require these big companies to edit their currently cross border corporate plans and if other countries join in on this amendment, these companies will amass a lot of money for the government treasury. The amendment was brought in the wake of the mismatch between tax regimes which in turn leak billions from the treasury.

Tax experts say that big firms thrive on the loopholes they find in taxing laws hence they pay the minimum amount possible while making the maximum. This has caused the government treasury and the public way too many losses but now it’s time that such practices are taken into account.

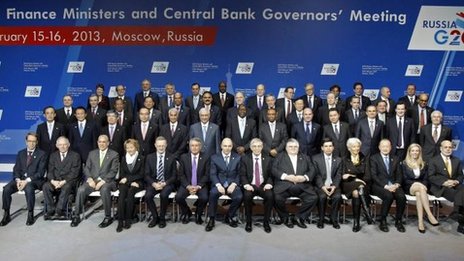

For those who don’t know what the G20 is; G20 or the group of twenty is a forum of governments and 20 governors from different countries. The amendment to tax laws was decided by them, so as to bring some credibility to the global treasury and avoid any loopholes to be further exploited by the big companies of the world.

One other amendment that is being brought up is to prevent these big companies to move their money to lower tax jurisdictions. The tax experts who designed this amendment say that they have for long been on the losing end: losing money to these big companies who make millions all around the world without tending to their tax responsibilities.

High end companies like Google Inc. (NASDAQ:GOOGL) and Amazon.com Inc. (NASDAQ:AMZN) will suffer the most from this amendment as until now they have enjoyed tax free money in their offshore accounts. Now they’ll have to think twice about their next move otherwise they can be sued in tax fraud.

However, some leaders including Barack Obama haven’t showed much promise for this amendment and called it un-American and unpatriotic. Tax experts across the globe believe this will bring all the large companies to a reasonable profitability level.

Other countries that are not part of the G20 should employ this rule as well, if not anything else it’ll put a lot of money in the state treasury which can be used for the growth and welfare of those countries. This goes for all the under developed countries or countries in political turmoil.

The G20 reform isn’t really a bad thing; in fact it reminds every company that their first priority should be towards the country it is operating in. There hasn’t been anything formal issued by companies in this regard but it’s quite natural they are not too happy about it. The question remains, how iron clad is this reform and can the companies find a loophole in this as well? Only time will tell…

Pingback: click over here

Pingback: buy polka dot mushroom bars online hong kong

Pingback: turkey tail mushroom capsules expiration date

Pingback: 웹툰 사이트

Pingback: max muay thai stadium

Pingback: สมัครเน็ต ais

Pingback: พรมปูพื้นรถยนต์ Changan Deepal L07

Pingback: Buy ecstasy tablets Europe secure delivery

Pingback: pglike

Pingback: scam links

Pingback: FKA Twigs

Pingback: https://stealthex.io

Pingback: รับสมัครตัวแทนประกันรถยนต์

Pingback: cougar cubs for sale

Pingback: gunpowder

Pingback: จอ led ขนาดใหญ่

Pingback: Sevink Molen

Pingback: ประวัติของเว็บหวยออนไลน์ เฮงเฮง789 บาทละ 900 บาท

Pingback: top camstop webcams

Pingback: sci diyalaa

Pingback: herbal tea

Pingback: chat sites

Pingback: เว็บพนันออนไลน์เกาหลี

Pingback: ของเล่นสนาม

Pingback: Kapook888 ผู้สนับสนุนอย่างเป็นทางการ West Ham United

Pingback: เว็บปั้มไลค์

Pingback: คลินิกความงาม ช่องนนทรี

Pingback: Aviator

Pingback: poor quality

Pingback: ผู้ผลิต โบลเวอร์

Pingback: vps forex

Pingback: แผ่นดินเหนียวสังเคราะห์

Pingback: The spirit pen

Pingback: Besuchen Sie jetzt die Website, um das neueste Update zu sehen

Pingback: firewood delivery hernando county

Pingback: 煙彈

Pingback: กระดาษสติ๊กเกอร์ความร้อน

Pingback: ล้างแผงโซลาร์เซลล์